Intro – What is a trap?

– First, it doesn’t really exist. There is no external force trapping anyone. Paranoia will not make trading easier.

– Because no one knows what the next bar is, it is always a surprise.

– Good traders understand probability and have a range of expectations for the next few bars – but that’s it.

– A trap means that one side is trapped into a bad trade, while the other side is trapped out of a good trade.

– Traps look super obvious 5 – 15 minutes later.

– Traps leads to strong moves. Why? Because both sides have to agree.

– Bull trap means the BTC / Stop Buy bulls are in a bad long, probably with a big stop distance and its reversing down. That also means bears didn’t get a high probability setup nor signal bar.

– Opposite for a bear trap.

– Repeated trapping of the same side leads to trends.

– Repeated escaping from traps leads to trading ranges.

How to trade them?

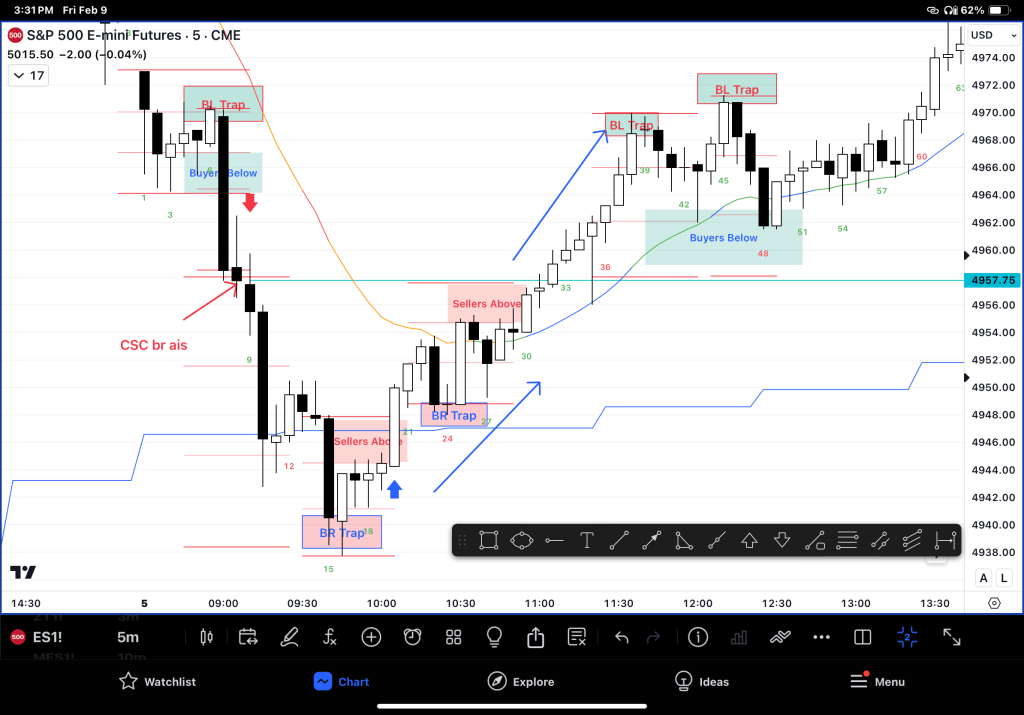

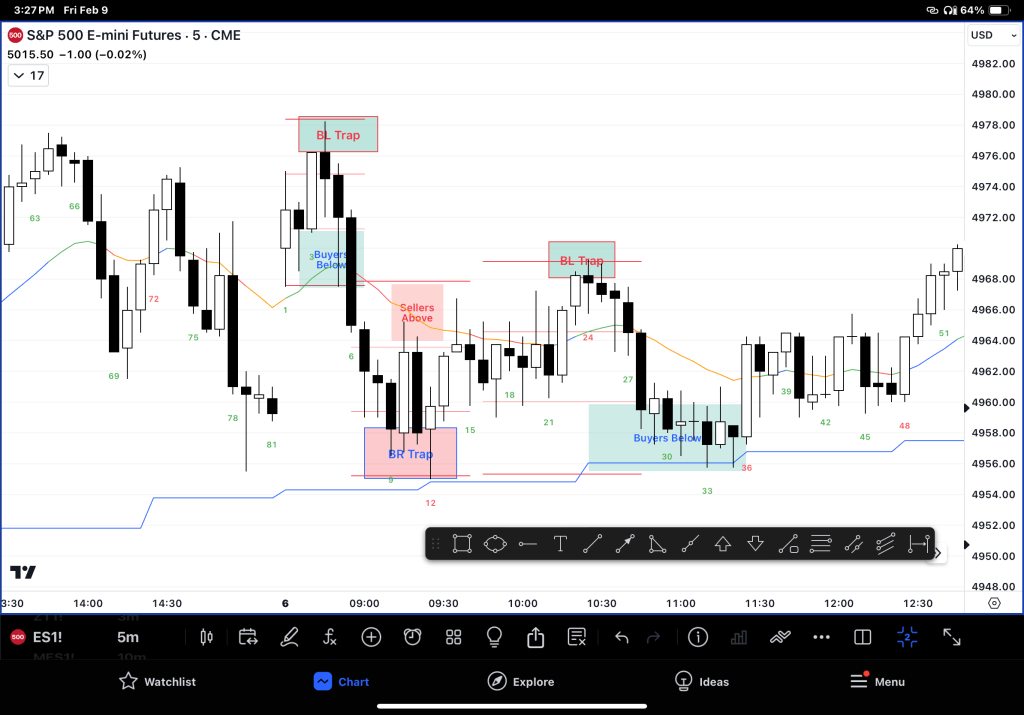

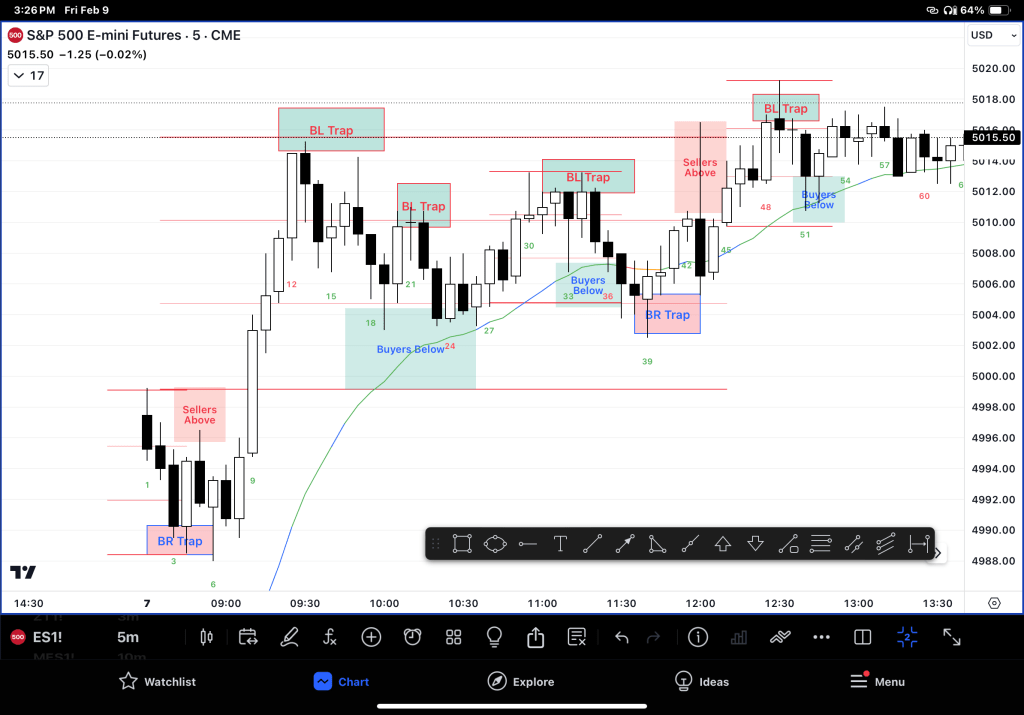

– First practice marking up how they work.

– Secondly, when I’m trading, if I had to work to get out of a dud trade – or exited in haste – that is my cue!

– The side that is trapped either exits quickly or looks to scale in.

– That means use a Fibonacci tool to mark up the trading range now in effect and look for limit order trades / scale in opportunities.

– Bull traps lead to buyers below.

– Bear traps lead to sellers above.

Practice

– Mark the highest BTC in a bull move and the lowest STC in a bear move.

– Draw a 1/3 fib across the last range.

– Remember to use the BO Point / give up bar, not just the swing low for greater accuracy

Leave a comment