Summary

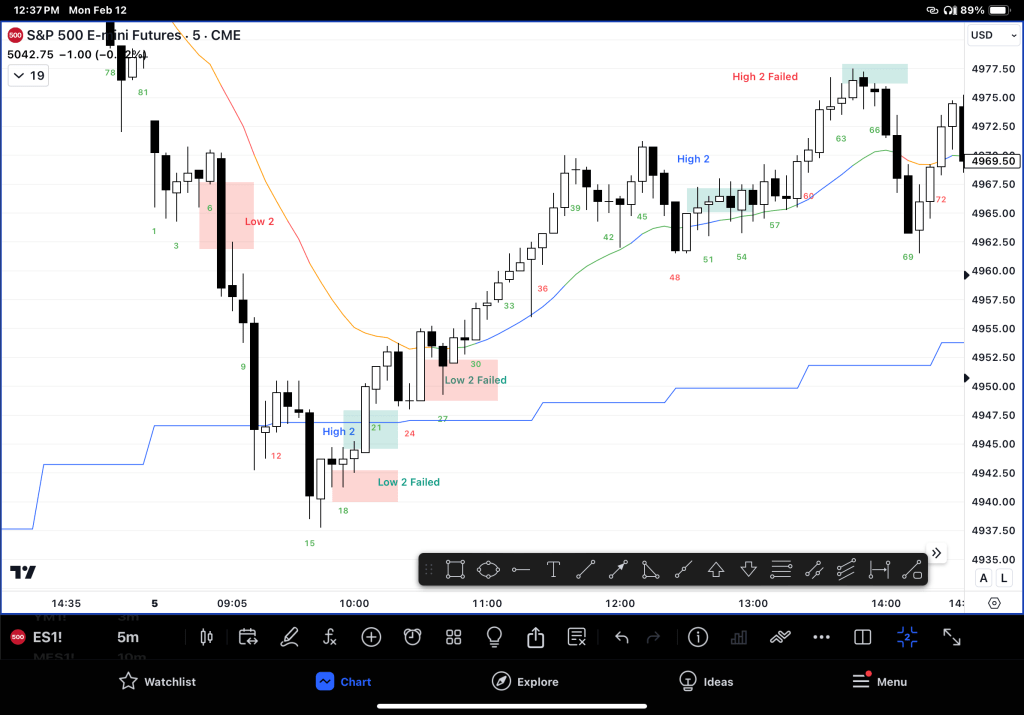

– 80% of reversals fail in Trends

– 80% of Breakouts fail in Trading Ranges

– Having guidelines for determining what we are in on the trading timeframe helps increase probability and point count.

The Second Entry

– A common entry technique relates to the “2 attempts” principle. This also relates to breakout second-leg. More simply, when something works well, we ‘give it another go.’

-In Al Brooks ‘Brooks Trading Course‘, this is a central theme to finding good entries.

– But what happens when that fails?

– This can then help us determine when we have changed from a trend to a trading range.

Examples:

– Bull environment, above 20MA and 200 MA, expecting a Low 2 to fail

– When H2 fails, bulls will scale in because high % of High 3 working near MA

– What about when both H2 and L2 are failing? TR.

– Once it clearly fails I draw a Fib 1/3 across the range and look take a bar range wherever I can.

– Golden rule is always – stay flat in the middle, or stay in your trade. Don’t hit any button.

– Bear environment below shows success and failure (Bull swing)

– Newer traders will miss these constantly because the count is implied.

Implied High 2 and Low 2

– If 2nd entries are so obvious, why would anyone take the other side? They wouldn’t.

– But they provide pro traders a chance to exit out of trades and keep their profits.

– They also allow scalpers to switch to the new momentum.

– Implied means the count is on the lower timeframe (LTF.)

– So practice seeing the micro pattern in current timeframe.

– For example, counting the Micro Wedge on the 1min chart, by looking at the 3 tails on the 5min chart.

Leave a comment