- Intro

- Definition

- Principles that help me find trades:

- Example Charts

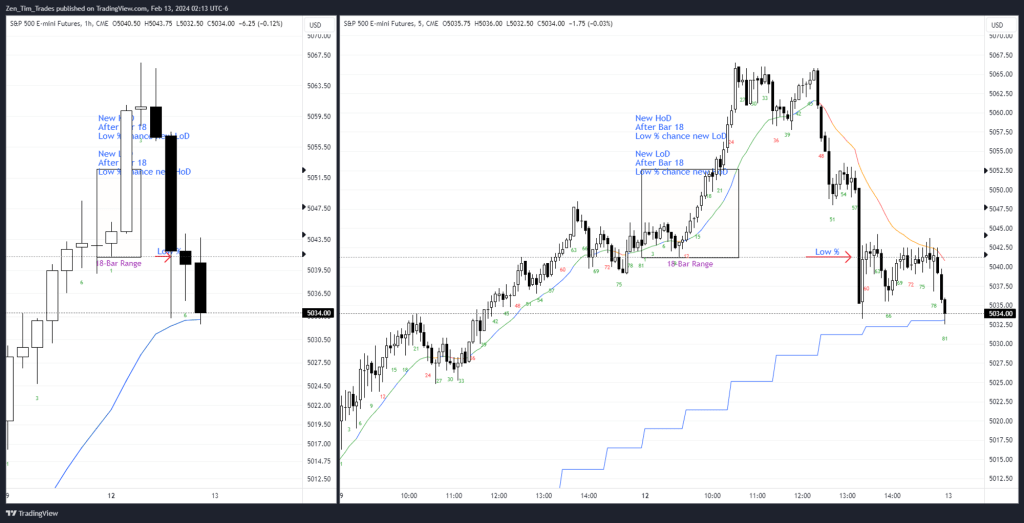

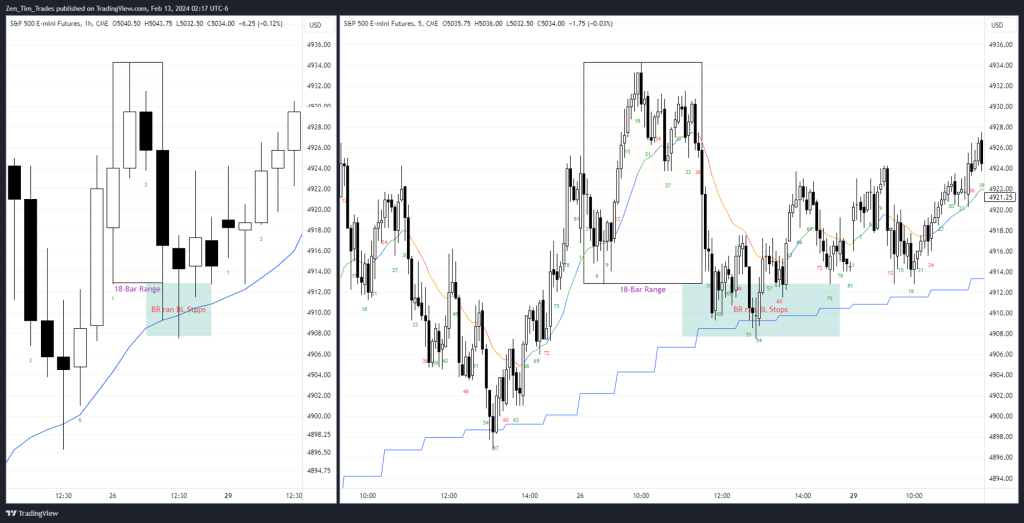

- Breakout of the 18 Bar Range – Measured Move

- Breakout of the 18 Bar Range – Measured Move Fails

- Fading the BO of the 18-bar range

- Breakout of the 18-bar range – shouldn’t run stops

Intro

One skill that helps me trade is the ability to read the opening range.

Definition

The Opening Range is ambiguous.

But for my purposes here I use the following:

- The first hour of the RTH

- The first 18 bars of the 5 minute chart of the RTH

- In a protracted TTR – what happens after the first DB and DT.

- Includes at least 2 reversals (ORRV)

Principles that help me find trades:

- The size of the opening range (OR) can predict what type of day be unfolding.

- 90% of days have the High of the Day (HoD) and the Low of the Day (LoD) within the 1st 18 bars.

- Therefore swing traders pay attention to this for their stops.

- TTR days have limit order traders fading the BO of the range. Sometimes they get trapped.

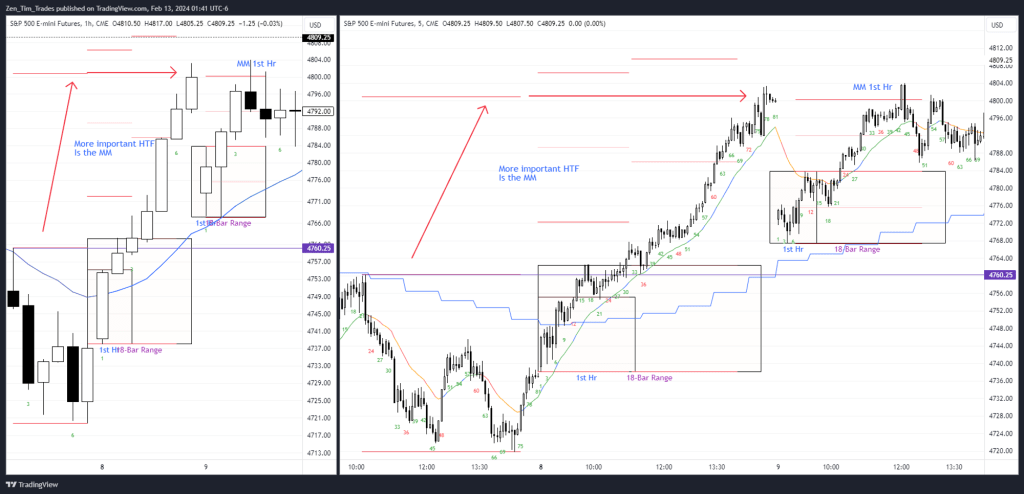

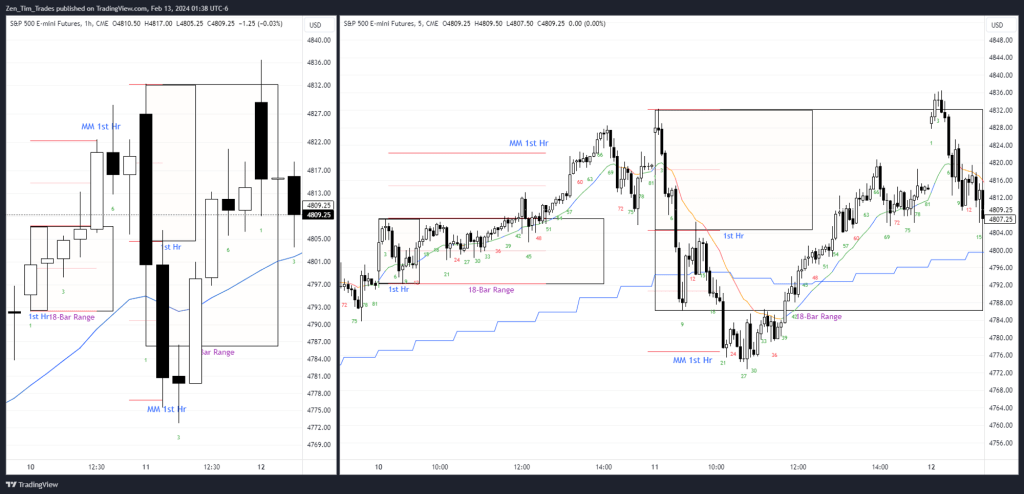

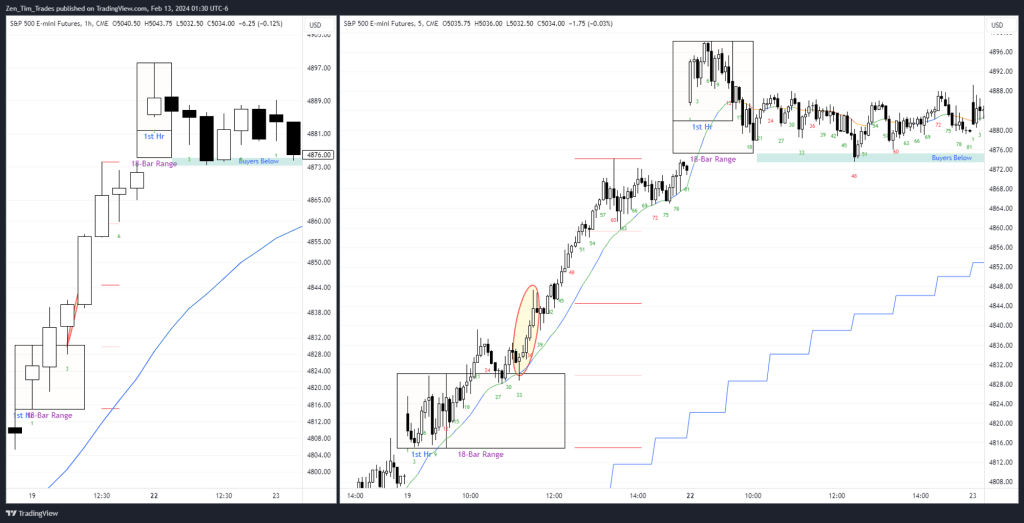

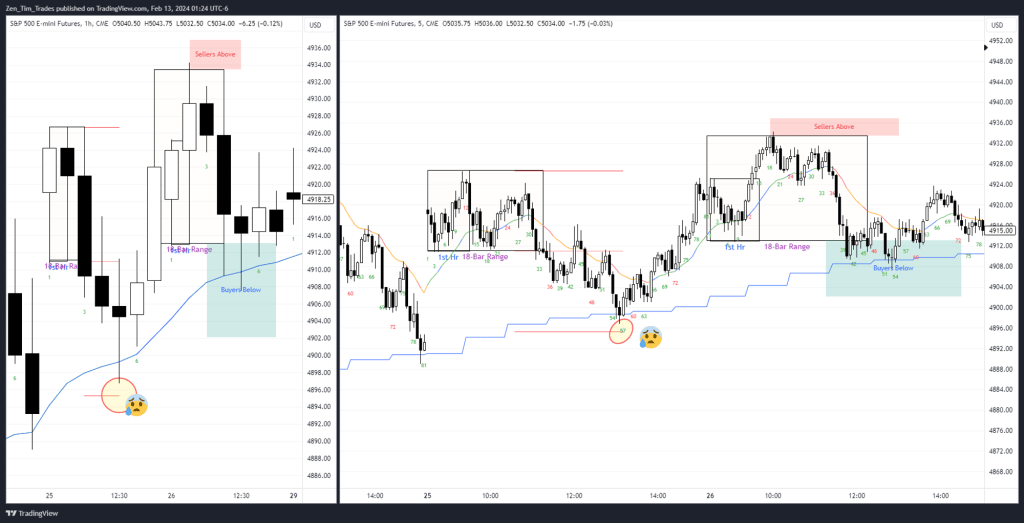

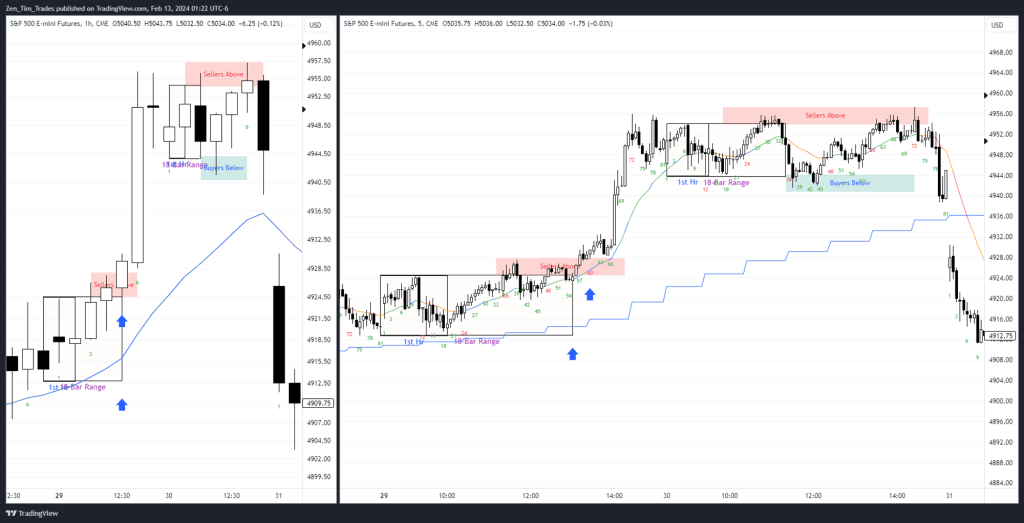

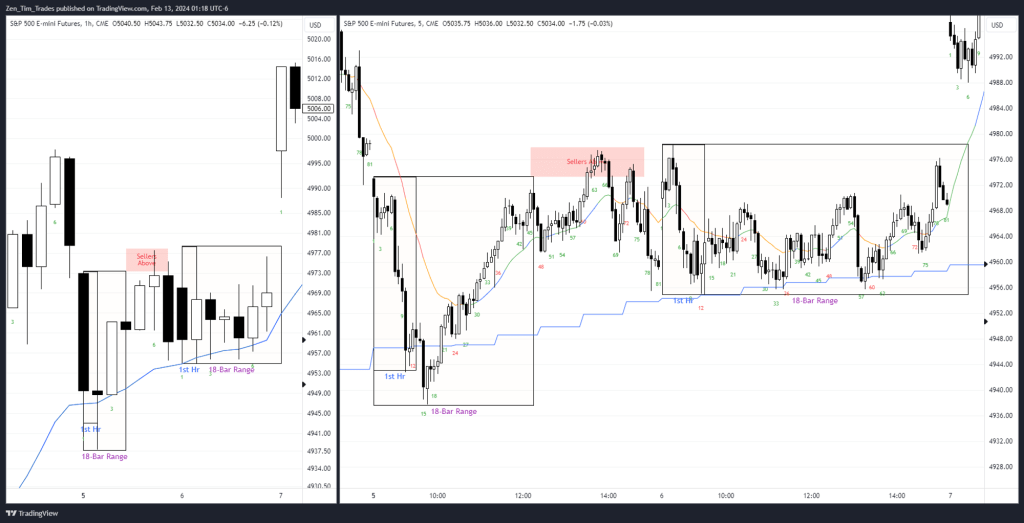

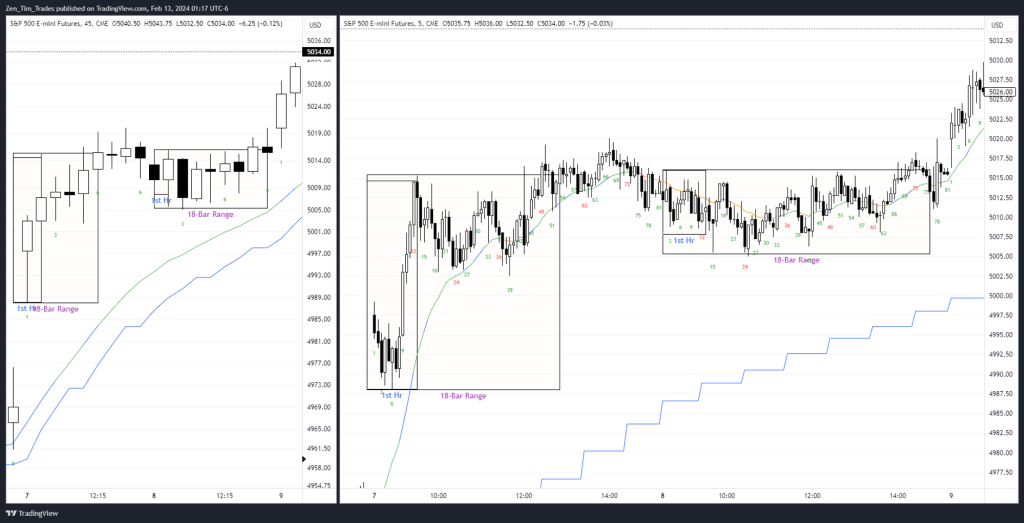

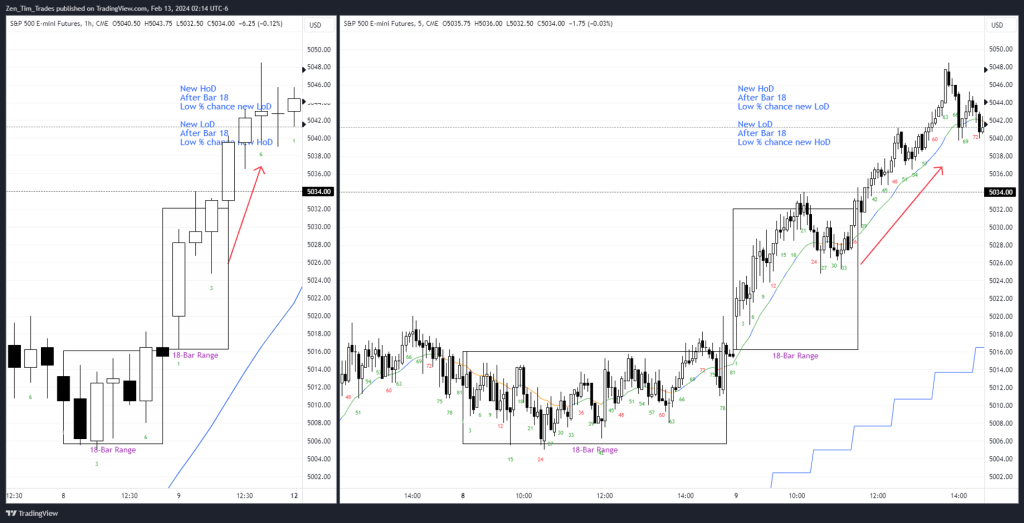

Example Charts

Here are some charts showing the mark up I like to practice to help me improve my trading skills.

Breakout of the 18 Bar Range – Measured Move

Breakout of the 18 Bar Range – Measured Move Fails

Fading the BO of the 18-bar range

Breakout of the 18-bar range – shouldn’t run stops

- “Most” days this will not happen. So it is a low probability % outcome.

- I have some examples here.

Leave a comment