The market is quite funny.

The more observing I do, the more fair and balanced I see it.

This is the total opposite of what happened for me as a beginner trader.

I saw the other side making money, and me, well, giving it to them!

But it seemed that the “pros” I was observing were not so phased by sudden moves against them, or indeed they expected a little of it anyway.

Did they have a secret phone line to the alleged “smart money”?

Or do they have a fluidity and style and grace with entering and exiting trades?

Maybe both!

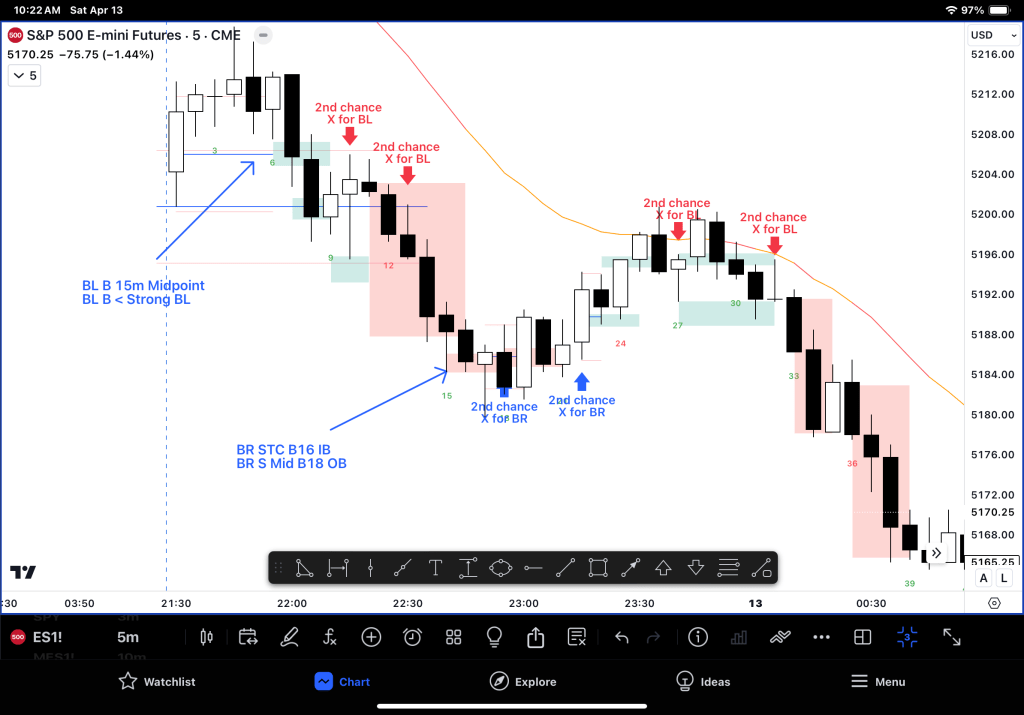

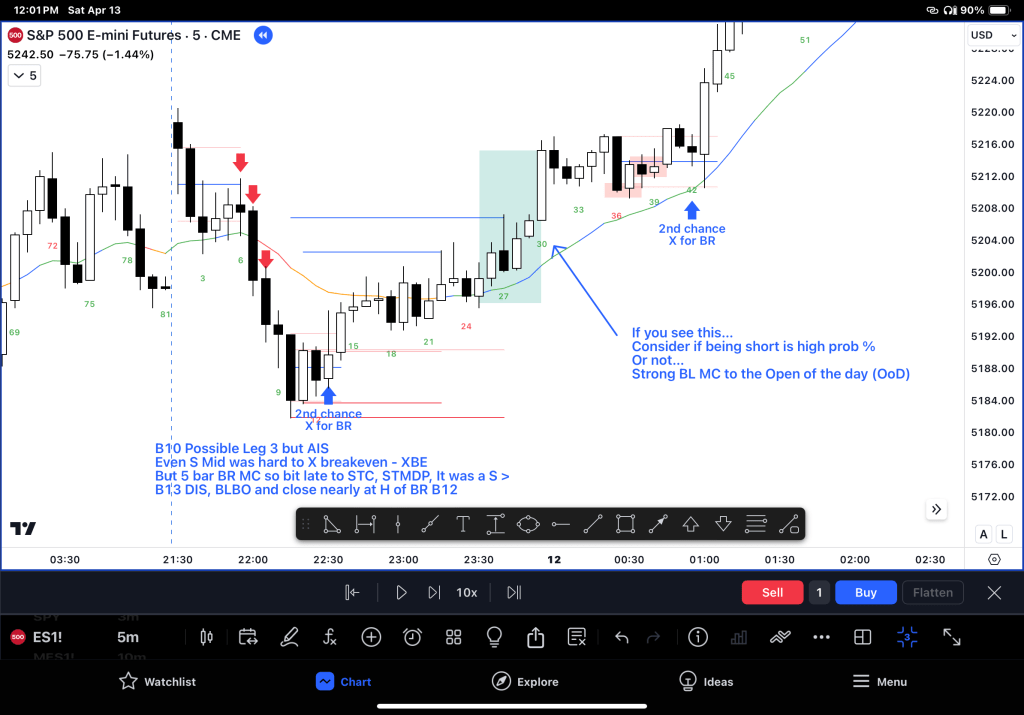

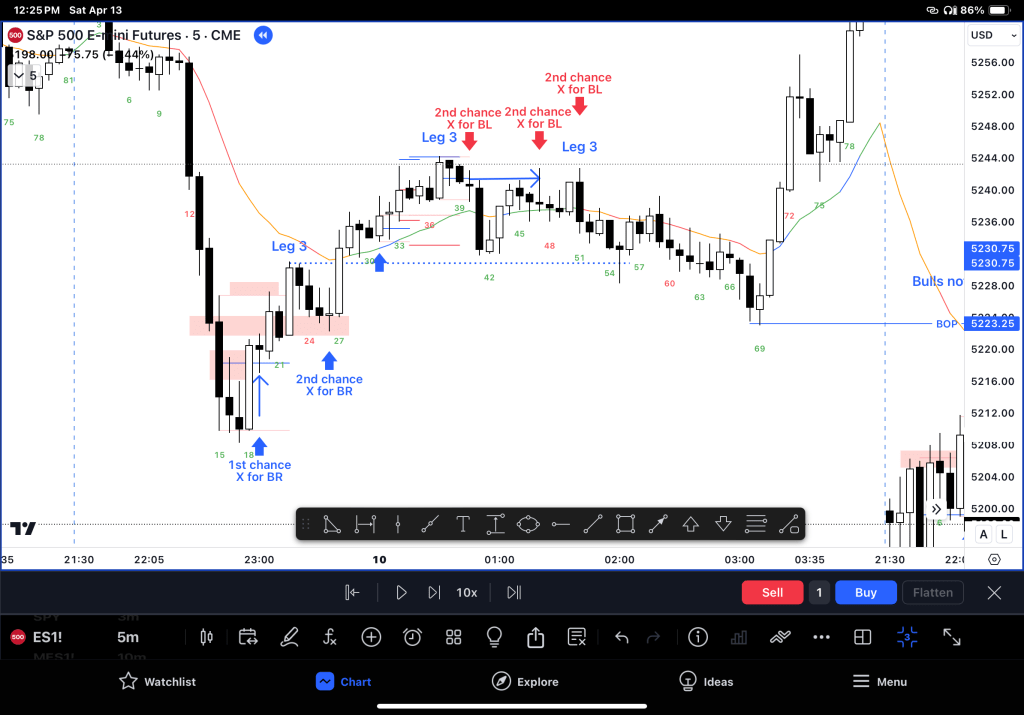

Chart Review

– Big Gap Down often so it is more common to expect the pullback to be to some levels bears want to sell

– For me the 1st decent STOP order buy signal was 6 but the entry was one tick above, never got triggered – FLAG 1

– Strong first 15m BL bar – bad FT – FLAG 2

– Generally I leave the first few bars of the day as it can be hard to manage. And the flip-side is that once someone gets trapped you can trade against them.

– BL Trapped 7-8 – so that makes the DB a weak buy. But why? Bulls will use the move to get out of the earlier red entries.

– Here they get two chance before the BR leg down which was a fun trade.

– Later on the same thing happened to BL again.

– B24 had a strong reversal at the right area (MA) B26.

– Then 3 BR bars so BL S out above, BR S in above and drops.

The Good Dr (Dr Al Brooks) says:

“the market exists in a grey fog where nothing is as clear as you would like..”

Homework

– Mark up your charts with entries and then look at the chances you had to leave that trade.

Entries to look at include:

– Class Stop entries from BTC course

– BTC/STC (Buy the close / Sell the close), – BMID/SMID

– Buy above / Sell below (BA/SB)

Question to ask:

– Which entries gave you a good balance of risk/reward?

– Which entries could you not have gotten out of ? (Or had to scale in ridiculously to do so.)

– How could you adjust your entry techniques to filter out the traps?

– When is entering on close better? When midpoint? When above or below?

Further exercises

– Explore the effect of late legs on entries. Once bulls are getting 2:1s, entering later than them should not give you also 2:1… entering earlier is higher risk therefore expect more reward.

– Explore the effect of both MA on the entries – 20 and 200 – if you use them

– Explore limit order entry techniques such as: Entering midpoint of the bar, entering back 1/3 of the bar, entering above / below the bar

Other examples

Leave a comment