Ah my old friend.

You were there when I removed money from my account again and again.

What makes you so persistent?

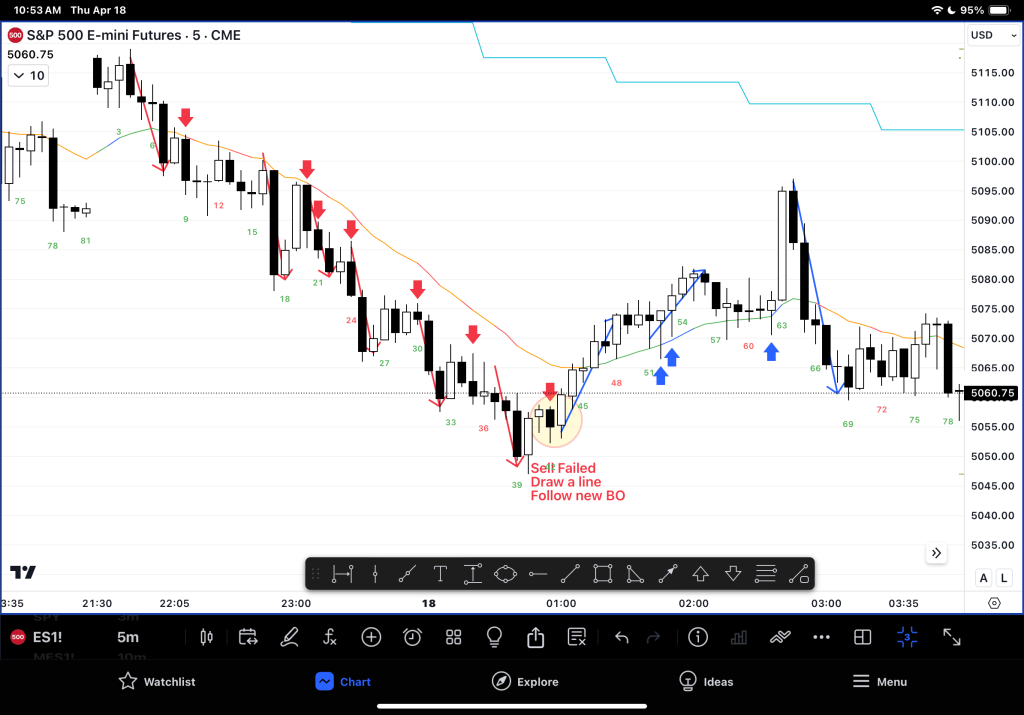

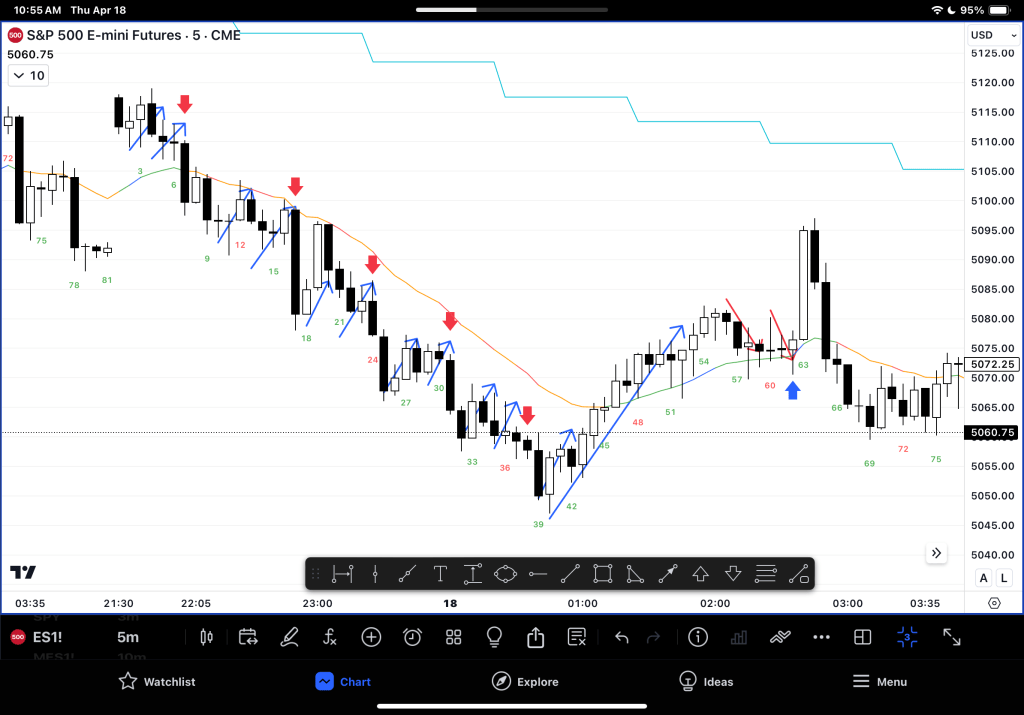

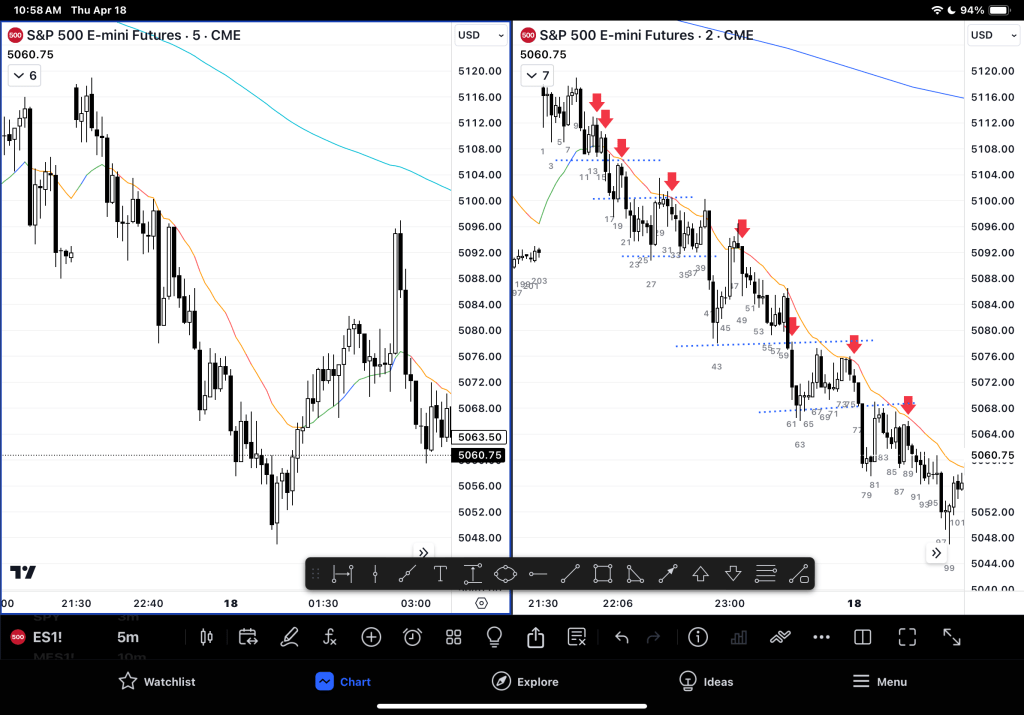

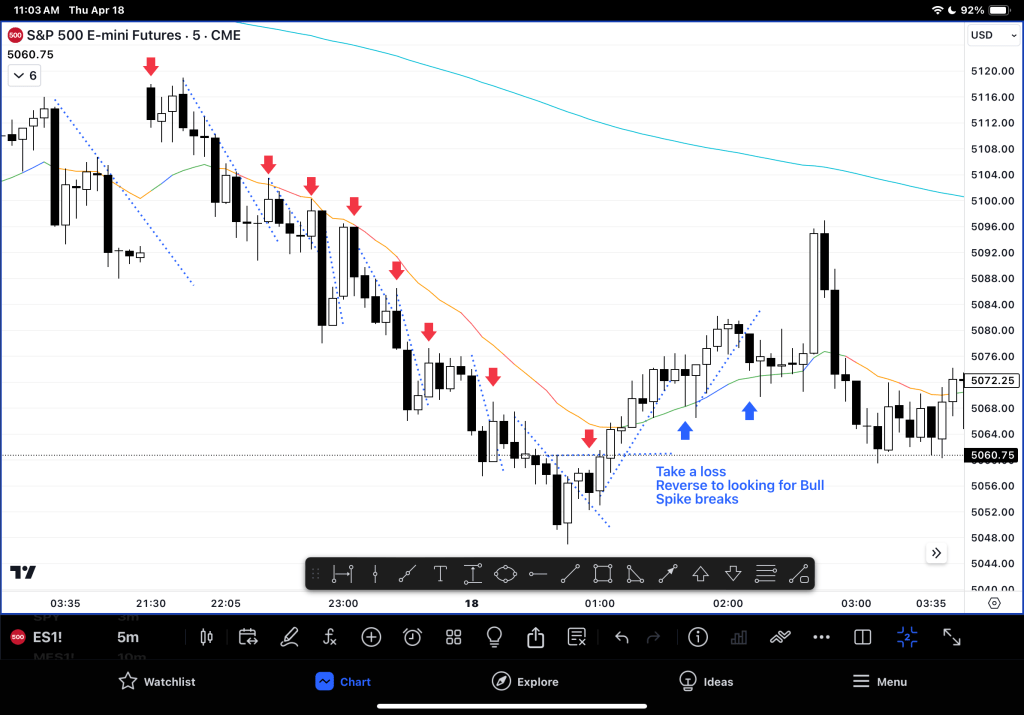

Ways to trade a Bear Channel

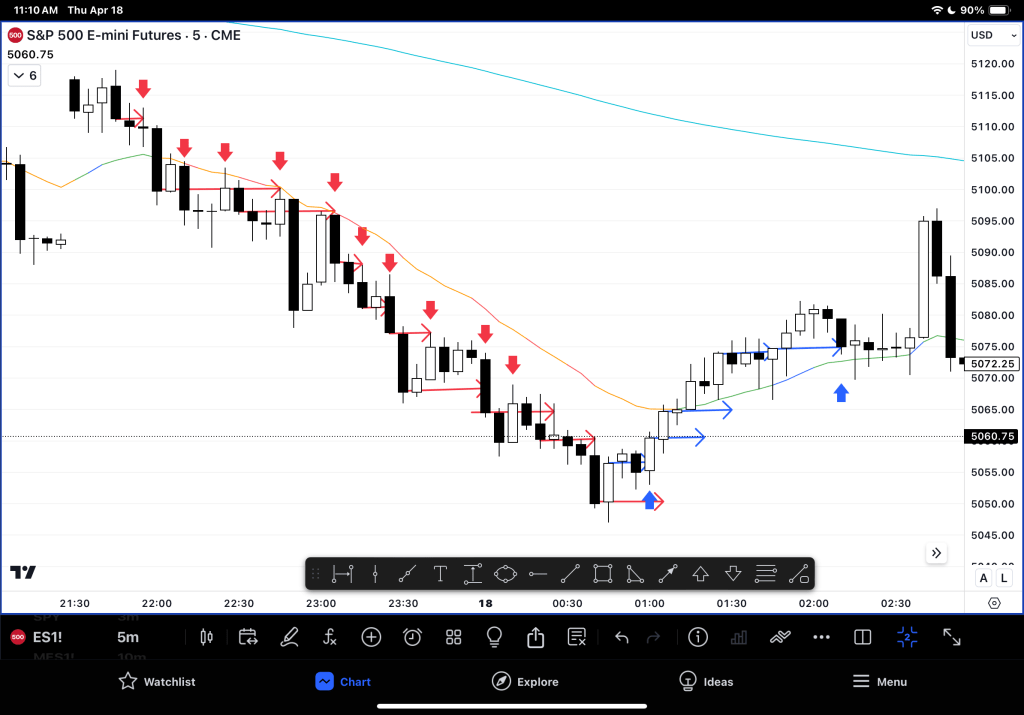

– Follow the breakout and catch a second leg

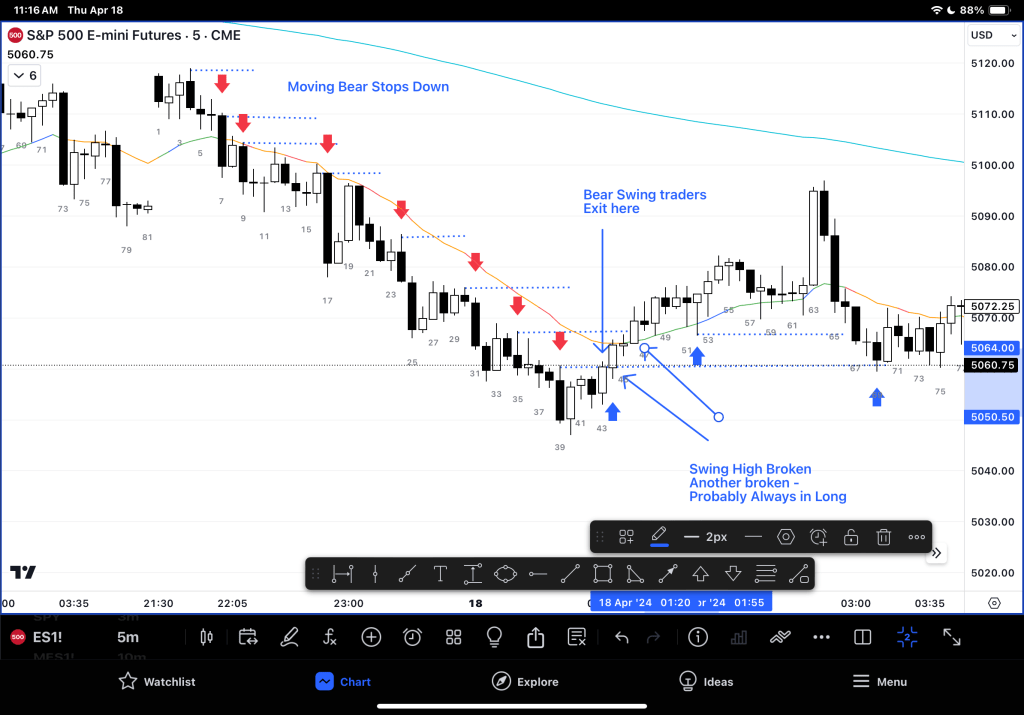

– Wait for any 2nd reversal to fail

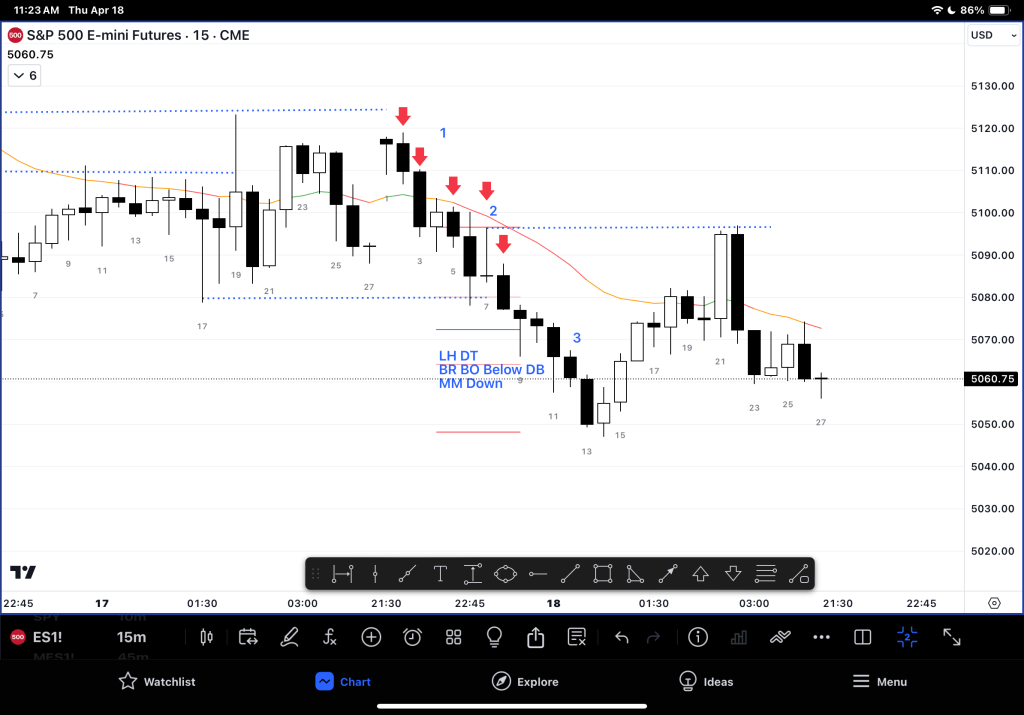

– Reduce the timeframe to 2min (turn into a wider channel to see gaps / BO point tests. Yesterday gaps were decreasing and then increased again! So watching gaps is a valuable strategy

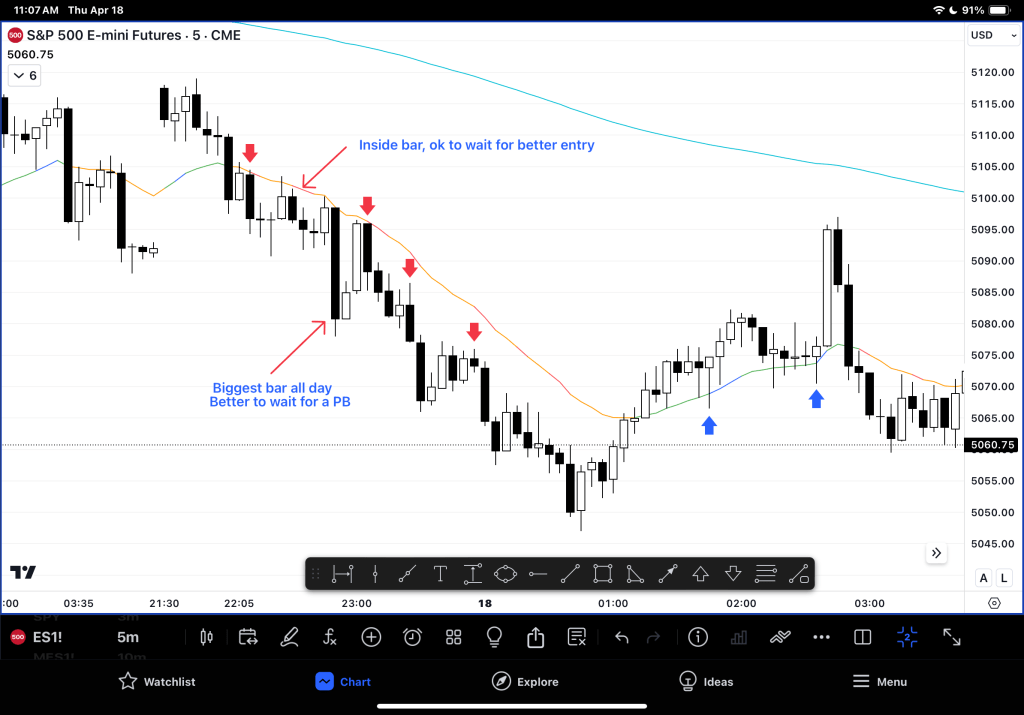

– Trade spike breaks (test back to the BO point of a tight channel. This means a trader could have sold at the break and higher and made money until the trend ended – which is where you have to take a loss and switch – recovering your loss and making a profit on your final long trade.

– Take every good entry – especially 2nd entries, near the MA – it should hurt a little.

– Wait for the stop entry to trigger and get follow through, then try to enter at that price again

– Keeping adding small positions and be mindful where the last protective stop is for your guide on when to start closing

– Go up a timeframe (15min) and trade the MM targets there

What is it about the bear channel?

– On ES, which is a stock index which is made up of the most successful companies in the USA, it has never been in a bear trend. Take a look at the yearly chart. So by definition, bear channels will be appear the least for ES traders. Credit for Ali Moin-Afshari from Quant Systems for that great nugget!

Practice Suggestions

– I hope you found some of this useful for your own price action study.

– Practicing the above techniques each day will build muscle memory you can likely call on when trading live.

– Please comment below if you want more details.

Leave a comment