– This week was an interesting week for the classic double top and double bottom trades.

– In fact in uncovered some flaws in my own price action reading that I believe will be valuable for me, so I’ll try and articulate them as best I can for others.

– I began noticing that whether we get a new High of Day (HoD) or Low of Day (LoD) can support holding the trade longer.

– The issue becomes with the classic expanding triangle! New HoD and a new LoD.

– Another factor is whether we just had a bull breakout and are pulling back to the breakout point vs opposite (bear breakout.)

Observations

– The main issue stopping the obvious trade is determining when we are testing the double to continue, and testing it to break and reverse.

– It seems the clearer double is a better guide.

– Some thoughts below and ideas for further drills to improve real-time trading skills.

Drills for skills!

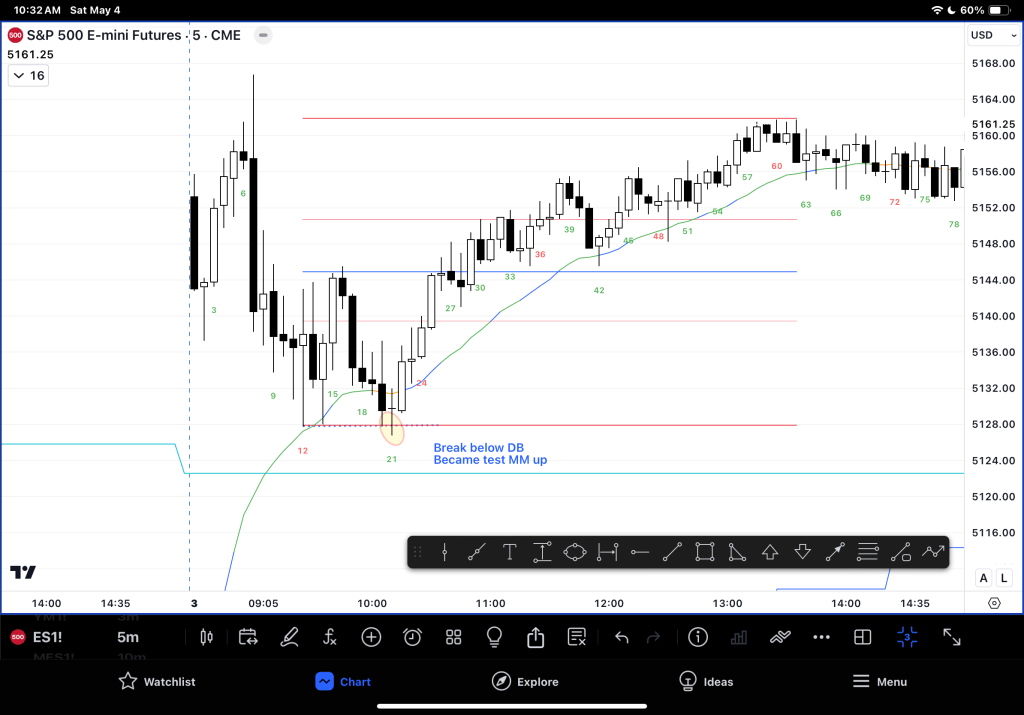

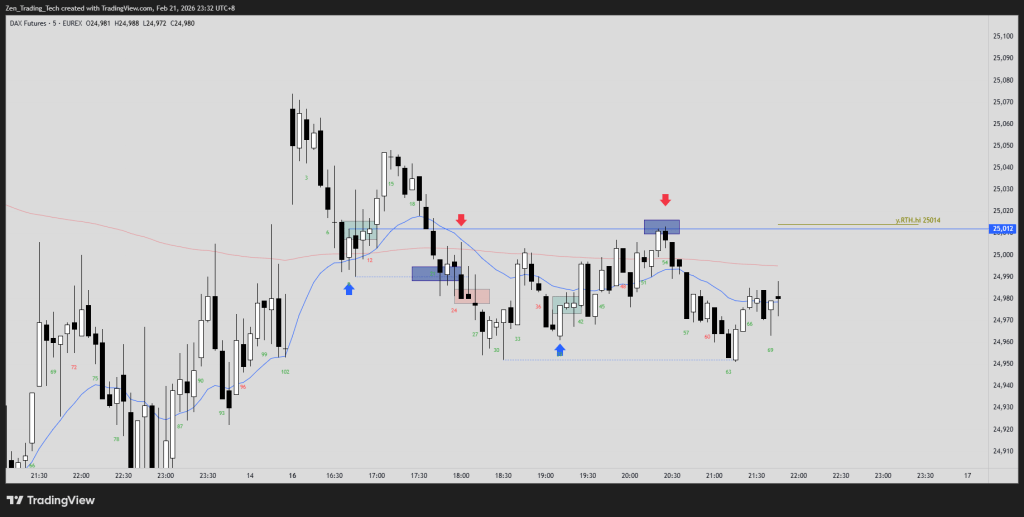

Double Bottom LoD

– New HoD then new LoD – expanding triangle open – classic nemesis of mine as a breakout trader!

– In this example, buying B14 triggered but pulled back too far below it for me to stay in. I exited breakeven (XBE)

– My mistake was not re-entering on the High 2. I have a rule of not entering the same trade at the same price right after (to avoid tight trading ranges) but this was not helpful today.

– On other days I would typically buy and buy below (B+BB) to give me an average price in the midpoint. But I don’t buy 5 consecutive bear bars. That was good technique. Failing to re-enter (hesitation) was weaker techinque.

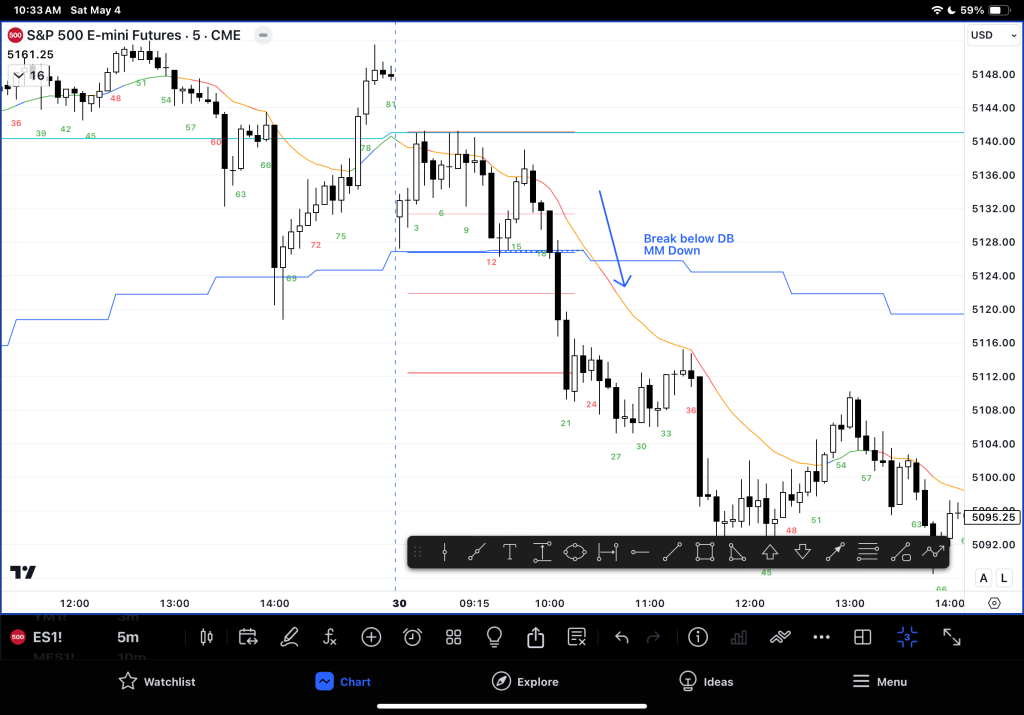

Double Bottom MM Down

– The first difference between the two is that yesterday we set a new HoD and here we did not.

– The second difference is the moving average (MA).

– Here buying the DB was good, but you need to XBE or reverse 19/20. On this day I didn’t buy the DB (spider sense?) and instead got short during B20.

Practice ideas:

– Look at DB and DT in relation to new highs of days (HoD) and lows of days (LoD)

– Look at DB and DT in relation to the MA. Where do they work or fail best?

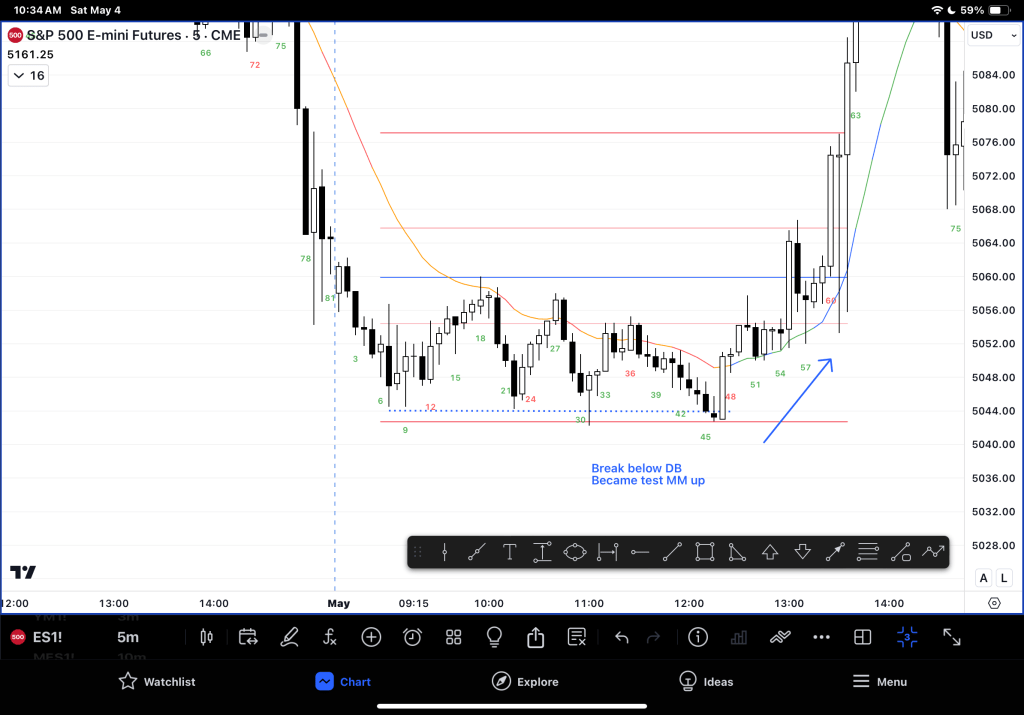

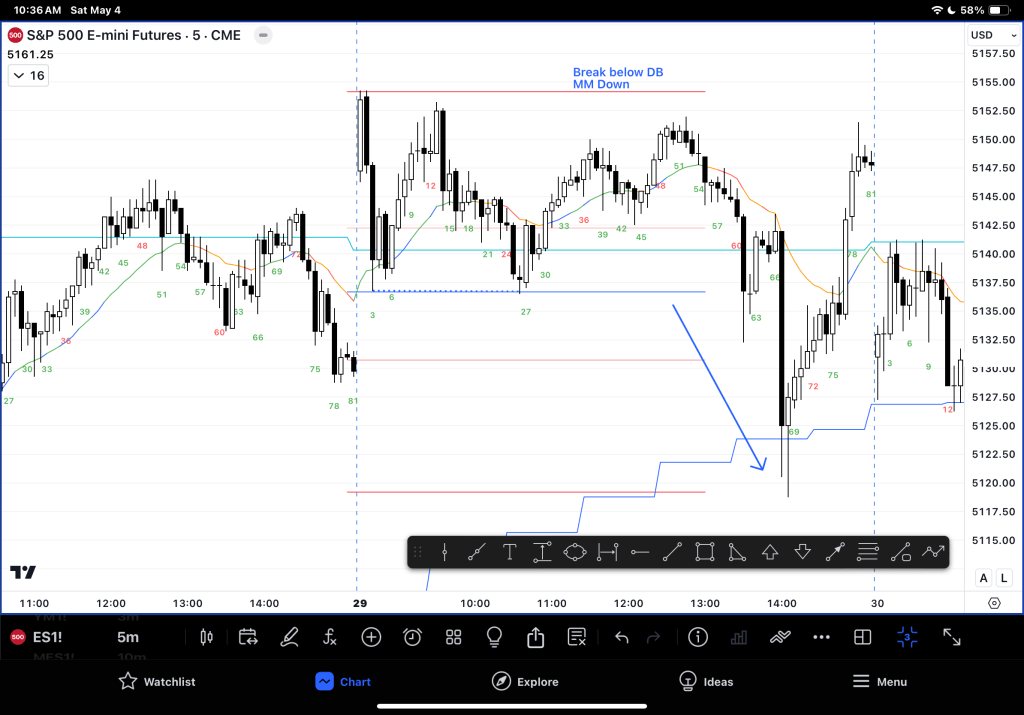

Double Double Bottom

– Here I bought B9 and B12 to trade back to the open. I kept missing the sells and buying low which worked today.

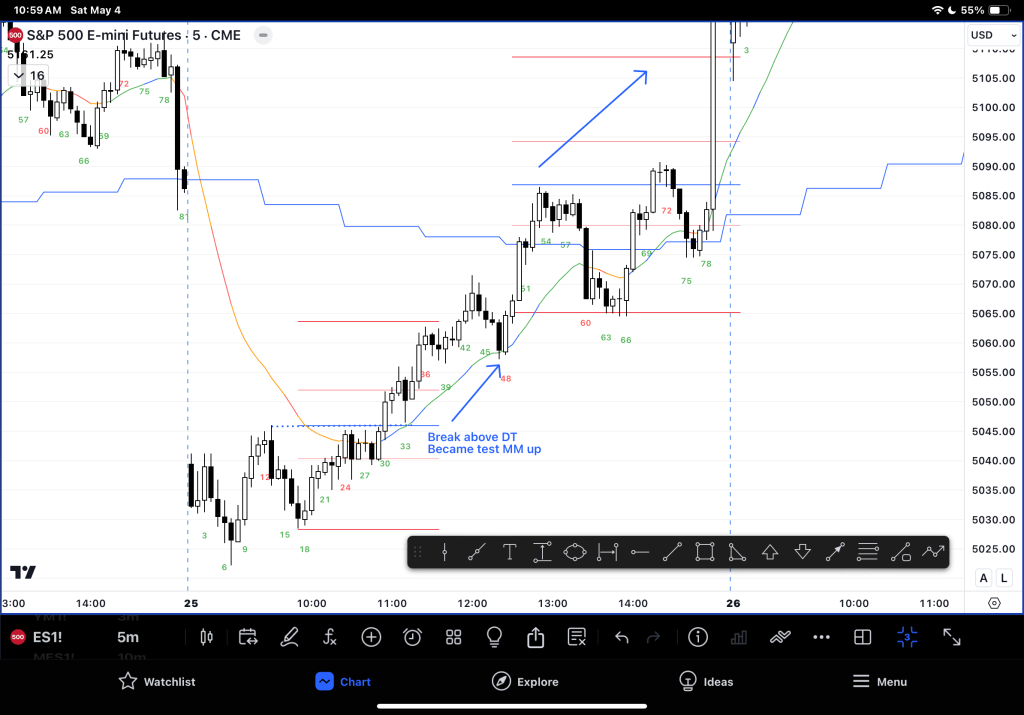

Higher Low DB, Reversal and FT – MM Up

– Bars were too big for me to short. In hindsight the 2nd leg down was high probability and a good trade.

– Long worked well but I can work on my bias! By work on I mean remove it probably.

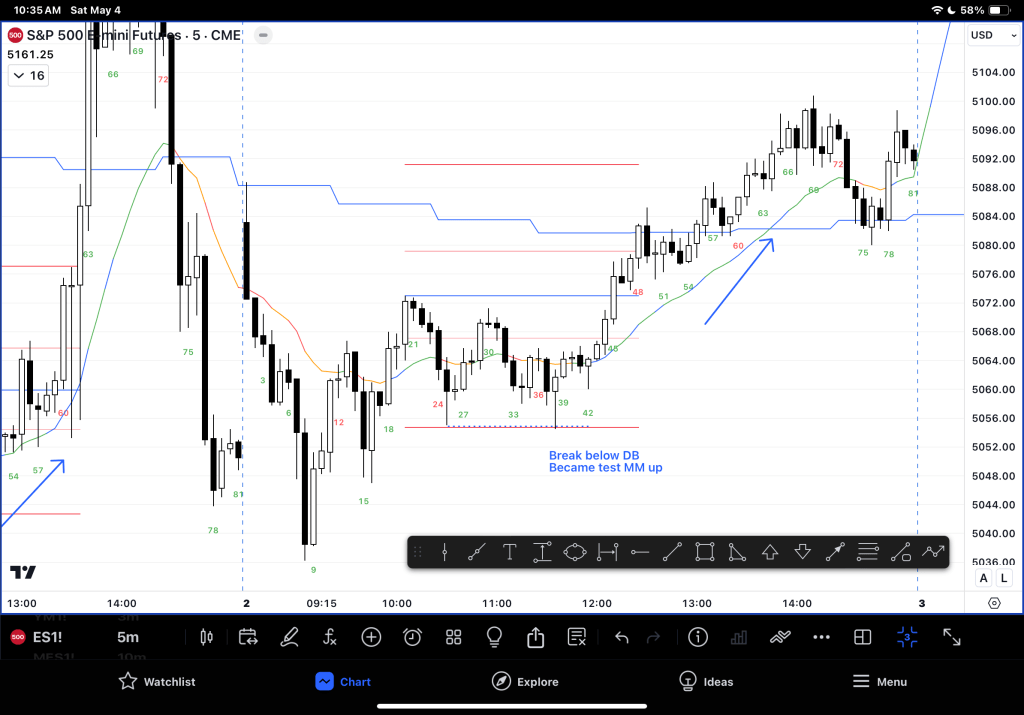

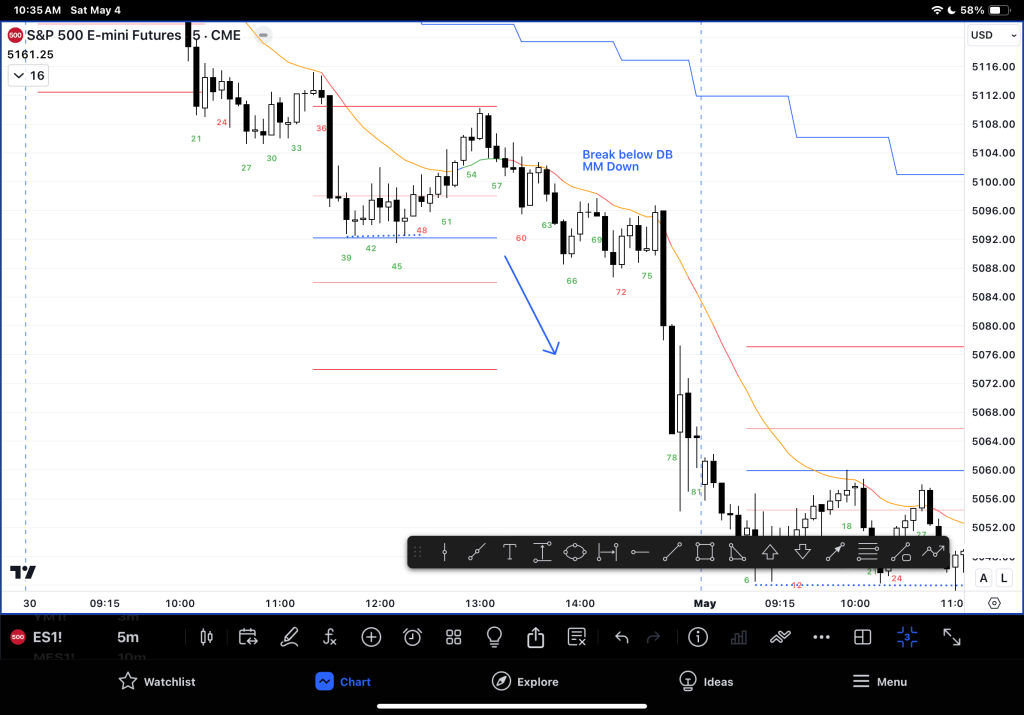

Bear Channel – DB breakdown

– Trading channels by ignoring the spikes and waiting for the pullbacks works very well on these days. But hard to do with FOMO.

– Practise selling the spike and sitting in the pullback for 2 hours and feel the difference?

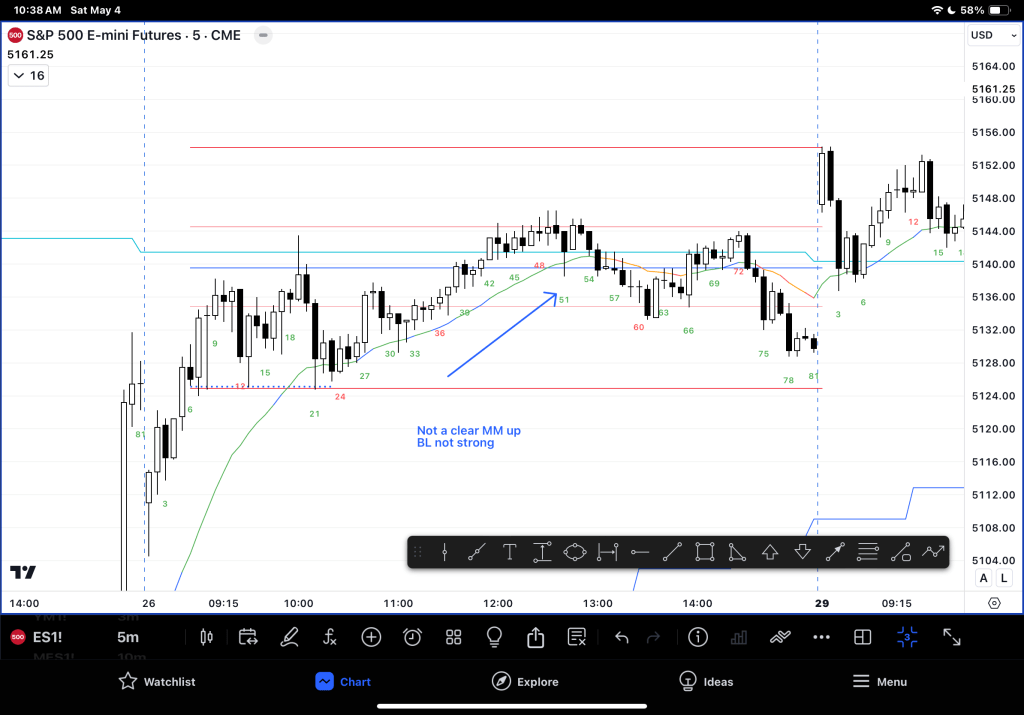

Bull Breakout, DB was a test, failed and broke down

– My mistake was selling the 2 late for a scalp and missing my exit by one tick… I did move the target…

– Correct was to sell higher and exit with a small profit and then buy the High 2 at the MA.

Practice Ideas:

– Can I switch bias from a short trade which doesn’t work to a long trade within a few bars? Why or why not?

Bull Breakout, DB never led to a MM up!

Bull Channel, Double Tops Breakup

Leave a comment