Ah you were my first love.

Then we had a strong breakup.

Now whenever we are together it is extreme!

To be with you cost me a lot of money. But that investment was the best one I ever made.

I have learned more from those days than any other.

May we be together always.

Just not all day always….

– Tim the Trading Ranger

Intro

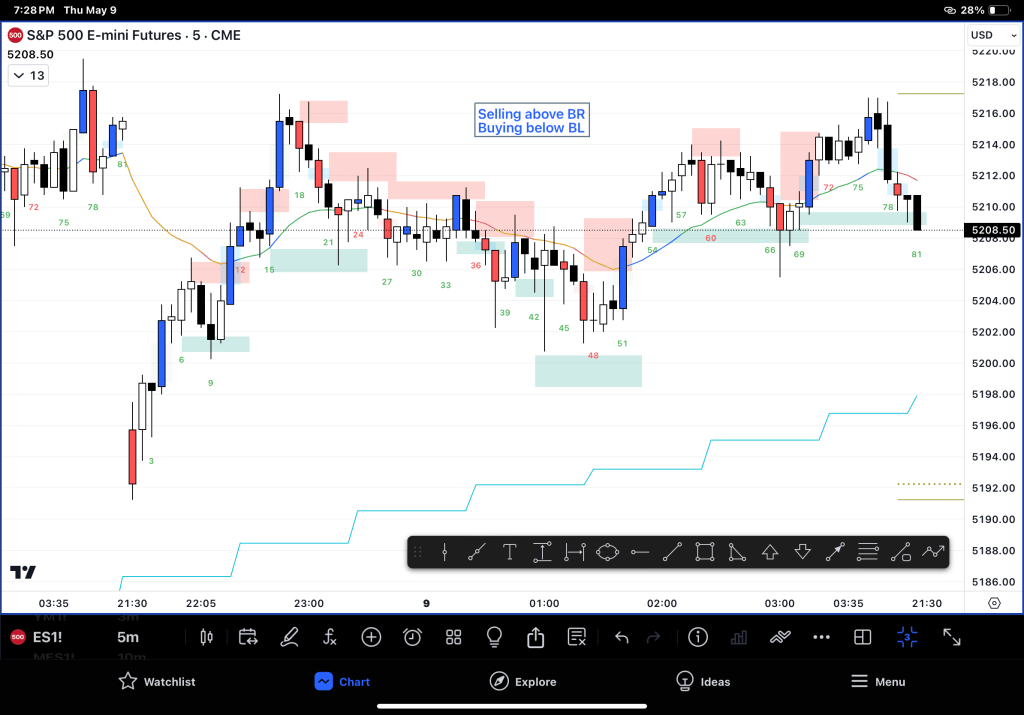

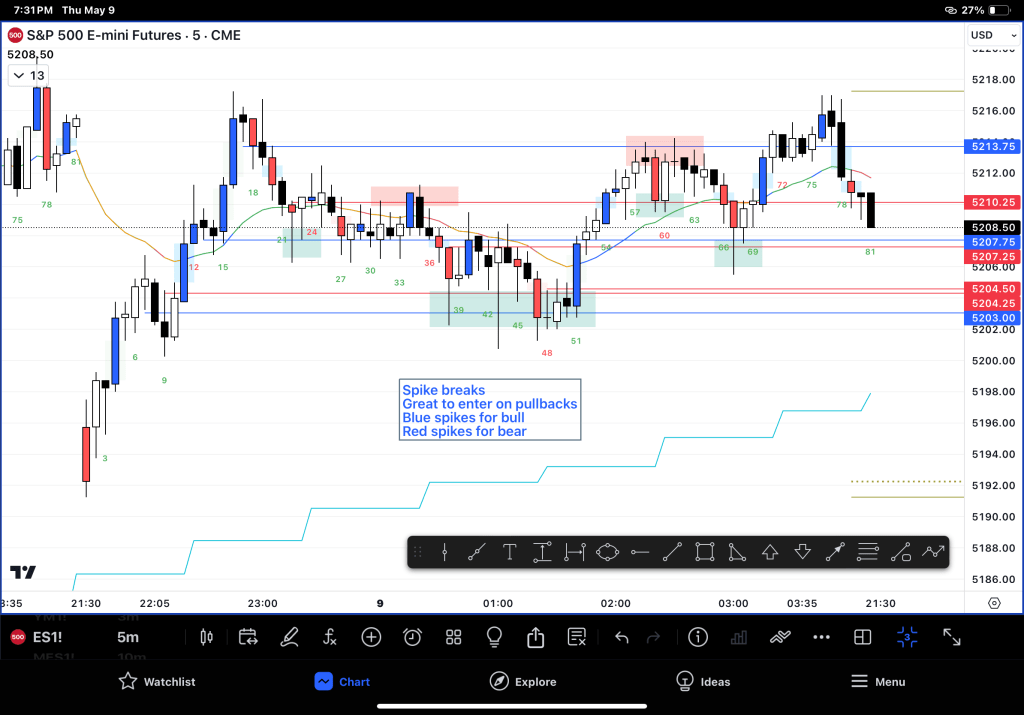

Let’s talk about various approaches to a trading range.

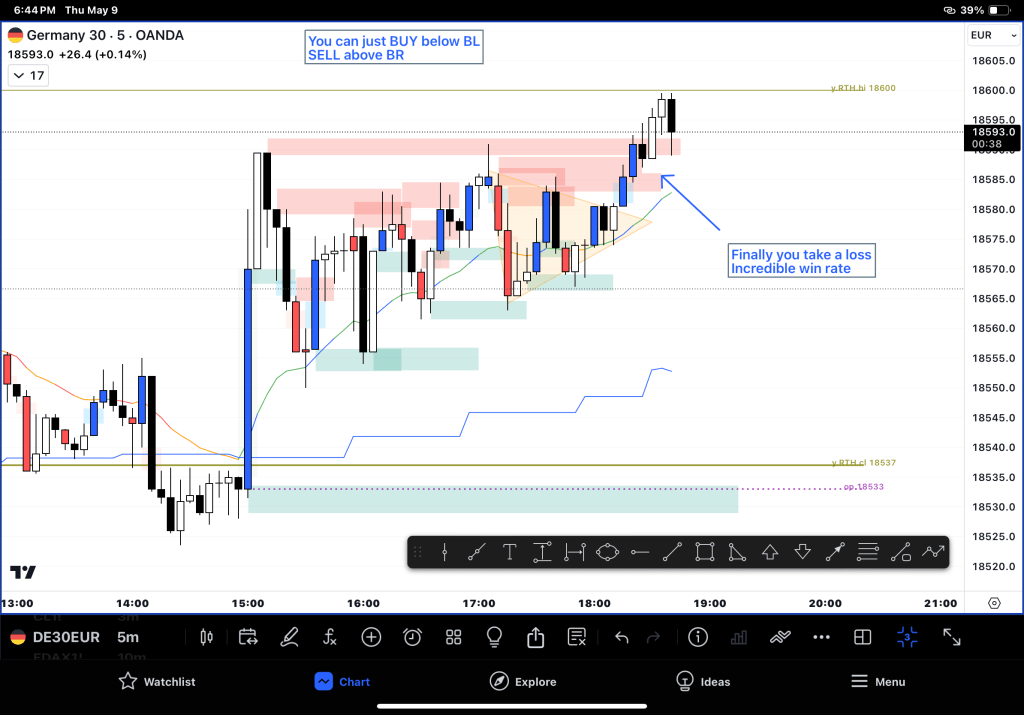

So it’s Opposite Day like from school right?

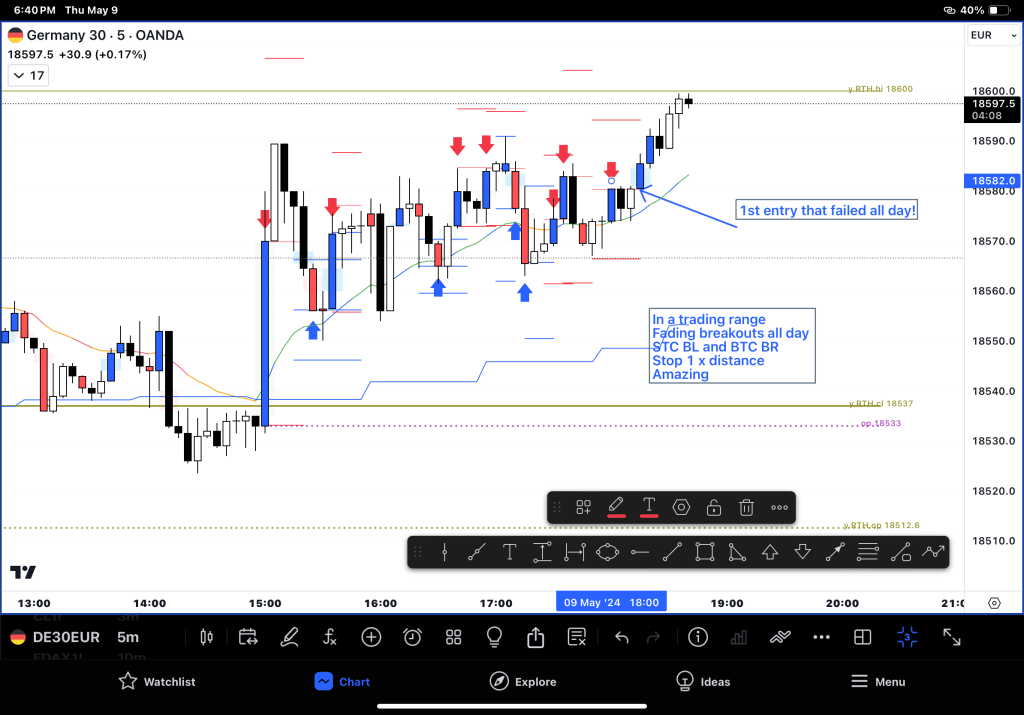

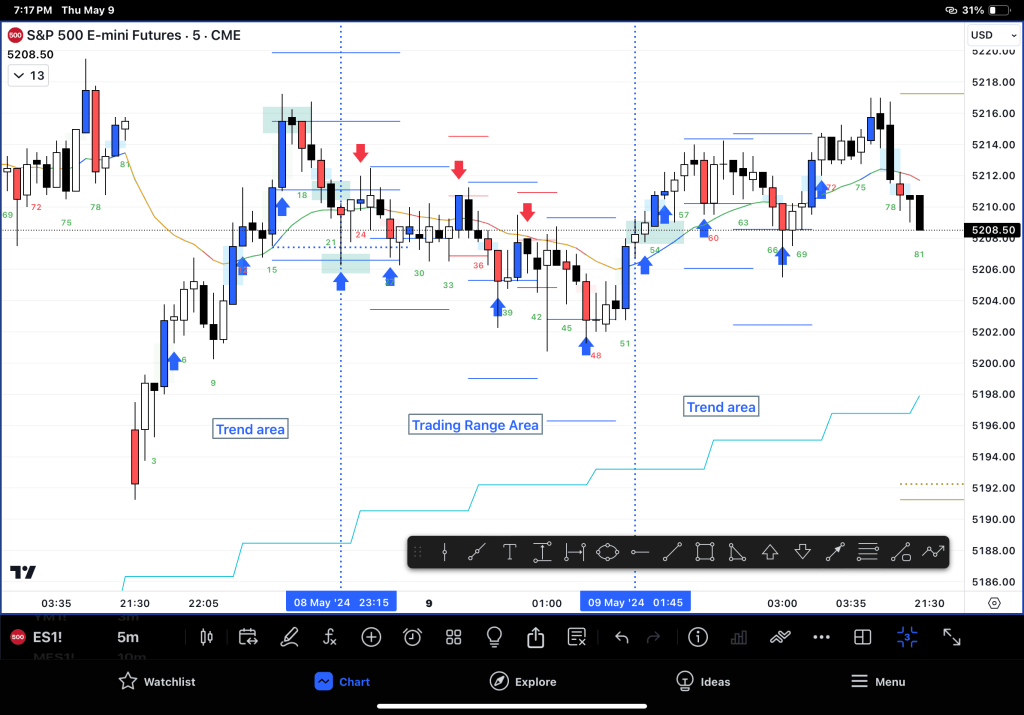

Determination of TR

– What says it is TR time?

A 75% pullback of a strong leg usually tells everyone to wide stop it and trade smaller

A good entry that fails hard? That can do it.

A late leg – that too.

A move that never really gets going… that too.

Basically whenever it is not clear.

As a breakout trader, most of the time you will be able to profit from the market.

But limiting damage done from risky scaling in practices will all be revealed on TRD.

That’s why we call it a protective stop!

Fade the Close, stop 1 x leg distance

Consider how important determining when a TREND and a TR is:

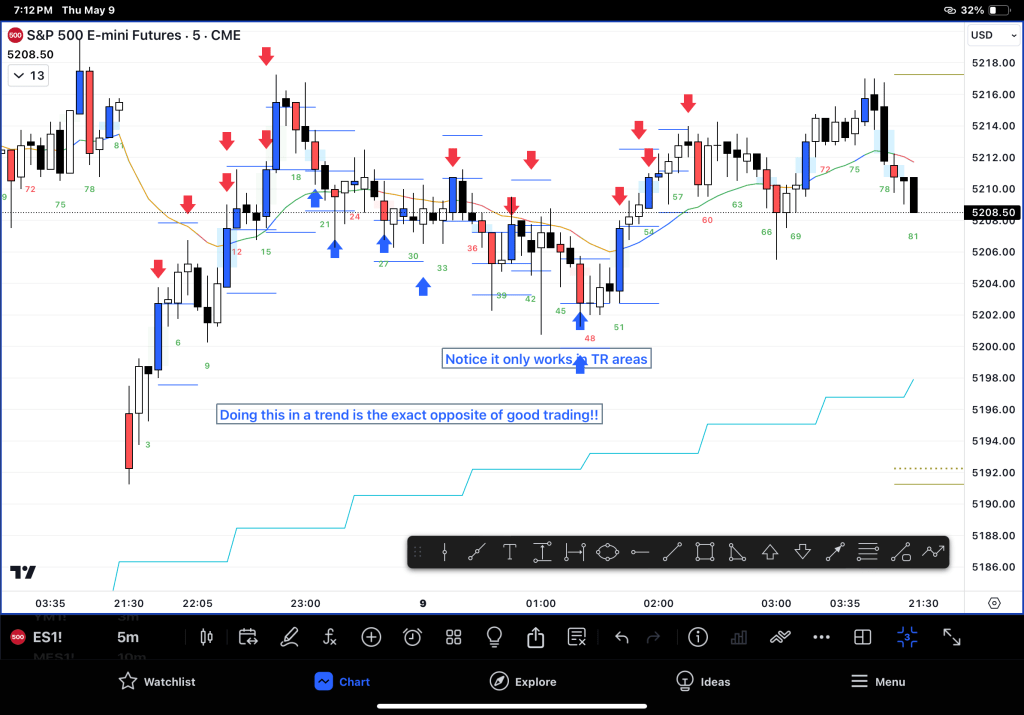

2. Buy below a BL, Sell above a BR

Consider doing this in a trend and see what happens

3. Spike Break Tests – enter where it failed before

Spike break is the only strategy I will use in a trend and see below how it works

Leave a comment