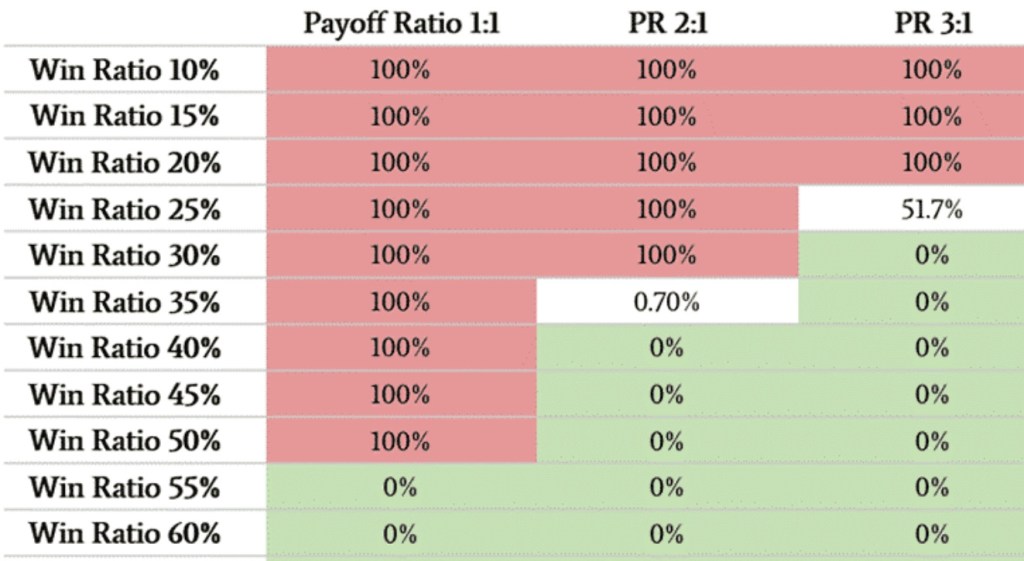

– The Risk of Ruin chart below clearly shows how difficult it is to blow an account getting 2:1 actual or initial risk.

– If anything, most newer traders have high hit rates (scalping / closing before targets) but have largest loss > largest win and average loss > average win..

– So should we all just trade for 2R targets?

– As a scalper I certainly want to improve my average win size in points, but not be in the market for so many bars.

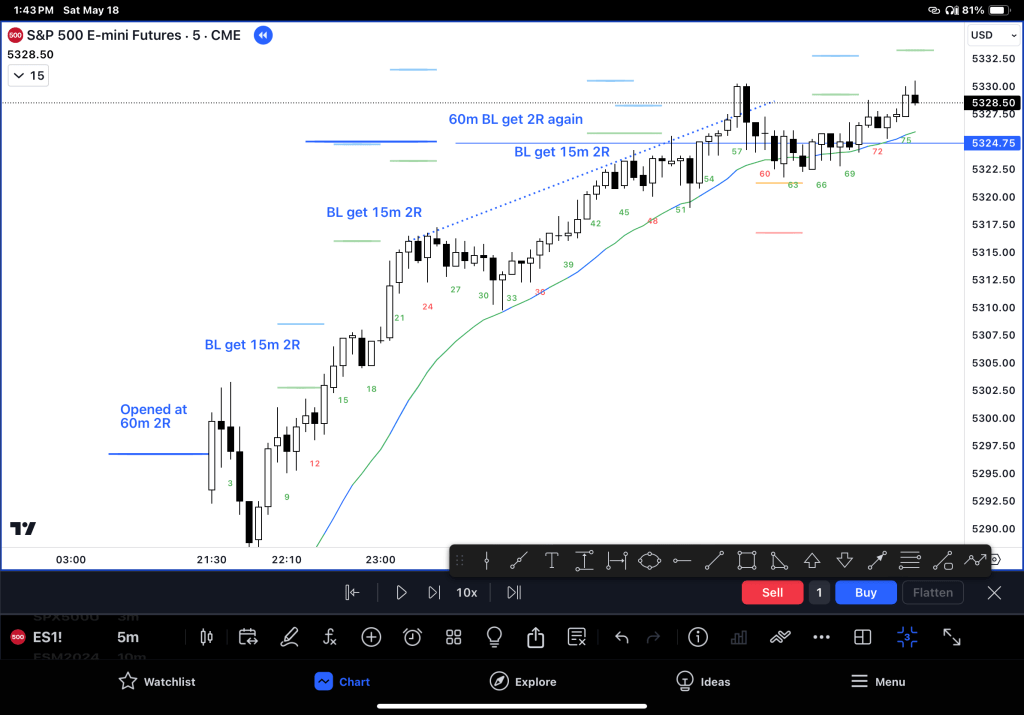

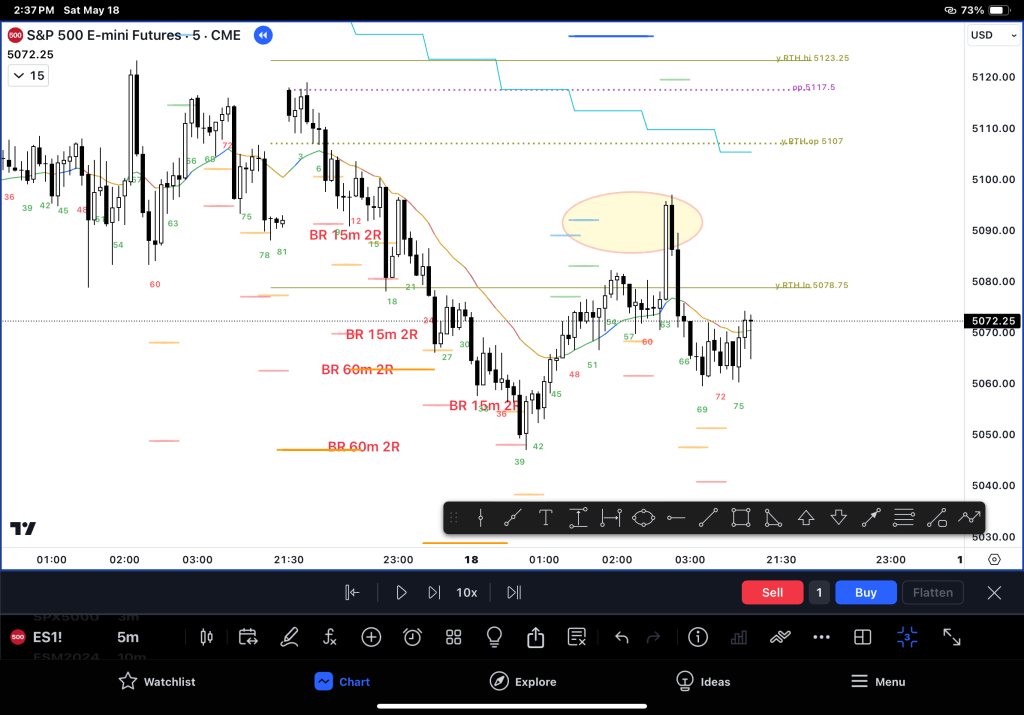

15m vs 60m 2R

– What does a 5m chart look like in relationship to 2R targets on HTF?

– This indicator I wrote uses IBS and body size for filters

– Reasonable IBS and at least 40% body size to measure the signals

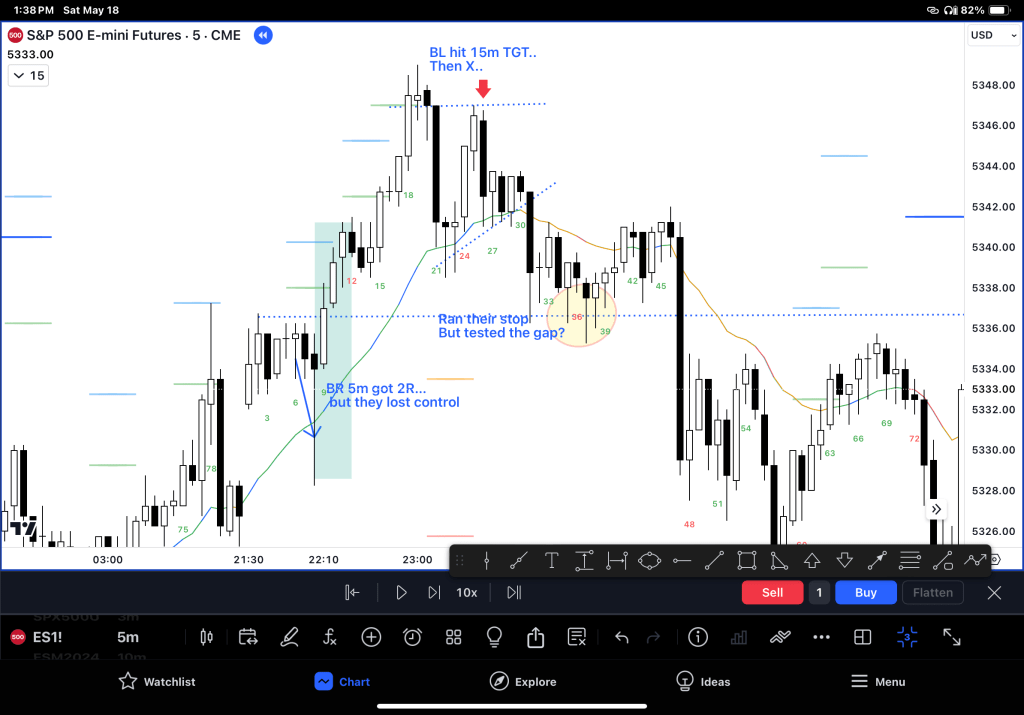

Bull trend day

– Bulls hit everything

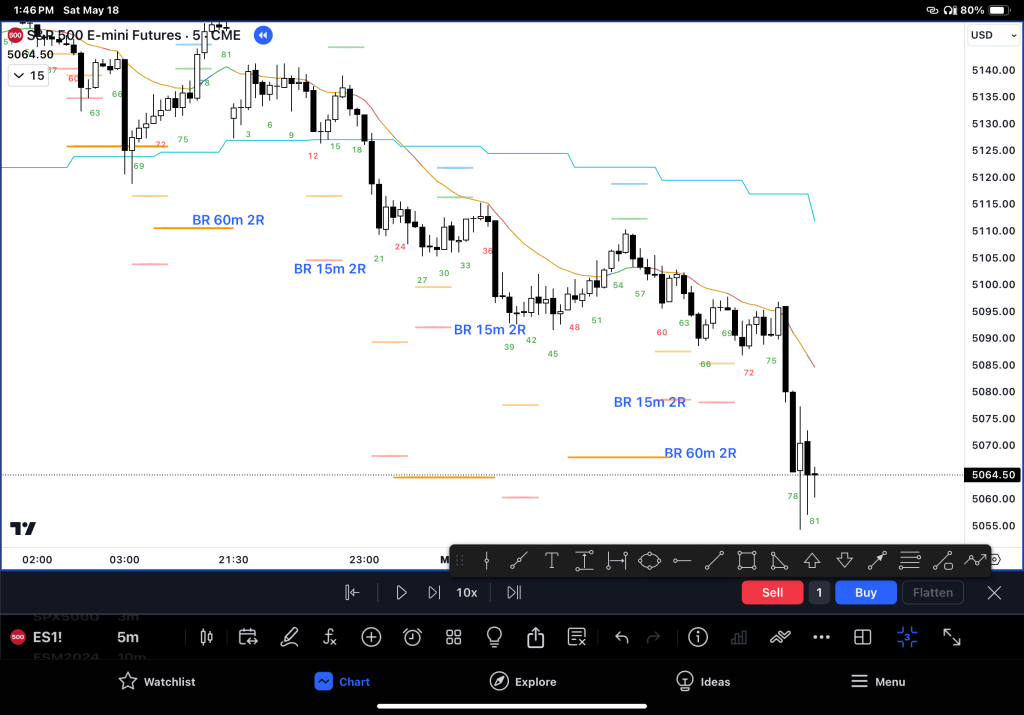

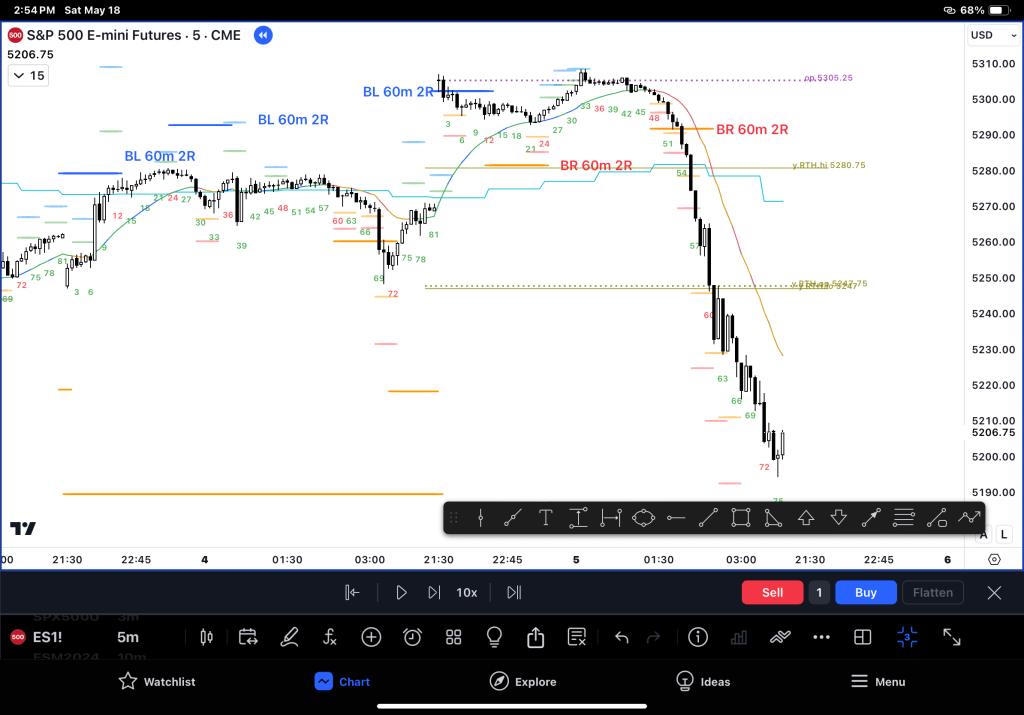

Bear trend day

– Bears hit everything

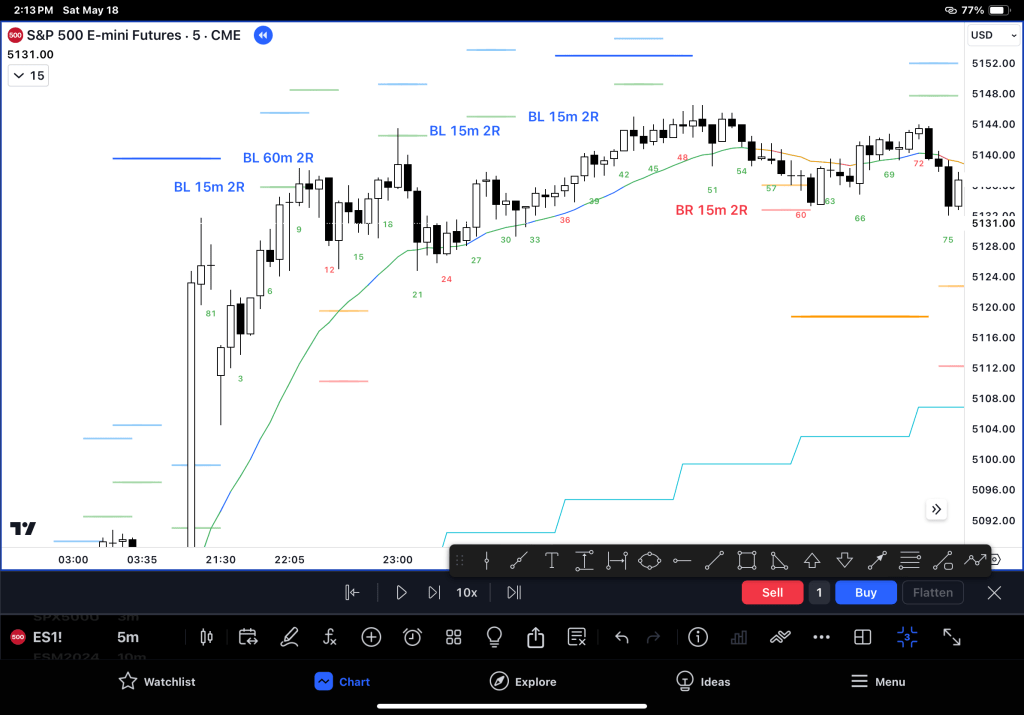

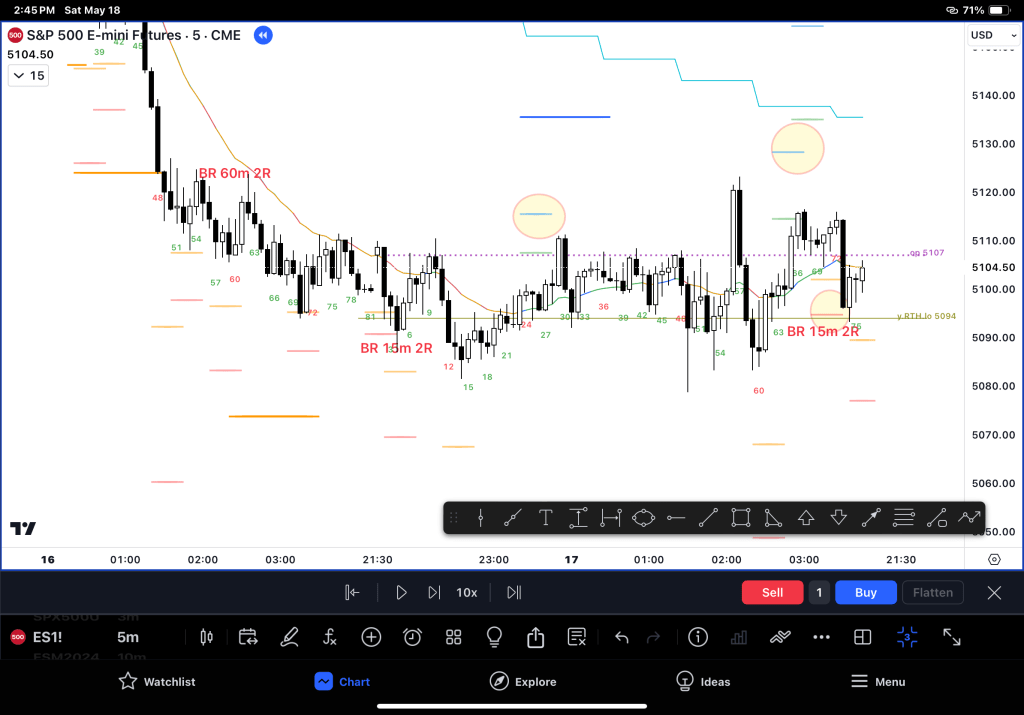

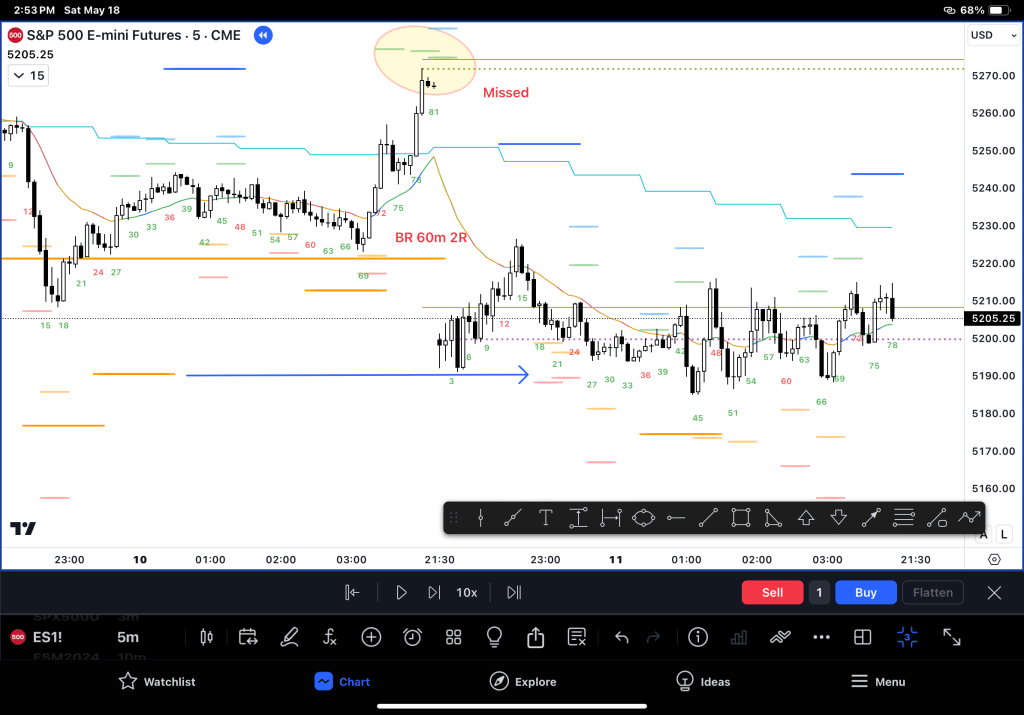

Up and Sideways Day

– Bulls hit 60m 2R and a couple of 15m 2R, BR can’t get anything

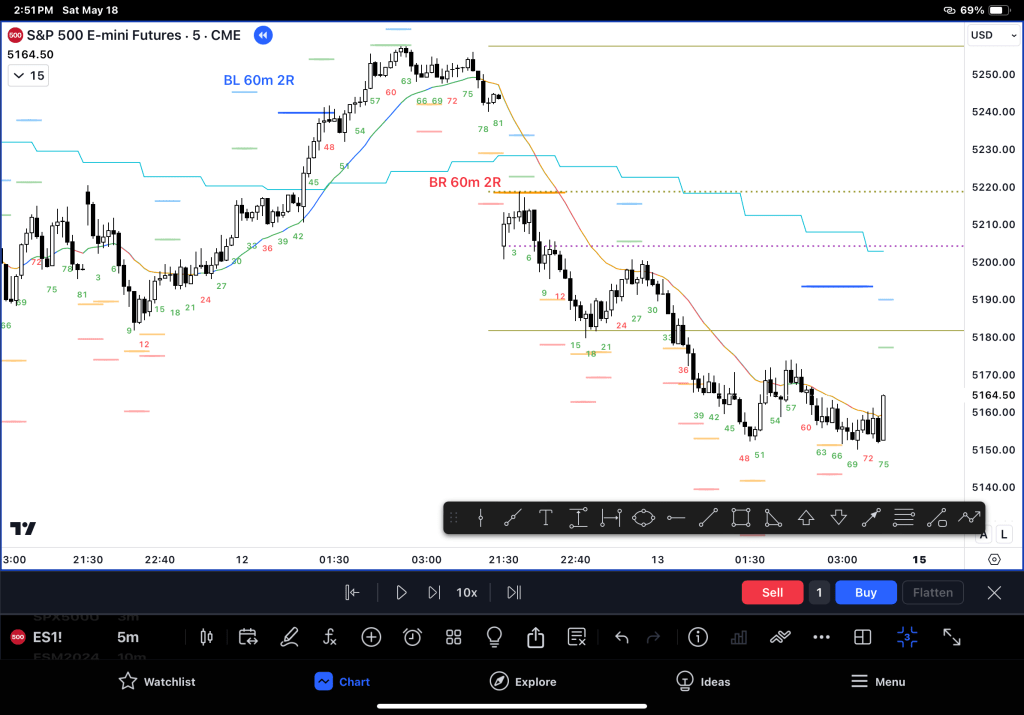

Down and Sideways Day

– Open just above and hit 60m BR target 1st hour

– BR get a couple of 2R 15m

– Just before 60m target strong reversal

– BL surprise got a 2R – back to LOYD (Low of yesterday)

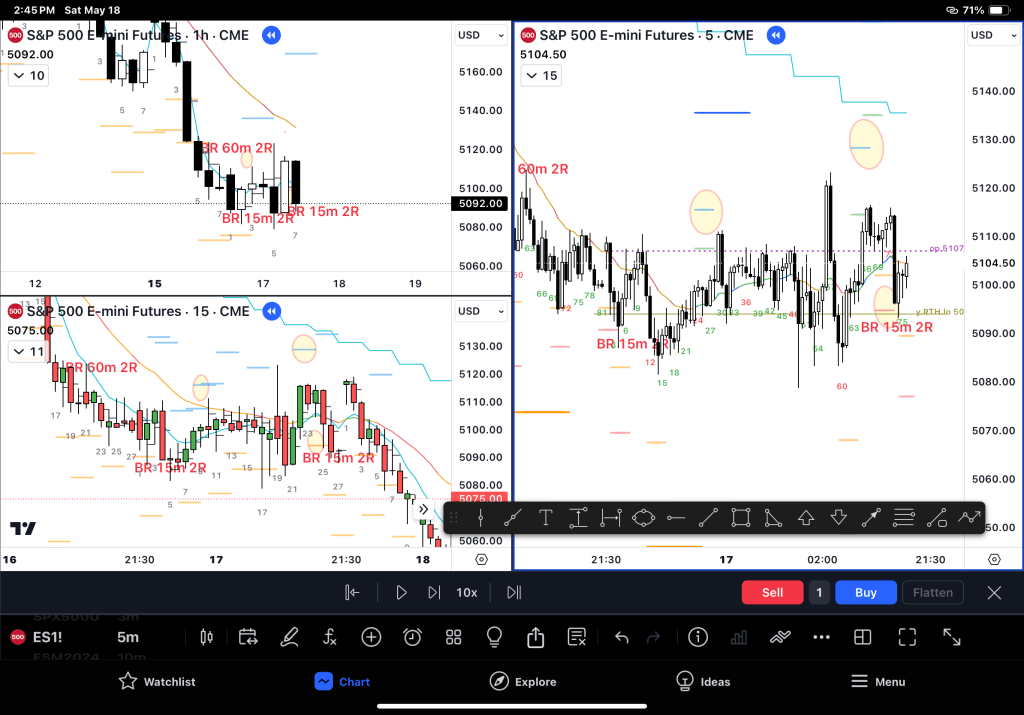

– Sideways

So what is a TRD?

– 60m 2LSW pullback before a Leg 3?

– HTF TTR

If we look at the HTF for comparison and context

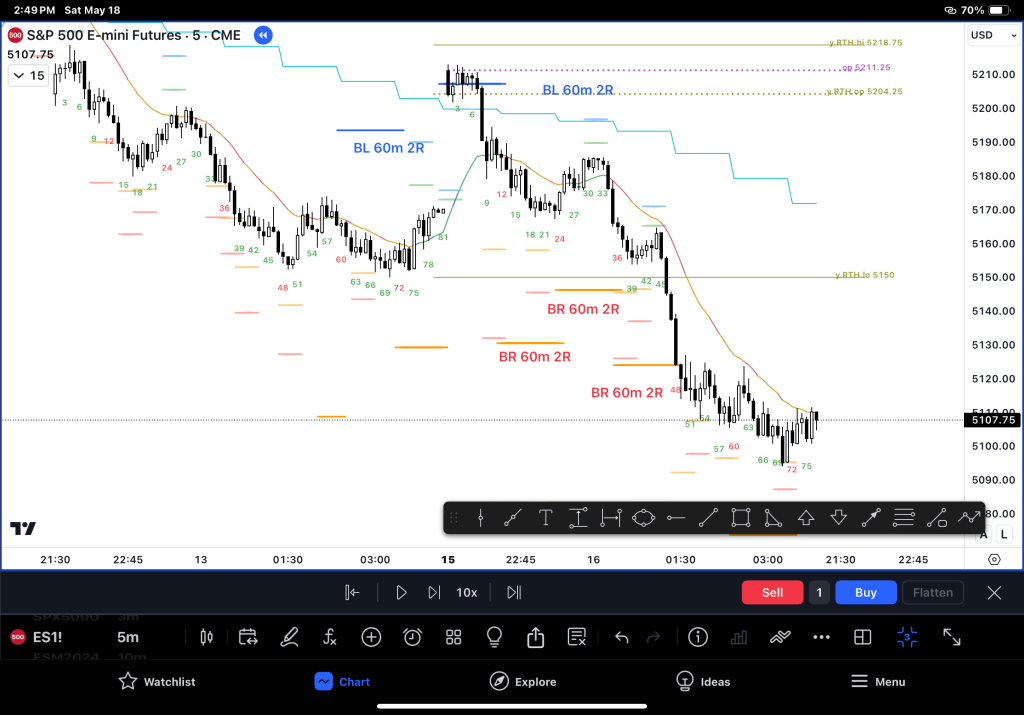

Opening at a 60m 2R target

– Seems to indicate a trap open

– But not always – here an overshoot test and more down

Relationship between 2R and 1R

One thing I’m not clear on is, ok, yay for pattern recognition.

But can I trade it?

– Does getting a 2R mean I should keep going or does it mean stop?

– Chart below BR got 2R then trapped?

– BL got 2 lots of 15m targets then finished for the day?

Research is ongoing!

Leave a comment