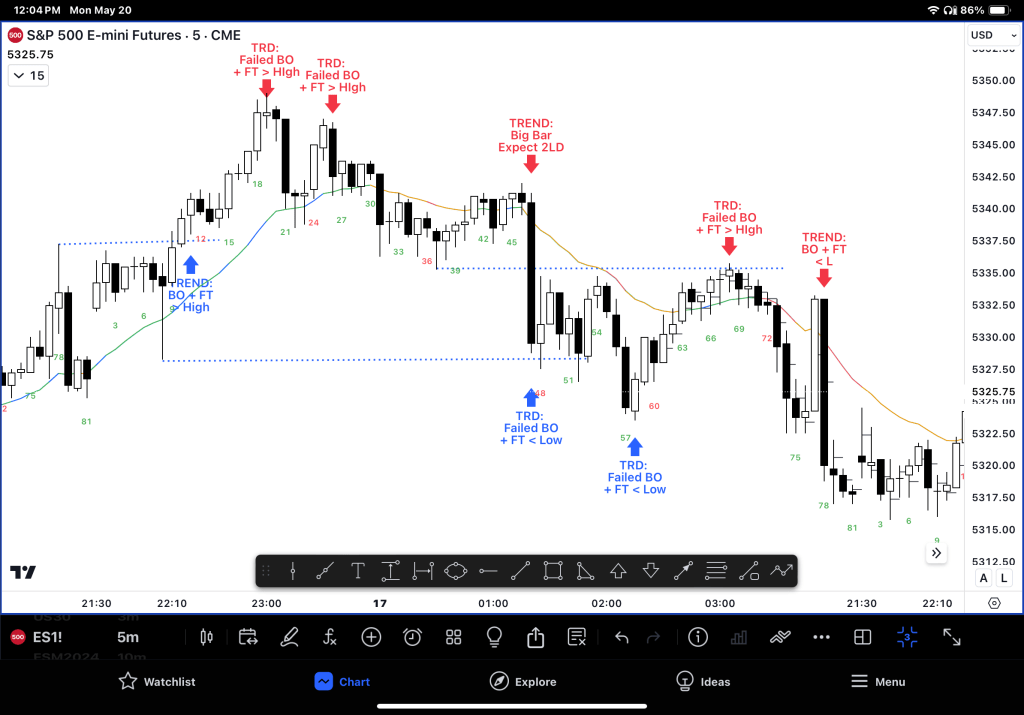

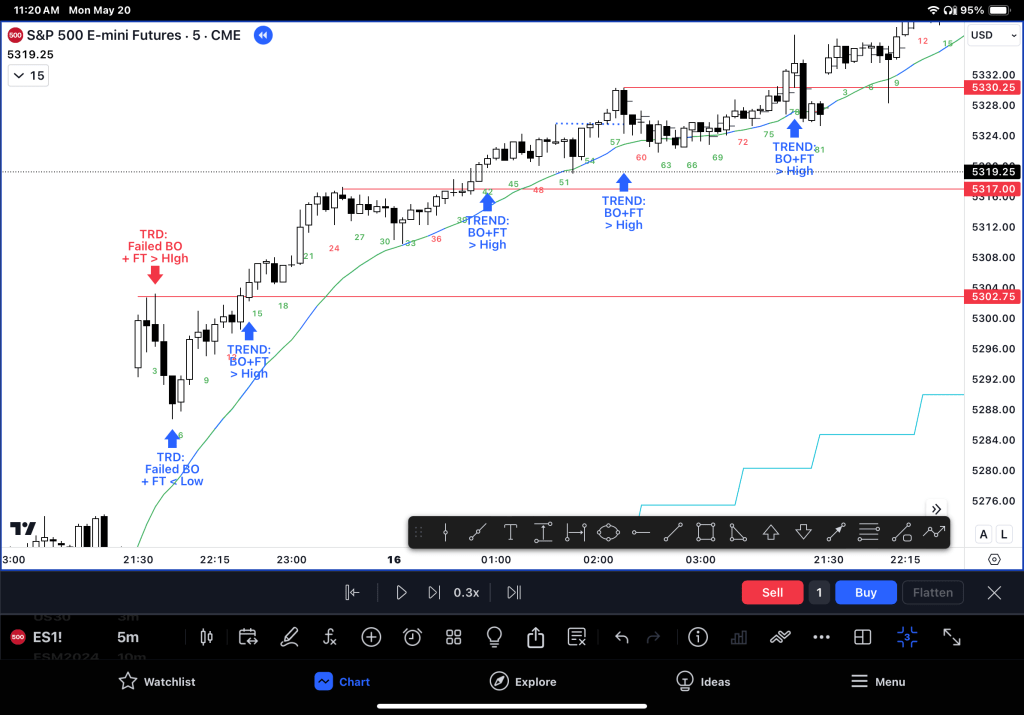

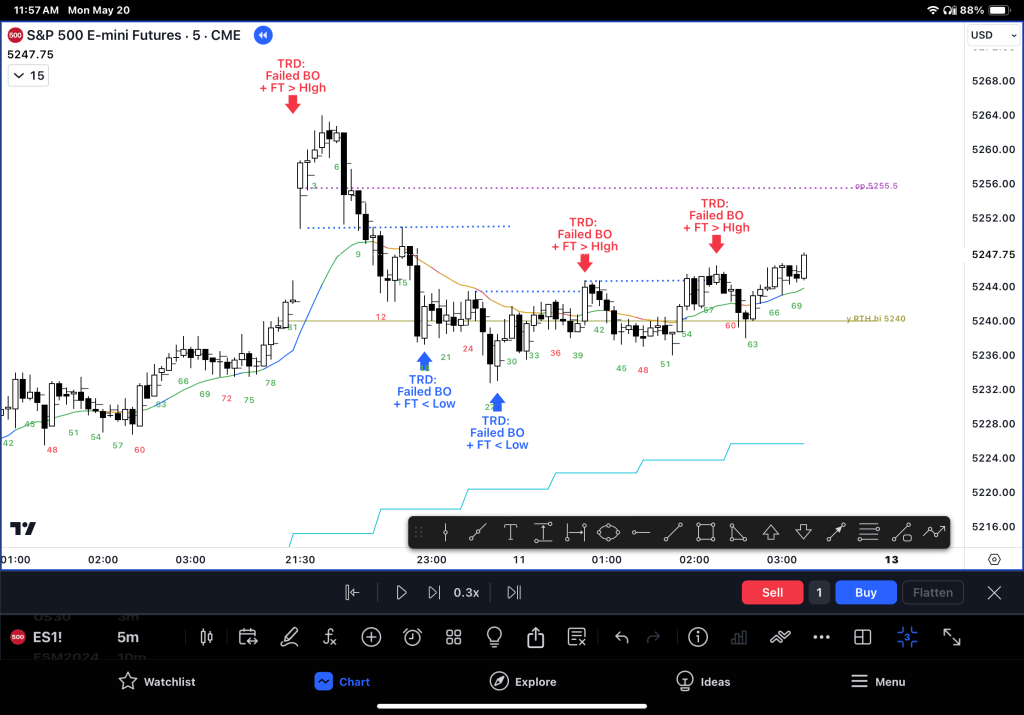

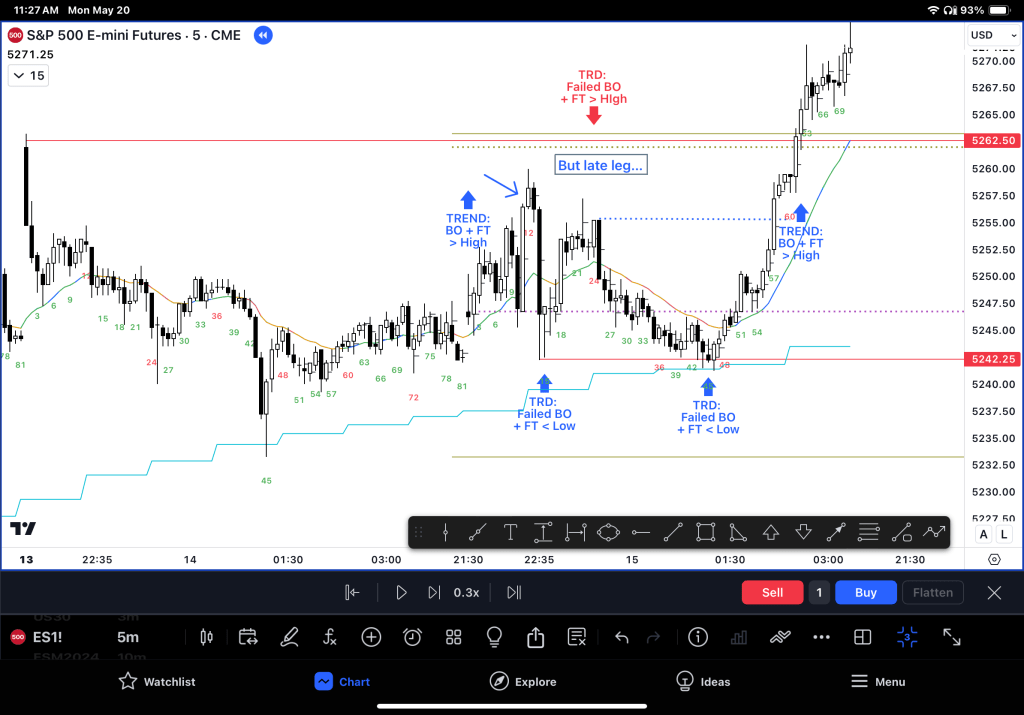

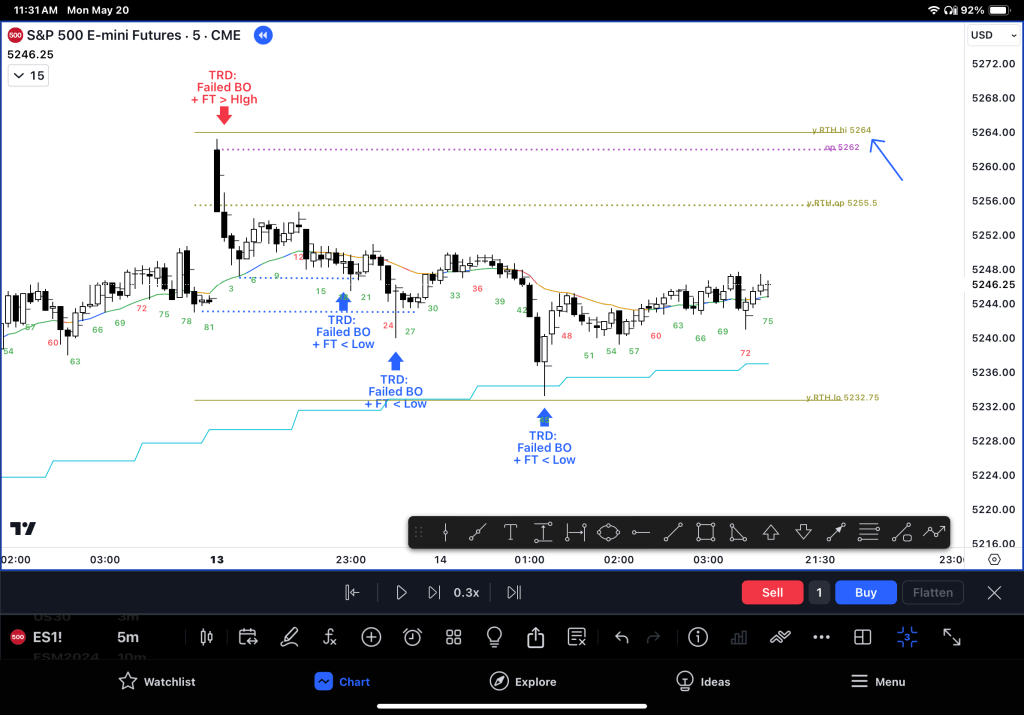

Exploring the impact of a failed BO + FT (Breakout and Followthrough) outside of key magnets (OHLC today / yesterday) and how we can use it to take TR (Trading Range) entries in a TRD (Trading Range Day)

Summary from below research:

– Failure to get BO+FT highly related sign for TRD

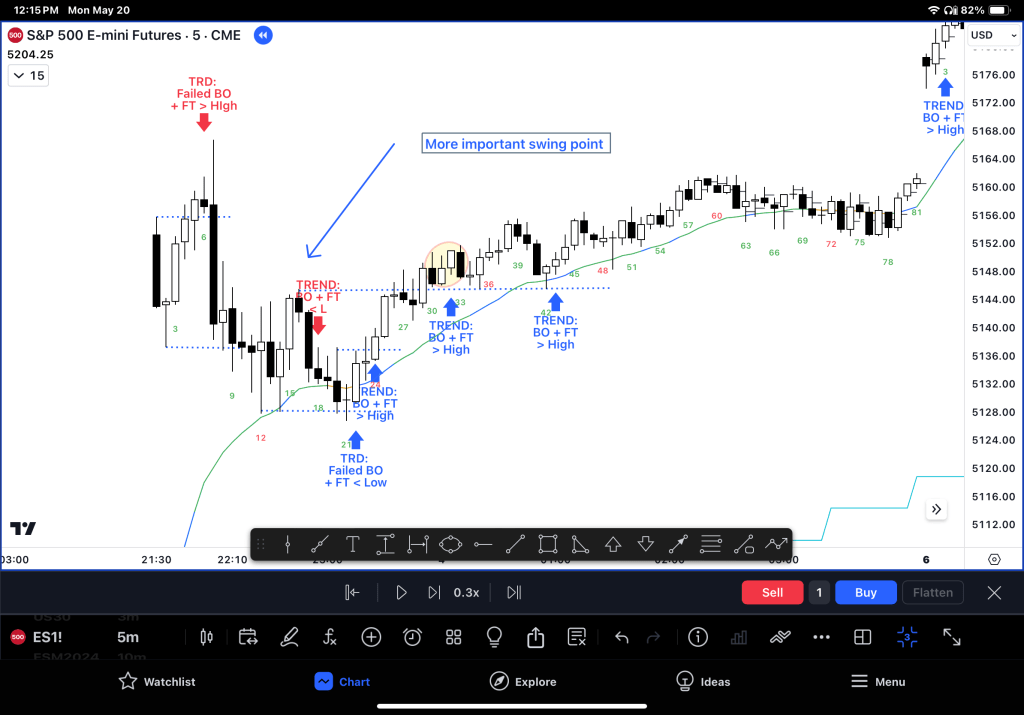

– Sometimes BO+FT far distance away from range, trade PB

– Clarity between swing high and a range high – ie YD TRD, so more important to BO

– Leg 3 is high % failure, especially in TRD

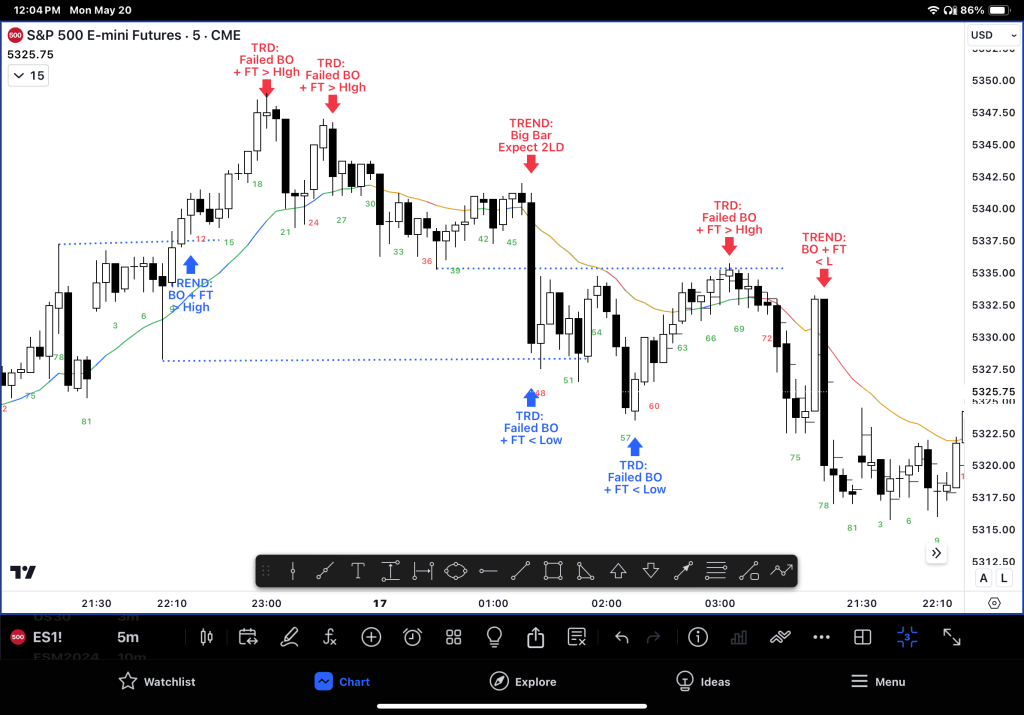

– Channels don’t BO+FT but get legs in that direction

– One big bar can do it

– If the BO+FT gets not trending behavior – usually time to exit before loss

– Don’t be precious on swing points – day structure is more important

– Test extremes of range, DT or DB in middle can be broken by a lot

Examples

– When BO and FT is unclear, channel and deeper pullbacks likely

– When BO and FT is more obvious, sideways and then new L / H more likely

– BR Trap open above with BL trap below…

– But that gives us the issue of always putting the PA inside a range from before…

– But helped again here as YD

Channels

– Channels have failed BO+FT, but have many legs in that direction

– So now with channel research, we can remove one side of our TR trading – ie if BR spike, trade short side high, but not long side low… stop too wide, more fun to trade with the stronger side until something changes

BO+FT but still TR

– Everything fails, which makes sense because trading is two-sided

– Here BO +FT but didn’t turn into trend

– Here we can see not, being precious on swing points meant staying long for longer

But swing points are important, just not all equally important – here – ET day, look for reasons to enter

5 failed BO’s = BOM!

– Squeezes H and L, so be ready for the more obvious move

Leave a comment