Concept

- How does WHERE we open impact the first few trades of the day?

Video

- I did a video about part of this process here:

- Concept

- Video

- Research

- Open in YD Range

- Open in YD Range – YD Channel

- Open outside YD Range – Breakout

- Open outside YD Range – Sucked back in

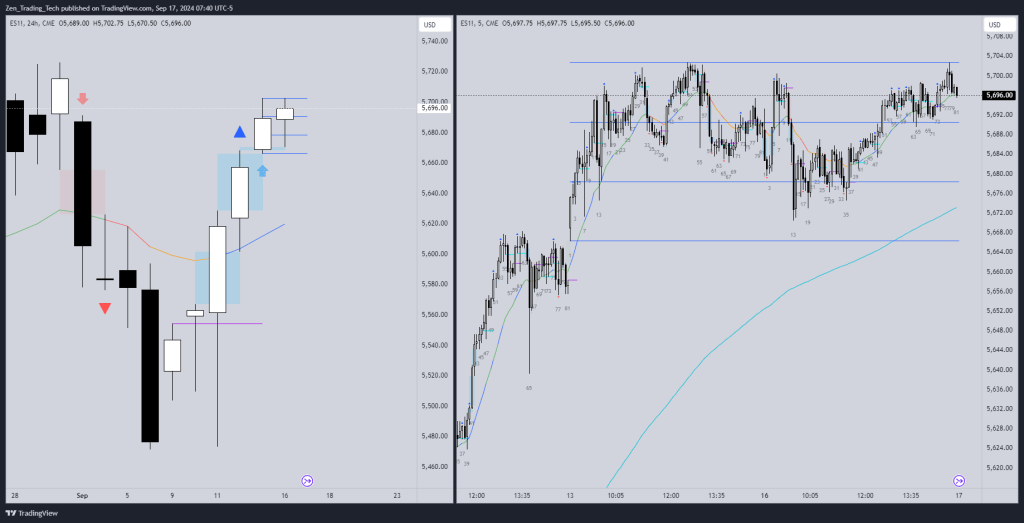

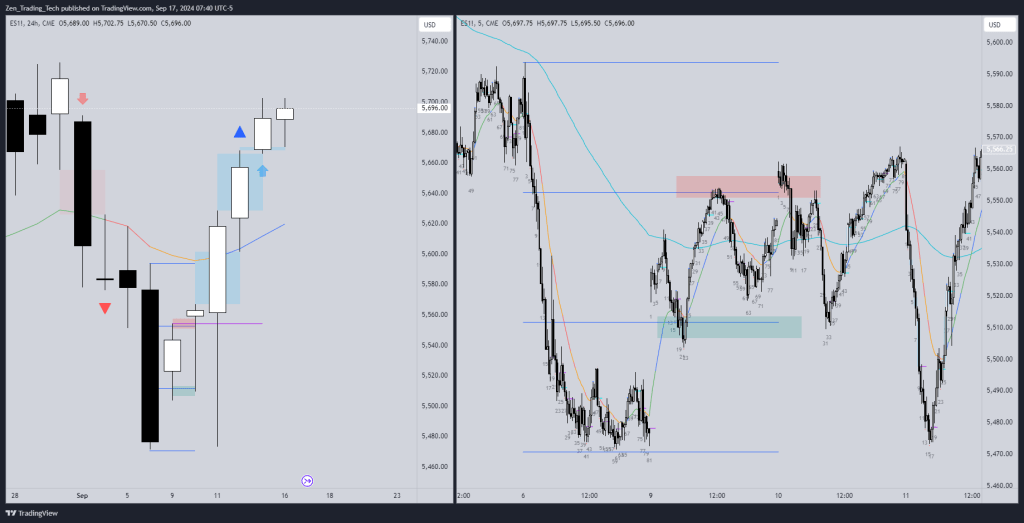

- The Daily Chart

- Conclusions

Research

- There are a few common groupings of opens I found interesting and possible ideas for building trading strategies around them which I’ll share here.

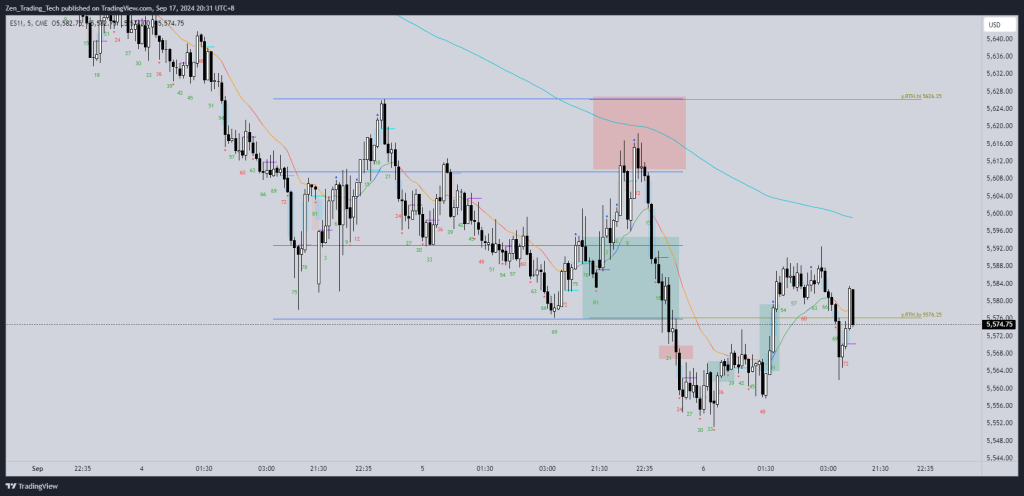

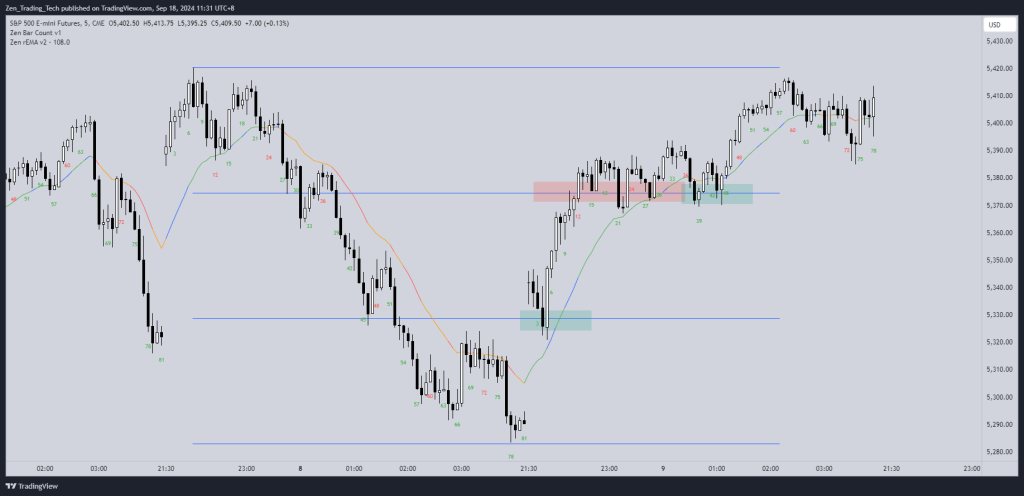

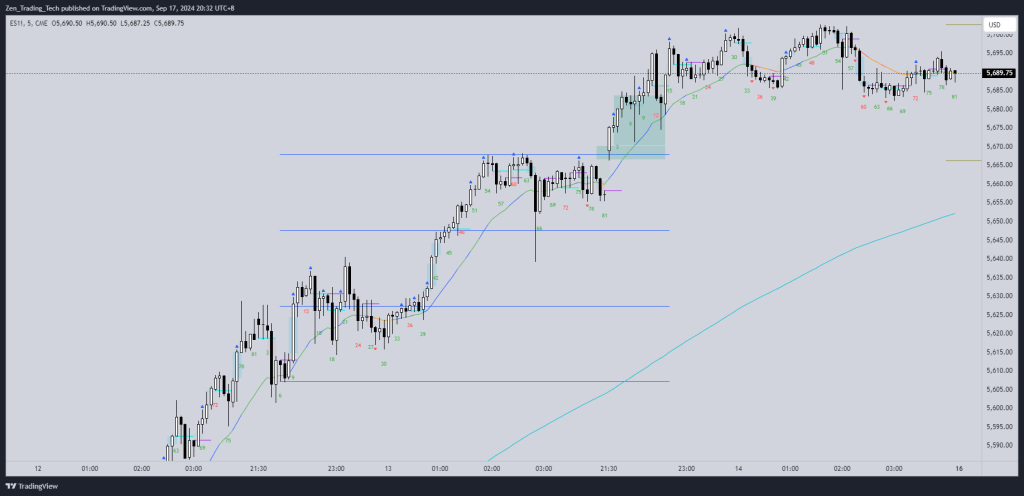

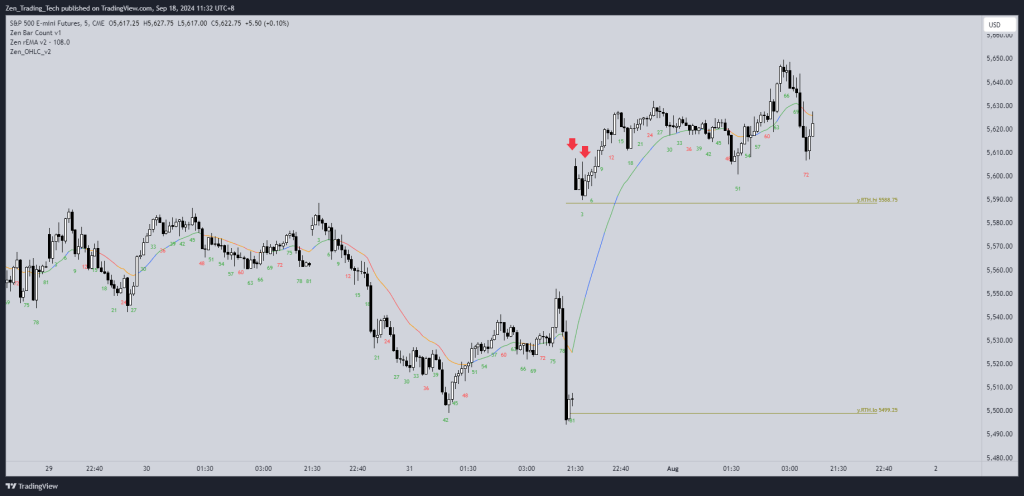

Open in YD Range

- Here YD was a TR and we kept the vibe going all day. A small day followed by another small day!

- Sold off from the top third and brokeout below.

- Open in the middle, buyers below and sellers above

- Open low found buyers, and selloff in top third

- Open bottom third and trend up

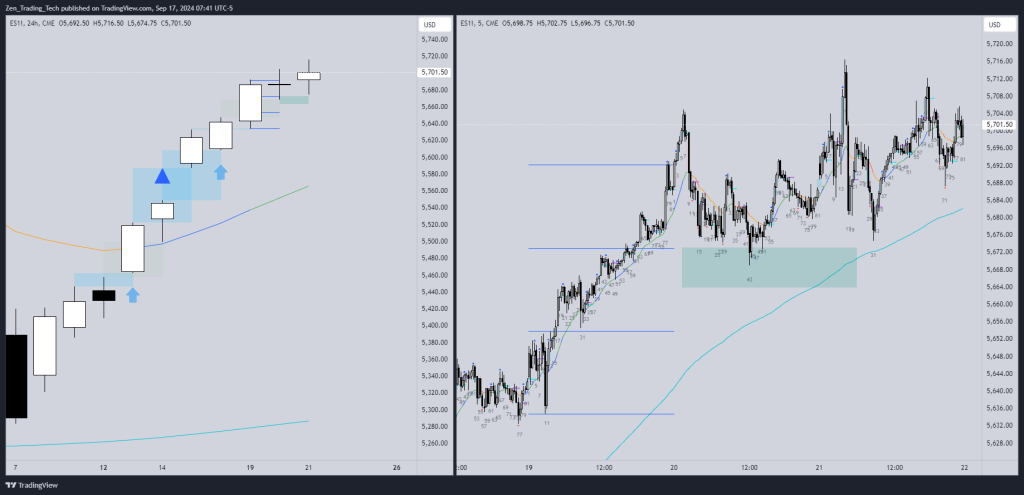

https://www.tradingview.com/x/15IExX57/

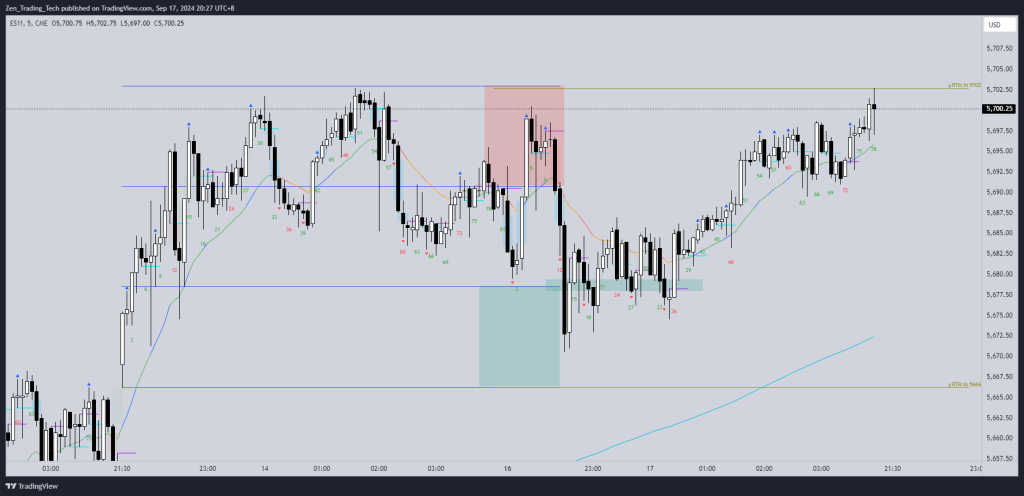

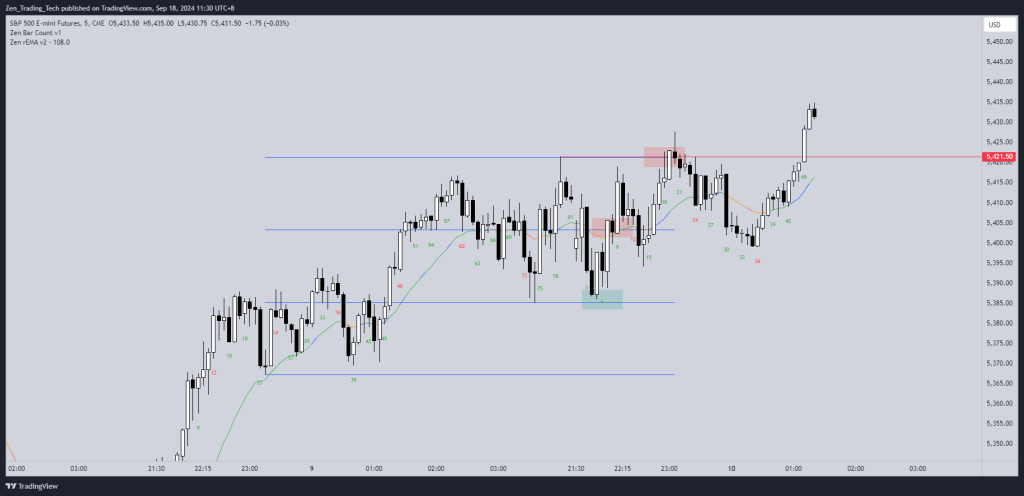

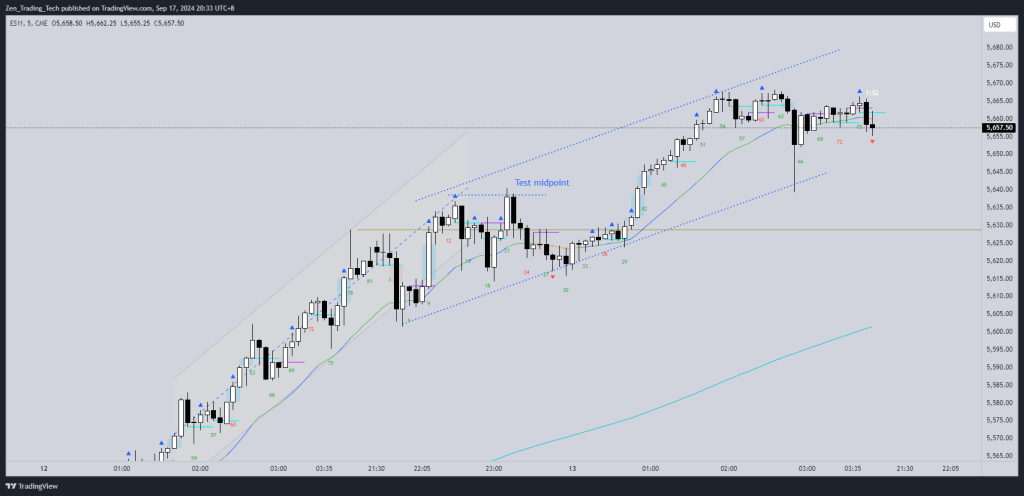

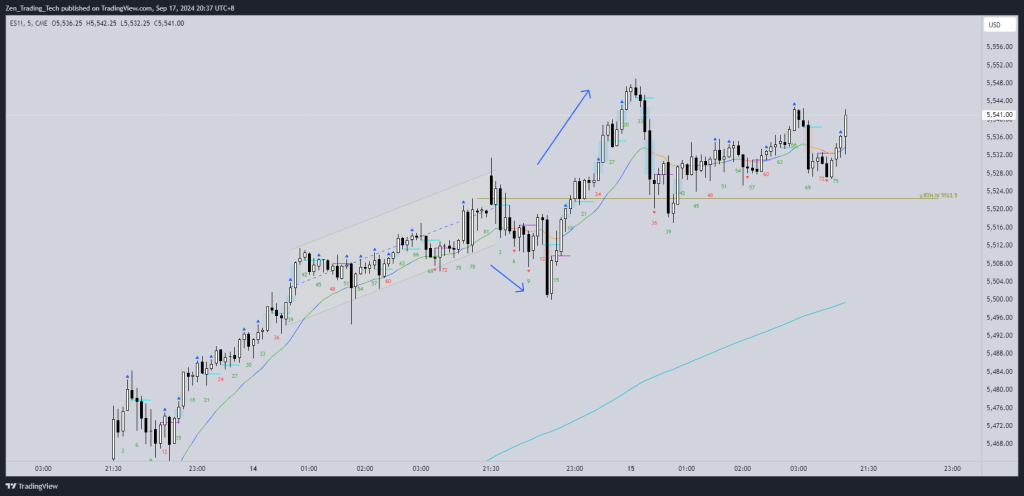

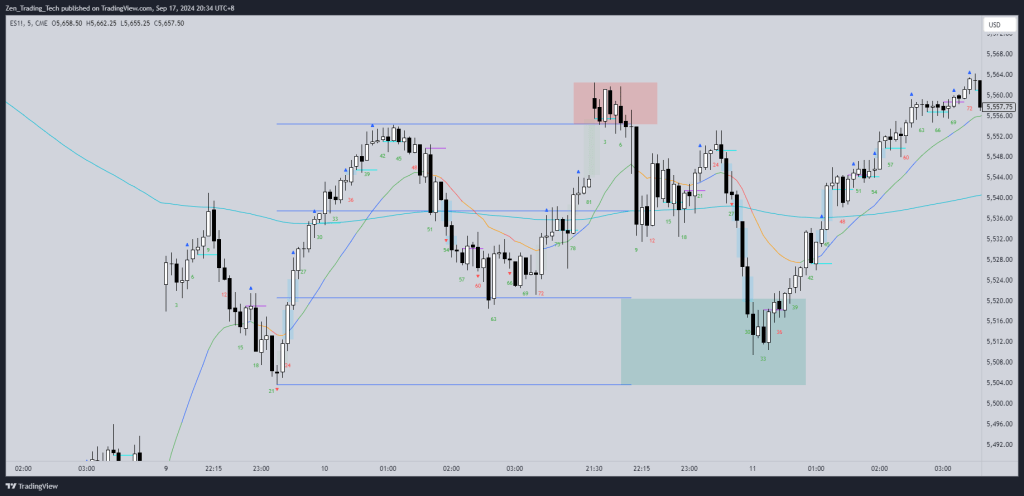

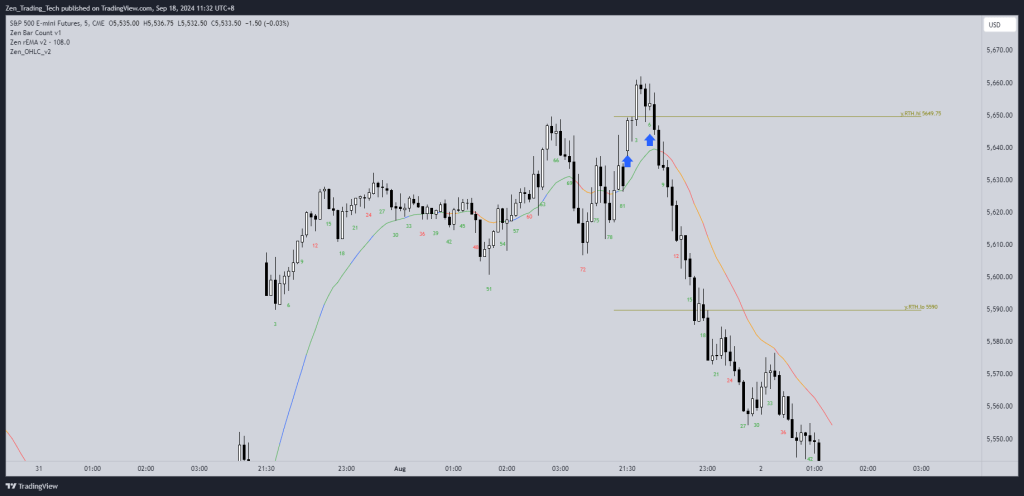

Open in YD Range – YD Channel

- Strong bull channel yesterday, broke out, tested midpoint, then made a more gentle channel

- Strong bear channel

- Bull channel, first a bear breakout then a bull breakout, then sideways

- Bear channel, bear BO then bull BO

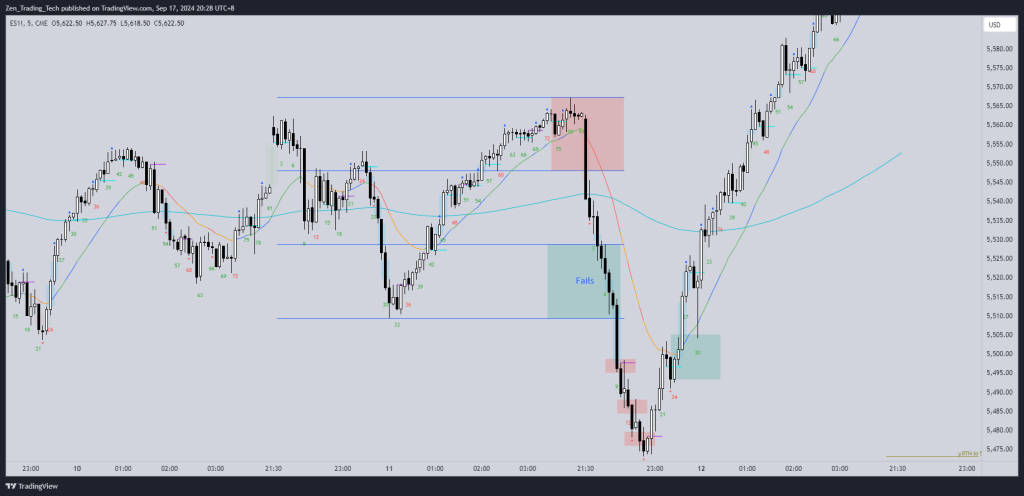

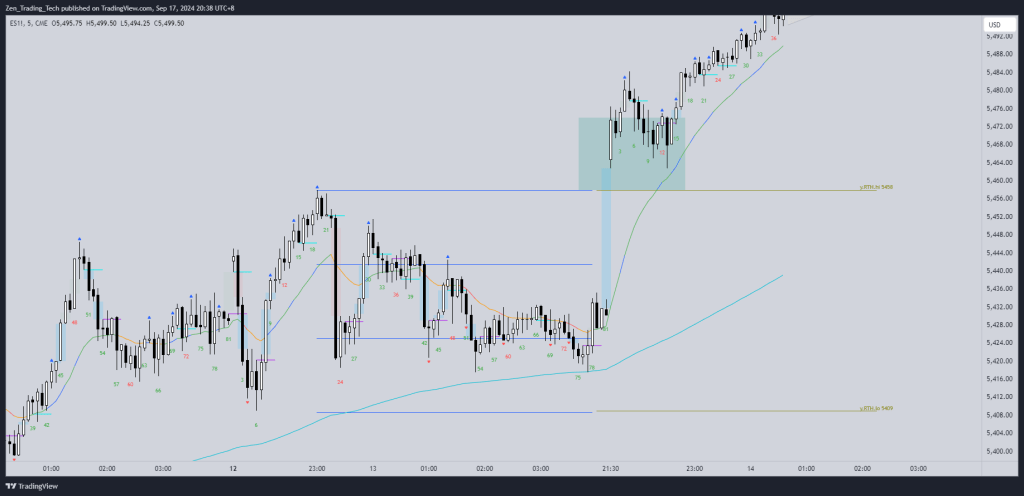

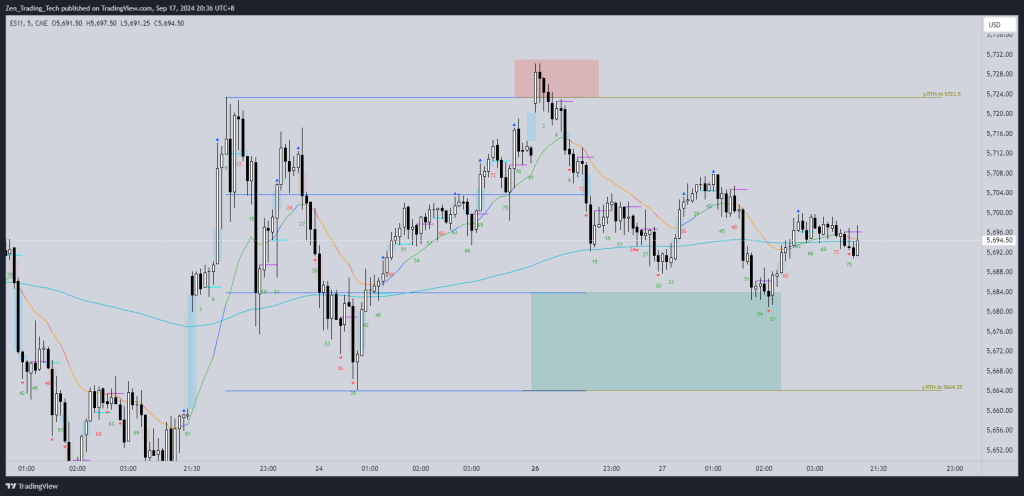

Open outside YD Range – Breakout

- Bull day and then next day bull trend from open

- 2 attempt to reverse, more buyers

- 2 Attempts then sideways to up

- Sometimes it comes back later

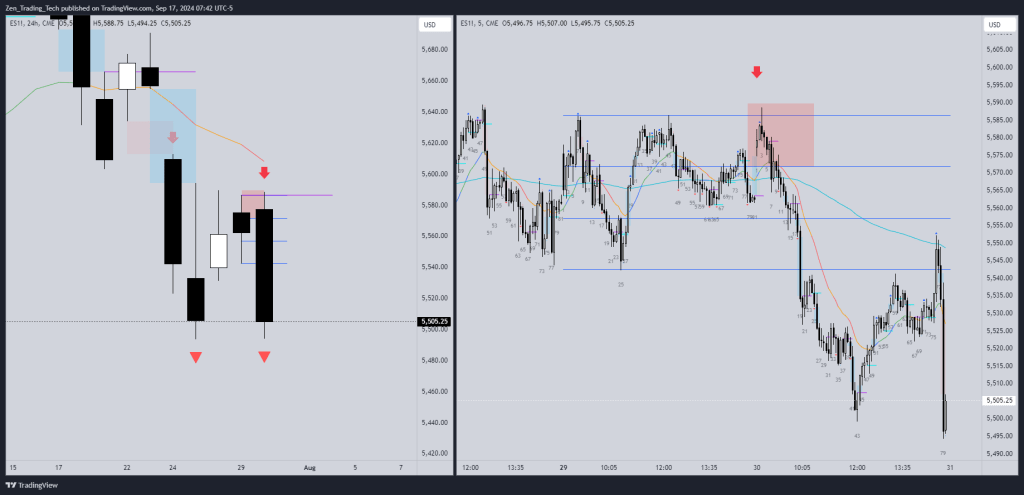

Open outside YD Range – Sucked back in

- Opened above but fell back in. Buyers in lower third.

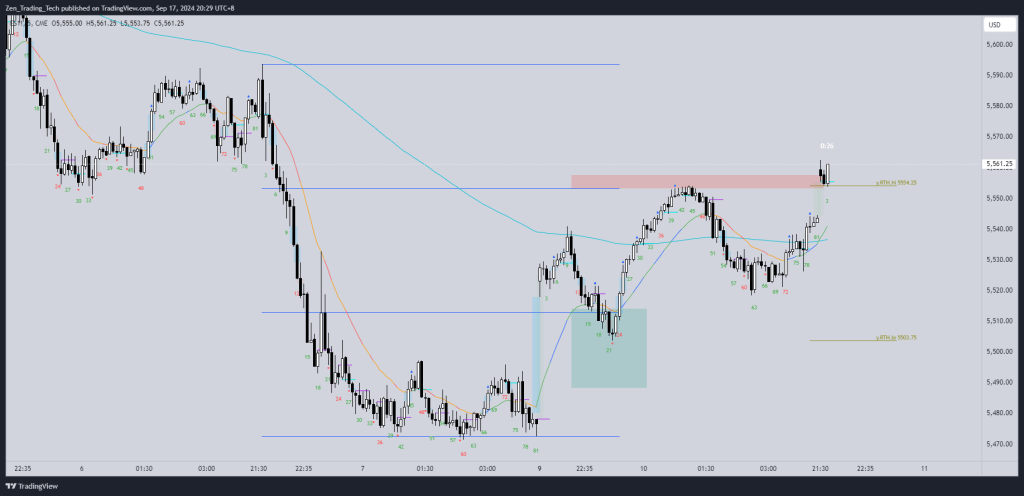

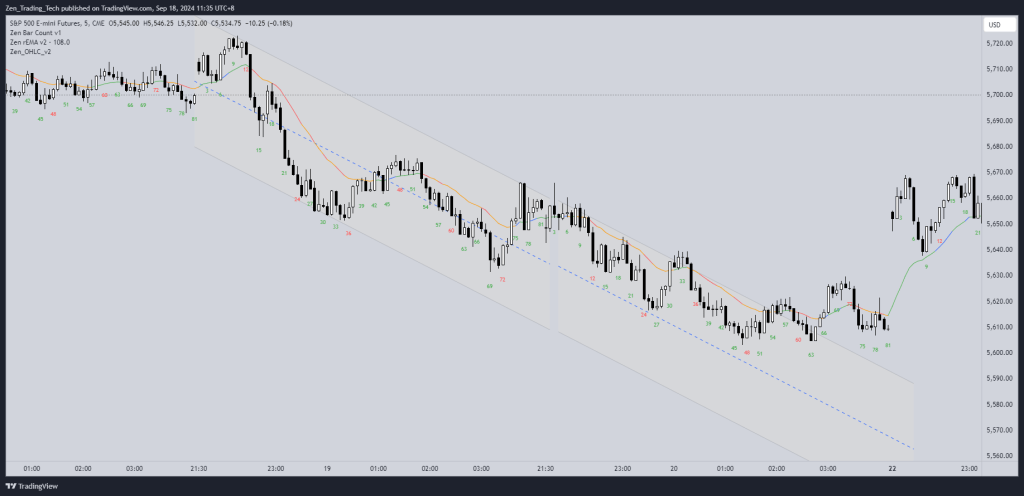

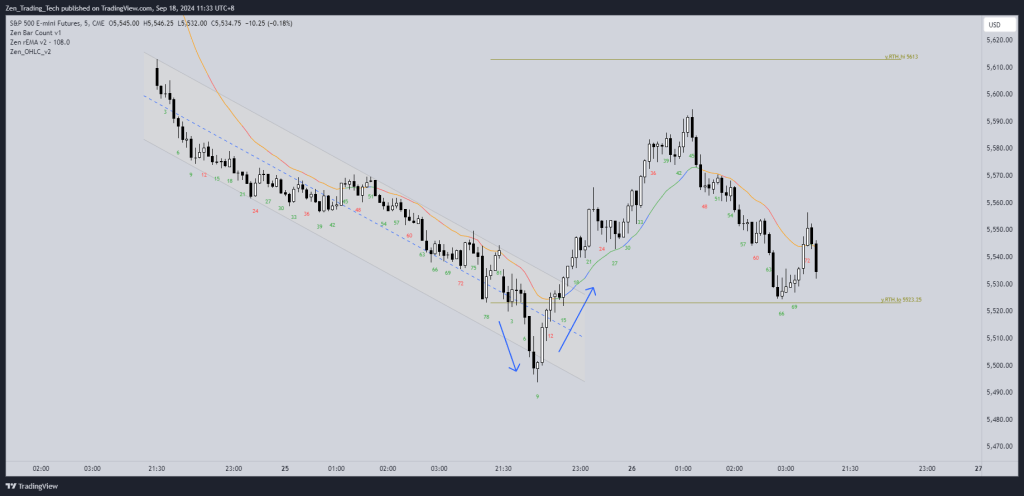

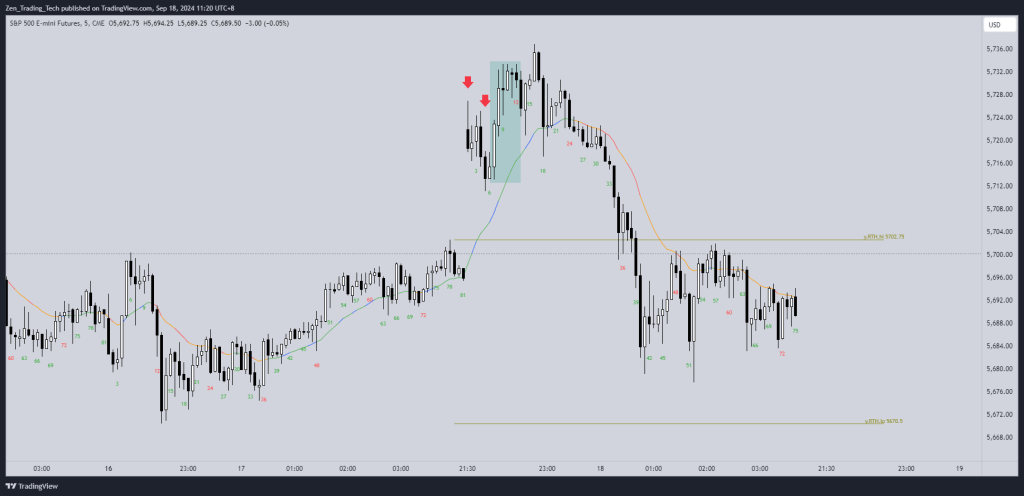

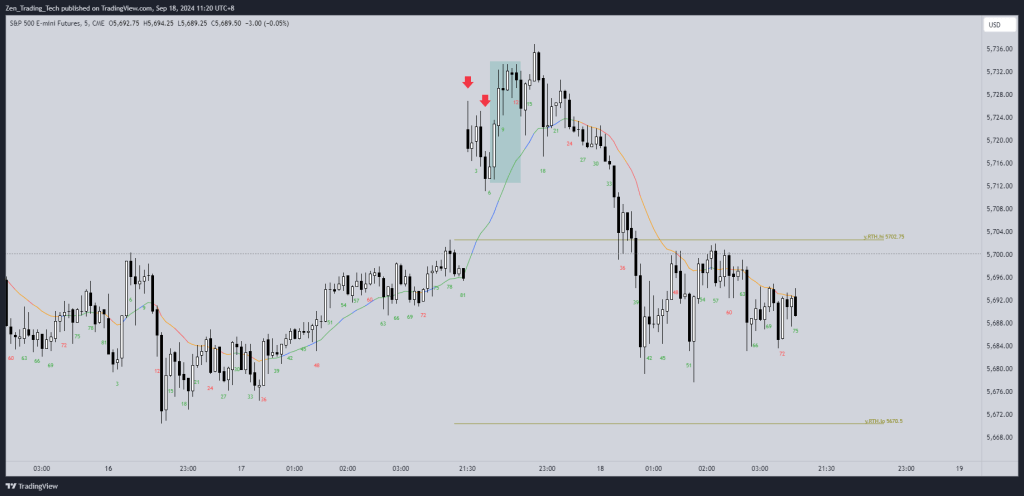

The Daily Chart

- One of the biggest factors I found was the Daily chart (24h RTH)

- Some charts below

- Bull bar, in bull spike, buyers in lower half

- Big bear bar, sellers in top half – top third

- Bull spike, buyers chased it up from above 50% – urgent bulls!

- Sell signal bar in bear trend, sellers above

Conclusions

- This is an ongoing research to improve trading on the open

- I hope you enjoyed it and maybe it inspired you to take a look at ways to improve your trading on the open.

Leave a comment