Intro

- Once do this drill you will see them everywhere

- It will give you more confidence in reading price action if you practice it

Video

- See more details here:

Leg Counting: 3 Ways

- Pullback goes below low of prior bar in bull leg

- Pause – sideways / inside bar / opposite bar (Lower timeframe had a pullback)

- Implied – tails (Lower timeframe had a pullback)

Instructions for Drill:

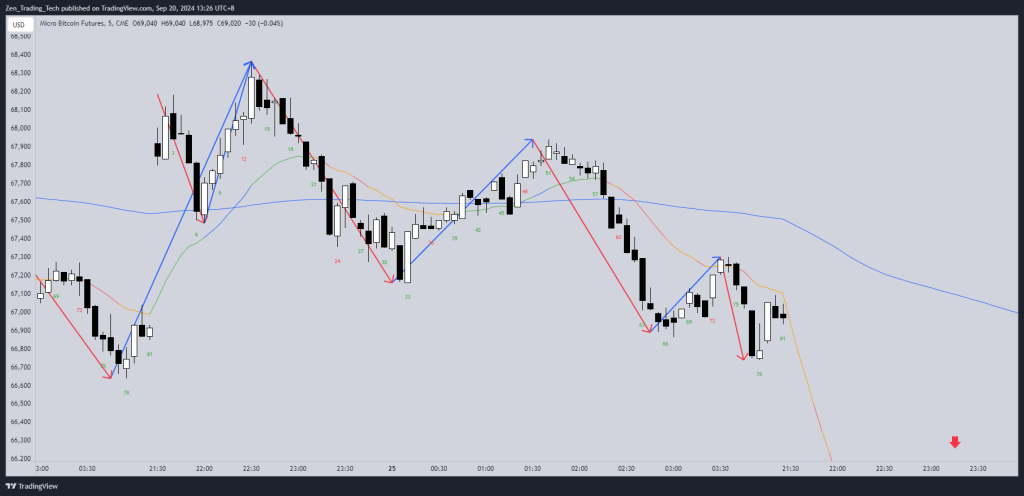

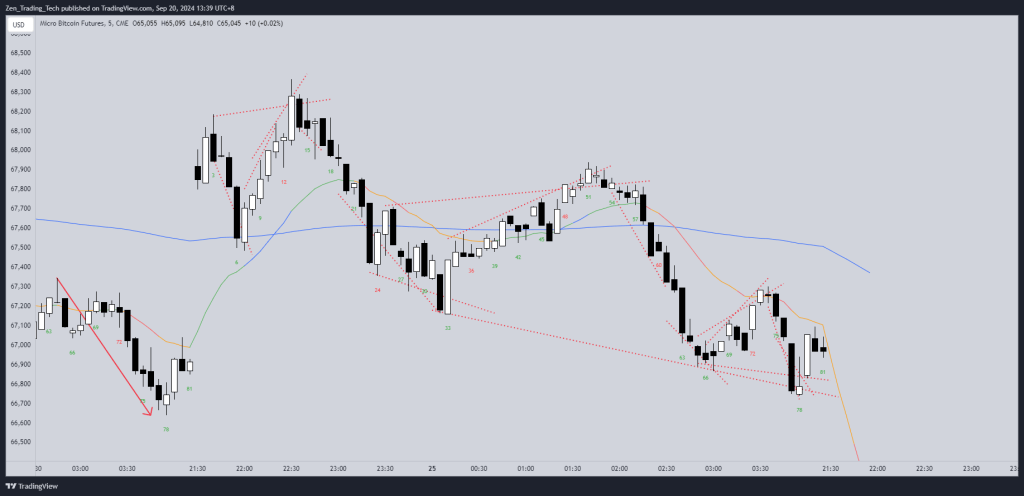

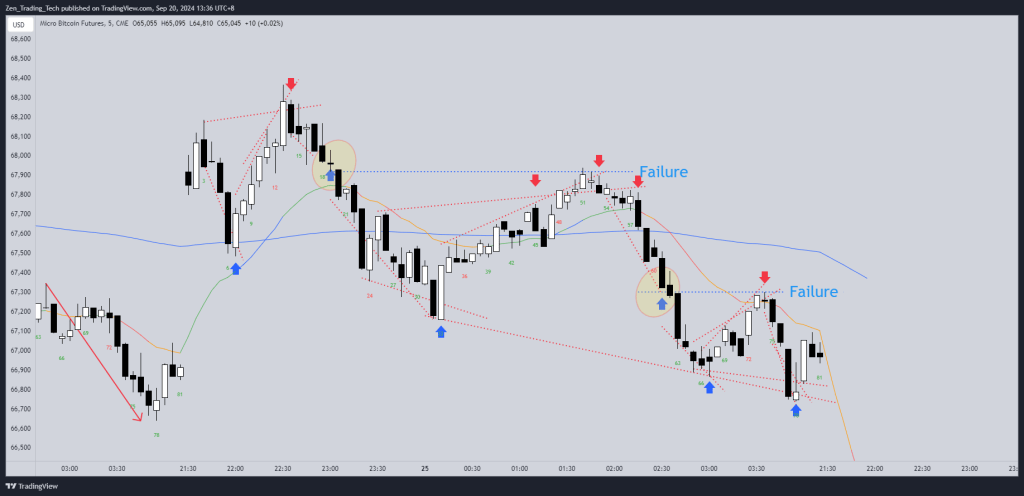

- I used the 5min chart as my tradable timeframe. If yours is different then you can adjust from there.

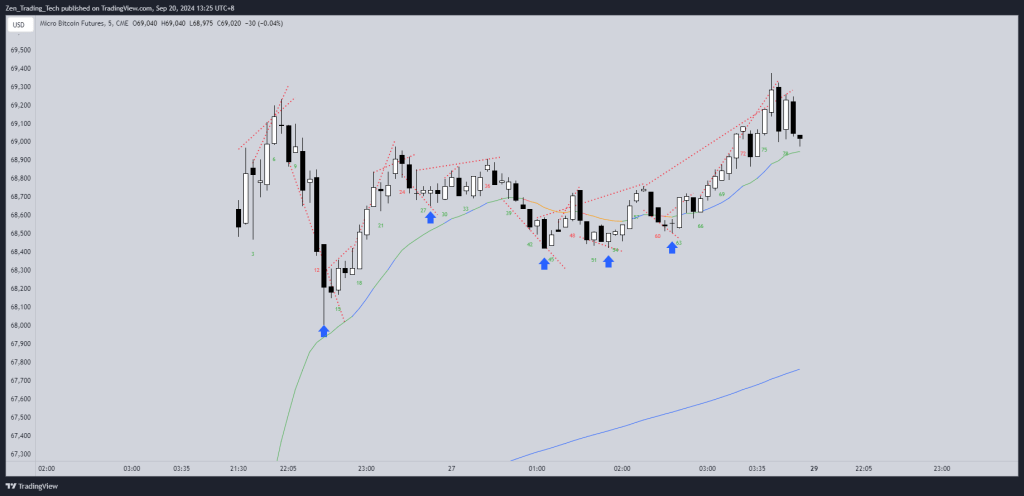

- Go up a timeframe by a factor of 3x (For me 15m)

- Draw arrows – Snap to highs and lows of the spike – use the obvious one if unsure

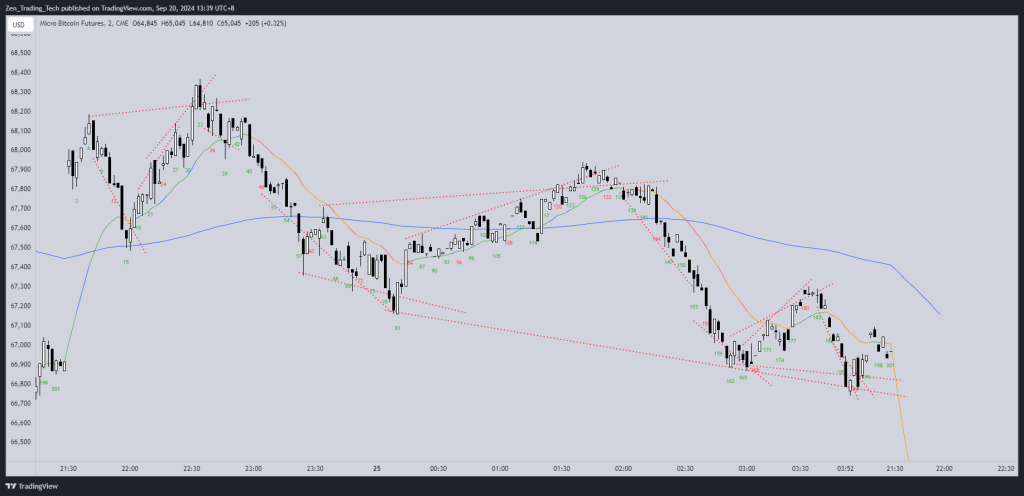

- Go down a timeframe by a factor of 2-3x (2m)

- Connect 3 push patterns – ok for overshoot and undershoot

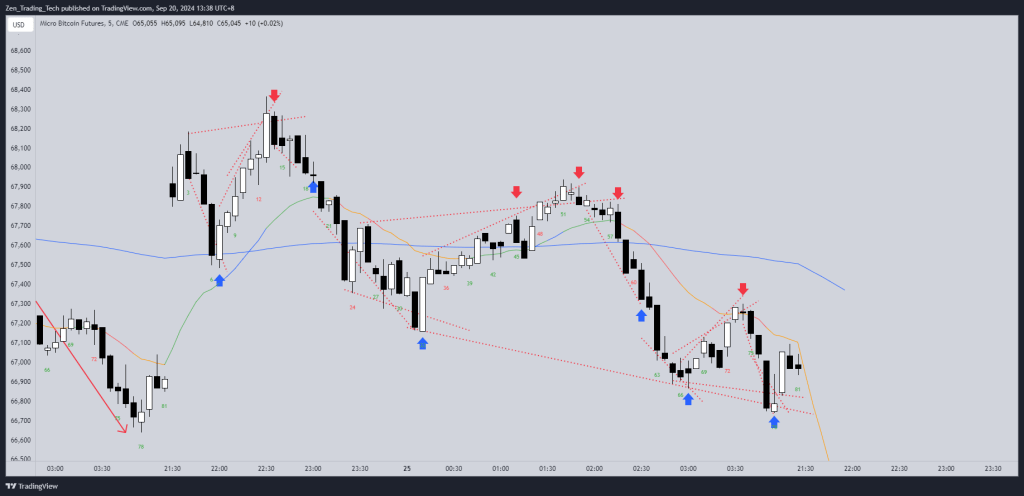

- Go back to the 5min chart

- Now mark reversal signals with small arrows

- Notice where they fail for the secondary trade!

- Notice the different between trend vs counter-trend wedges

- Counter trend wedges will help your profitability a lot!

Various

Other Notes on Wedges

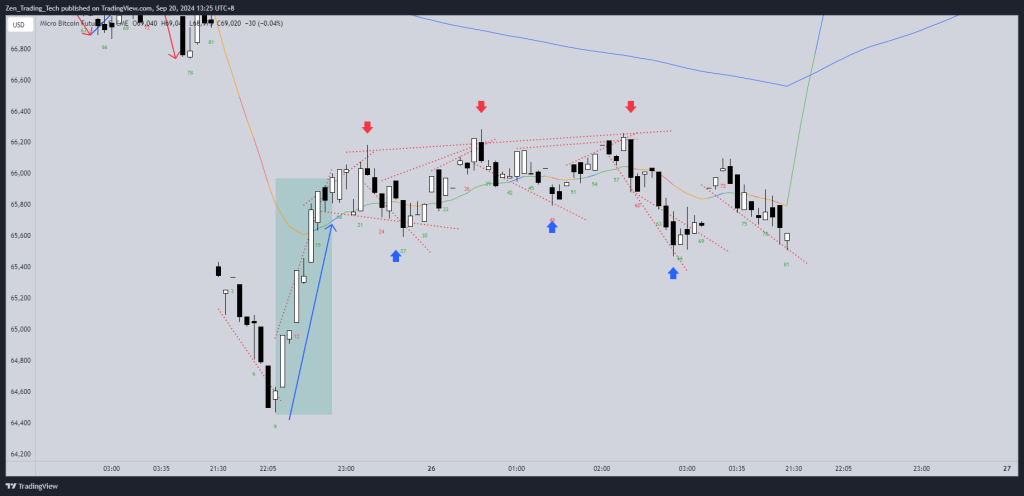

- Reversal setup

- 2 legs similar

- Slice one leg – Overshoot / undershoot

- Wedge is often 2nd part of a DT / DB

- Wedge can fail!

- Wedge with trend and counter trend

- Whole wedge can be one leg in a bigger wedge

Conclusion

- Practice this one until it becomes natural!

Leave a comment