Intro

- So you’ve done the BTC Brooks Trading Course, you may or may not be in the traderoom, how to keep improving?

- Well apart from hammering the drills I keep posting you should get the Brooks Encyclopedia.

Video

Check out the video here!

- Intro

- Video

- Finish The course

- Get an Index!

- Each Pattern is a Failed Opposite Pattern

- Are you looking for a pattern or a whole day?

- Use it on the open

- Most Common Slides

- Conclusion

Finish The course

- As I have been working with traders to help them improve (and work out how to teach trading well!) it is clear most of them are unfamiliar with most of the basics of price action and market behaviour.

- If you are struggling with the Encyclopedia this could be the first cause!

Get an Index!

- Once you have your foundations in place how do you navigate 8000+ slides?

- You need an index.

- Luckily I already made one,

- You can find it here:

- Scroll down to me!

Each Pattern is a Failed Opposite Pattern

- So you have 2 ways to find everything

- I go through how to practice this in the video above

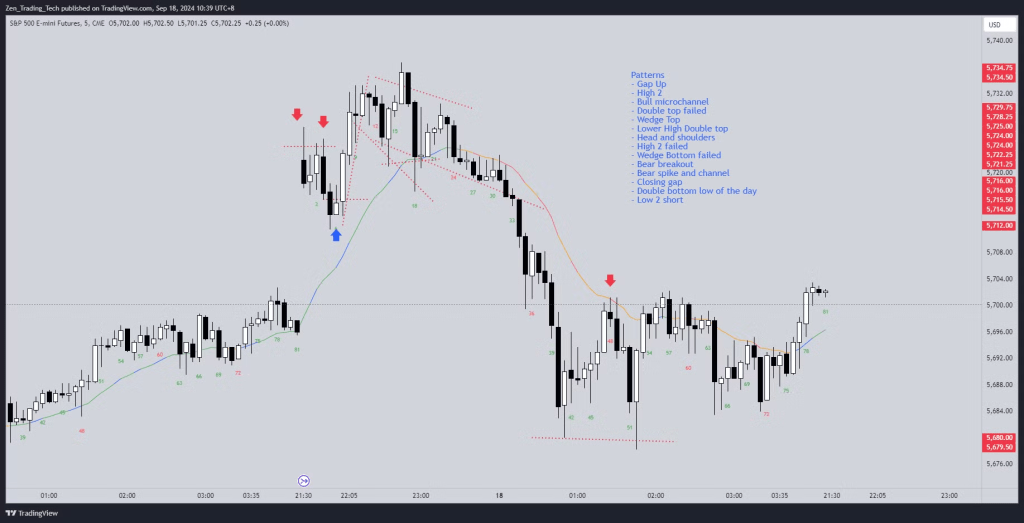

https://www.tradingview.com/x/8BcYpLxE/

- Here is the example from the video

Are you looking for a pattern or a whole day?

- In the video I cover in detail how to find part of a day

- I also cover inflection points and how to use it for finding the next swing setup.

Use it on the open

- In the video I cover how best to use it on the open

- I also cover how the presenters in the lvie trade room use it as well.

Most Common Slides

- I cover in the video all myb favourite slides from the Encyclopedia so you can freeze and find them yourself.

- Some of them are:

- Common market structure

- Types of Bull Channel

- Types of Bear Channel

- Gap up open / Gap Down Open / Trading Range Open

- Building blocks: Breakouts, doubles and wedges

- Building Blocks fail

- BTC / pullbacks

- STC / pullback

- Traps

Conclusion

- Highly reocmmend using it everyday as a way to improve your understanding of price action.

- For intermediate traders, why not startt building your own!

Leave a comment