Intro

- Higher time frame and lower time frame analysis is very important in staying relaxed in trading

- In the first post and video I explained the exercise

- But this was only for channels.

- It can be used on every pattern

- Here is part of my homework from this morning

Video

- I made a video on this here:

Links

Link to first post:

Effective Trading Techniques: Higher vs. Lower Time Frames (Part 1)

Link to first video:

- Different strengths in channels

- https://www.brookstradingcourse.com/

Drill Instructions:

Instructions

- Start at highest timeframe (Monthly and work down)

- Focus on the HTF and HOW it impacts the LTF (Don’t zoom in to much just yet)

- Sequence:

- Monthly -> Weekly

- Weekly -> Daily

- Daily -> 60m

- 60m -> 15m

- 15m -> 5m

Examples

Monthly -> Weekly

- Pullback MM

- Test breakout point (BOP)

- 1R targets weekly buy signal bar

Weekly -> Daily

- Test of BOP

- 50% pb weekly

buy signal bar - MIG – 50%

Daily-> 60m

- Use ETH if many gaps

- Test BOP

- Big body gap – did not close

- Bull channel, broke below and test midpoint

- Micro Wedge Bottom to MA

- Test Daily MA looking for a buy signal

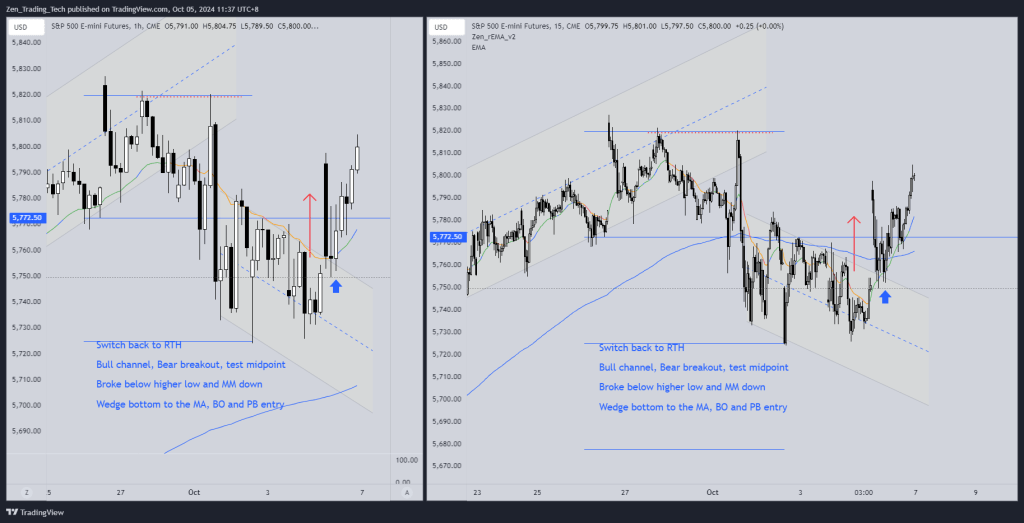

60m-> 15m

- Switch back to RTH

- Bull channel, Bear breakout, test midpoint

- Broke below higher low and MM down

- Wedge bottom to the MA, BO and PB entry

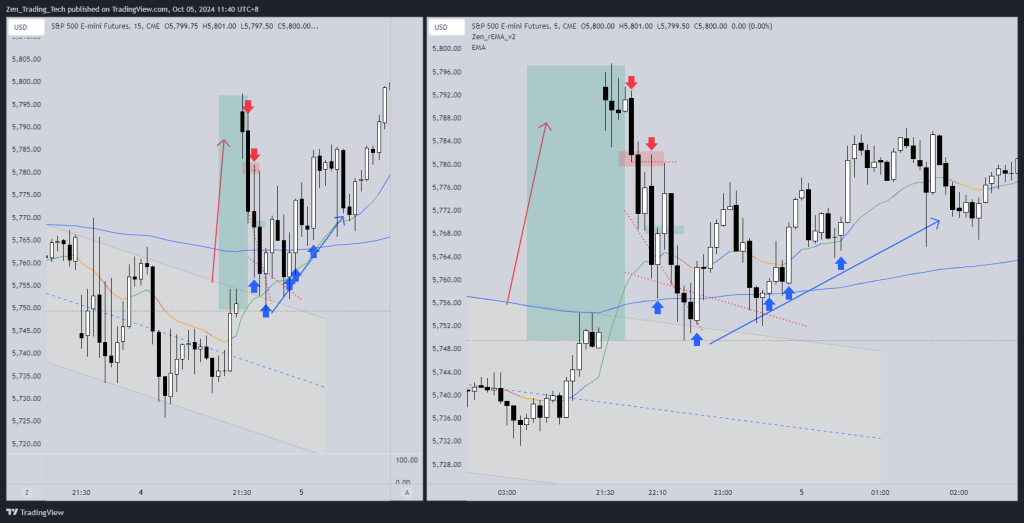

15m-> 5m

- Bull breakout STRONG – but too high to buy without a pullback

- Short for gap close

- Short again – 2 legs

- Long for LOD wedge bottom

- Long again

Conclusion

- When confused, go up timeframes until your confusion disappears!

- Practice on all patterns until you can zoom in and out with little stress

- If stress is there, either practice hasn’t been completed or very strong trading range!

Leave a comment