- What You’ll Learn in This Post

- Intro

- Video

- Why do 60-Minute Signal Bars Matter?

- The Daily Practice Drill

- Conclusion

What You’ll Learn in This Post

In this blog post, I’m going to walk you through three key concepts:

- How a 60-minute signal bar from yesterday impacts today’s price action.

- How you can use these signals to position yourself for larger swings.

- A step-by-step daily practice drill you can use to identify potential targets and trading ranges.

Intro

- Today, I want to share a simple daily drill that can help improve your trading—60-minute signal bars.

- This is a technique I’ve incorporated into my own trading, and I believe it can be useful for you as well.

Video

- I made a video on this here:

Why do 60-Minute Signal Bars Matter?

In a previous video, I talked about how you can use the 60-minute chart to guide swing trades on the 5-minute chart during day trading.

If you missed that, you can check it out below:.

This post is part of a series aimed at helping you develop your skills with the 60-minute chart.

One key insight I’ve gained is that when a 60-minute signal bar is still active, it might look like a trading range, but it’s often a range in the direction of that signal. So, when I start my trading session, I always check for any signal bars that are still in play from the previous day.

The Power of the Higher Time Frame

You can apply this approach on any higher timeframe, such as the daily or weekly chart. However, I’ll focus on the 60-minute chart in this post, as it provides a larger view than the 5-minute chart and has a significant influence on price action.

The Daily Practice Drill

Here’s a simple drill that you can apply to sharpen your skills with 60-minute signal bars.

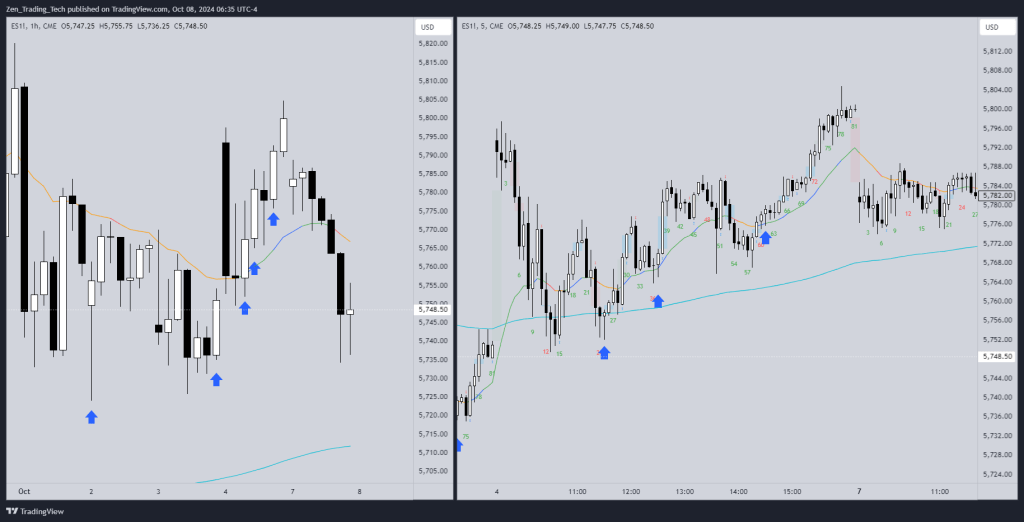

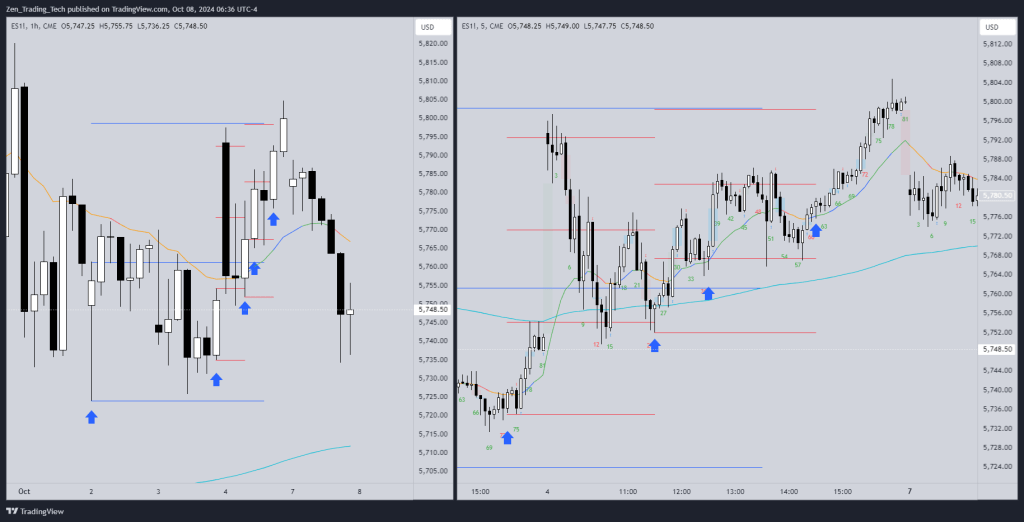

Step 1:

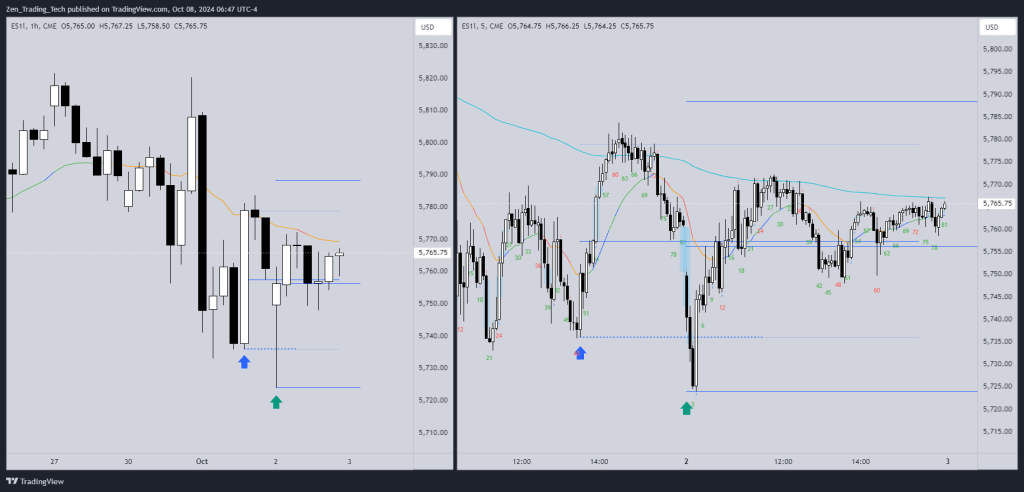

Open the 60-minute chart (or another higher timeframe if you prefer) and place a blue arrow under all reasonable bull signal bars that haven’t been stopped out. A signal bar is considered active if the price hasn’t dropped below its low.

Step 2:

Use a Fibonacci tool or a measured move to plot a 1:1 or 2:1 target from the high or close of the bull signal bar. This will show potential price targets the market might aim for.

Step 3:

If any of these bars have reached the 2:1 target, leave the marker there, as this may indicate that we are in a larger trading range – and the top and bottom thirds are important.

Step 4:

Repeat for bear bars on the 60m chart in their direction.

Chart Example

- Select signal bars

- Measure and remove arrows

- Draw lines for support and resistance – low and close and high of bull bars (draw high only if stop entry above triggered on next bar)

- Look at midpoints for potential traders exiting breakeven

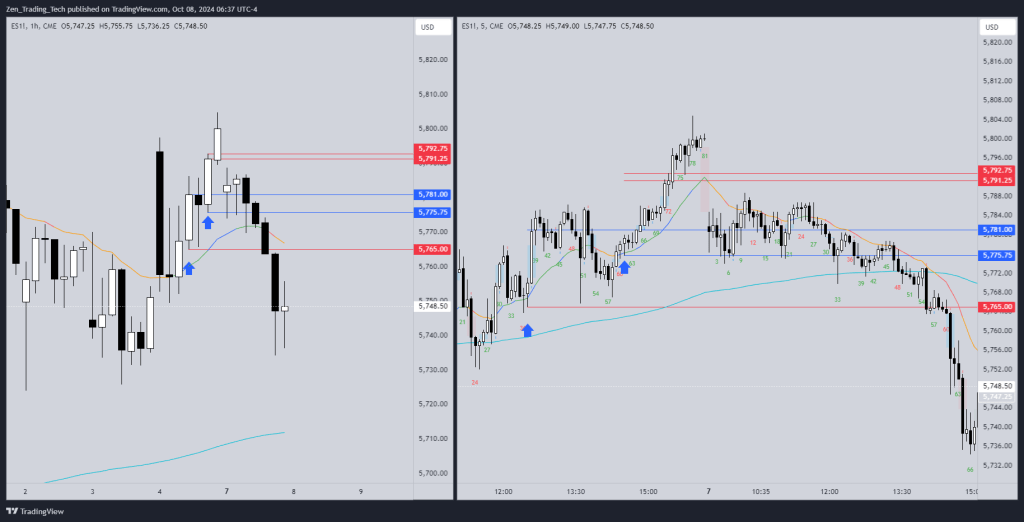

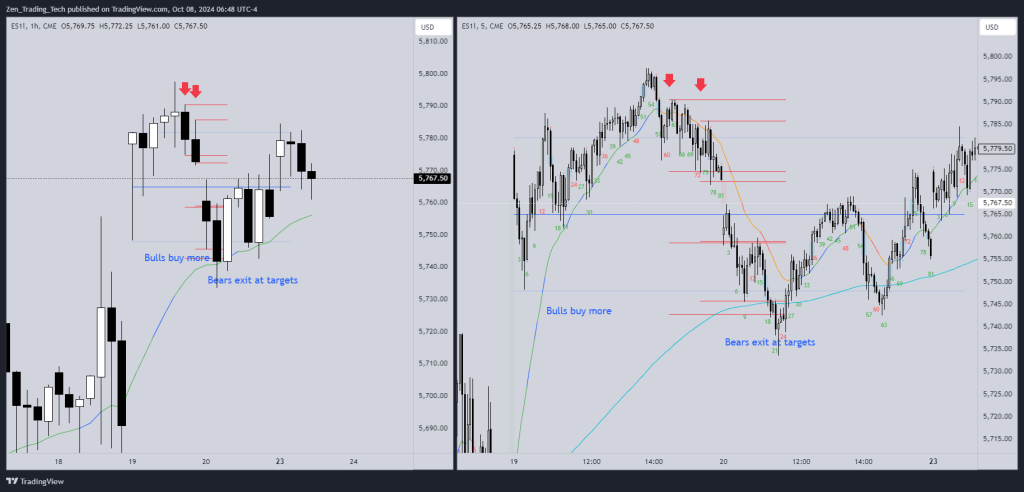

Chart Example 2: Signals complete on the open

- Coming into session the signals are marked

- Bulls buy below strong 60m signal bars

- Bears exit at 1R and 2R targets

- Bulls from doji exit at 1R

- Only big bull bar signal bar left

- New bull signal bar prints and traders buy the clse (BTC)

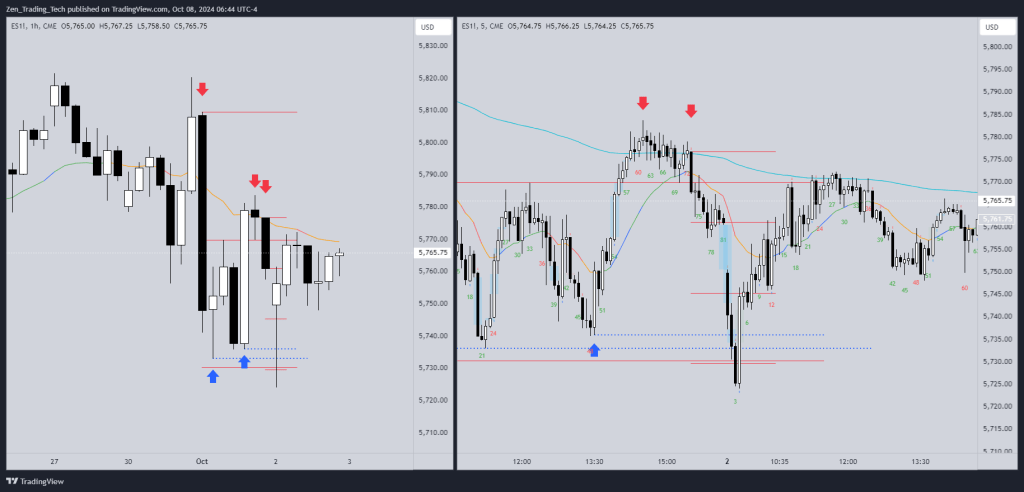

Chart Example 3:

Applying the Drill in Live Trading

This drill is a powerful way to identify active signals and potential swing opportunities in your day trading. By regularly checking the 60-minute chart for active signals, you can position yourself more effectively and potentially capture larger-than-normal swings.

While I’ve focused on the 60-minute chart here, feel free to apply this concept to other timeframes, like the daily or weekly chart. The principles remain the same—the larger the timeframe, the stronger the influence on price action.

Conclusion

The 60-minute signal bar is a simple but effective tool to improve your trading by giving you a broader view of the market. Incorporating this drill into your daily routine can help you stay ahead of potential market movements and improve your swing trading.

If you found this post helpful, make sure to check out my other resources, including the Zen Bar Range Indicator, available on TradingView. Let me know your thoughts and how you’ve applied signal bars in your trading in the comments below!

Happy trading,

Tim

Zen Trading Tech

Leave a comment