Index

- Index

- In This Post:

- Why Read About Spikes and Channels?

- Where Did We Get to Last Time Video

- Spike and Channel Introduction

- Why Is This Important? Different Trade Management for Difference Parts of the Cycle

- Drill #1: Finding Spike and Channels

- Drill #2: Draw and Re-Draw Channels

- Drill #3: Spike and 2, 3, or 4 legs

- Drill #4: BO of Channel One Side, Then Breakout of the Other Side

- Drill #5: Leg size

- Summary

In This Post:

- We will cover new drills to take your understanding of spike and channels to the next level

Why Read About Spikes and Channels?

- In the first spike video we practiced identifying spikes

- In the second spike video we practiced one way to enter spikes after a pullback

- In this video we connect spikes to the rest of the market structure and introduce new drills

- Trading entries and exits should match the market structure they live in.

Where Did We Get to Last Time Video

- We found spikes

- We marked up 2nd legs

- We looked for failures

- Then we saw how failures lead to measured moves

- We also looks at counter-trend vs trend spikes

Spike and Channel Introduction

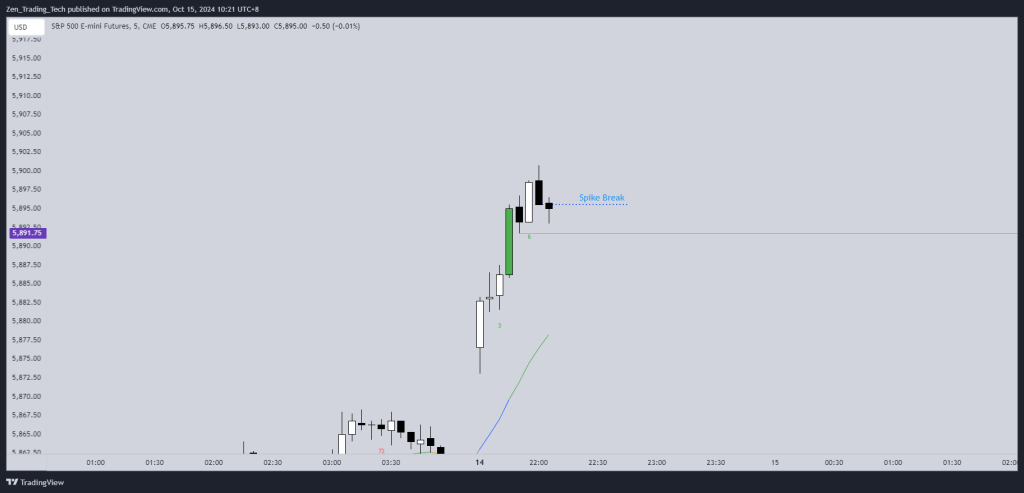

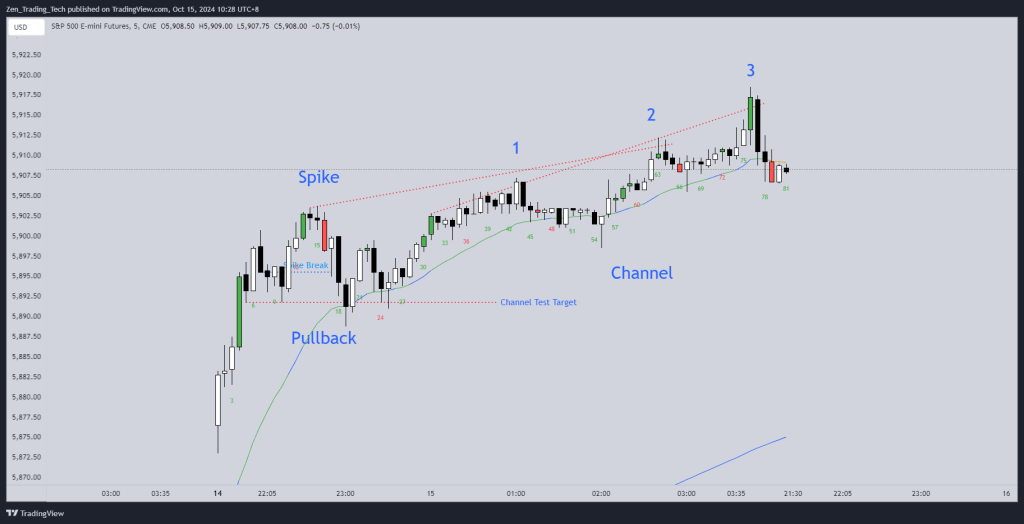

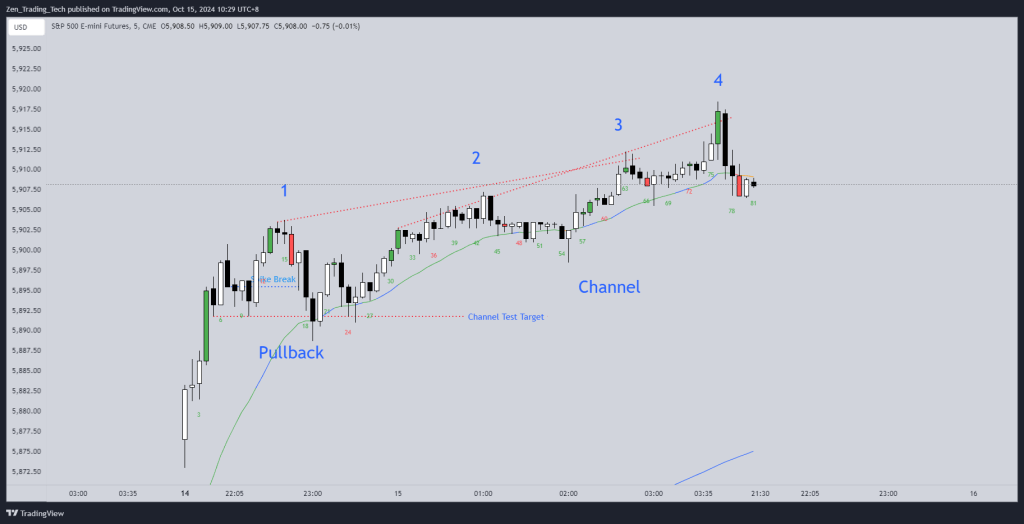

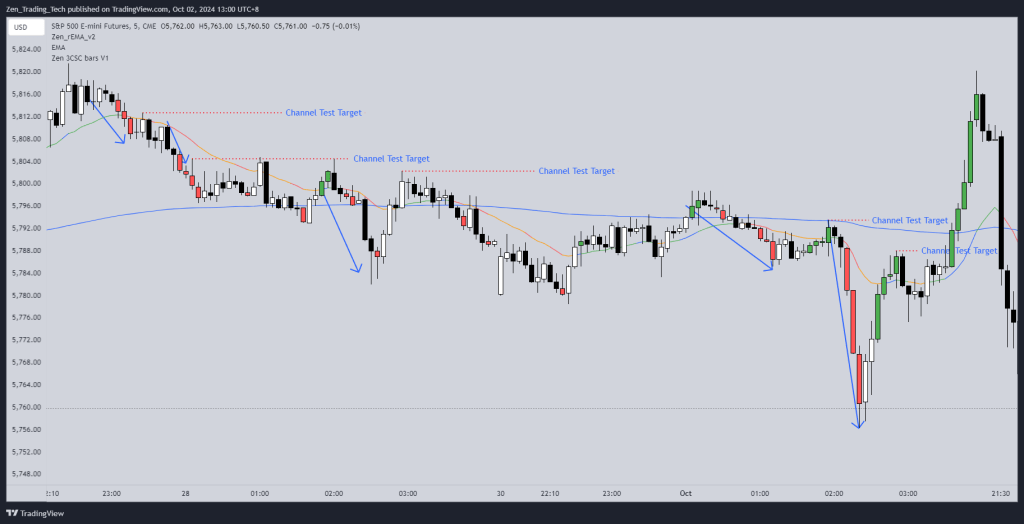

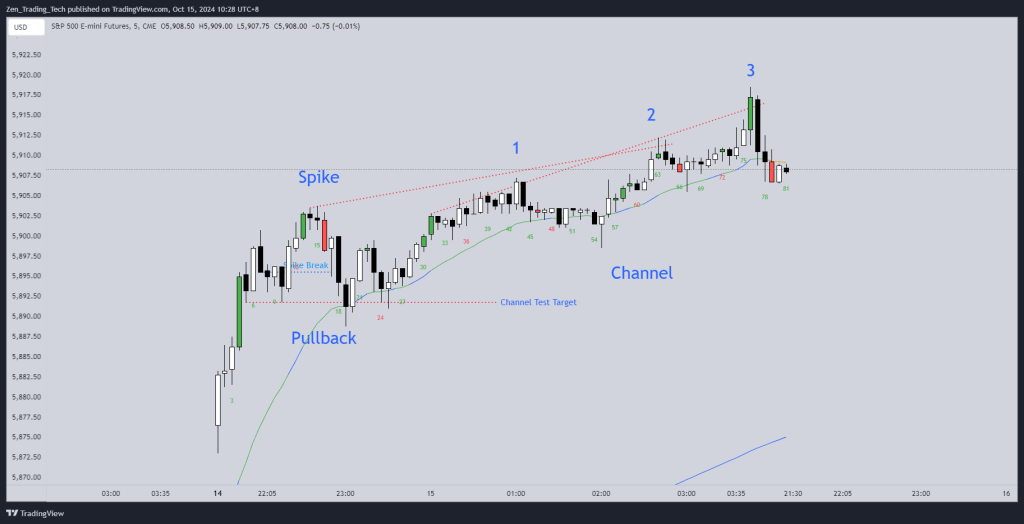

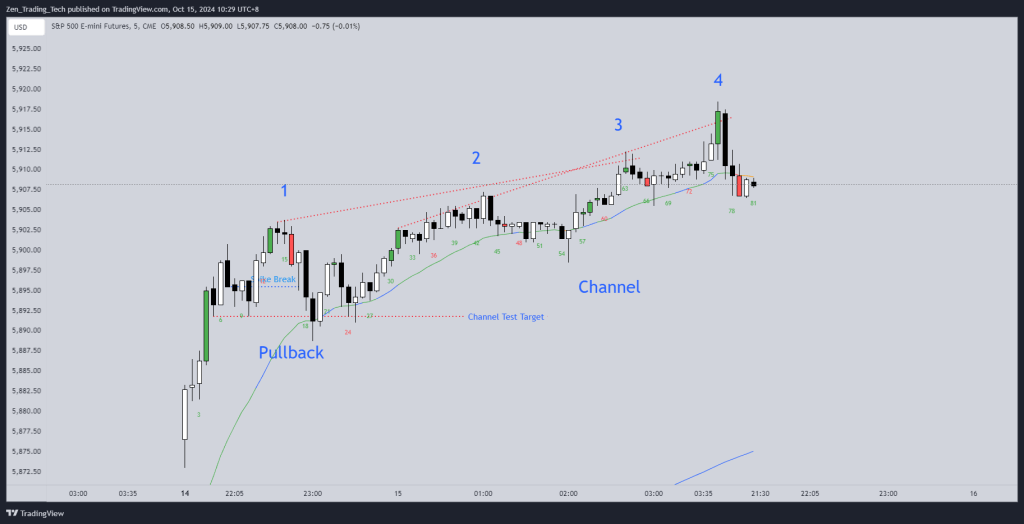

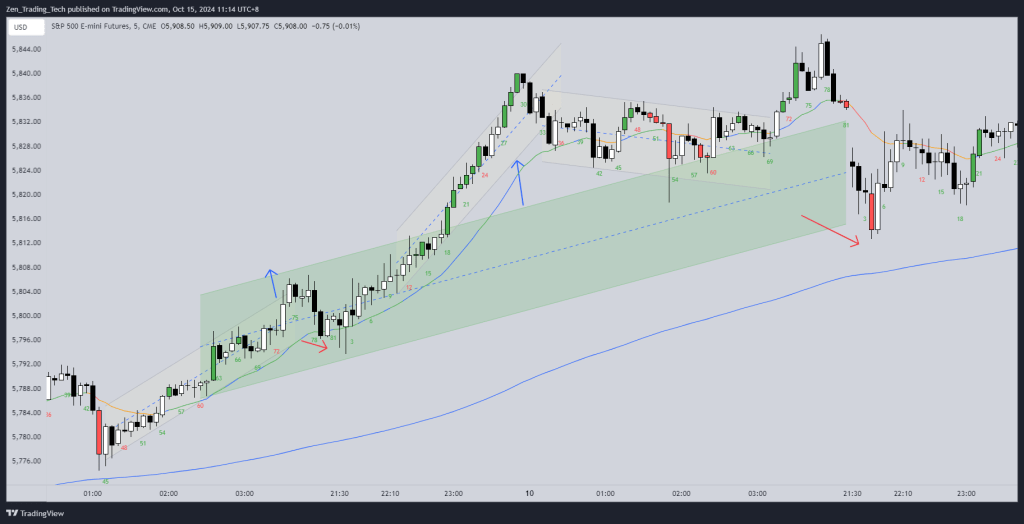

- Below is a breakout on the open

- The spike breaks, but we don’t know where the pullback will finish

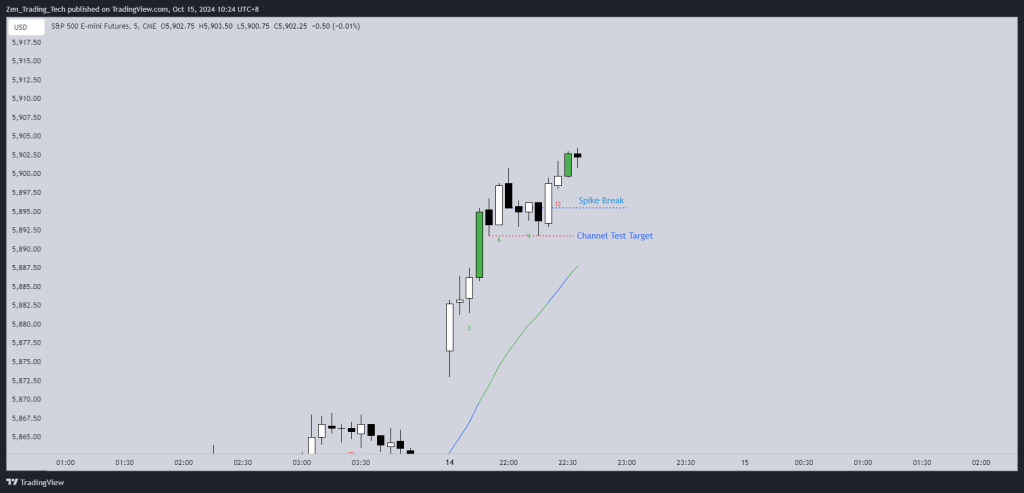

- New high, so we can see where the channel test target is.

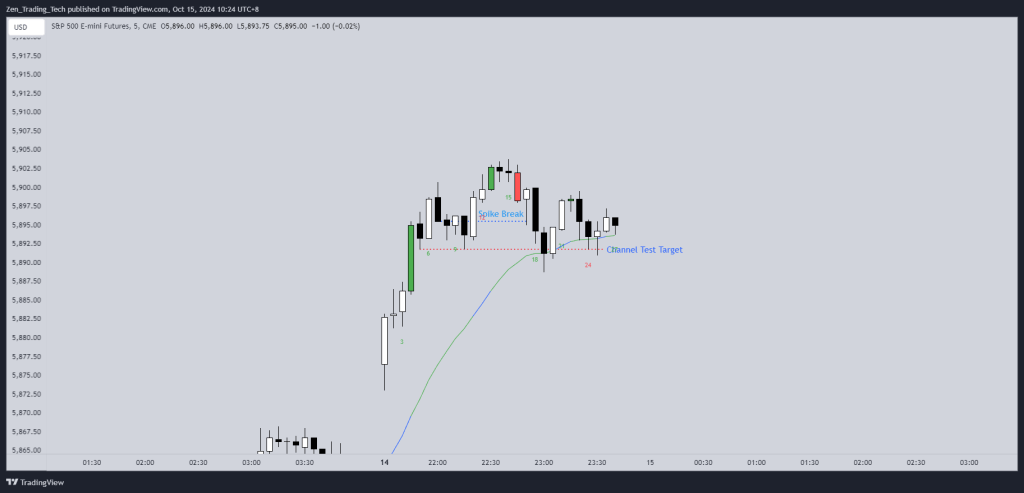

- Test the channel and it holds after 2 tests

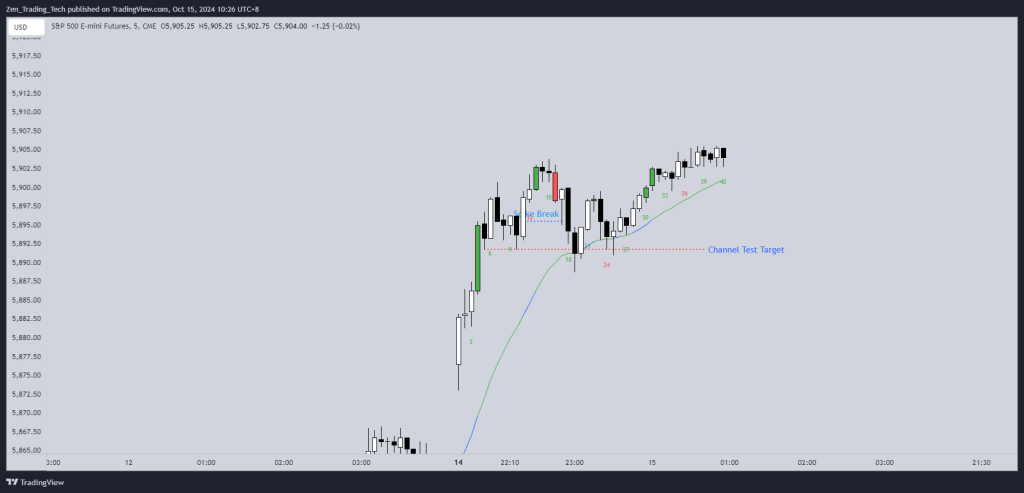

- New high and spike and channel continues

- Structure looks complete now. Spike and 3 legs up. Or 4 legs up.

Why Is This Important? Different Trade Management for Difference Parts of the Cycle

- It will be difficult to get consistent entries when our price action reading is not consistent

- So lets practice!

Drill #1: Finding Spike and Channels

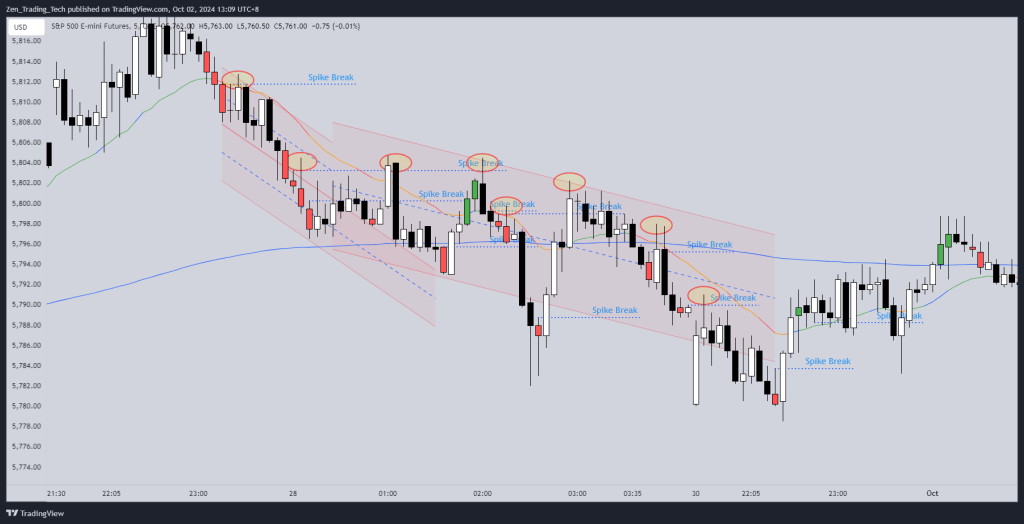

Step 1: Mark Up Spikes

- Use indicator if unsure

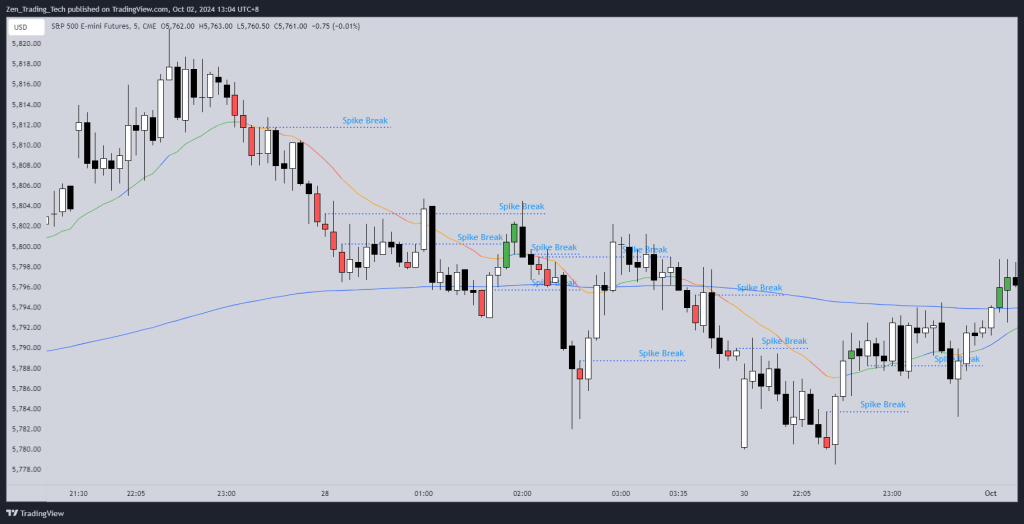

Step 2: Mark Up Spike Breaks

- Where does the pullback start? Where the spike breaks

- An up-spike gets broken when we go below a prior bar. The reverse for bears.

- Note that a spike can break with an opposite or pause bar. See my video on leg counting.

Step 3: Furthest edge of the pullback is a test target

- Now you know where the spike is because you also now know where the break is

- When price continues in the spike direction we can see the furthest point of the pullback

- Draw a Line at the furthest edge of the pullback

- This is the start of a channel

- This is a test target for later alligators

- The market loves to test them

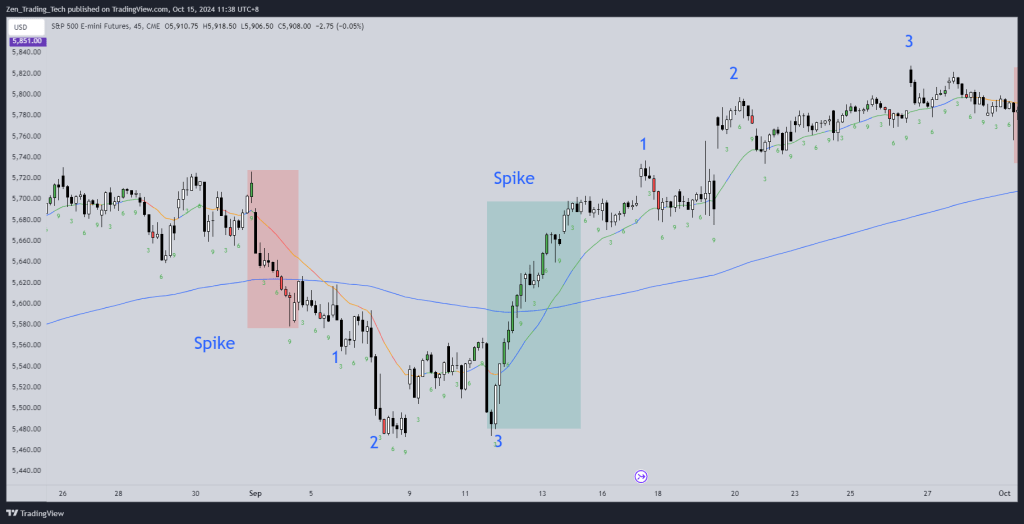

Drill #2: Draw and Re-Draw Channels

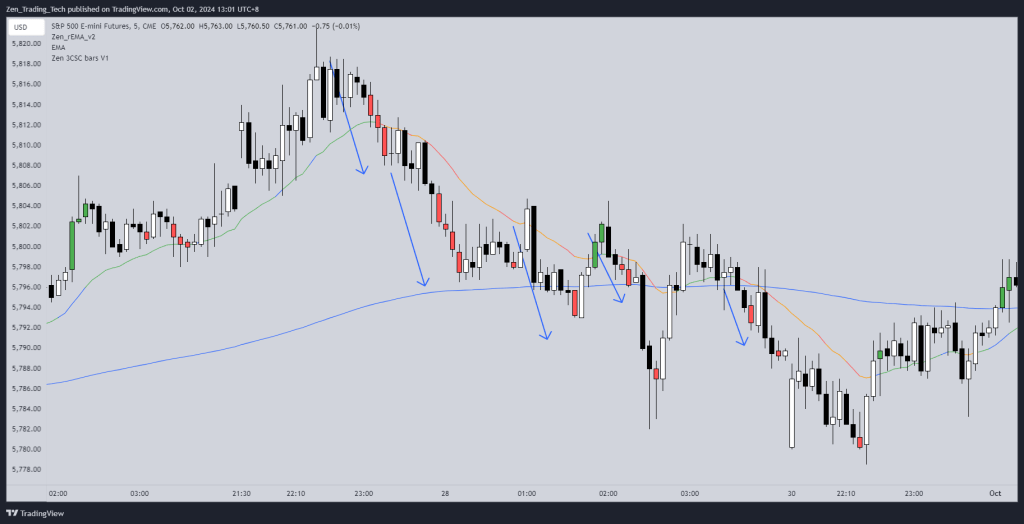

- Follow the drill from before and connect channel line (Use channel tool if your software has one)

- If the spike becomes faster, it will over-shoot the channel line

- If there is a 2-legged pullback it broadens the channel

- Over time it will change so practice redrawing the channel to see how they behave.

- Below I have not drawn ALL of them – just what I considered to be the major ones.

- As the day goes on the channels change – but they stil act like a channel

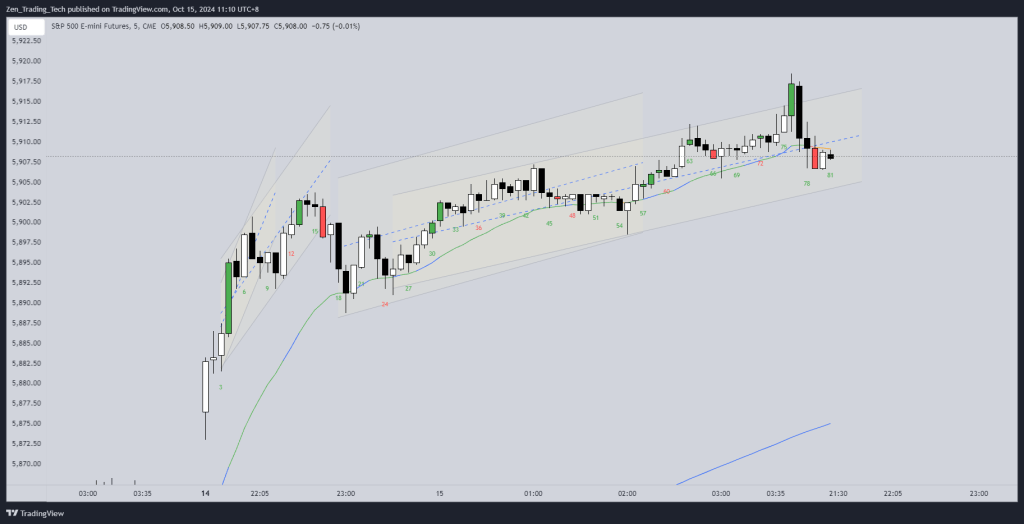

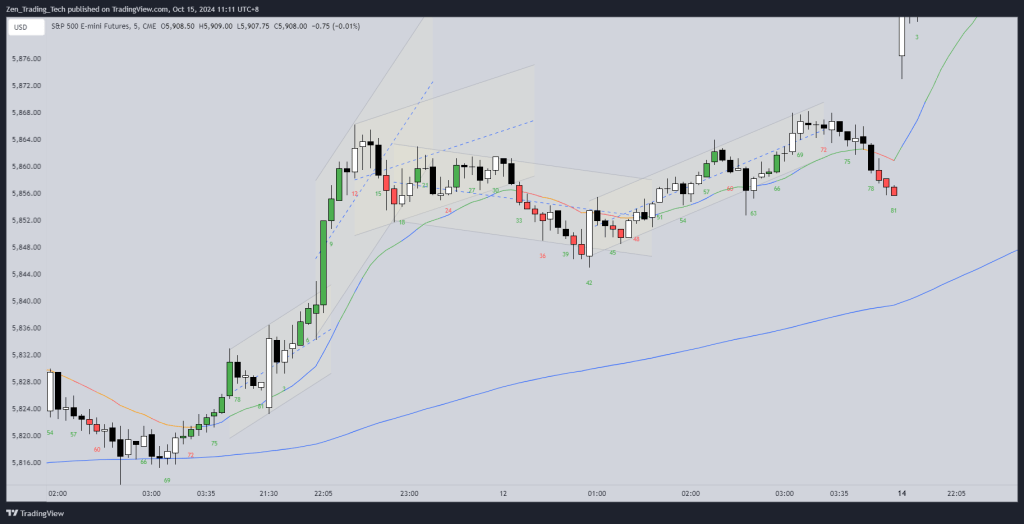

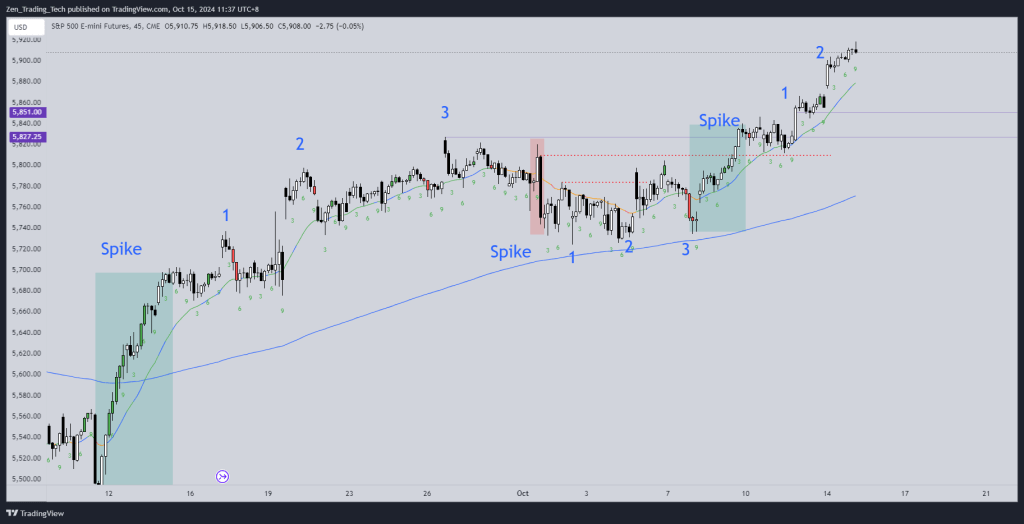

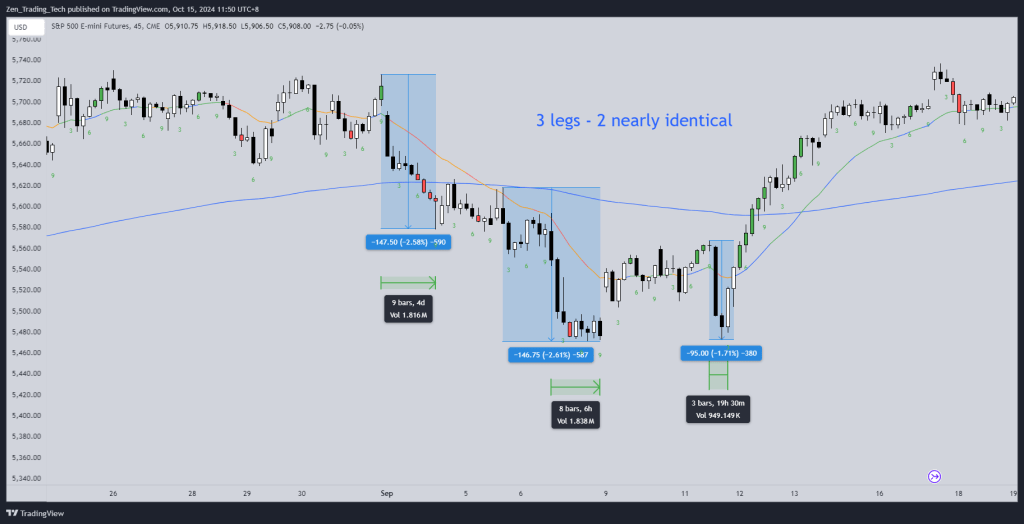

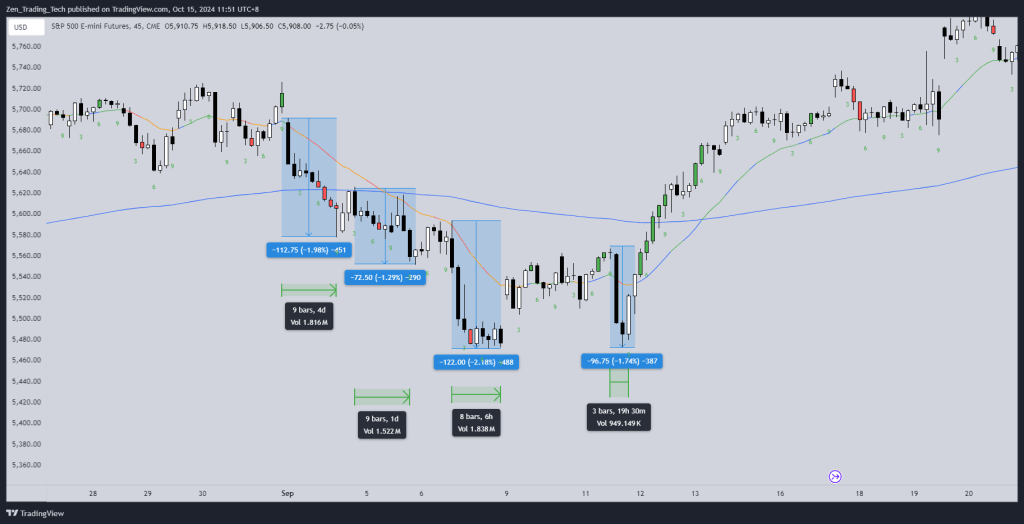

Drill #3: Spike and 2, 3, or 4 legs

- Put a box (green or red) around the spike

- Start counting the pushes relative to the size of that spike

- Most important part is to focus on the spike and legs after it to avoid countertrend trading

- Many ways to count

- Works on all timeframes

- Market can create infinite variations of the same pattern.

- Function is to match your trade order type and management to the structure

- Different phases will be relative to the spike

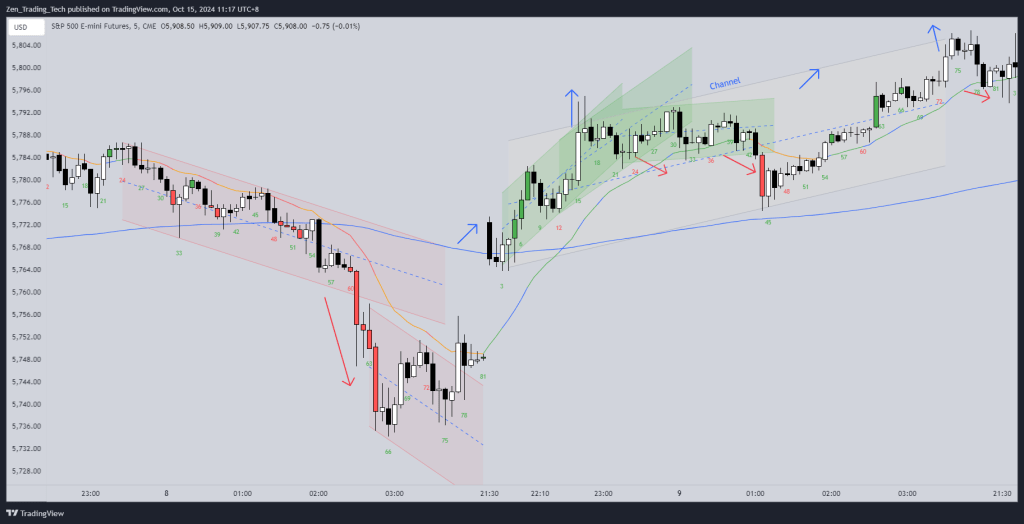

Drill #4: BO of Channel One Side, Then Breakout of the Other Side

- In this drill we will draw channels and look for the breakout of either side

- Here a small version and a larger version

- This drill can prevent you from entering late and help to position yourself for the swing back into the channel

- You can also combine this drill with trendline break test – Video below

Drill #5: Leg size

- Once you can find spikes and channels look at the leg sizes

- Practice finding which 2 legs are the most similar

- This will help counting in a live environment because the legs should be relative to each other.

Summary

- In this post we covered 5 drills for spike and channels

- I highly recommend practising each one for a set of charts – 20 days or set a timer and practice it for 25 minutes.

- Staying focused on one aspect of price action will help develop live trading skill

Leave a comment