Introduction

- In the video below I talk about how I traded a great long, only to trap myself out of a great short.

- I was live in the trading room and it was a mistake to spend too long patting myself on the back while an even better swing set up. Something for me to continue to improve in my trading.

- Trading live exposes existing weak points, make them larger, but does not create new ones such that i’m aware of.

- Discussions around a rare, high-probability occurrence that can provide an edge in trading systems

- Introduction

- The Video

- The Setup

- Yesterday’s Trade

- How to research this O==L, O==H trade

- Could I trade it on the hourly?

- When B1 60m is a fade?

- Finally found a time it didn’t work

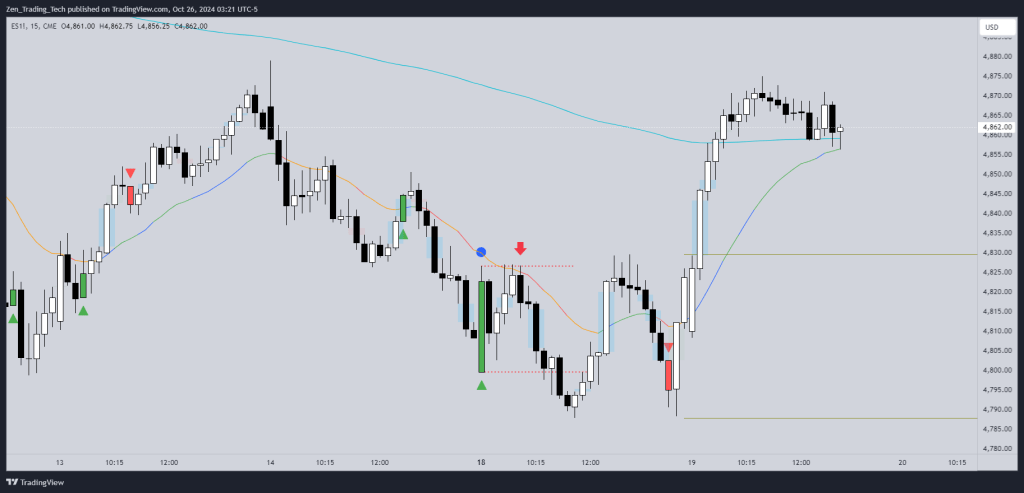

- 15m Chart

- Conclusion

The Video

The Setup

- In short, RTH Daily bars have tails – it is VERY rare for them not to have them.

- In particular a BULL bar with no bottom tail, or a BEAR bar with no top tail.

- That is what we are researching.

- If a bar opens on its high or low, it is a VERY high-probability fade back to it

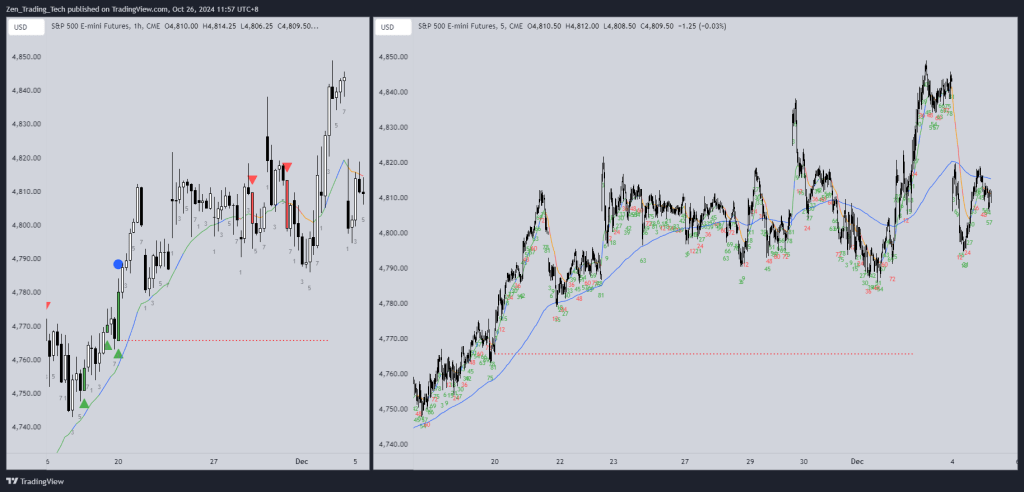

Yesterday’s Trade

- Full disclosure, I was long to near the high of the day where I got outt and I missed all of this down move! So this is admission of hindsight trading and homework for me to improve for next time.

- In short, Daily bars have tails – it is VERY rare for them not to have them.

- In particular a BULL bar with no bottom tail, or a BEAR bar with no top tail.

- That is what we are researching.

How to research this O==L, O==H trade

- What’s our process?

Indicator

- Indicator available for free here (code is open)

- Start with the Daily Chart

Start with the Daily Chart

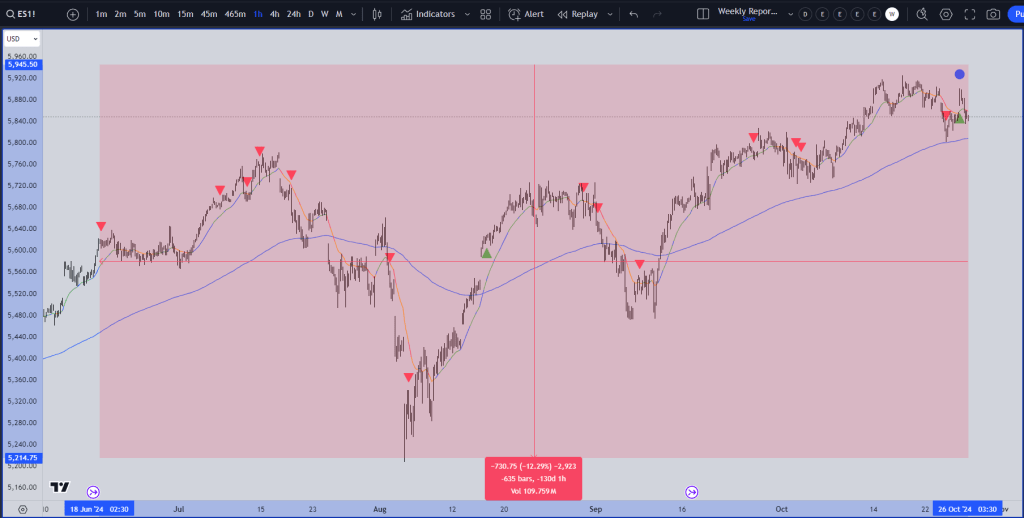

- 14 occurrences in 2494 bars (about 10 years) = 0.5%

- 99.5% chance it does not happen – what an edge

- So now we have an edge on the Daily chart

- The market is fractal – hourly chart – 16 times in 635 bars = 2.5%

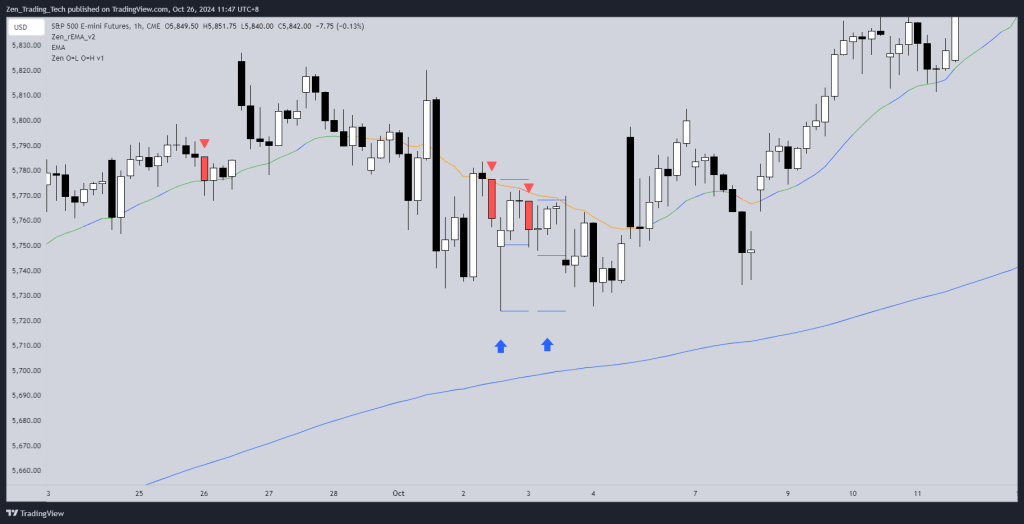

Could I trade it on the hourly?

- 1:1 RR trades on the hourly

When B1 60m is a fade?

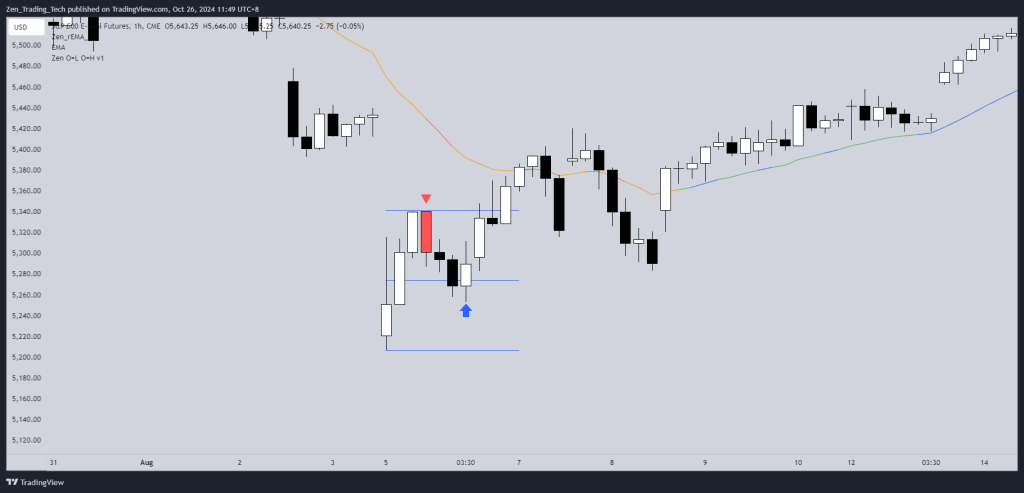

Finally found a time it didn’t work

15m Chart

Conclusion

- I will be better prepared now for this setup.

- I had thought I had reviewed it enough in the past, but being unable to trade it is the best indication I know that my work was insufficient.

- And that’s great news because it can be added to me repetoire.

- Hopefully this process helps you improve your own trading.

Leave a comment