Intro

- In this series I will review trades sent in by other traders who have asked for feedback

- I really appreciate their courage to do so, so we can all improve!

- Not enough of the trading community do this – I will also review my own good and bad trades.

Process to Review Trades

- Market Cycle

- Trend vs Trading Range – Always in?

- Did the trade match the structure at the time

- Entry – Strong / Weak / Mistake*

- Scale-ins / Add-ons – Strong / Weak / Mistake

- Exit – Strong / Weak / Mistake

- Strong = I would do it again

- Weak = I would not do that again exactly

- Mistake = Execution error

Video

- I made a video on this here:

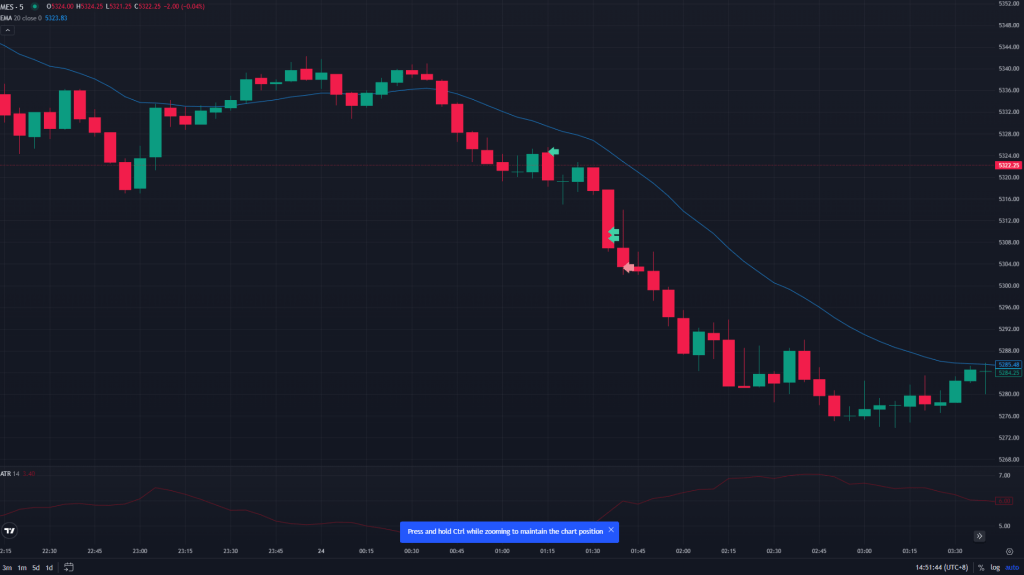

Trade 1:

Suggested exercises to practice:

- Spike and H1 video

- Which entry for which trade? Buy the close, Buy 1 Tick above the High entry

- Reversals

- Did not exit the High 2 when it failed

- Scaled into a failed trade / opposite breakout

- Exit criteria – Exit on breakout + follow-through would have been earlier by one bar

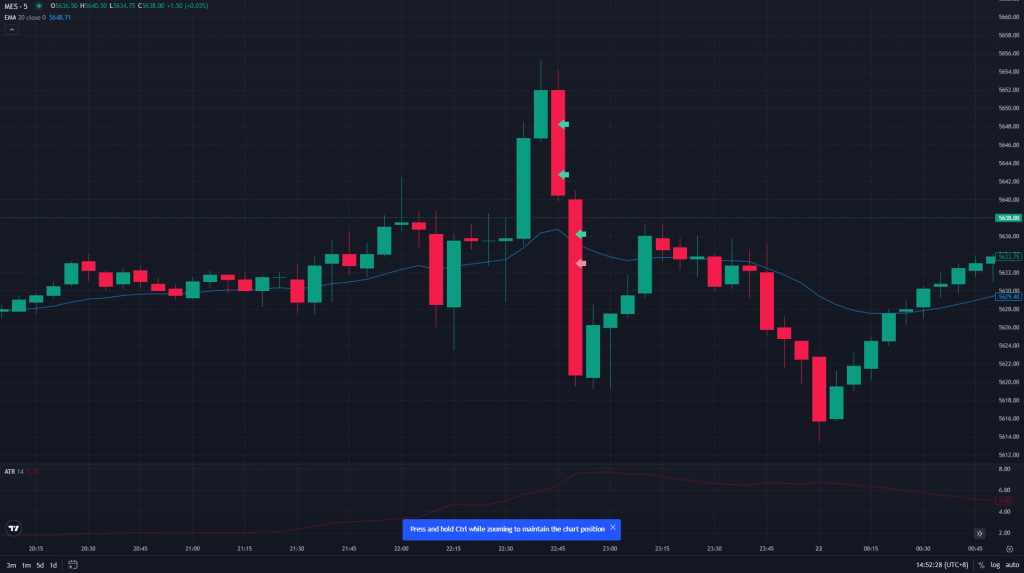

Trade 2:

Suggested exercises to practice:

- Missed the wedge bottom reversal entry

- Always in – Swing point not broken – so still bearish

- Market Cycle needs work (Trend -> Trading Range -> Trend)

- Scaling in makes no sense – buying bear bars when always on short

- Intrabar scaling-in

- How to trade a Trading Range

Trade 3:

Suggested exercises to practice:

- Breakout and pullbacks

- Scale ins

- Keeping the original trade and not changing it mid-way through the trade.

- Confusing breakout trading with trading range trading

Conclusion

- A big thank you to those traders who kindly let me review their trades.

- If you would like me to review your trades here please get in touch.

- Practice this on your trades for last week and I guarantee you will start to move the needle on your performance.

Leave a comment