- Lets take pullbacks a little further and build strategies about which ones to enter and which not to.

Previous Video

- Missed the first part? Catch up here:

New Pullback Drills Inspired by Top Trading Mentors

These techniques are inspired by insights from three legendary traders:

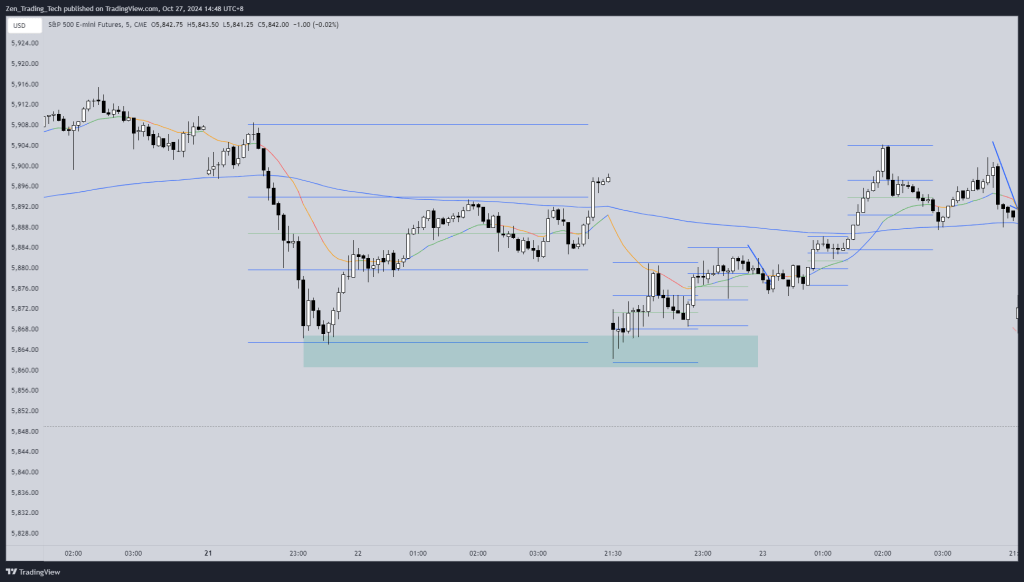

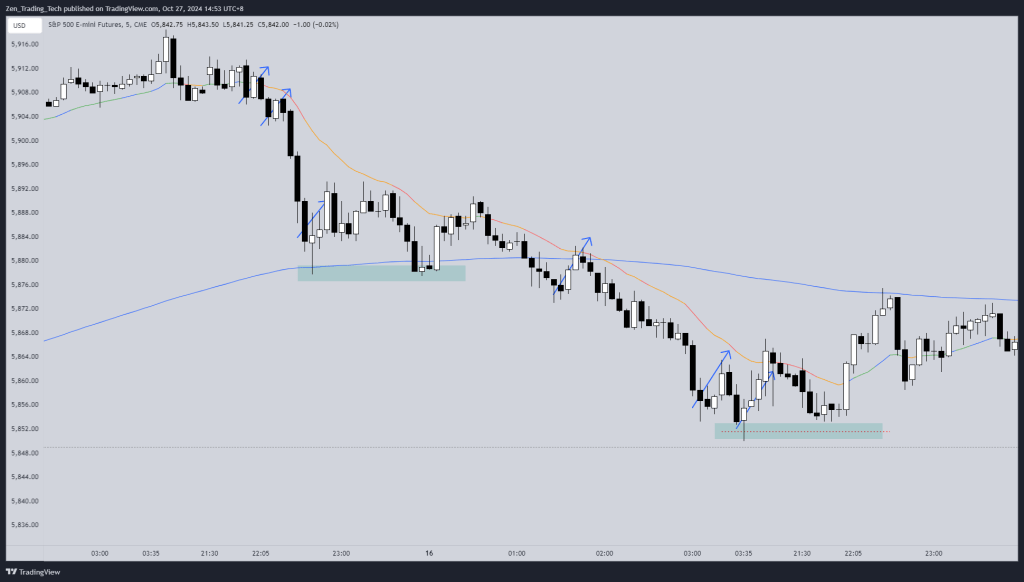

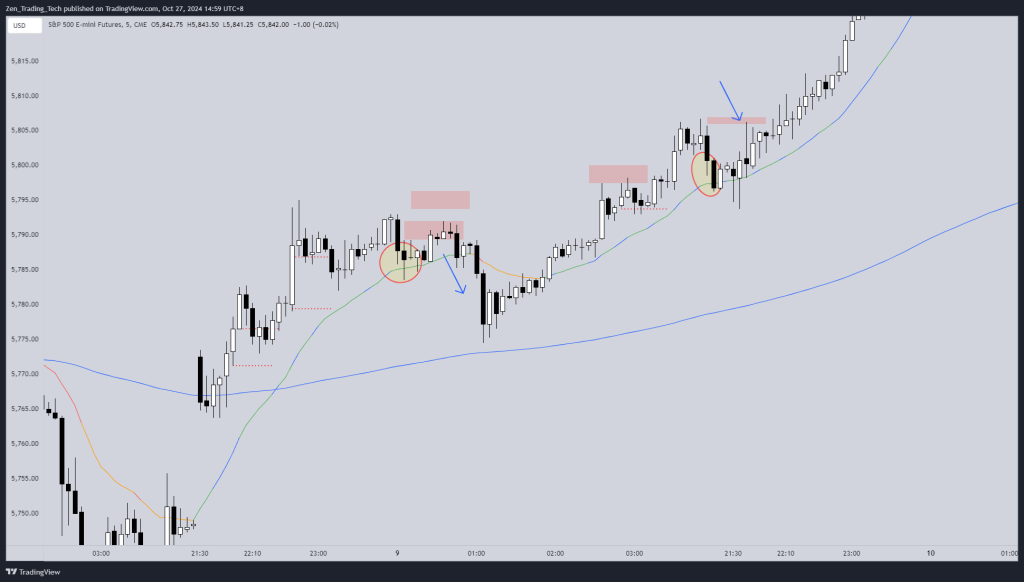

Drill 1: Assessing Pullback Distance

Analyze how far the pullback goes against the leg:

- <50%: Urgent—look for continuation in the original direction.

- =50%: Trend is strong; likely to continue.

- >50%: Less urgency; consider a possible channel formation.

Also, a pullback into the lower third of a bull move often signals an upcoming trading range.

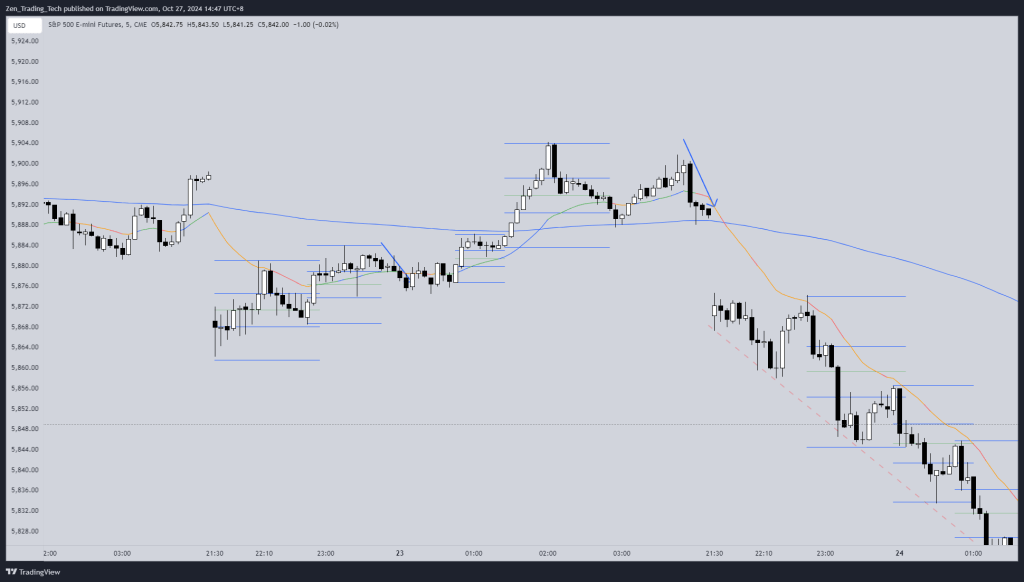

Pro Tip: On a day where the whole move is a pullback, keep an eye on buyers below the daily chart.

- Whole day was a pullback – buyers below daily chart

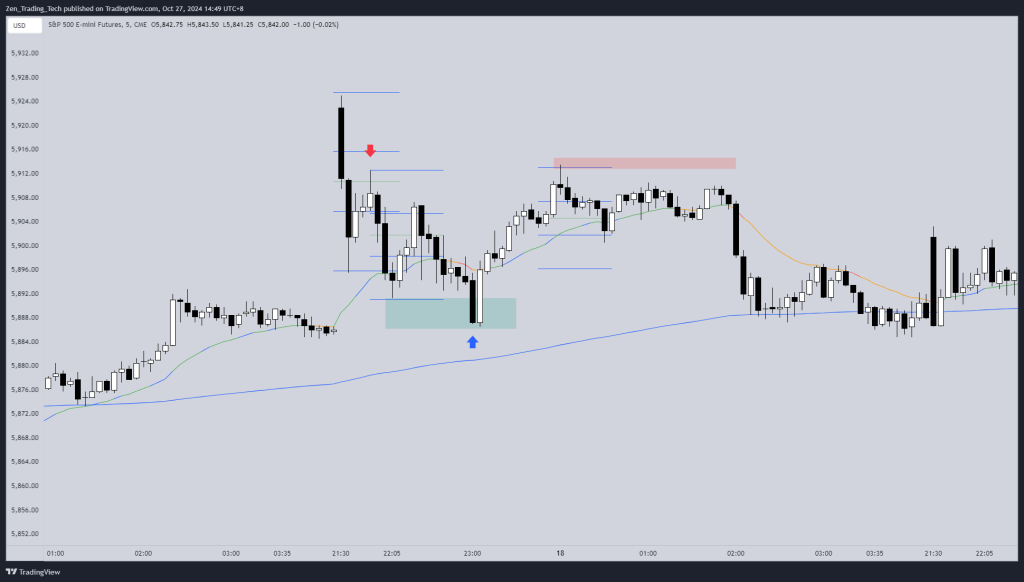

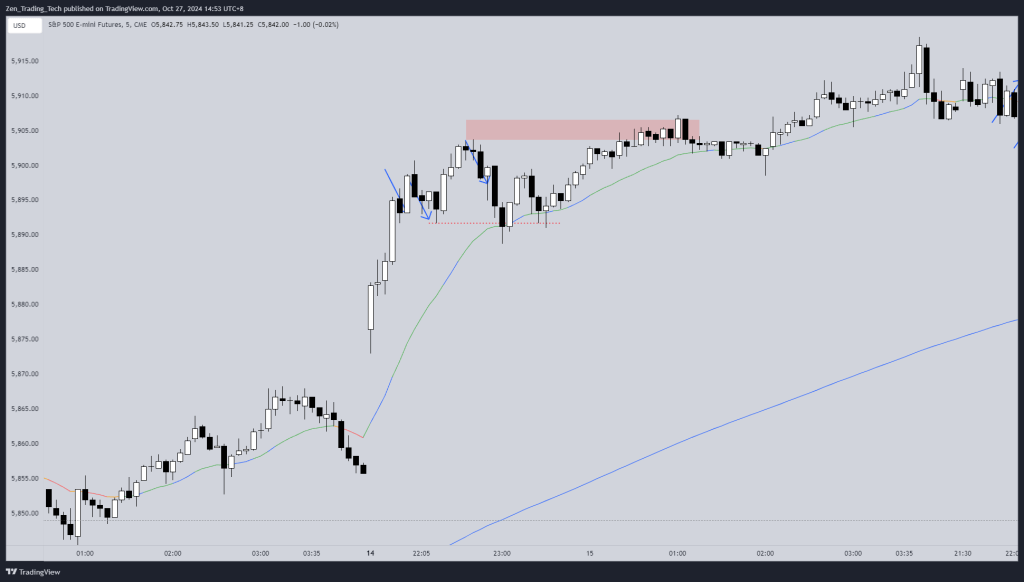

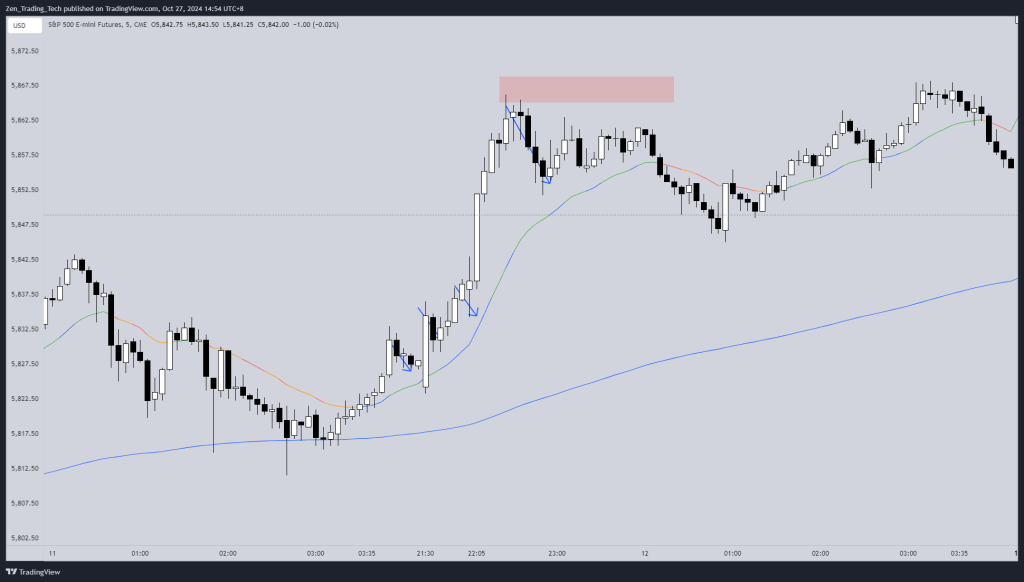

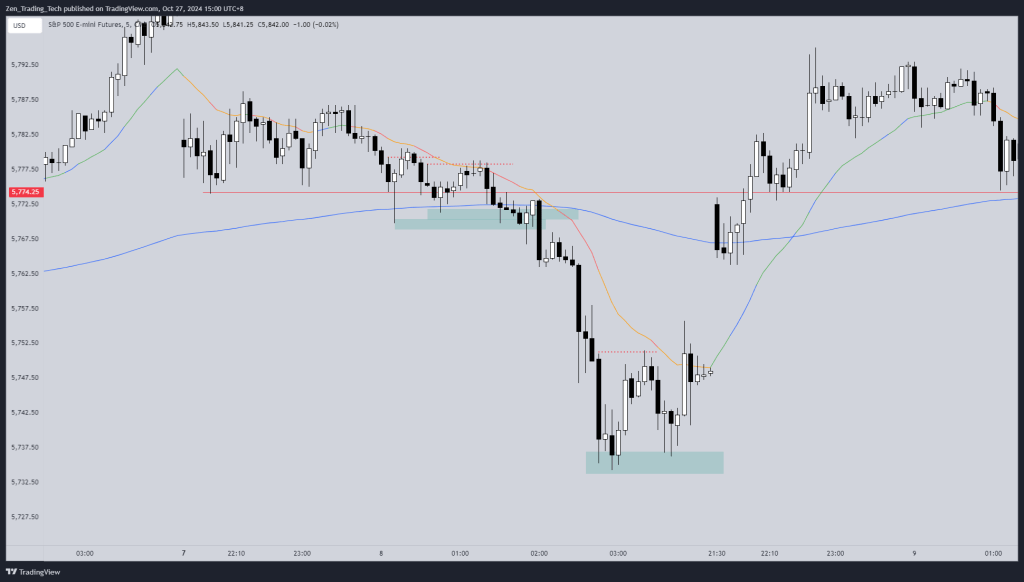

Drill 2: Counting Pullback Bars

Assessing bar count in the pullback provides trend insight:

- 1-2 Bars: Strong trend—ideal for buying at H1 or selling at L1.

- 3+ Bars: Trend weakening; watch for a potential channel or trading range.

Note: Trading ranges rarely get more than 3 consecutive bars without a reversal.

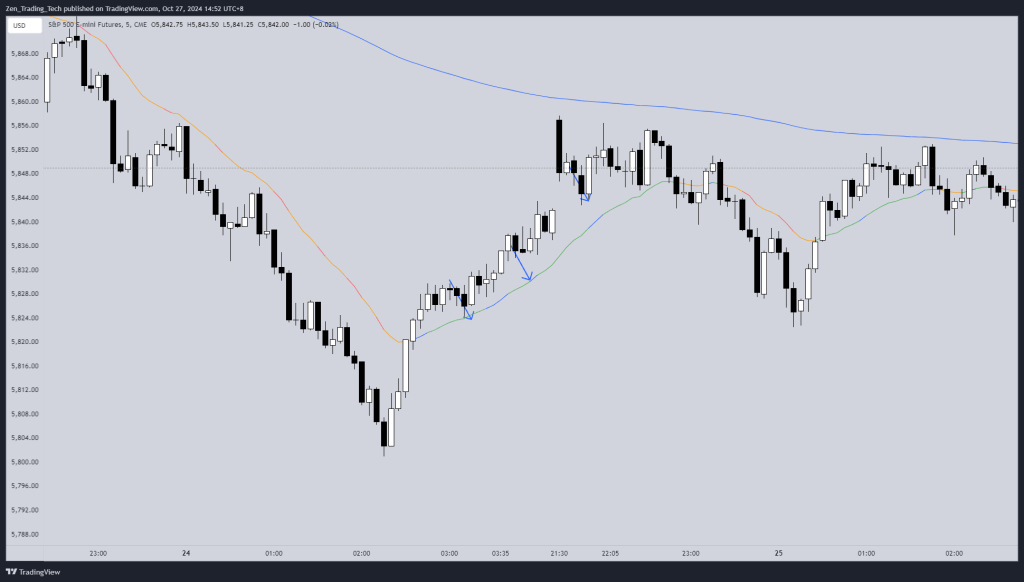

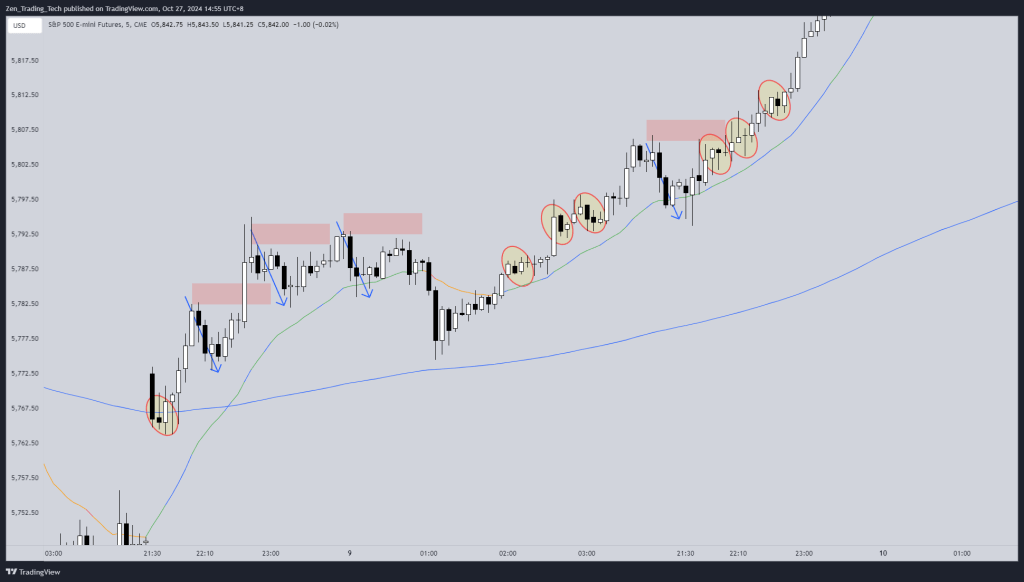

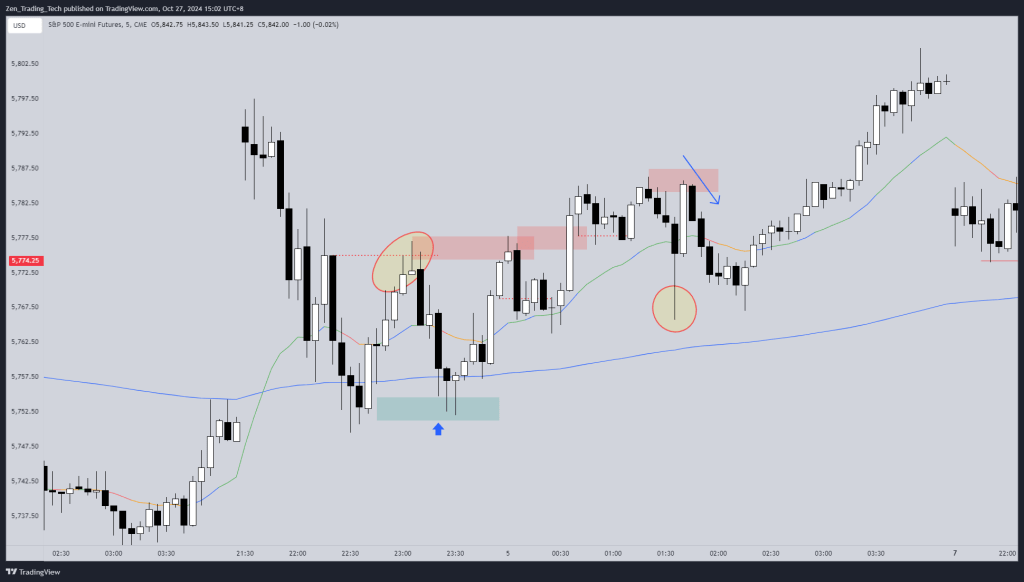

Drill 3: How Many Prior Lows Were Taken Out?

Evaluate the trend’s resilience in a microchannel by counting how many prior lows were breached:

- 1-2 Lows: Indicates normal trending.

- 3+ Lows: Channel or trading range likely forming.

If in a bull trend, notice if it took out a low of a bear bar vs. a bull bar. This detail can add clarity to your entry decision.

Final Thoughts

Mastering pullbacks lets traders fine-tune trade entries. Just as waiting for pullbacks can increase the success rate of breakout trades, assessing them can also improve channel trade entries.

Let me know in the comments if these drills helped! Thanks for reading!

Leave a comment