Intro

- In this drill you use the higher time frame to understand how your favourite setups work.

- For example – mine is a High 2.

- Zoom into your favourite setups to develop new understandings.

- I spend a lot of time researching how they play out, so I can manage them well.

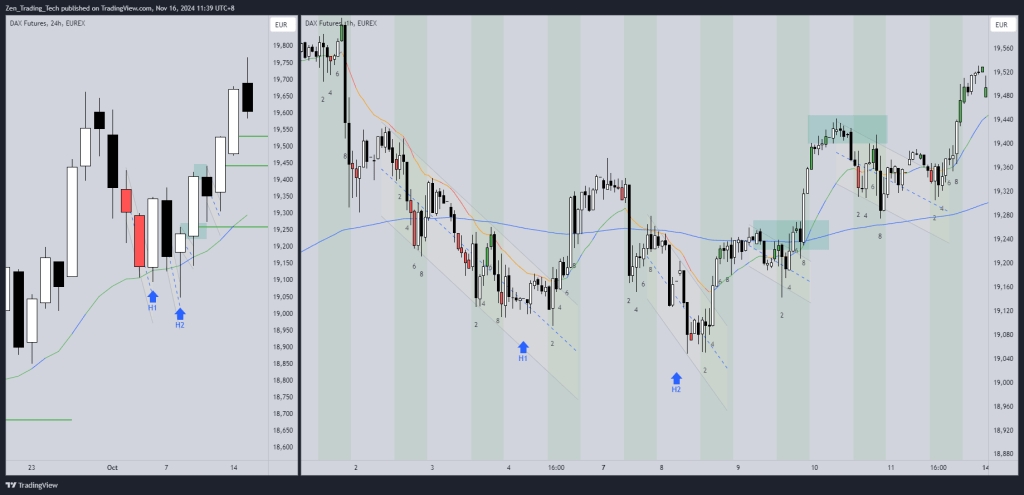

Daily High 2 on DAX 40 – Success

https://www.tradingview.com/x/euTlpBC0/

I write notes:

- Daily H2

- Good entry bar

- Good follow-through bar

- 60m Chart

- BR CH

- BLBO Fails

- TR

- LL MTF

- HL Inverse H&S

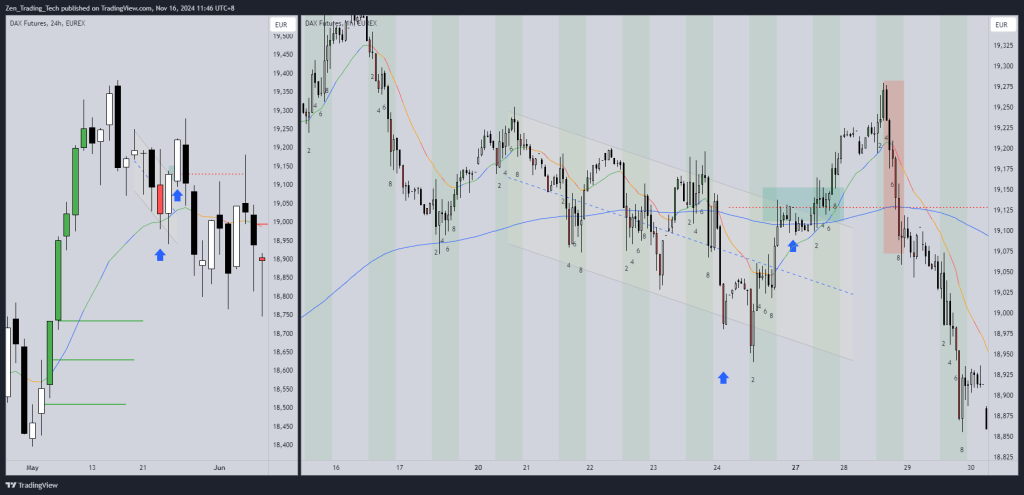

Daily High 2 on DAX 40 – Fail

- Compare the above with this one

- Daily H2

- Good entry bar

- Bad follow-through – which closes below my entry

- And I can’t get out at my entry

- Earlier disappointment should have been a sign

- 60m

- Bear Channel, failed bear breakout, then failed bull breakout

- Once strong bear spike appears – probably close entry

- You can see in the first image that pullbacks were more of a channel – here the pullback is surely a SPIKE – needs more down.

Breakeven on the daily chart

- Buying the H2

- Buying below the H2

- Could exit breakeven

Conclusion

- Suggest you take your favourite setups and begin to analyse them on a higher timeframe to develop the feeling of what the good ones look like AS THEY ARE FORMING.

- Using 2 or 3 is best.

- I like Daily -> 60m -> 15m

- Also 60m -> 15m -> 5m

Happy trading!

Tim

Leave a comment