- The Problem: Passive Homework Keeps You Stuck

- The First Step: Building a Homework Checklist

- Levelling Up: Learning From Your Mistakes

- Creating a Repository: Screenshot and Annotate

- Organizing for Mastery: Structuring Your Knowledge

- Sharing Your Insights: Practice in Public

- Scaling Your Learning: Turning Notes Into Videos

- Encyclopaedia

- The Professional Trader’s Edge: Iterative Homework

- Conclusion: Professionalize Your Homework to Accelerate Success

For traders at all levels, from beginners to intermediates, one of the most overlooked yet transformative practices is trading homework.

A structured approach to homework can dramatically improve your understanding, refine your skills, and, ultimately, boost your profitability.

This post will guide you through the stages of professionalizing your trading homework, helping you move from a passive observer to an advanced practitioner who extracts actionable insights from every session.

The Problem: Passive Homework Keeps You Stuck

Many struggling traders approach homework in the same way: they open a chart, passively scan it, and make casual observations. There’s no structure, no focus, and no measurable progress. This approach not only wastes time but also reinforces bad habits.

If you’ve been trading for years with little to show for it, this may be your starting point. The good news? There’s a clear path to move forward.

The First Step: Building a Homework Checklist

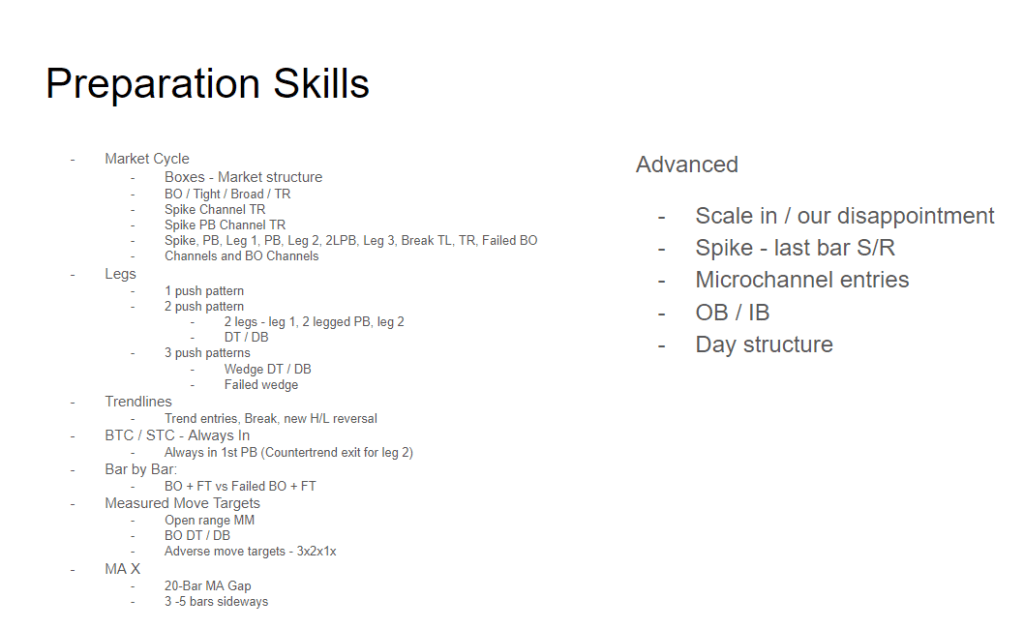

The first upgrade to your trading homework is to create a checklist of specific setups to look for. For example:

- High 2 setups

- Wedge bottoms

- Failed double tops

Your task: go through a set number of charts or allocate a specific amount of time to identifying these setups. This targeted practice helps you train your eye and develop pattern recognition skills.

My list has changed over the years but a few I dug up are:

Levelling Up: Learning From Your Mistakes

Once you’ve mastered identifying setups, it’s time to analyse your own trades.

This is where true growth happens.

Look back at your mistakes and missed opportunities. What patterns didn’t you see clearly? What did you misinterpret?

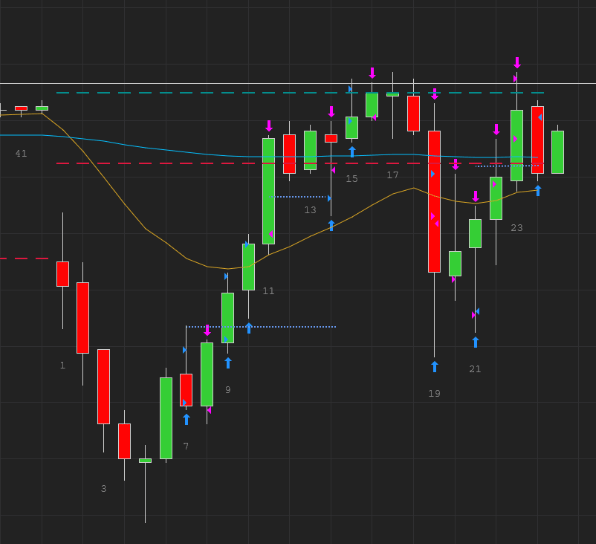

Here is an old chart – I’m scalping but taking too many trades and not managing well – you can see I don’t understand how a breakout point test works, now how 15m chart works with the 5m, nor how crossing the MA works.

So now I add to my checklist:

After I add these findings to my checklist I get better each day I practice.

By iterating on your process, you turn failures into valuable lessons and improve your execution over time.

Creating a Repository: Screenshot and Annotate

The next stage is to document your work visually. For each setup, take a screenshot, annotate it with your notes, and save it in a repository.

I use NOTION, but have used Google Docs, MS Office, etc

For instance, you might have a section for “Trendline Breaks / New High Reversals” with:

- Screenshots of different examples

- Annotations explaining the context and outcome

This repository becomes a powerful resource you can reference and expand as you progress.

It is just to collect things you see at this stage.

Organizing for Mastery: Structuring Your Knowledge

As your repository grows, organizing it becomes essential. Group setups into categories, such as:

- Setup: Trendline Break, New High Reversal

- Context: Big gap opens, daily charts, intraday trends, different instruments

- Variations: Bullish vs. bearish setups, strong trends vs. trading ranges

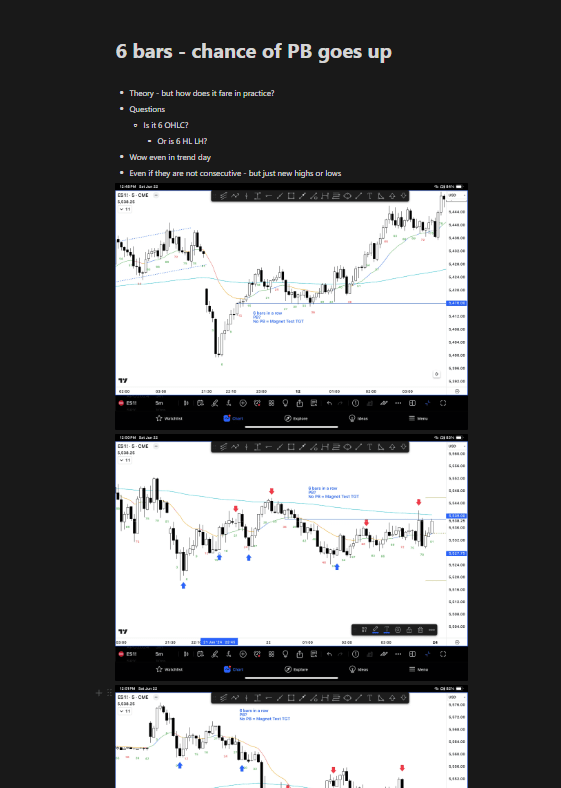

Here is one page I’m researching swing setups for open gaps

Those are headings in a table of contents – which can have several charts (or indeed sub-pages in them.) So easy to screenshot.

This structure helps you quickly find relevant examples and deepens your understanding of how setups behave in different contexts.

Sharing Your Insights: Practice in Public

Once you’ve built a strong foundation, consider sharing your work.

This blog came from me taking the next step in my own development.

Blogging or posting about your setups forces you to explain your thought process clearly, making gaps in your understanding more apparent.

I learn SO MUCH from writing these.

This practice not only helps you but also provides value to others, building your accountability.

Scaling Your Learning: Turning Notes Into Videos

To take things further, turn your annotated notes into videos.

My channel came from all of this work compounded into short videos!

A short summary of each concept can serve as a personal reference or teaching tool for others. Recording videos requires clarity and organization, which reinforces your learning.

Encyclopaedia

Well I’m not at this stage yet!

Al Brooks is my example here.

I’ll blog about this stage when I get there!

The Professional Trader’s Edge: Iterative Homework

At this stage, your homework has become a continuous process of improvement.

Each session deepens your understanding and strengthens your skills. By iterating on this process, you force yourself to think, rethink, and absorb information at a higher level.

Conclusion: Professionalize Your Homework to Accelerate Success

If you want to transition from a beginner to an advanced trader, the key lies in professionalizing your trading homework. A structured, iterative approach helps you:

- Identify patterns consistently

- Learn from mistakes effectively

- Build a repository of actionable insights

- Share and refine your knowledge

By following this process, you’ll uncover gaps in your understanding, develop deeper insights, and ultimately increase your profitability. Trading success is built on discipline and continuous learning—and it all starts with your homework.

Start today. Turn your trading homework into your competitive edge!

Leave a comment