Intro

- This is part of a series on learning the MARKET CYCLE. Many traders contacted me asking for ways to improve this part of their price action reading.

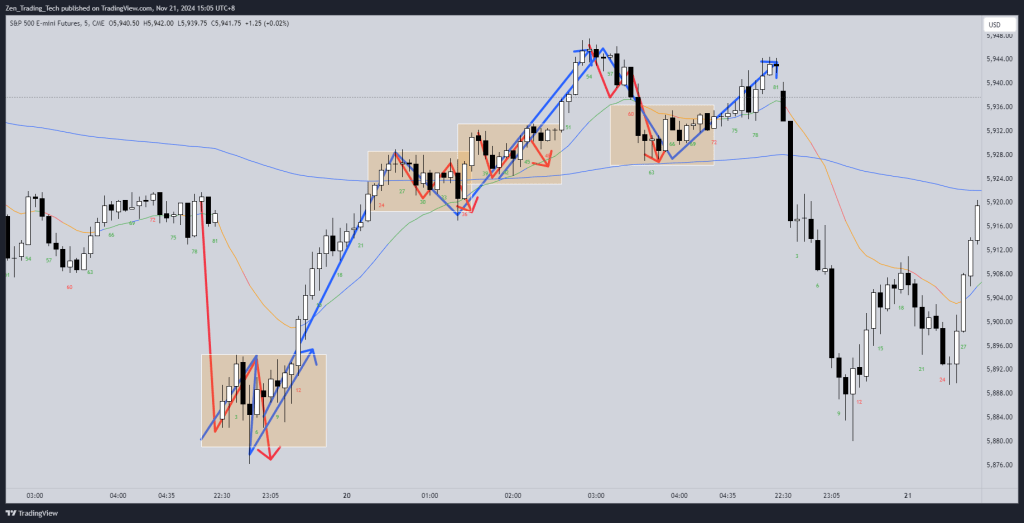

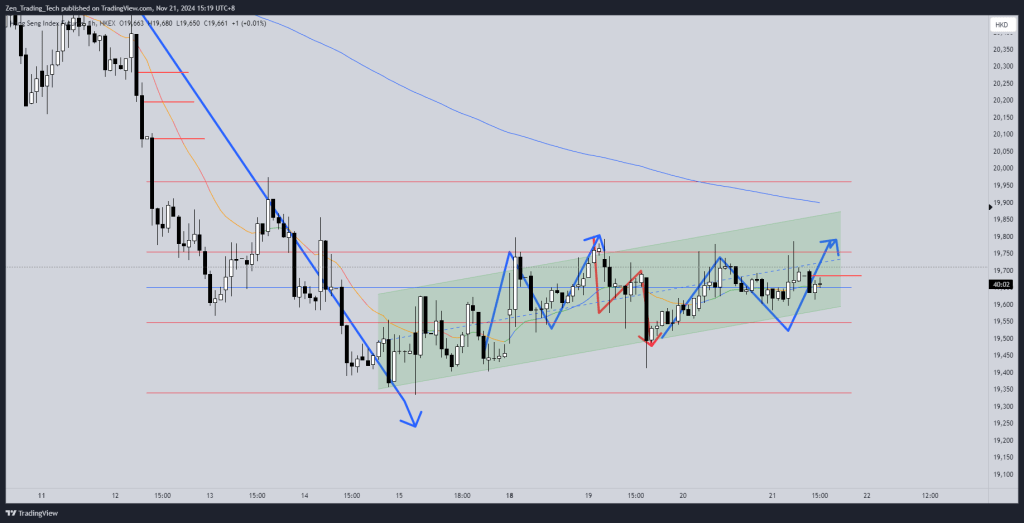

- The market moves in two legs.

- Often it is not clear whether this is a two-legged move down or up.

- Traders are able to trade in either direction as long as they DO NOT trade it like a BREAKOUT.

Goal

- Identify trading ranges as areas where opposite 2-legged moves exist.

Drill Instructions

- Follow the previous drills for lightning bolts

- Where there are TWO POSSIBLE 2 legged moves in the same space – now draw a trading range box.

- There are areas where traders can be long or short. Notice where they occur:

- Far from the MA

- After 3+ legs

- Top Sell Climax / Bottom of a Buy Climax

- If you have NO IDEA how to draw the arrows = TRADING RANGE

- If the market looks like this – assume disappointment, so you won’t feel disappointed.

Conclusion

- Use your confusion as a radar to trade it like a trading range

I hope you enjoyed that drill! Please let me know in the comments if you found that valuable.

Leave a comment