Intro

- This is part of a series on learning the MARKET CYCLE. Many traders contacted me asking for ways to improve this part of their price action reading.

- 90% of the time the market is sideways

- Most traders enter like its always a breakout and panic on the pullback.

- 90% traders lose. So enter and expect a pullback.

Goal

- We wish REMOVE the bad habit of hitting the button when the market moves. Statistically you are in a CHANNEL or a TRADING RANGE most of the time.

Drill Instructions

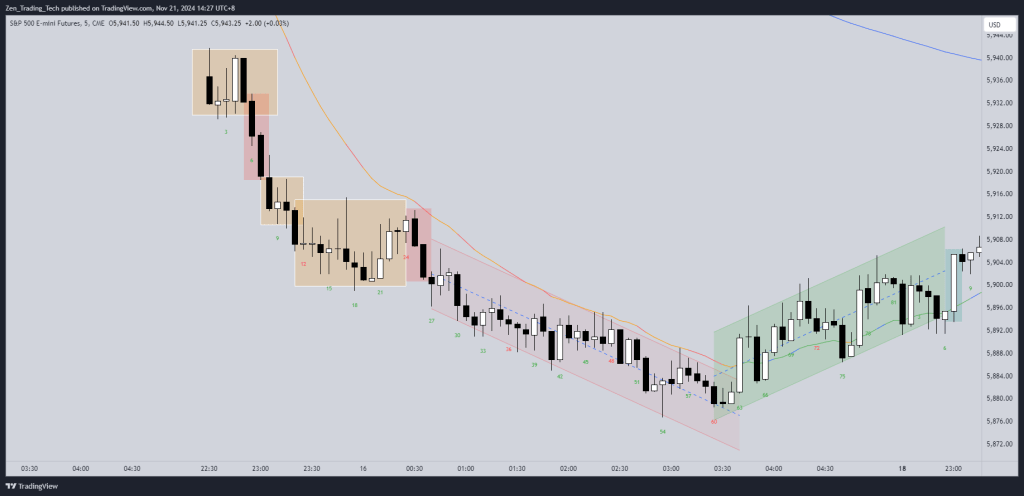

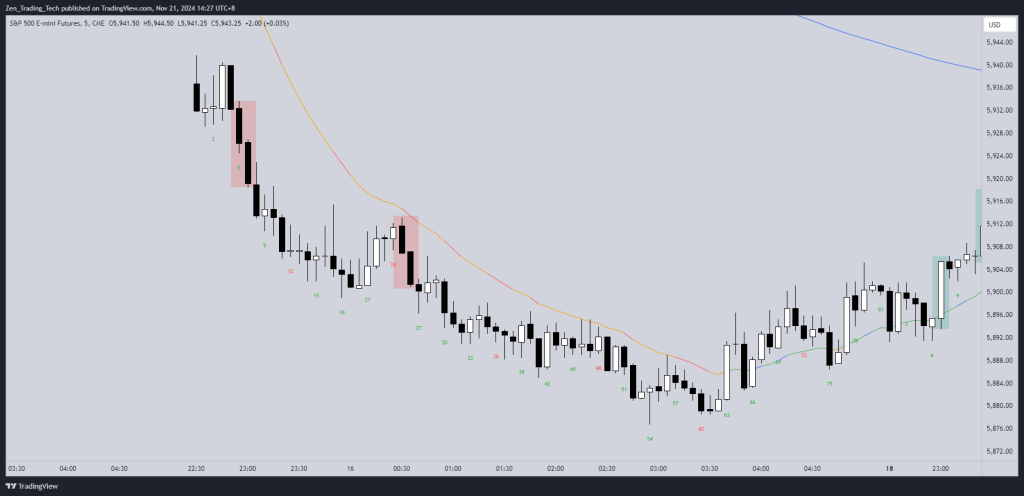

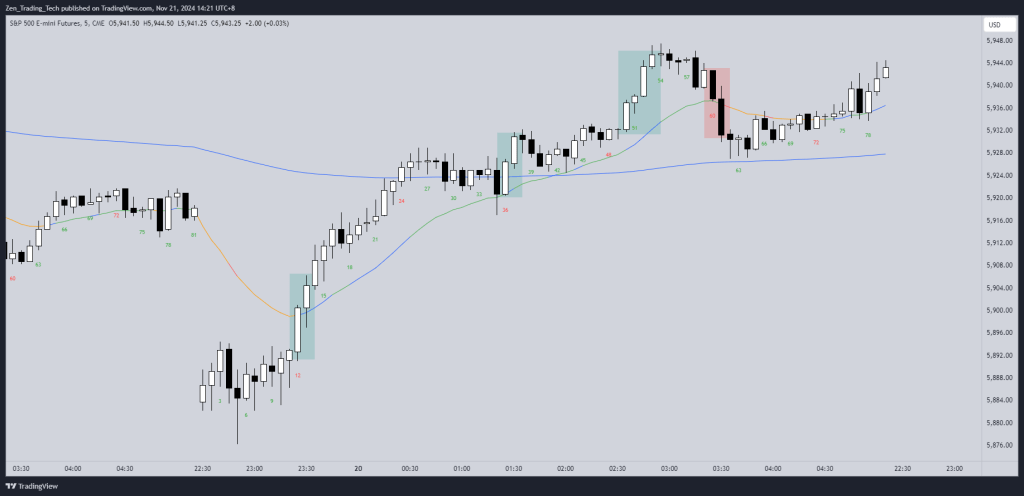

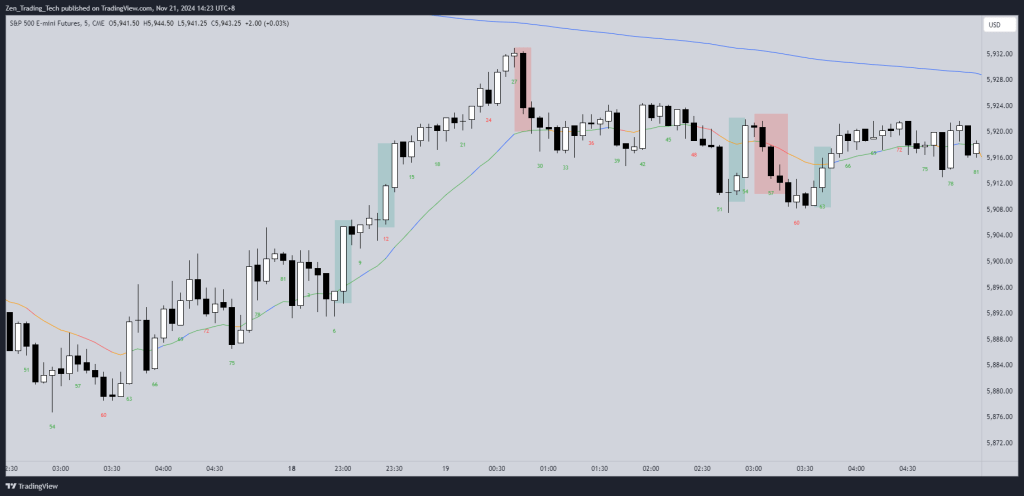

- Draw BREAKOUTS, CHANNELS and TRADING RANGES like before. See earlier drills.

- Tighten the BREAKOUTS so they DO NOT OVERLAP anything.

- Remove the channels and the trading ranges.

- Repeat until you convince yourself 90% of the time the market is NOT in a BREAKOUT.

- So just trade everything like a channel

- Repeat this drill until you are convinced 90% of the time the market is NOT in a breakout

- Its very difficult to find a BREAKOUT that cannot be part of a channel.

- Even the ones I selected below could be argued against

Conclusion

- Most traders enter like its always a breakout and panic on the pullback.

- 90% traders lose. So enter and expect a pullback.

I hope you enjoyed that drill! Please let me know in the comments if you found that valuable.

Leave a comment