- Introduction

- What You’ll Learn

- Principles of the Strategy

- Microchannel Fade

- Consecutive Signals

- Avoiding countertrend

- Sell Above a Bear bar, Buy Below a Bull bar

- Fading Breakouts in Trading Ranges

- Stop Location Choices

- Actual Risk

- Use it like a MA Fade

- Further Research

Introduction

In trading, understanding market behavior and identifying recurring patterns can significantly improve decision-making and profitability. This blog post will cover key trading concepts such as the Low 1 Fade.

I call it a Spike Break Fade and a Weak Reversal Fade, focusing on practical drills to help you spot and capitalize on these opportunities.

We will explore essential principles, including the concept of the market making two attempts at significant moves, strategies for fading weak first attempts, and specific drills to enhance your ability to identify high-probability setups.

By the end of this guide, you’ll have a structured approach to recognizing and executing effective trading strategies across different market conditions.

What You’ll Learn

In this post, we will delve into the following key areas:

- Principles of the Two Attempt Strategy: Why the market often tries twice and how to leverage it.

- Microchannel Fades: Identifying and executing trades based on microchannel patterns.

- Consecutive Signals: Understanding when a trend is extended and when to stop.

- Avoiding Countertrend Trades: Recognizing unfavorable conditions and how to navigate them.

- Key Entry Techniques: Effective ways to enter based on bull and bear bars.

- Fading Breakouts in Trading Ranges: How to effectively trade within ranges.

- Stop Location Choices and Risk Management: Setting realistic targets and managing risk effectively.

Let’s dive into the details and explore how you can apply these concepts to your trading routine.

Principles of the Strategy

The Two Attempt Principle

The market very often makes two attempts to achieve any significant move. Recognizing this pattern allows traders to:

- Fade the weak first attempt, positioning themselves for a stronger second leg.

- Enter for the second leg of a breakout.

- Stay in a trade for the second reversal attempt.

- If buyers were above, that means avoid selling the 1st attempt Below

- 2nd Entry Short (2ES), 2nd Entry Long (2EL) can improve probability but will reduce number of entries.

For instance, when the market is trending UP, triggering stop-entry shorts below has a low probability of success. By understanding this principle, traders can better time their entries and exits.

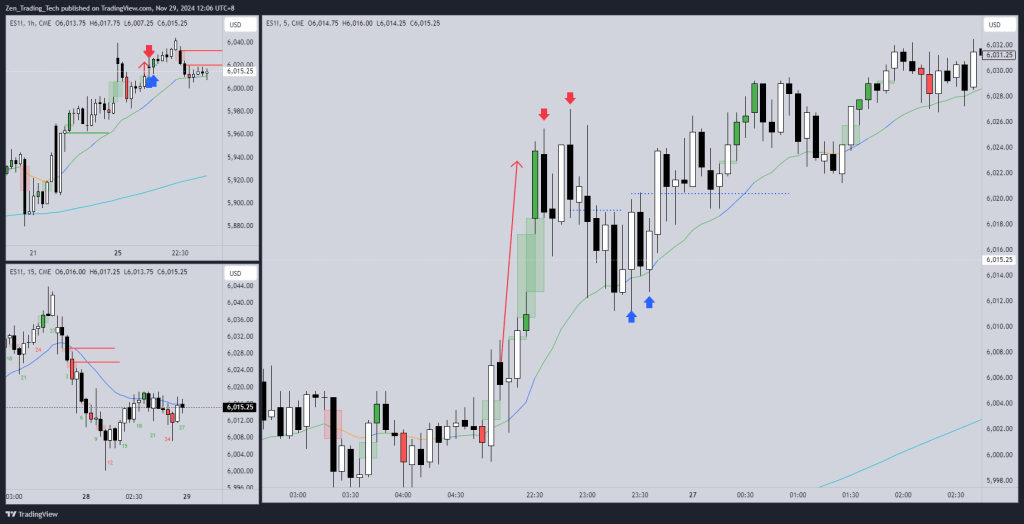

2ES then 2EL

But a scalper sees this:

Drill #1: Look for the Second Attempt

To apply this principle effectively:

- Observe the high or low of yesterday being tested twice.

- In a breakout and pullback scenario, expect two tests of the breakout point before continuation.

- After the first reversal attempt, expect a second try before a significant move occurs.

Once you start looking for these patterns, they will become more apparent in your trading analysis!

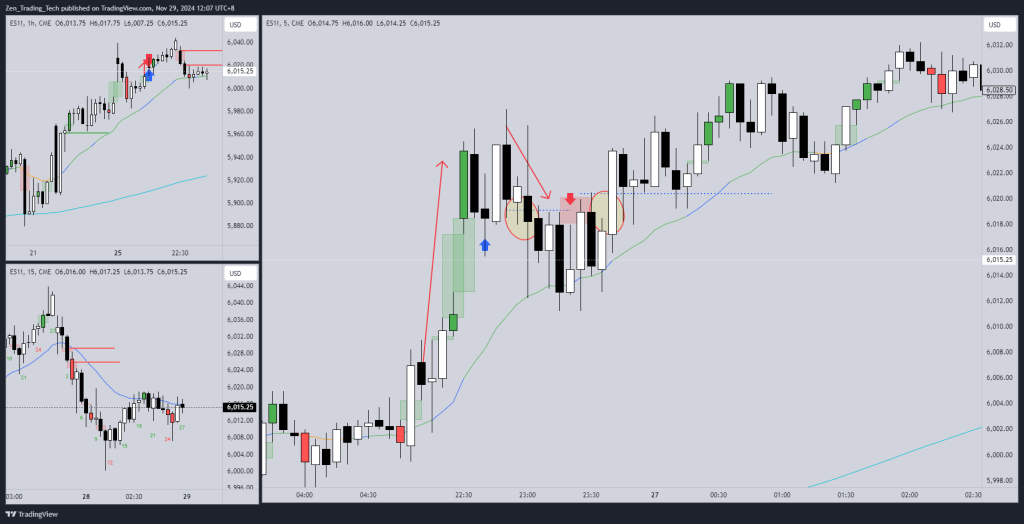

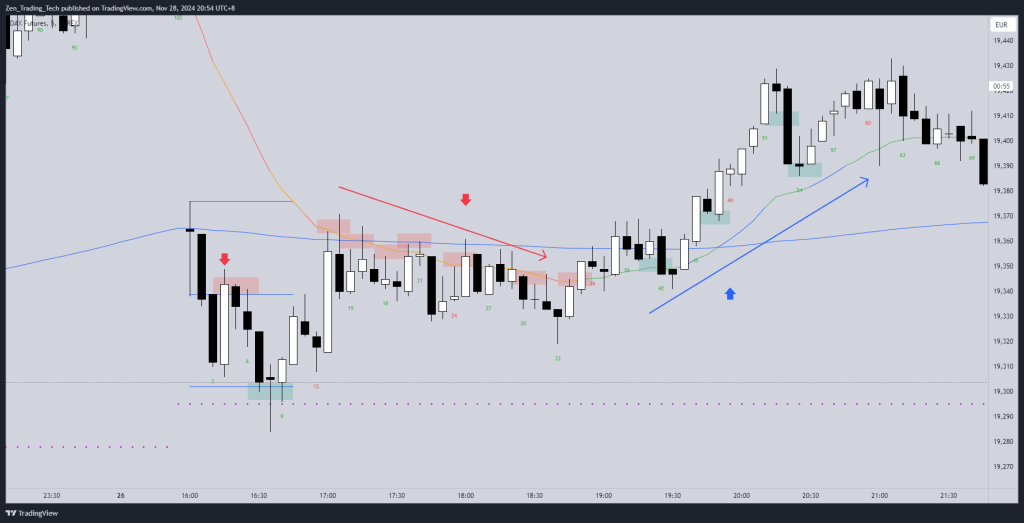

Microchannel Fade

Another effective strategy is the Microchannel Fade, which involves fading stop entries against a microchannel. Here is an example:

Drill #2: Microchannel Fade

- Look for a microchannel defined by three consecutive bars and a gap between the 1st and 3rd bar, ensuring the pattern is not countertrend.

- Ideal entry locations:

- In a bull microchannel, enter below a good bull bar (last 1 or 2 bars).

- In a bear microchannel, enter above a good bear bar (last 1 or 2 bars).

- Place stops at the swing point or spike edge for risk management.

Consecutive Signals

Recognizing consecutive signals helps traders avoid overtrading late-stage moves.

Drill #3: Consecutive Signals

- Analyze 20 to 50 charts and note how often 4, 5, or 6 signals appear in a row.

- Understand that after three signals, the leg is often considered late, reducing the probability of continuation.

- Stop after 3 signals, as it typically indicates a late-stage move (3 legs).

- 2 examples below.

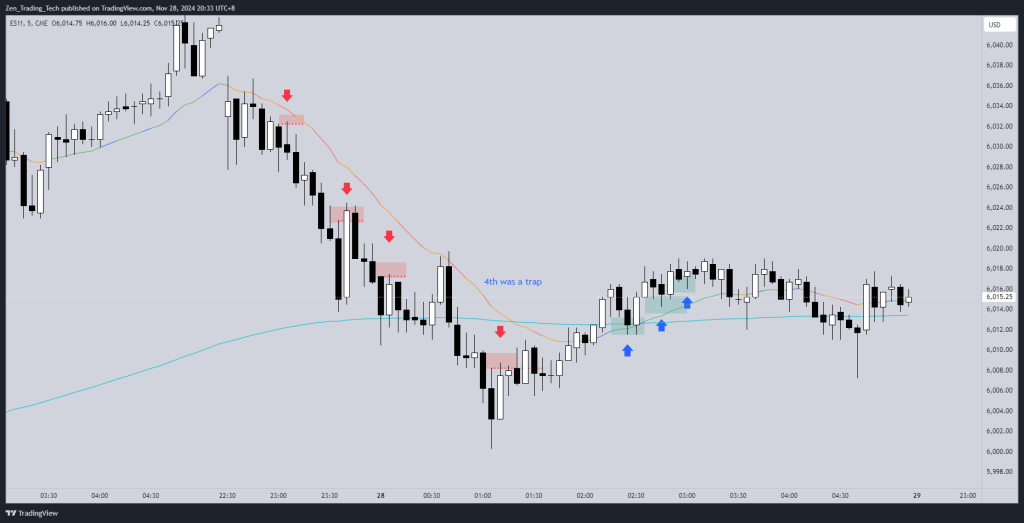

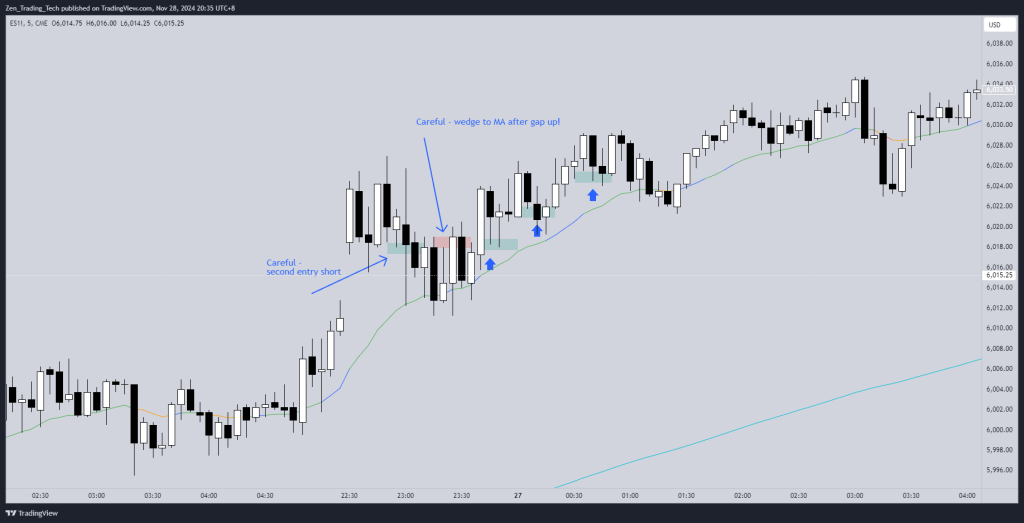

Avoiding countertrend

Countertrend trades can be risky and require careful analysis of context and market structure.

Drill #4: Countertrend Trading

- Study 20 to 50 charts and observe the success rate of countertrend trades.

- Assess potential exit strategies if countertrend trades don’t work.

- Recognize patterns indicating the market may be transitioning into breakout mode.

- This was a previous example – avoid the countertrend one in favour of a with trend MA setup.

https://www.tradingview.com/x/kAgdOCgo/

Example

- Analyze the above example. What makes this sell setup different?

- Gap up and pullback to the MA. You are betting on a BEAR breakout in a BULL environment so far.

- So by looking at context, leg counting and what pattern you are in, it might be time for breakout mode and a new direction.

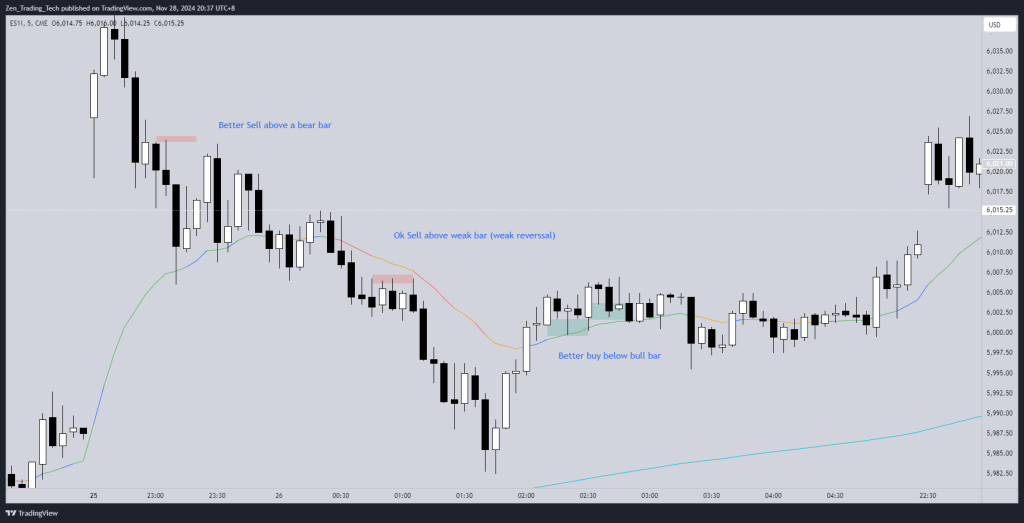

Sell Above a Bear bar, Buy Below a Bull bar

This principle provides a simple yet effective entry strategy.

Drill #5: Sell Above a Bear Bar, Buy Below a Bull Bar

- Examine 20 to 50 charts and analyze the best entry points.

- Often, the best entries occur above a bear bar or below a bull bar, signalling failed reversal attempts.

- You don’t have to take these, but it they appear and then a good STOP entry, that can provide further confidence.

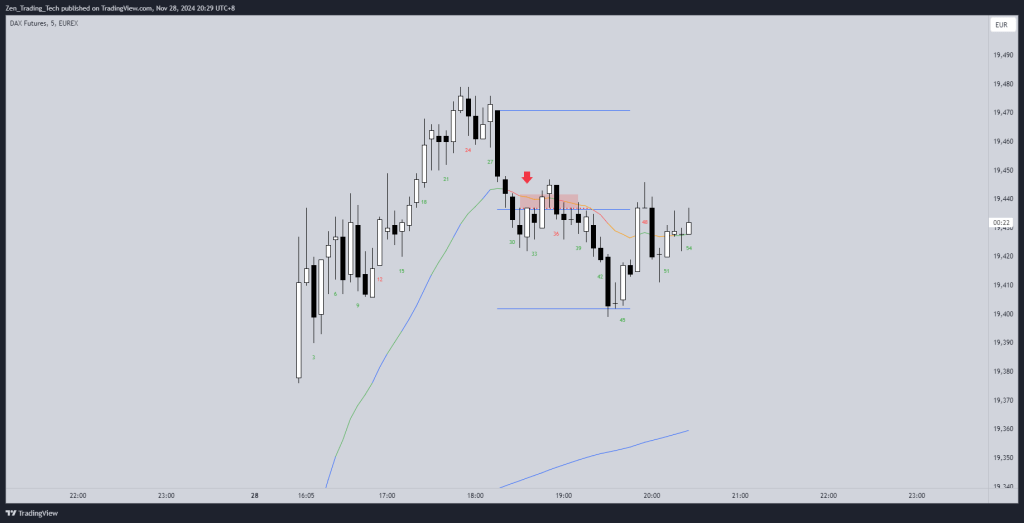

Fading Breakouts in Trading Ranges

Trading ranges frequently present opportunities for fading breakouts, though they require patience. Example below.

Drill #6: Trading Ranges

- Review trading range days and mark all High 1 (H1) sells and Low 1 (L1) buys.

- Understand that these setups occur frequently but may take time to develop.

- Trading Ranges have these non-stop.

- But they can be tough to take.

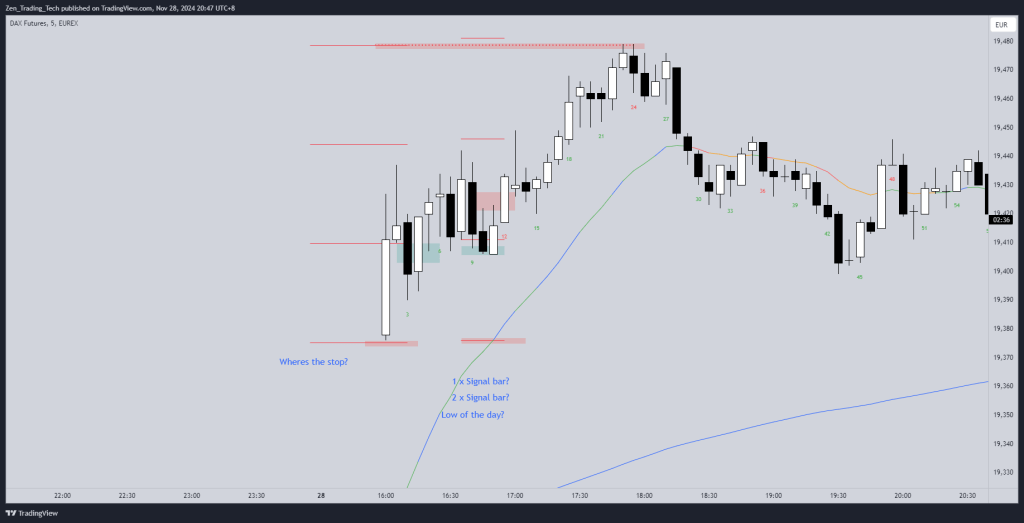

Stop Location Choices

Proper stop placement is crucial to risk management.

- Analyze key swing points and structural edges for optimal stop placement.

- Use actual risk measurements to set realistic targets.

- Consider using a moving average (MA) fade strategy for confirmation.

- Example below.

Actual Risk

- You can even explore using ACTUAL RISK to determine targets.

- An example sits below.

- Be careful on your Risk Reward for these trades.

https://www.tradingview.com/x/AcIKmIQc/

Use it like a MA Fade

- This entry technique can also be considered a MA fade.

- Front-running the MA entry.

- Example below.

https://www.tradingview.com/x/xrpzVOze/

Further Research

To improve performance, consider:

- Identifying when to abandon an entry if conditions change.

- Establishing a position after a good stop entry has been missed.

- Fading pullbacks strategically to capture better entries.

By incorporating these drills and principles into your trading routine, you can develop a structured and disciplined approach to recognizing and executing high-probability setups.

Leave a comment