In this post, I’m exploring the trader’s equation and how our exits and stop locations fundamentally change our trading mathematics. These changes can explain why traders slowly blow accounts without even realizing it.

My own trading experience, combined with reviewing countless other traders’ decisions, has shown this pattern repeatedly.

This post aims to encourage traders to see every decision—whether it’s stop placement, exit timing, or scaling—as altering the probabilities of their long-term success.

The Mathematics Behind Stops and Exits

Every time you adjust your stop or exit location, you are changing the mathematics of your trade. Understanding these changes can help you align your trading strategy with realistic probabilities rather than wishful thinking.

Key concepts to consider:

- Changing stop location alters your reward-to-risk ratio.

- Adjusting exit criteria affects expected value.

- Scaling in can completely shift your probability distribution.

Let’s break down these concepts with real-world examples.

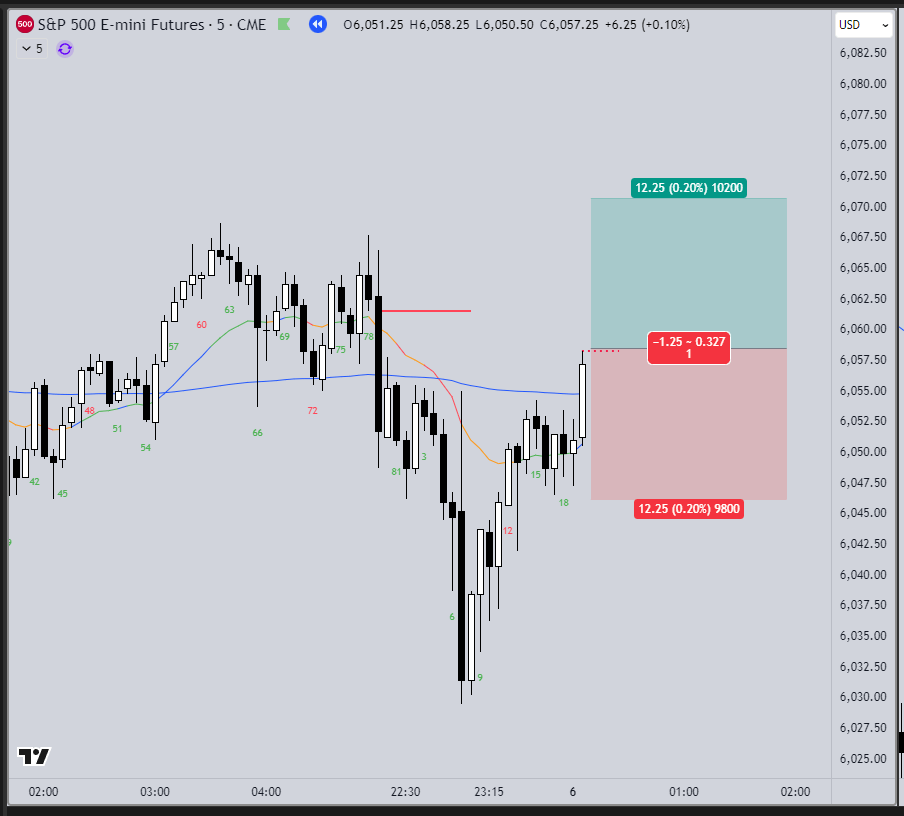

Example 1: Not Honoring Your Stop

Let’s say you have a reasonable B20 Buy setup, entering one tick above the high.

The plan is to use a fixed stop, but instead of letting it play out, the trader panics and exits below a poor entry bar B21.

Traders often believe they are executing this trade:

- Entry: Buy 1 Tick above B20

- Stop: Fixed logical stop (e.g., below B17)

- Target: 1R reward

But in reality, by exiting too early, they end up with this:

- Entry: Buy 1 Tick above B20

- Exit: Below B21

- Actual Reward-to-Risk: 1:1.88

It does NOT make sense to put stop in the middle of space like that. The market showed this.

Why this is a problem:

- The original setup had about a 60% probability

- By exiting early, the trader is essentially aiming for 100% probability, of going 12 points in profit before falling 6 points in drawdown…. but that is fantasy

- If the trade had been stopped out properly, they could have waited for another valid buy signal—and in many cases, those re-entries work.

- Stopped out here:

- Can BUY again with another signal which worked

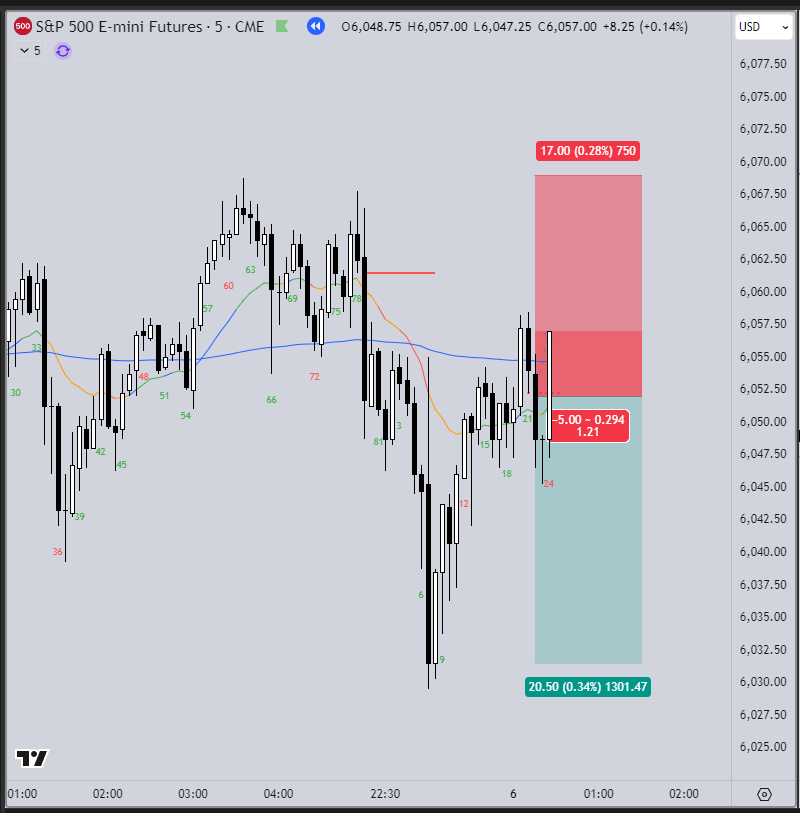

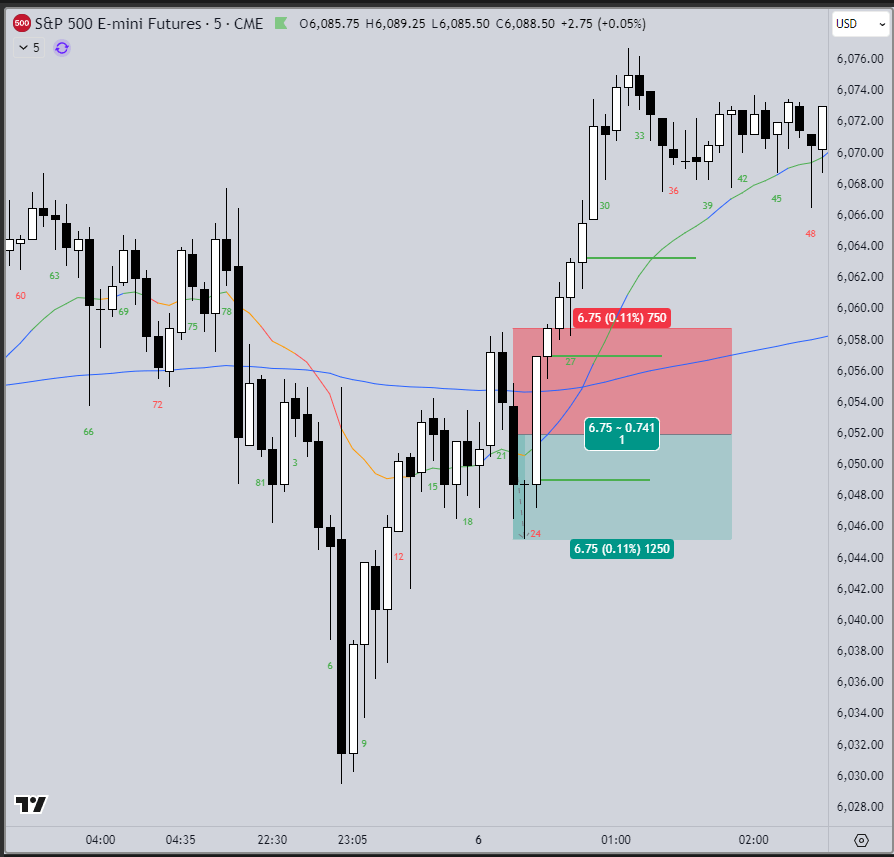

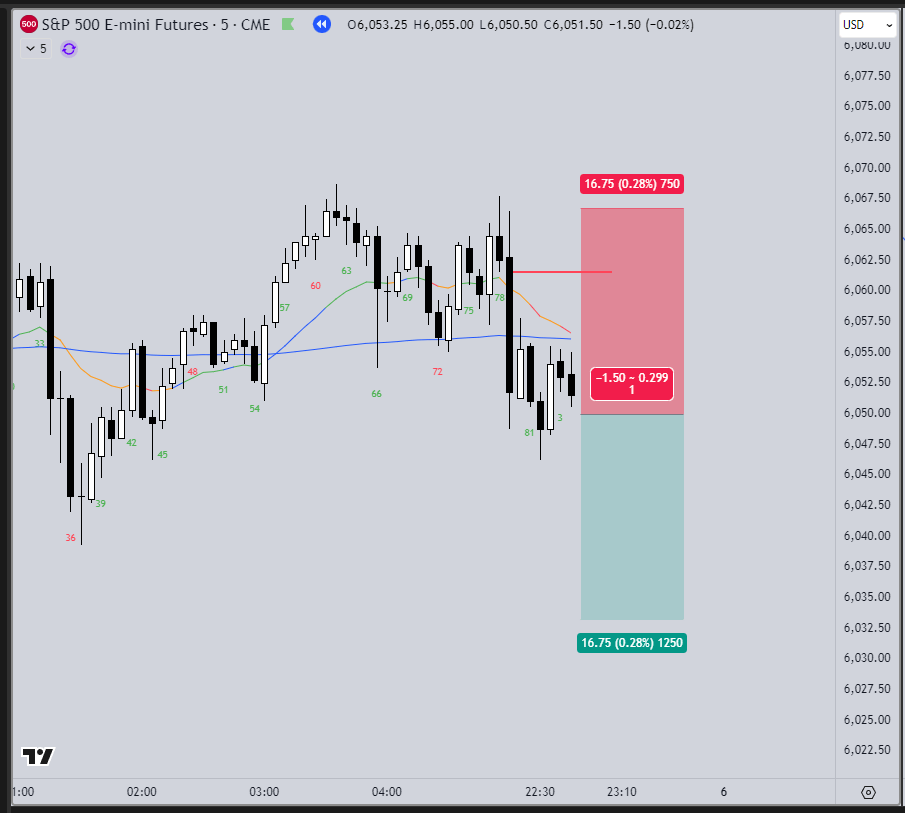

Example 2: Moving Your Stop Back

This scenario involves a failed breakout trade:

- Entry: Fading a breakout of a tight trading range. Decides to try to sell the high of the day. Low probability but good reward-to-risk

- Stop: Properly placed, accepting a standard scalp loss, reversal attempt

However, the trader gets scared with a large bull bar (B24).

Instead of closing the trade, they move their stop higher.

Now, the equation changes:

- Original RR: 3:1

- Imaginary New RR (after moving stop): 1.21:1 (worse equation, higher loss risk)

Why imaginary? Because they would NEVER stay in to get that reward.

- Actual NEW RR based on where they would exit on a pullback. Probably at the area everyone else took profit

The Real Issue:

- TRADING RANGE CONTEXT: This trade occurred in the middle of a trading range (TR), with 12 sideways bars in the past hour.

- The trader never planned to hold for 20 points—they would have been thrilled with 5-10 points and convinced themselves that was a good trade.

- The correct approach? Leave the stop at 1R and scalp accordingly within the range.

What happened? Big Loss

- The correct approach was LEAVING the STOP for 1R, a scalp in a TR and take the loss.

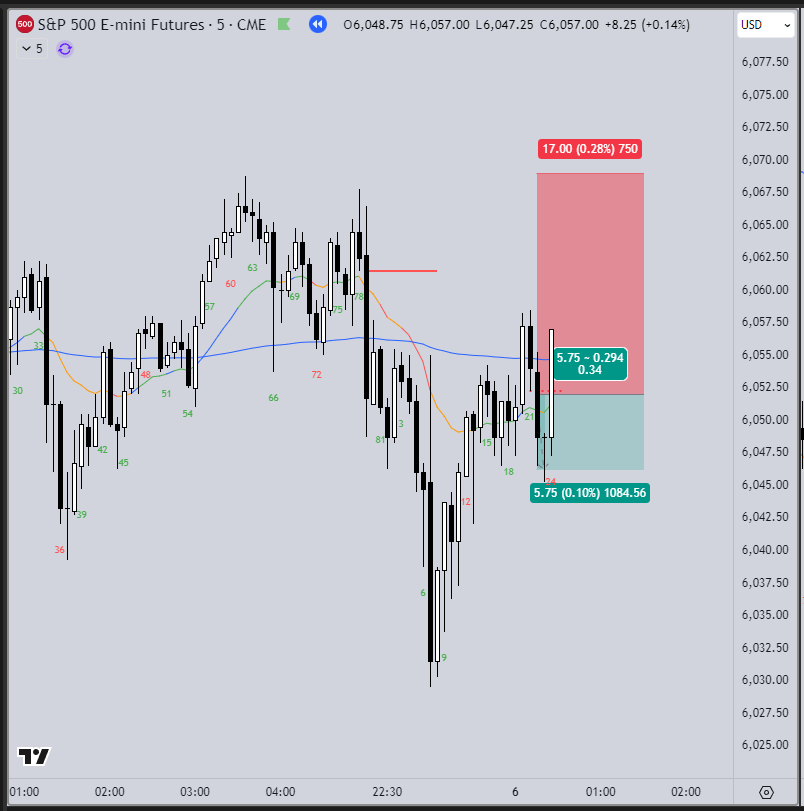

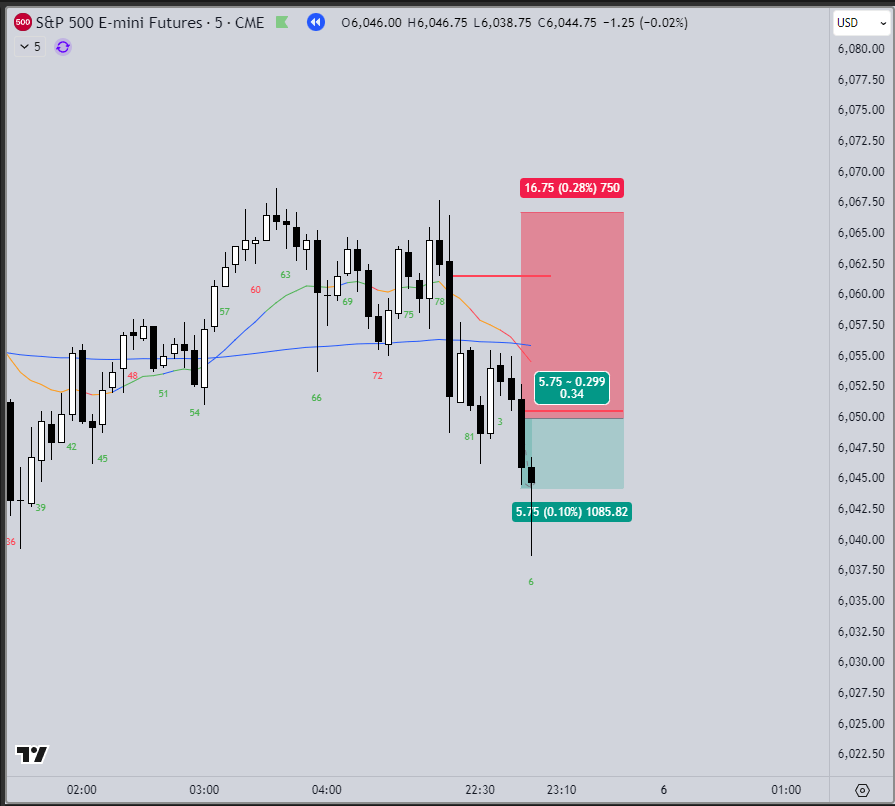

Example 3: Exiting Too Soon on a Low 2 Sell

A trader sells a Low 2 setup below B4. The trade is valid, but they panic and exit after B6.

- Original Trade Plan:

- Entry: Low 2 below B4

- Stop: Logical placement above B3

- Target: 1.5R or a measured move

- Actual Execution:

- Entry: Low 2 below B4

- Exit: After B6 (early panic exit)

- Final RR: 0.34:1 (extremely poor mathematics)

The trade ultimately reached the intended target, but the trader’s early exit destroyed the probability edge.

Why is this a major issue?

- Let the bar print before deciding. Good for 99% of trades.

- Institutions are trading a different game. They are not cutting trades early unless there is a mathematical reason.

- Early exits skew expectancy. If you are always exiting before your plan allows, your winners are smaller, but your losses remain full-sized.

- The correct approach? Either let the trade play out or structure a proper scalp exit strategy from the start.

Institutions looked to be doing something different

Final Thoughts: Everything Affects Your Edge

Every tweak to your stops, exits, and scaling approach alters the mathematical probability of your success.

Many traders slowly bleed their accounts—not because their trade ideas are bad, but because their execution changes the maths in ways they don’t realize.

If you take one thing from this post, let it be this:

Trading is probability, risk and reward. If you constantly change the parameters of your trades, you change your probability of success.

Stick to your edge, honor your stops, and don’t sabotage your own trades with last-minute fear-driven decisions.

Leave a comment