- How to practice training the eyes to see swing setups to improve your RR in your trading distribution

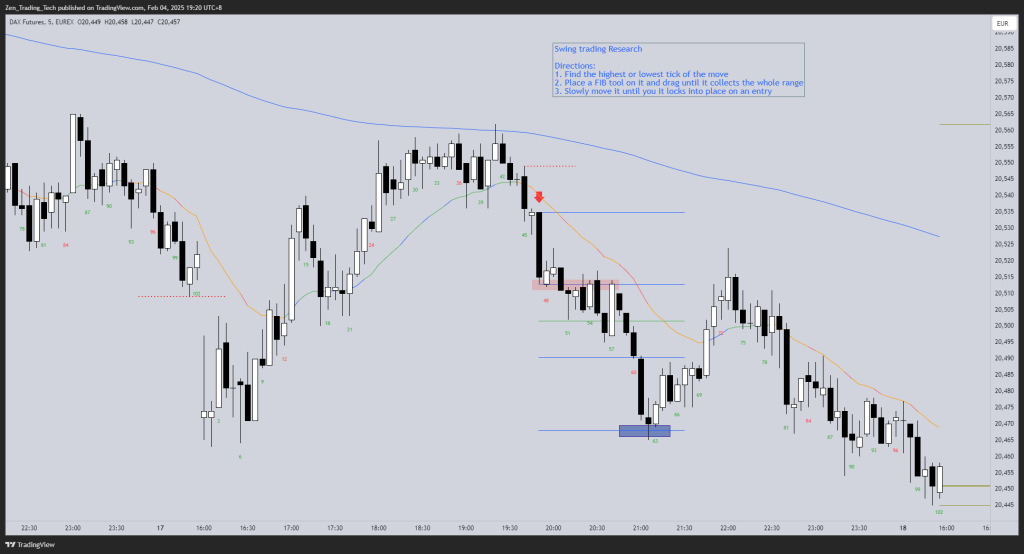

- By using the previous day’s chart, you can get a feel for possible places to swing some of your contracts for a bigger reward.

- Swing setups I define as a 1:2 RR – so 1 Risk for at least 2 Reward

- Initial Risk is the easiest way to measure

- Market is run by institutions and institutions are run on maths.

- So I’m using maths to reverse engineer the trades used so I can use it in future

- I’ve gone through 3 examples in the video and below to give you ideas of how to set it up and what to look for.

- It is not an exhaustive list, but it will get you started!

Video:

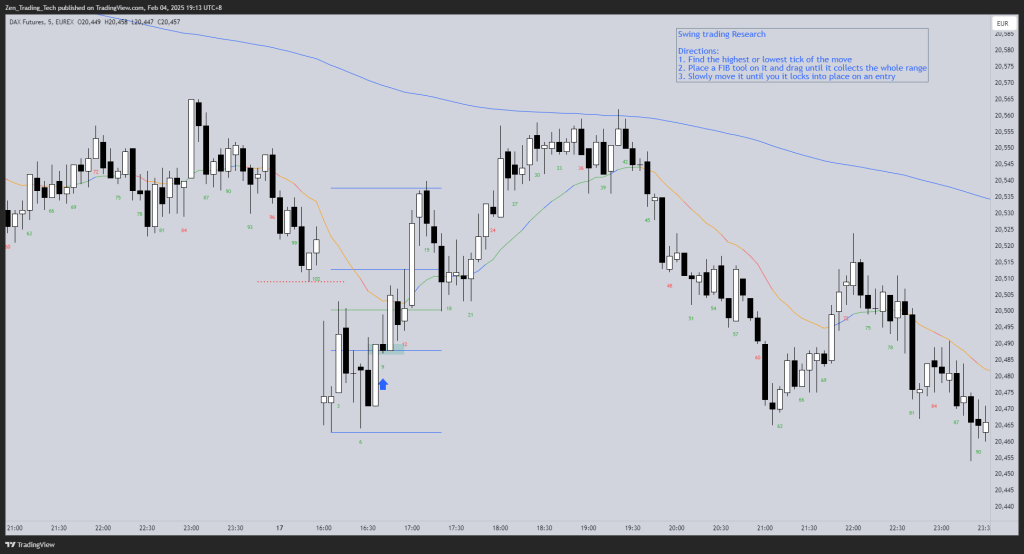

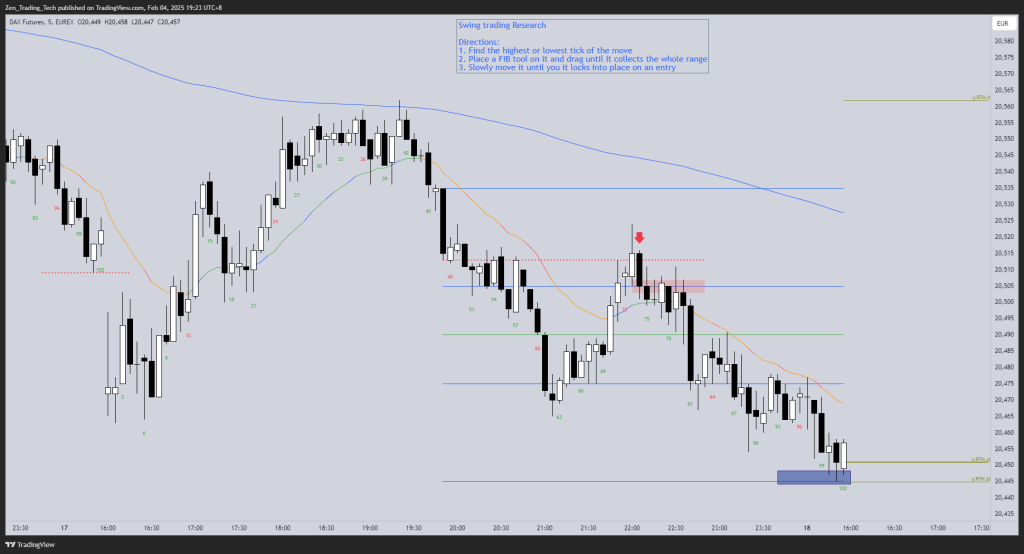

Example 1

- 15m BTC 2nd 15m bar

- First H1

- H1

- H2

- Double bottom attempt, 3 legs down

- Failed to go above the 200 and broke below the MA?

- What if use stop from the prior day for the bears? Now its a clean breakout below a double bottom for a MM down

- Keep it simple! Strong reversal bar closing on its low!

- Good signal bar from earlier never got taken out – keep stop same place, often sets up a new trade ie DTBRF Double Top Bear Flag

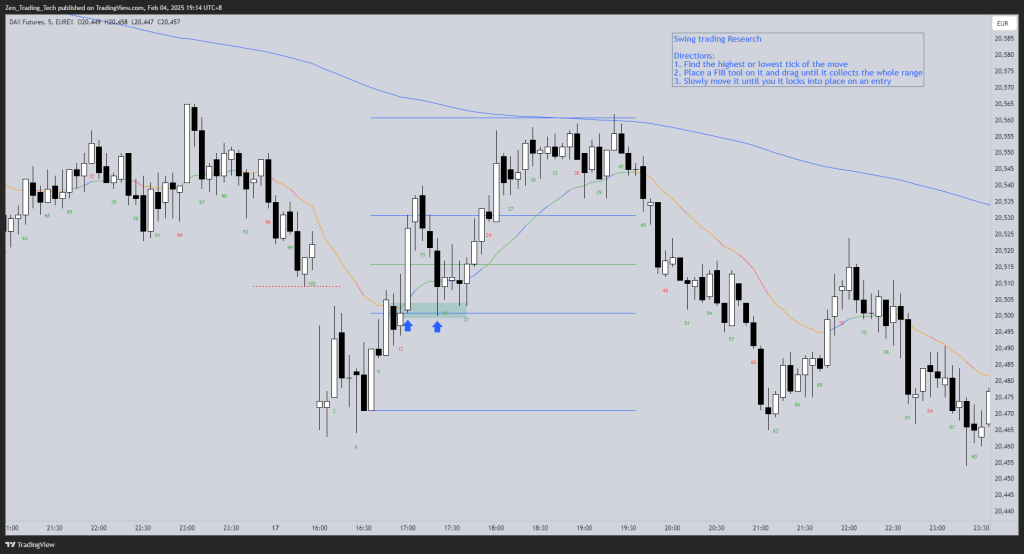

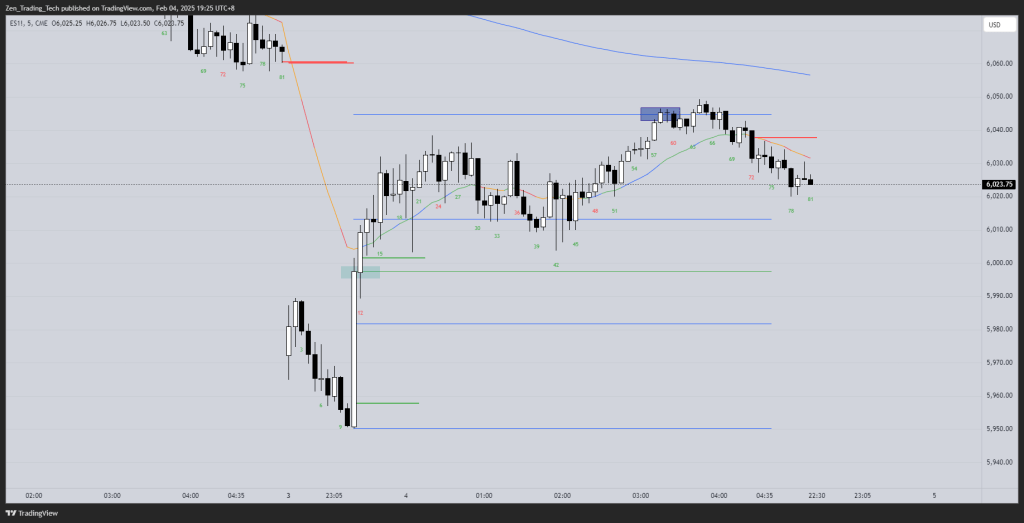

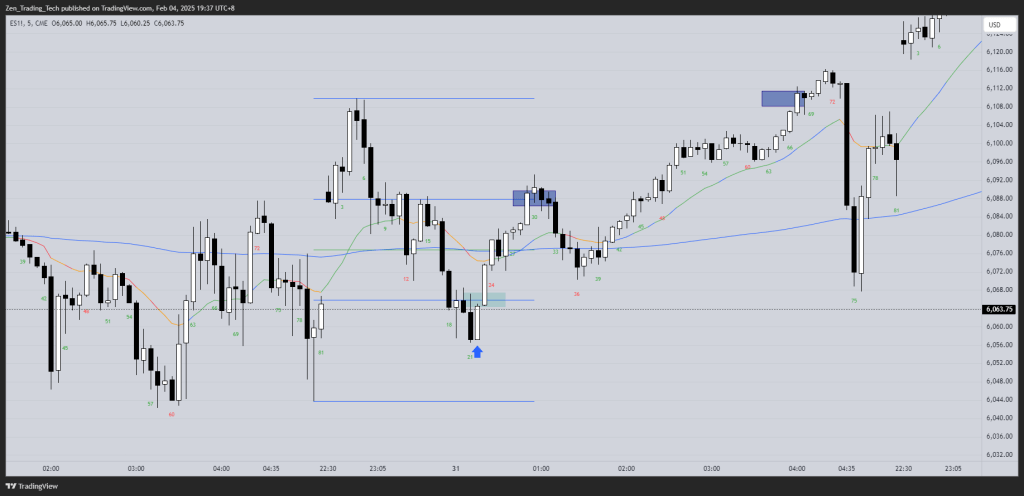

Example 2

- First thing I notice is huge BULL BAR – likely 1R success/fail MM – so measure that

- Then look at followthrough

- BO and FT, buy the FT bar, stop below?

- Spike and channel, buy the channel test with a tighter stop – bet first HTF reversal will fail

- Find TTR on the chart and put one target there and work backwards!

- target is above and find the entry and stop

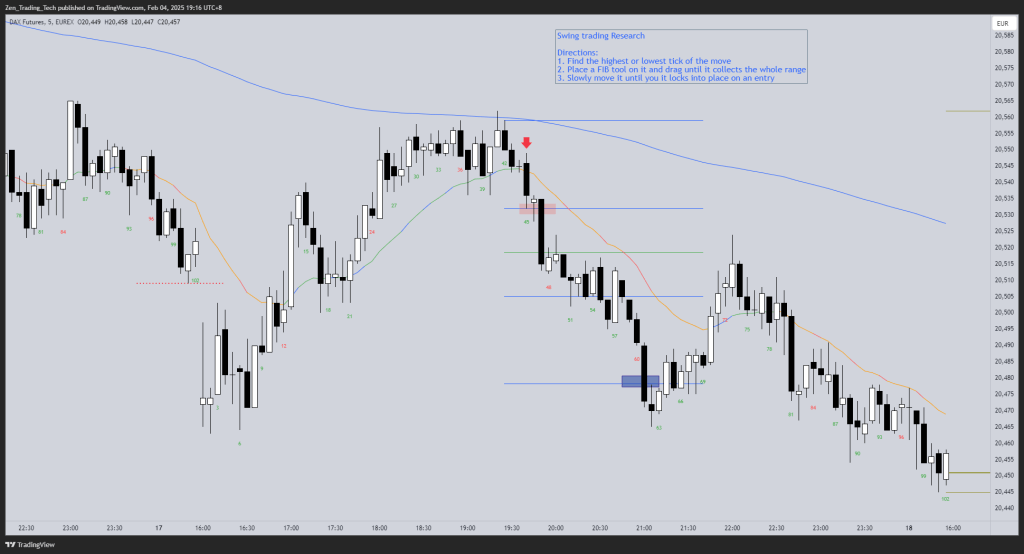

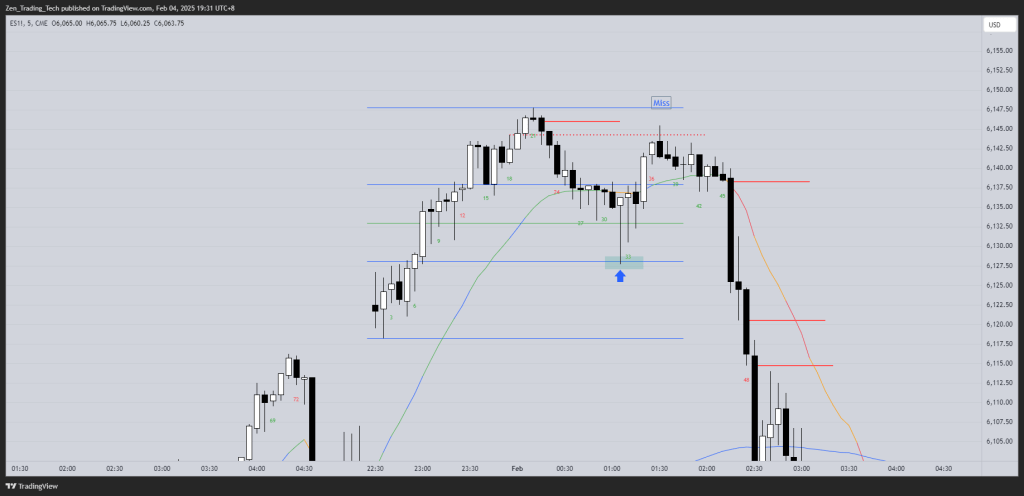

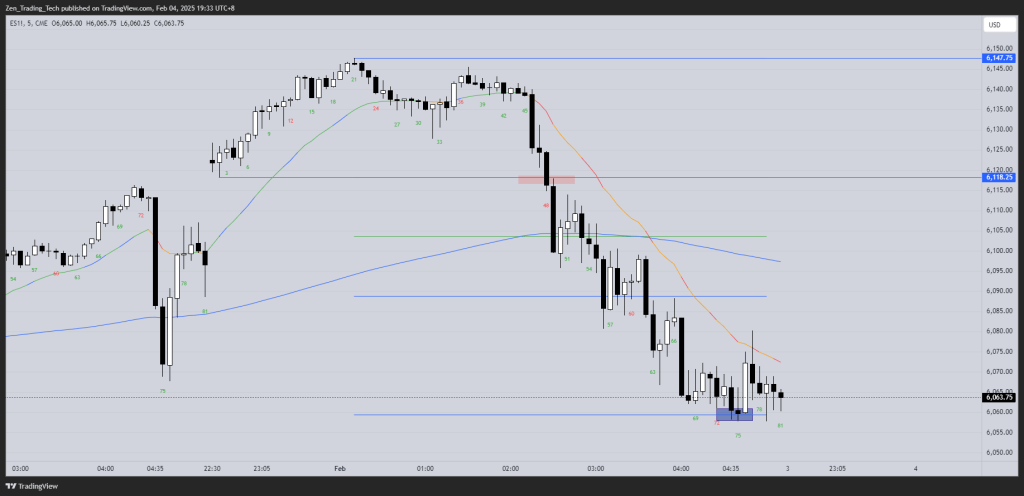

Example 3

- Buy above a weak 15m bar on a gap up

- Consecutive 15m bull bars after a gap up

- Sometimes it misses. I bought the low of the range, but scalped out before 1:2 RR

- Strong spike measured move – good place to measure from

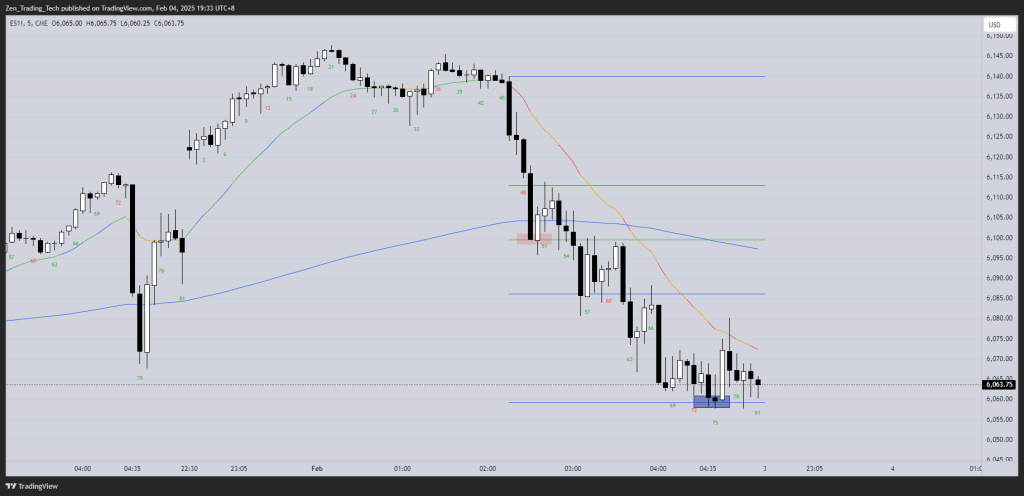

- Selling below the whole range. The day’s range wasn’t big enough, strong selling on tariff news became the swing short!

- 3 consecutive bear bars – 70% chance second leg sideways to down.

- Can scalp out and swing rest

- Find a pullback, which is a trading ranges on a smaller timeframe

Time for your to practice

- Now when I look at a chart a lot jumps out at me

Leave a comment