Just like in the classic Western The Magnificent Seven, where each gunfighter had their own style, every price action trader must master different drills to survive the daily shootout of the markets.

These seven trading drills will train your instincts, helping you recognize high-probability setups and avoid getting ambushed by false breakouts.

So saddle up, trader—let’s ride into the price action frontier.

Watch the video here:

📅 Drill #1: Is Yesterday’s a Good Signal Bar?

“Yesterday’s shot still echoes in the canyon—question is, do you ride toward it or away from it?”

Every day, the market leaves clues. Yesterday’s signal bar is one of the most important.

🔥 Your mission:

- Identify whether yesterday was a reasonable signal bar

- If you would’ve bought on the daily chart, look for ways to trade back to that price intraday.

- If yesterday’s bar failed, expect the market to test it again before committing to a direction.

Strategy: Draw a line to the right of yesterday’s key bar and watch how price reacts.

📈 Drill #2: Trendline Break, New High, Reversal?

“Every strong horse stumbles before it slows down for good.”

A strong trend doesn’t just vanish—it fights back.

And if yesterday was a strong trend, don’t be too quick on the draw to shoot short yet.

The first trendline break is often a bull or bear trap. Reversals need confirmation, and the market doesn’t roll over easily.

⚔️ Your mission:

- Wait for a break of the major trendline, then a retest.

- If buyers/sellers fail to reclaim control, the reversal is real.

- If the market hesitates, you’re likely entering a trading range, not a true top or bottom.

Strategy: Don’t fade a strong trend without proof—it often takes two attempts for a reversal to stick.

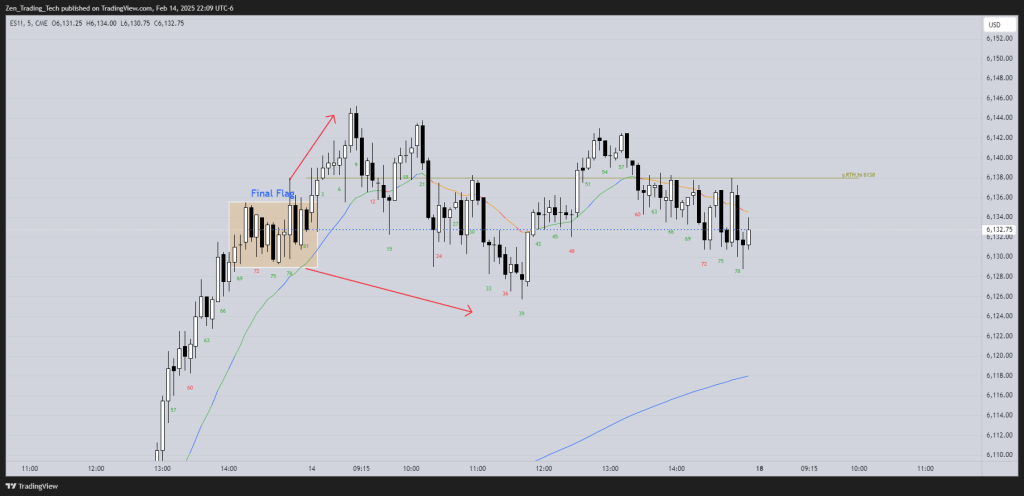

🧲 Drill #3: Final Flag – The Market’s Magnetic Pull

“Every outlaw makes one last stand before the dust settles.”

If you were going to have a good old Western shootout, you have to do it in the centre of town. That’s the Final Flag.

🔄 Your mission:

- Spot the last tight trading range before a major trendline break.

- If price breaks above the Final Flag, expect a fade back into it.

- If it falls below it, expect it to rally up to it.

Strategy: Don’t swing the first breakout after the Final Flag—it’s often a scalp only.

🎯 Drill #4: Two Attempts to Breakout of Yesterday’s High or Low

“The first shot’s a warning. The second one decides who walks away.”

Markets often test levels twice—once to probe, and a second time to reveal true conviction. The second attempt often determines whether price breaks out or reverses.

Inside bars are less than 10% of the chart – so there is a good chance today will not be one.

🤺 Your mission:

1️⃣ If the first breakout attempt fails, expect a retest.

2️⃣ If the second attempt fails too, the reversal can swing the other way.

🏔️ Drill #5: Highest High 1 (HH1)

“Reaching the top ain’t the hard part—staying there is.”

The Highest High (HH1) in a strong trend is a line in the sand that traders have a high probability of getting back to.

🔍 Your mission:

- Draw a line at the highest stop entry above a bull bar in a strong bull trend

- Look for ways to trade back to it

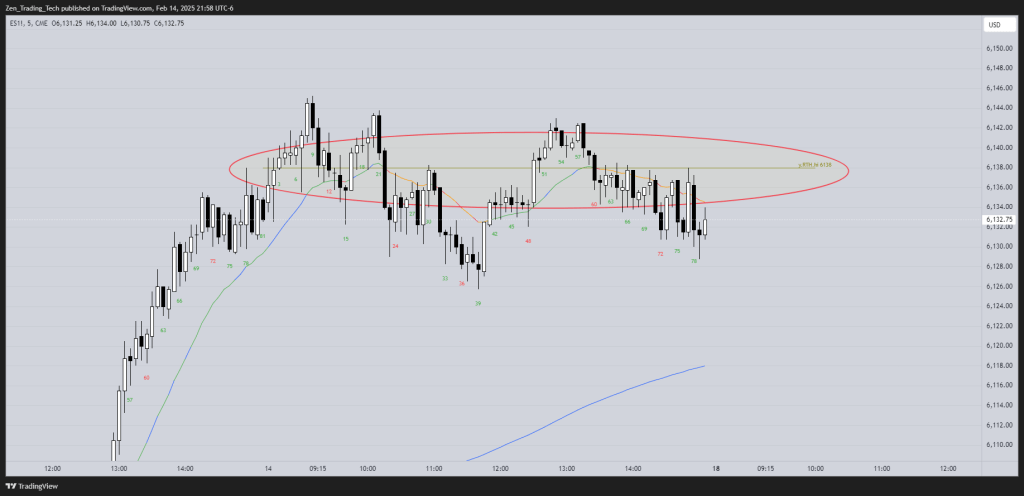

⚖️ Drill #6: Trading Ranges – Fade the High 1

“Not every breakout’s a jailbreak—most of ‘em just get dragged back inside.”

In the Wild West of the market, breakouts from trading ranges rarely last. Instead of chasing them, savvy traders fade the extremes back into the gunfight.

🏜️ Your mission:

- After 3 or more legs stop buying High 1’s and look left.

- If the last one failed and we are back there – look to see if traders will SELL above it instead. Join them.

Strategy: If price is in a range, assume every breakout is guilty until proven innocent.

🎲 Drill #7: Trading Ranges – Testing Reasonable Entries

“Ain’t no shame in missing the first shot—long as you hit the next two.”

Good traders don’t just take strong signal bars—they also look to trade back to ones that should have worked.

🧠 Your mission:

- Find a good-looking signal bar that didn’t work.

- Draw a line to the right—will the market test it again?

- Try and trade towards it

- If price fails again at that level, that’s your second trade away from it

🔥 Final Showdown – Are You Ready for the Gunfight?

The best price action traders don’t react—they anticipate. These seven drills will sharpen your instincts, helping you:

✅ Fade traps before they snap shut

✅ Avoid emotional trading decisions

✅ Ride momentum while knowing when to get out

Which of these drills is your favorite? Let me know in the comments—let’s train like a price action gunslinger.

Leave a comment