Introduction

- This is not a full system—just a look at a key behaviour that shows up often in trading ranges.

- I think it will help no to get frustrated and get back IN SYNC with what institutions are doing.

Main Idea

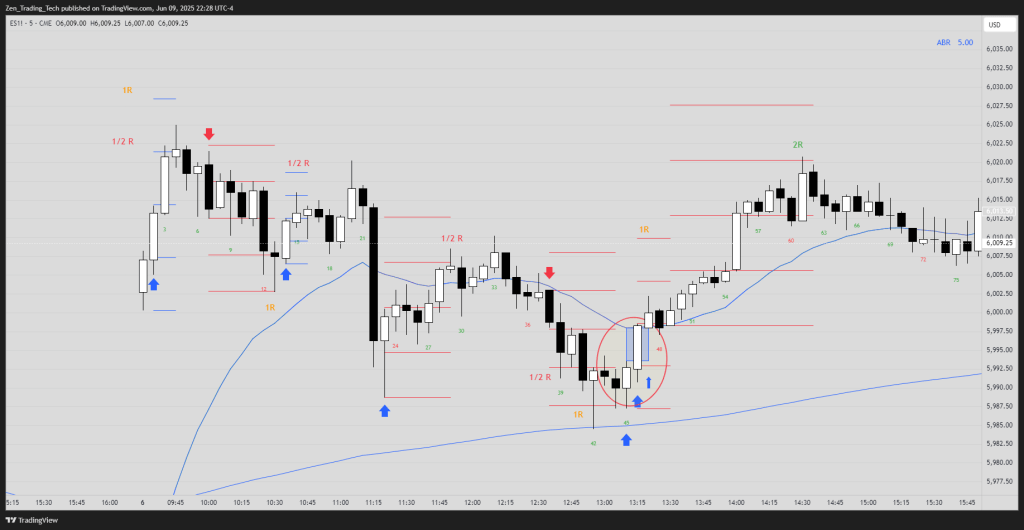

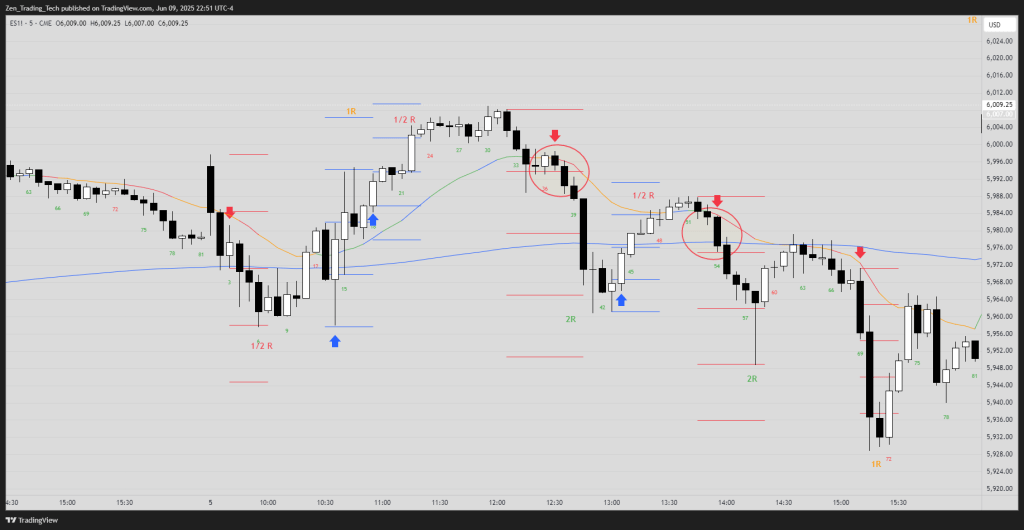

- In trading ranges, traders don’t expect swing trades. You’re unlikely to get a clean 2R move. 2R is often a surprise exit.

- Instead, the chart shows 0.5R to 1R targets are more common.

- That means you are always getting LESS than what you risk. So it is a dangerous place to be trading large.

- But by trading small, expecting sideways, scaling in and taking quick profits, you can rack up a days worth of points even when the range is small. And not get so frustrated doing it.

Chart Example 1

Chart Example 2

Chart Example 3

Summary

- Swing traders aim for 2R, but that’s rare in a tight trading range

- 0.5R–1R trades show up more often

- Adjust your stop, scale in, and trade smaller

- Range days feel confusing only if you’re expecting trend behaviour.

- This is a small part of reading price action—if it interests you, go study it further.

- Our job is not to predict, it’s to adapt.

Leave a comment