- H1 Failed – L1 Failed

- Skunk Stop / Wide Stop

- 2 Bar Reversals

- Opening Range Measured Move

- Gap Open – 50% PB, Test MA

- STC BL High > MA / BTC BR Low < MA

- Conclusion

- On ES, 16th June, 2025 there was a number of great setups – I missed some, I got some, some worked, some didn’t.

- But you can take those and practice them for next time

H1 Failed – L1 Failed

- H1 and L1 work in trends and fail in trading ranges

- Observing this can help you to synchronise with what’s happening

https://www.tradingview.com/x/XQjeGXdq/

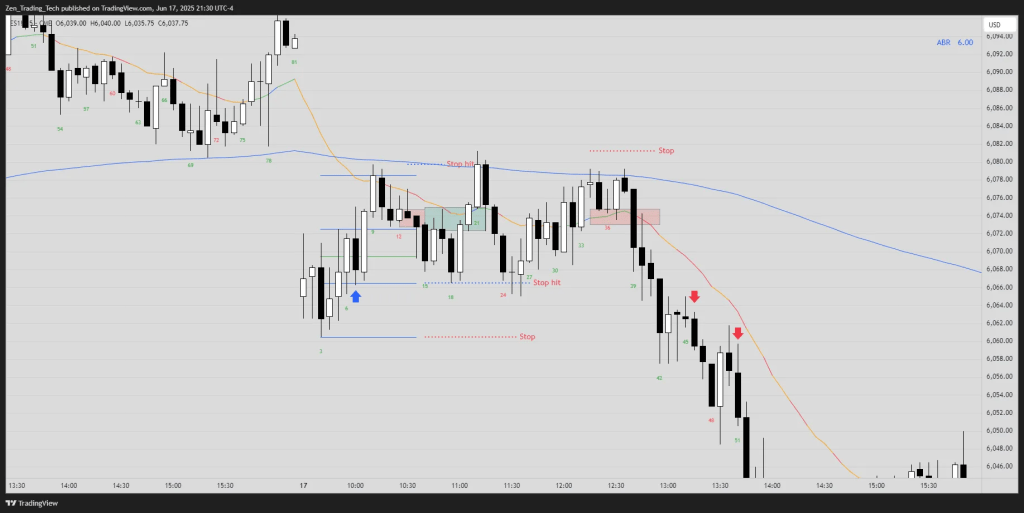

Skunk Stop / Wide Stop

- In trading ranges you ca have a close stop or a wide stop – but you can’t be in–between.

- If traders are betting the market will not breakout – they will ENTER at highs and lows – which make them TERRIBLE places for stops.

https://www.tradingview.com/x/AkxakO3k/

2 Bar Reversals

- Breakout pullbacks are a great trending trade

- But a 2-bar reversal is a sign of a trading range

- Avoiding taking repeated breakout trades at those prices later on will help improve performance.

https://www.tradingview.com/x/Faszyzzc/

Opening Range Measured Move

- Look at the average daily range

- When the market (including gap) has not moved that range yet, the chance of a swing in that direction increases.

https://www.tradingview.com/x/Vq1om4AR/

Gap Open – 50% PB, Test MA

- Big gap down but sideways, the market often drifts back to the MA

- You don’t want to use stops necessarily if you can enter on a pullback – smaller risk

https://www.tradingview.com/x/2p9lZY5s/

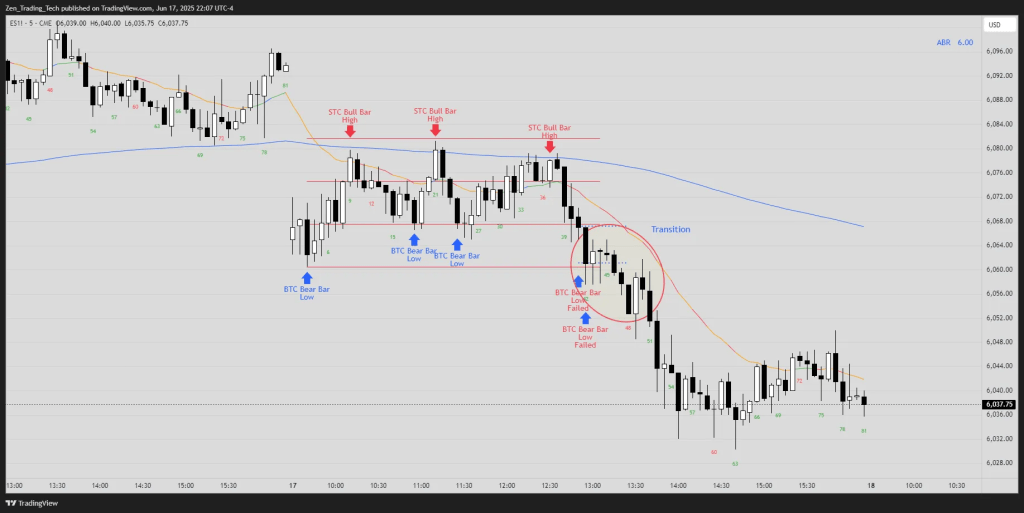

STC BL High > MA / BTC BR Low < MA

- A good bull bar above the MA should be a buy right? So what happens when it fails.

- Trading range opens / days have this behaviour where traders do the opposite.

- Watching for this behaviour can help you get in sync faster and avoid repeated losses at that same price.

https://www.tradingview.com/x/cl7tdPx4/

Conclusion

- Find drills you like and try to look for 30 – 50 examples.

- Write a page on it and find ways to trade it.

- Look for it in your next trading session and let me know how you go!

Tim

Leave a comment