Summary

In the past two posts we built a foundation around swing points in our price action trading.

What to do when they break?

In this next scroll we review possible trade setups and price action outcomes.

Lets cut right in!

Pre-Work

📜 See earlier scroll for Scroll I and II

- Summary

- Pre-Work

- Introduction

- Instructions

- Example 31st October 2025

- Example 4 November, 2025

- 🏯 Conclusion

Introduction

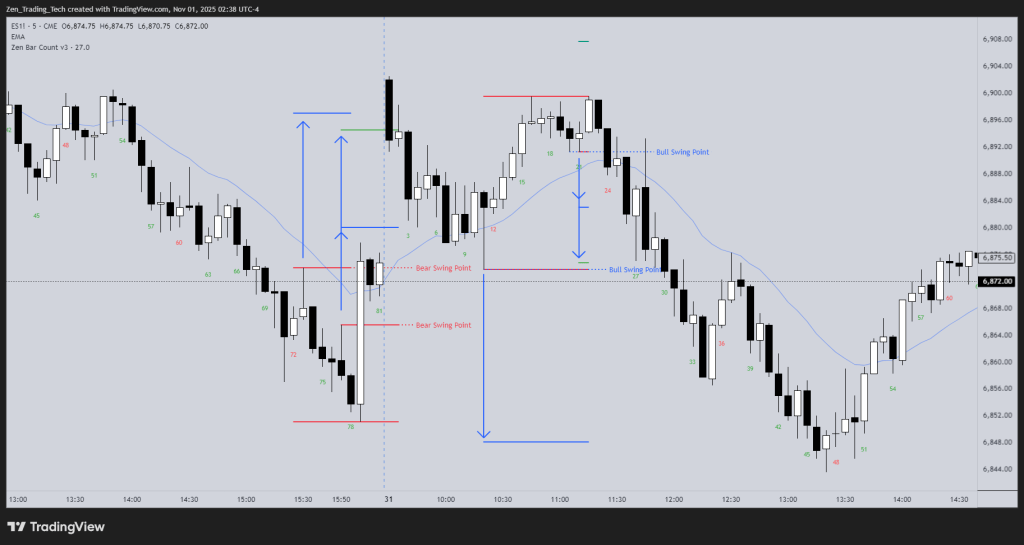

IMAGE LINK

- When a swing point breaks, the mini-trend is effectively over. But trends can resume.

- It is helpful to assume traders who trailed their stop are now OUT.

- Those trend traders either exit or start to manage out of their position – scale back into last entries or look to exit at a new high/low and not add on.

- They have all transitioned from channel trading expecting the next part of the market cycle: a trading range

- Breaking one swing point we say TRADING RANGE

- Breaking two swing points we can say the market has flipped – either into opposite trend or that side’s trending trading range.

- Traders in trading ranges can use measured moves and precision to make up for the ambiguity in the environment

- Here are some of the skills we need to practice when trading for swing point breaks

Instructions

- Follow the examples of the previous 2 videos for finding swing points and swing point breaks

- Project the last move that broke a measured move up/down.

- ie If the bull trend broke, project the last leg UP

- Use the whole leg for the projection for now, there is a bonus part later about using the last close / stop entry.

Example 31st October 2025

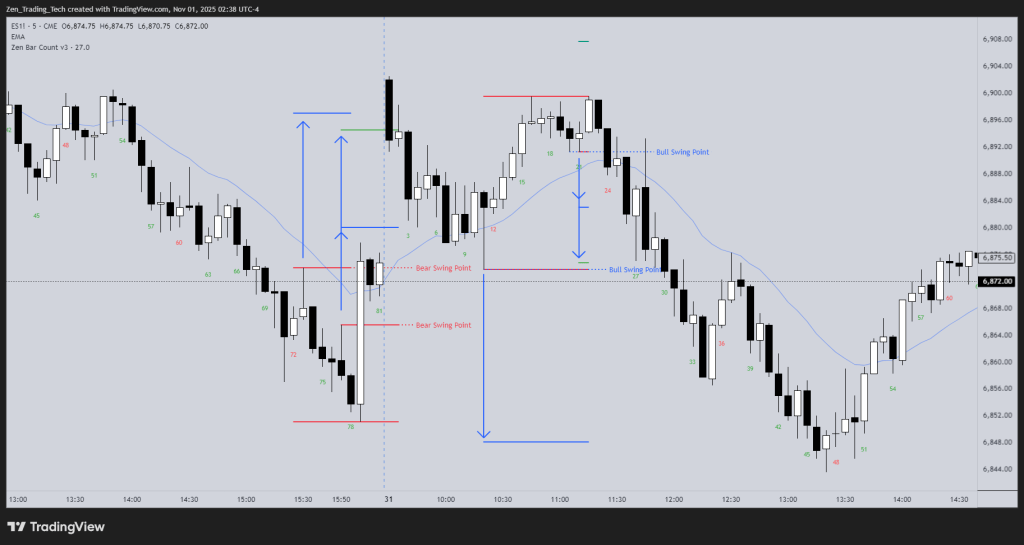

Bulls Break Bears Last 2 Legs – MM Up

Bears Break Bulls Last 2 Legs – MM Up

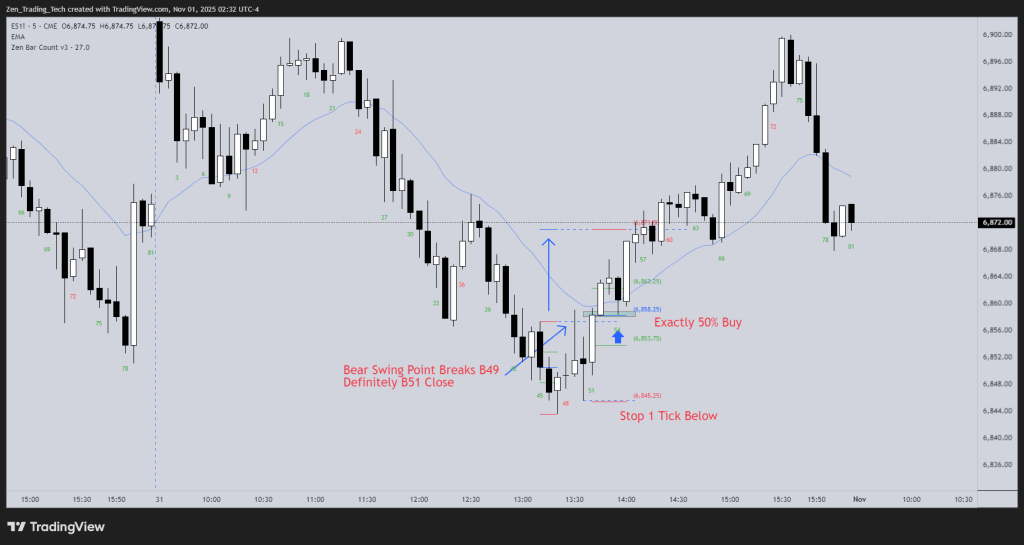

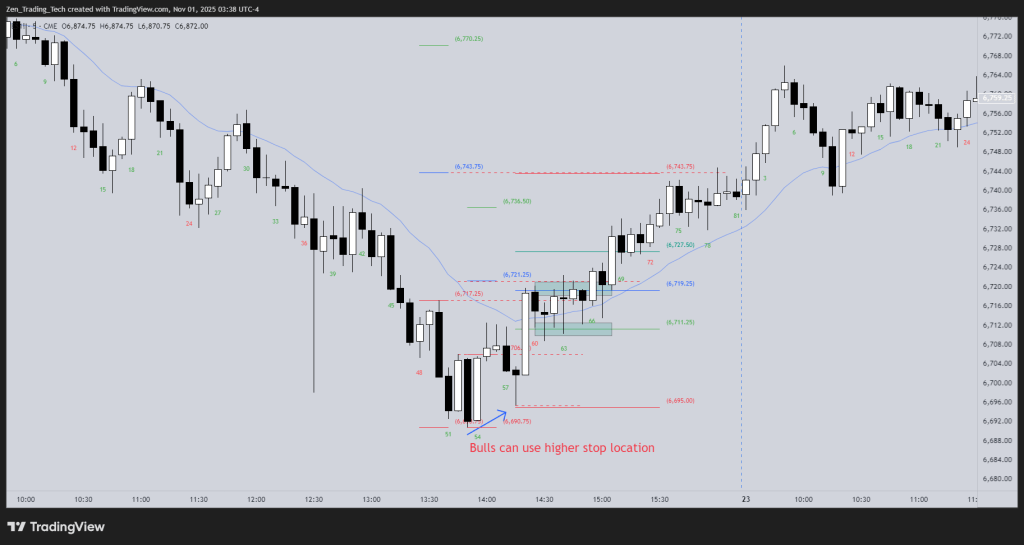

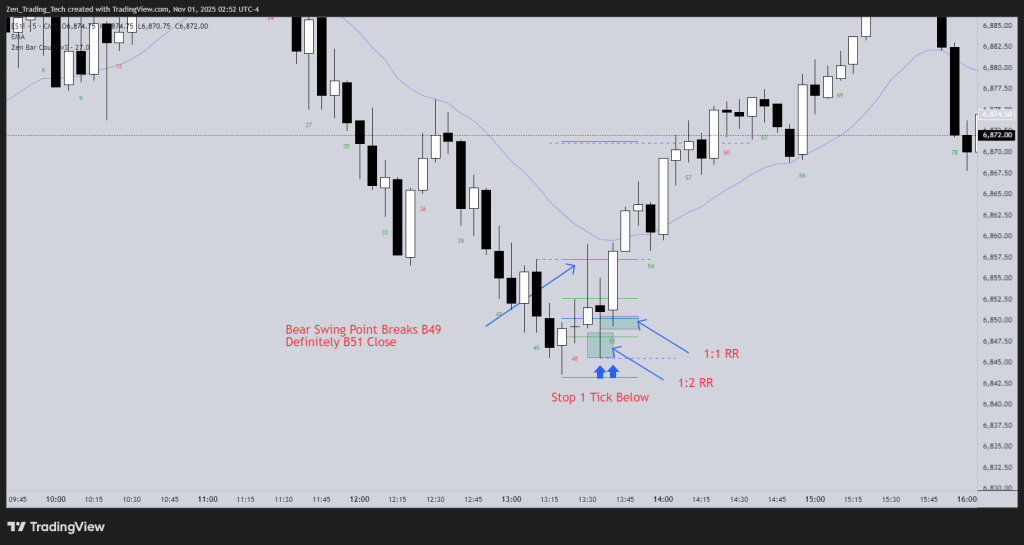

Swing Point Break: Breakout Pullback Entry

- Last bear leg breaks B45 High on B49

- Traders wait for first possible CLOSE above that swing point B51 and can Buy The Close (BTC)

- Other traders wait for consecutive bull bars B51-B52 and either Buy The Market (BTM) or buy a pullback

- Professional Breakout Pullback (BOPB) entry was BTC of B51 on B54! Snap!

- Go for the 2nd leg break measured move, bigger target, closer stop

Swing Point Break: Rebound Entry

- Last bear leg breaks B45 High on B49

- Rebound entry traders enter with a stop one tick below the B47 Low expecting a trading range and a rebound back to the breakout point

- Either during B50, lower probability so can expect higher risk: reward 1:2

- Or during B51 after the tails and so higher probability for risk: reward 1:1

Example 4 November, 2025

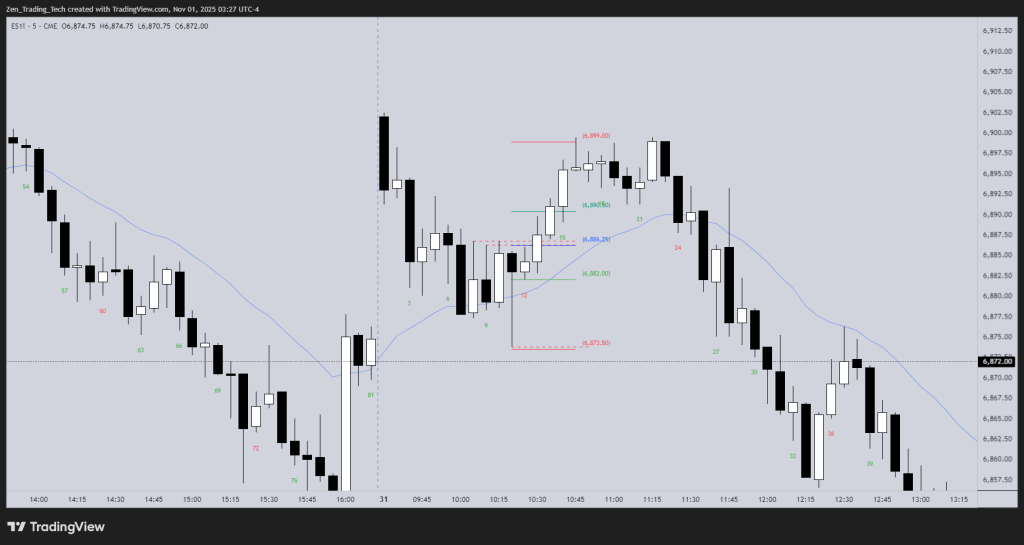

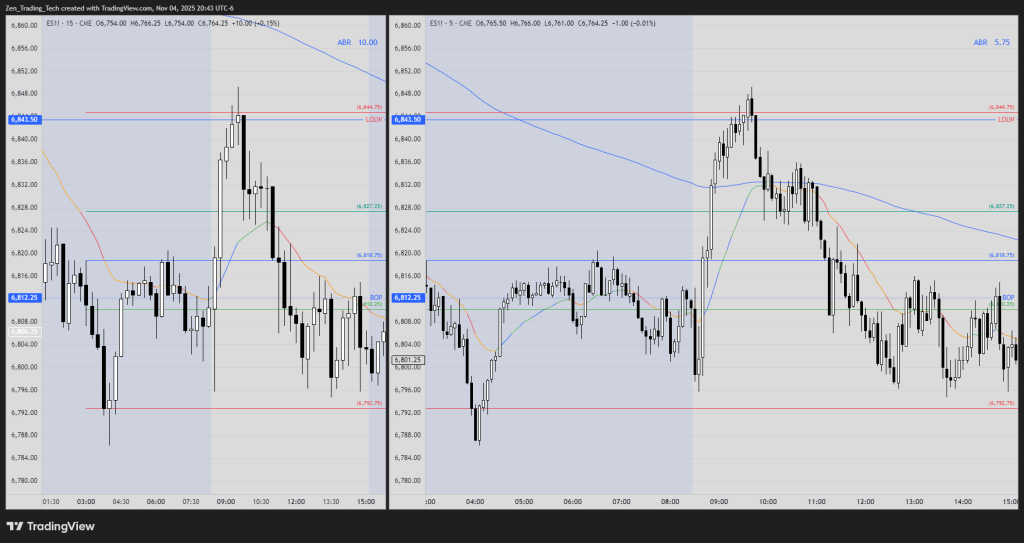

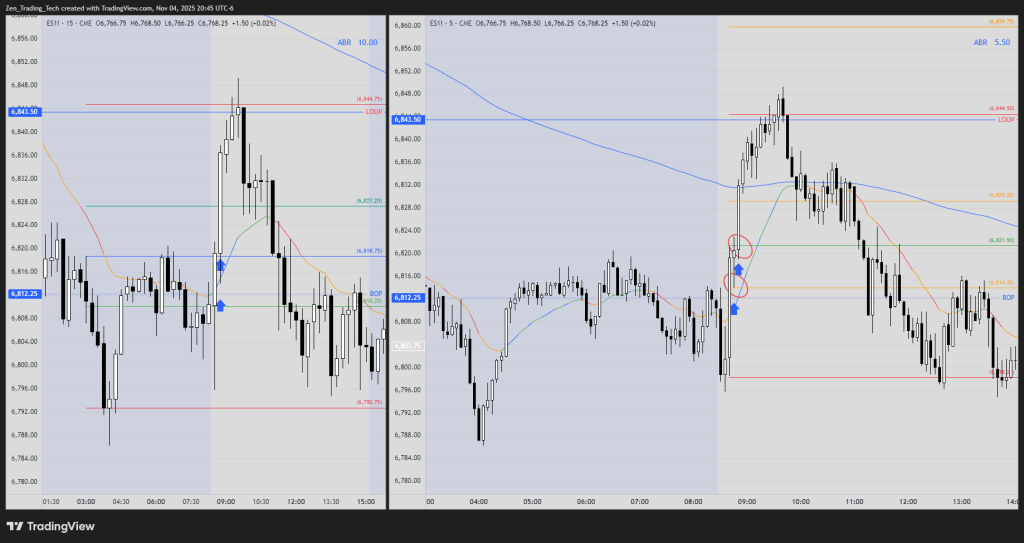

Bonus Idea: Using the Last Entry of a Failed Spike vs the Whole Spike

- Example from yesterday’s price action 4 Nov 2025

- Using the 15 min ETH chart we missed the whole spike measured move.

- Yet traders were still able to buy the close of the 15 min chart for a great trade up

- Using last BEAR CLOSE that failed I get a different measured move – more conservative.

- Why use this measurement? If I was scaling into a trading range THIS is how I would calculate where my scale in was.

- My first trade yesterday in US session was a swing to that price – see how I put a new fib on bar 3 looking for entries up. Does it always work as good as it did last night? No… but it was great to hit it!

🏯 Conclusion

In this drill we practiced looking for potential measured moves from swing point breaks.

These can provide new trades for those that are flat, but also recovery trades for traders that just got stopped out.

Let me know how you are using these in your trading plan.

Happy trading!

Tim

Leave a comment