Every trader hits a point where effort and progress stop matching.

The charts look the same. Study hours increase. Clarity doesn’t arrive. When that happens, the cause is usually internal, not technical.

For me, it came down to contradictions in how I thought about trading.

I hope the points below help other traders find some peace and build momentum in the direction that suits them. Whether in trading or something else.

1. Wanting Certainty While Holding Contradictory Beliefs

It’s common to hold opposing ideas without realising it. The examples show up fast:

- Following a trader’s guidance successfully, yet deciding the trader is fake.

- Wanting a simple, mechanical method while also wanting to understand everything at once.

- Trusting the opinions of non-traders more than people who actually trade.

- Try to become something while also not believing it is possible to become it

These contradictions keep the mind looping.

No strategy sits cleanly on top of that foundation.

The technical work becomes irrelevant because the internal logic doesn’t support consistent action.

2. Treating Trading as Personal When It’s Entirely Impersonal

Many traders frame the market as “me vs them.”

But trading is the opposite:

- Impersonal

- Two-sided

- Mathematical

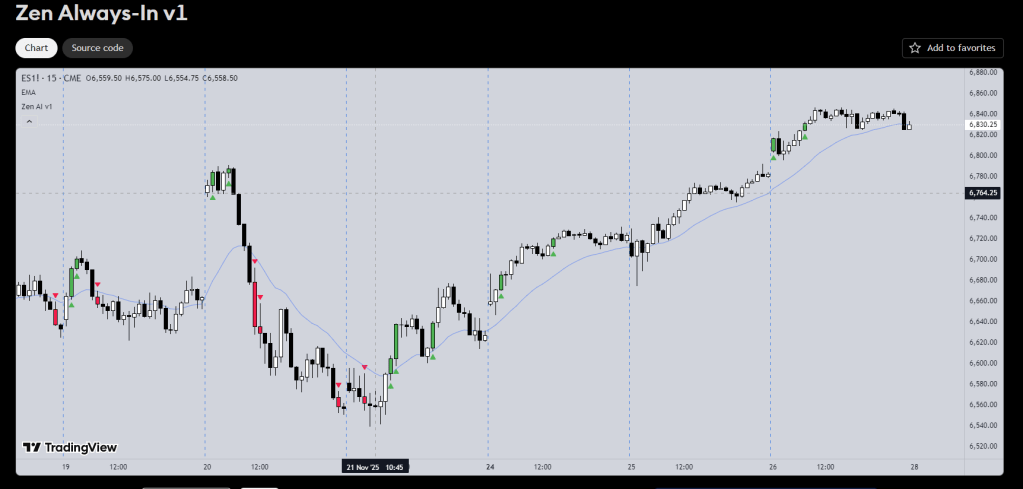

Professional traders simplify complexity. I know hundreds of setups, yet across my last thousand trades I’ve mostly use five.

Simplification means missing things. That’s normal. Missing things means relying on probability. And probability means living inside the uncomfortable 40–60% zone.

For most people, that discomfort never goes away. In Al Brooks book – Trading Ranges there is a chapter called: “The Mathematics of Trading” which explains this well.

How can I develop the skill to be highly-certain in area of indecision? I cannot!

So I can never be certain. So I must use Risk / Reward to make up for it.

One practical exercise helps: rewrite each belief from the opposite point of view. It exposes assumptions and reduces emotional load. It also mirrors how the market behaves — always two-sided, never personal, never certain.

3. Trying to Learn Trading in an Environment That Doesn’t Support It

A trader’s environment doesn’t need to be perfect, but it does need to be aligned.

If most of your conversations about trading involve:

- people who don’t trade,

- people who are negative about their own ability to learn,

- people who constantly show all their big wins and never their big losses, or

- people looking for quick wins rather than skill development,

the result is predictable: frustration, doubt, and slow progress.

When I started, I learned from traders. When I speak to friends who gamble on crypto, their questions aren’t about becoming traders. They want shortcuts. Easy money. That can be made on the toilet on their phone. That’s fine — it’s just a different activity.

Expectations matter too. Many traders think twelve months should be enough to “get it.” It took me eight years. It took others ten or more.

Who cares? There isn’t a quick path. Sometimes the most productive step is taking a break.

Every time I stepped away, I returned with more clarity. Including the possibility that trading might not be my path.

4. Asking Whether It’s Possible to Make a Living as a Trader

This question comes up often, and the answer is straightforward: yes, it is possible.

The evidence is visible every day. Institutions around the world employ hundreds of thousands of traders and move enormous volume. Their shareholders would never allow capital to be managed by unskilled people. Profitable institutions stay profitable because they allocate money to traders who can grow it.

The confusion usually comes from the online world. Many people play the role of traders for entertainment. That’s normal — every industry has performers. Most of us want to be entertained and not do the hard work.

But separating entertainment from actual trading is part of the skill. The productive question isn’t whether someone on the internet is a “real trader.” The productive question is whether the logic they use can help you improve your own approach.

Time spent trying to verify strangers online is time not spent developing your own system. The edge comes from building your method, not proving someone else’s.

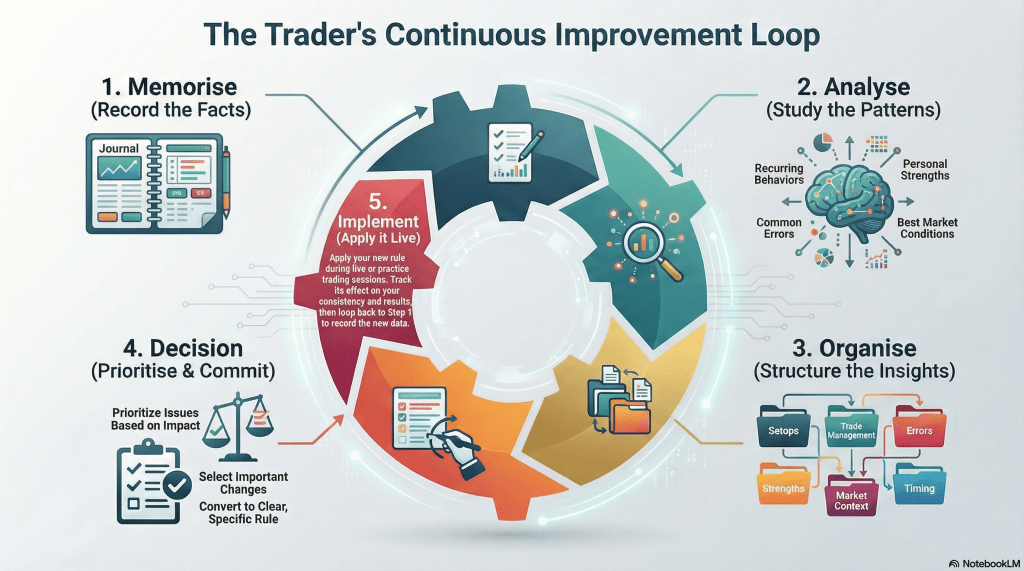

A Clearer Way Forward

All four contradictions have a common root: wanting certainty in an activity built on probabilities.

When those contradictions dissolve, the work becomes cleaner:

- You stop trying to reconcile impossible viewpoints INSIDE you

- You learn from the right sources.

- You simplify your method and accept the nature of the job.

- You get back to doing the work on yourself

One of my favourite quotes from Buddhism:

“You stop searching for everything outside, and instead discovering what’s inside.”

This is where skill and happiness grow from.

From there, trading becomes grounded again.

Leave a comment