- Introduction

- Why the 18 Bar Range?

- Data on the 18-Bar Range

- Link Indicator

- Trading a Measured Move of the 18-Bar Range?

- Targets for Trading a Breakout of the 18-Bar Range?

- Breakout Targets of 50% of the Range

- Conclusion

Introduction

- In this article, I propose ways to look at the open of the day and possible swing targets.

- I will use the 18-bar range show ways to research it.

- Then we will explore possible targets, probabilities and hit rates for a trading system.

- My hope is that this post inspires you to take ideas you hear from other traders. Then, turn those ideas into research. Eventually, transform them into trading strategies.

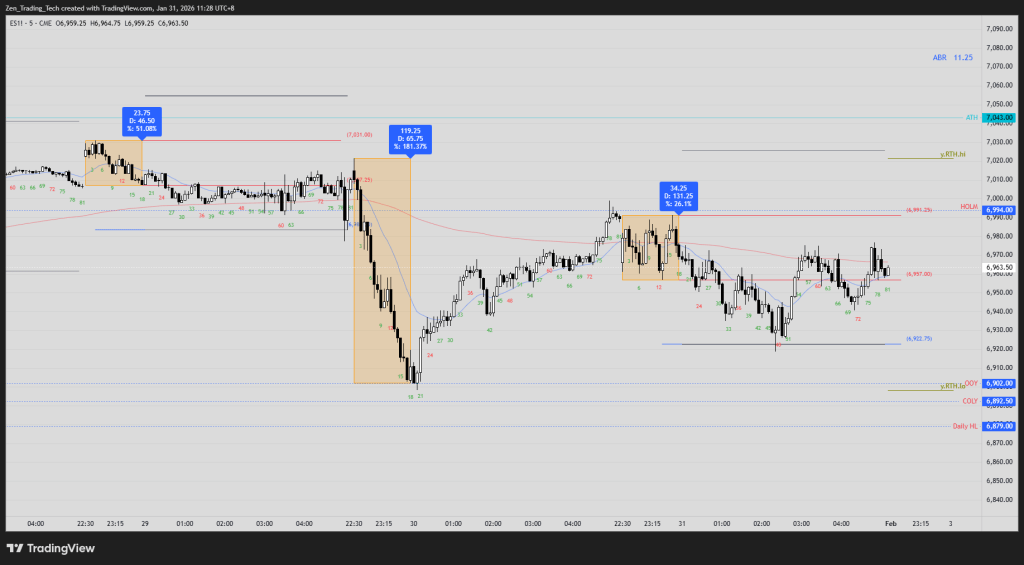

- If you were in the trading room last night, I mentioned these targets while I was short. This move ended up not far from the low of the day. Yay for me.

- It doesn’t mean these targets always work, but the data gives me confidence in my trading. I hope this helps you to discover yours!

Why the 18 Bar Range?

- Because 18 is a magical number? No.

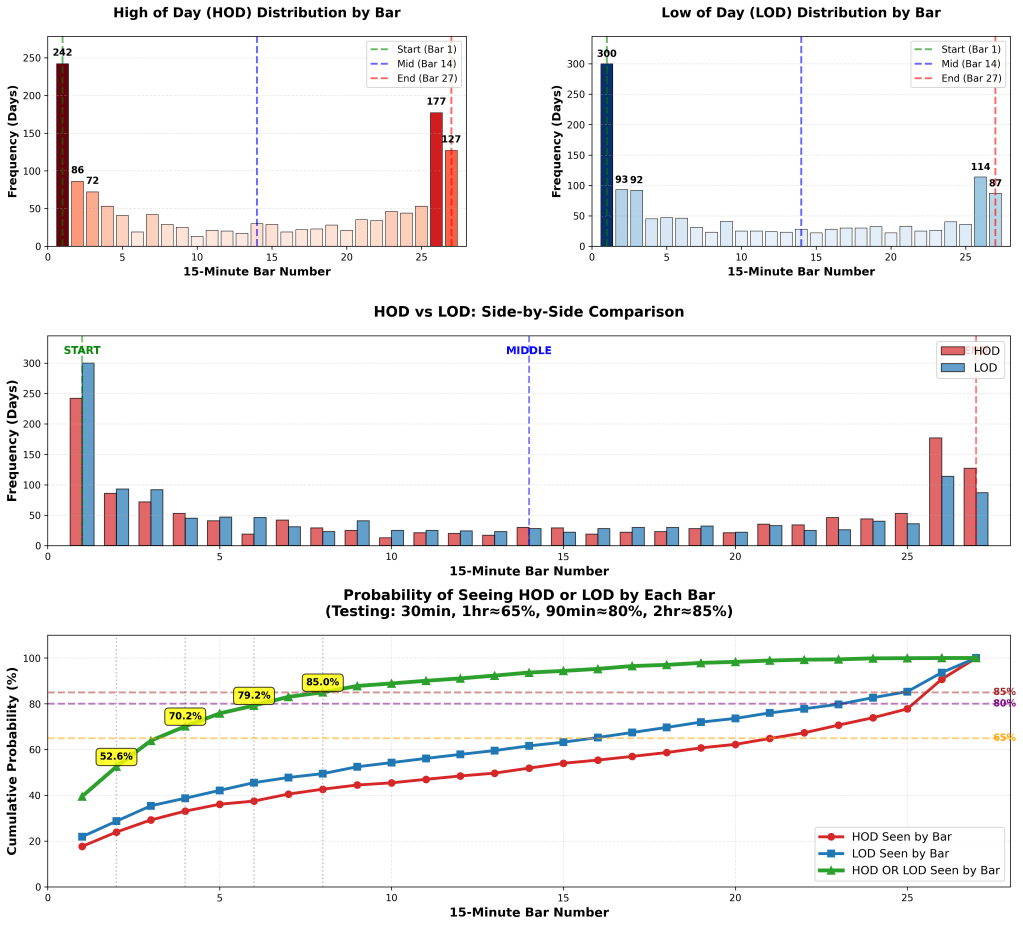

- In futures trading in the RTH session, the high or low of the day forms early.

- So it makes sense to use this to inform our trading later on.

- See the chart below (referencing the 15 min bars).

- By bar 6 on the 15 min chart (90 minutes into the session), 79% chance we’ve seen the high or low of the day. Thats an edge.

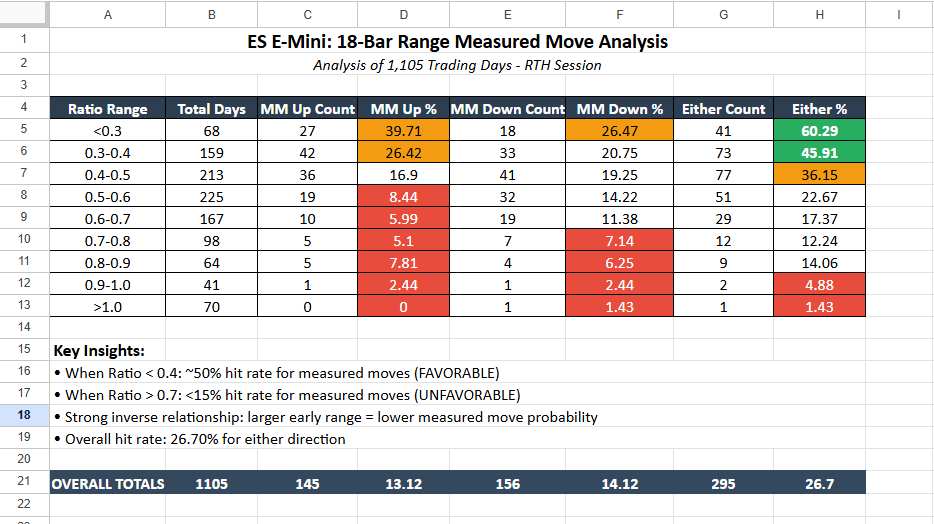

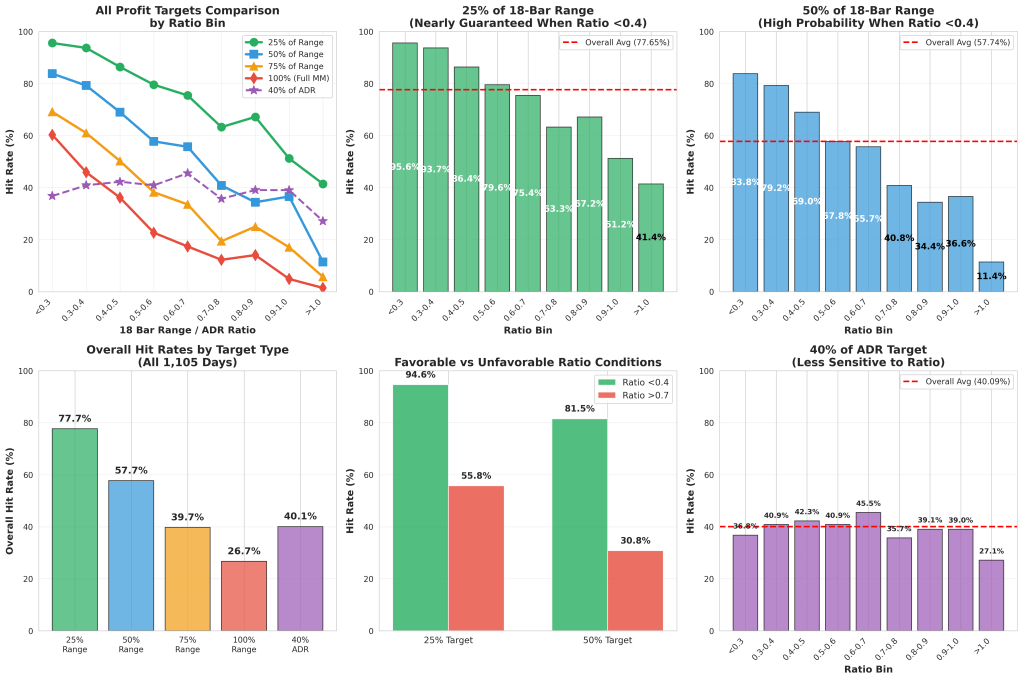

Data on the 18-Bar Range

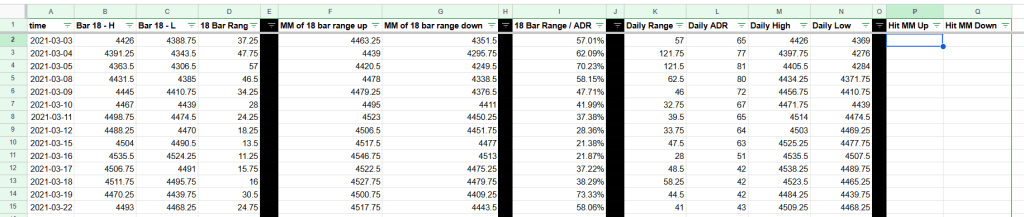

- We can pull data from TradingView into excel

- I’m comparing the range to a measure of volatility.

- I’m using the average range of the bars on the RTH Daily chart with an 8-bar lookback (ABR / ADR)

- We can also use an indicator (link below)

Link Indicator

Trading a Measured Move of the 18-Bar Range?

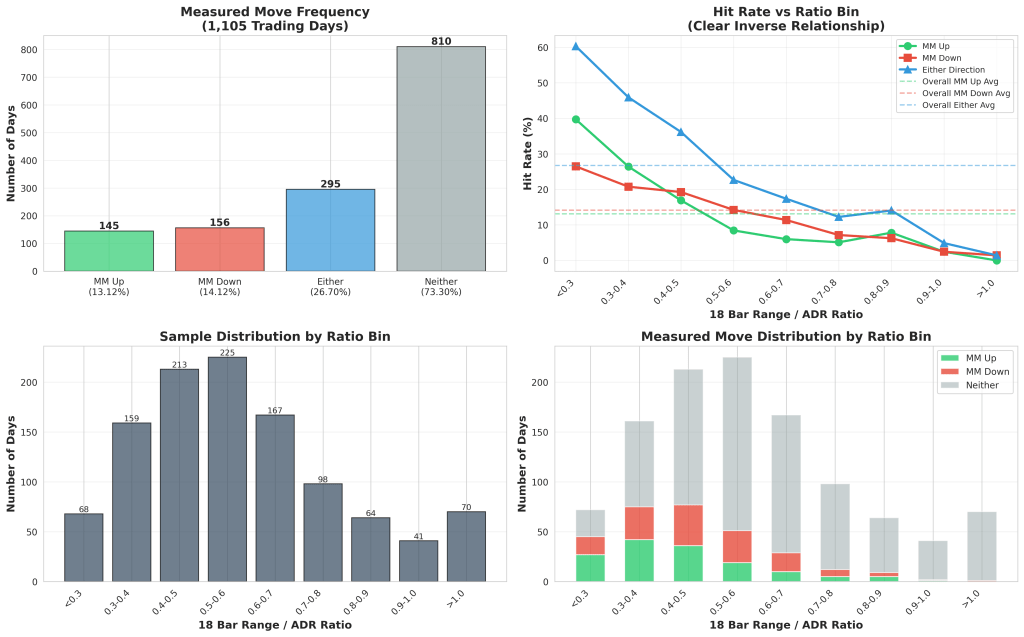

- Enter on a breakout? Well that data says that depends.

- Interestingly this was way lower than I expected.

- BUT – I suspected that a small 18-bar range was good for a breakout – and have been trading that for a long time so it confirmed that piece.

Data below

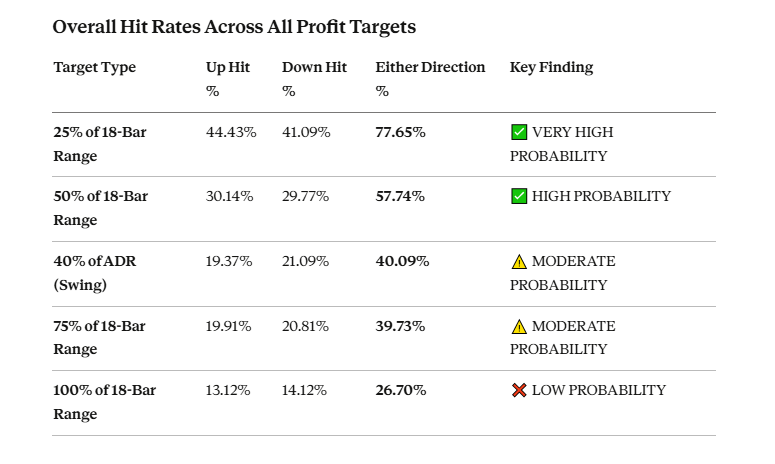

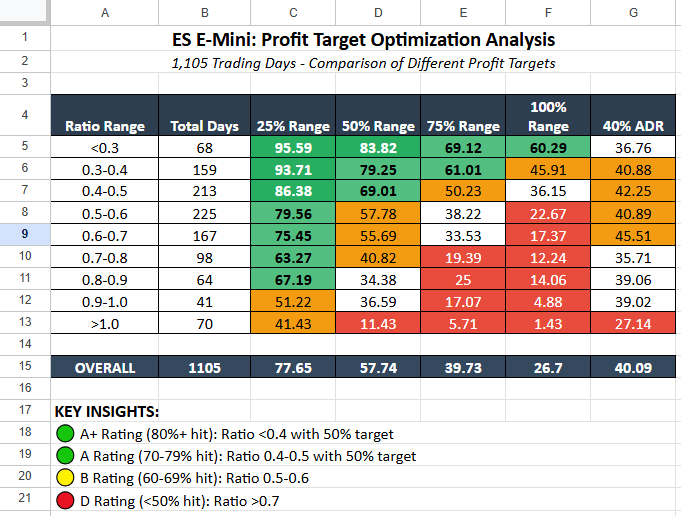

Targets for Trading a Breakout of the 18-Bar Range?

- Lets expand out research into more ideas

- It seems the simple go for a measured move of the range is a non starter.

Breakout Targets of 50% of the Range

- What does that mean for our chart above?

- I adjusted the measured move to look at the 50% of the range

- That means we need to work on our stop location to make it suitabe.

Conclusion

- In this article, I proposed some ways to look at the 18 bar range and researching it.

- We looked at measuring the 18 bar range. We also projected swings. We found that it’s actually low probability to get a measured move unless the range is small.

- We did this using the average range on the daily chart.

- I then examined profit targets based off that range. We generated a variety of higher probability options.

- These require dynamic stop management for the setups, and I’ll leave you to explore those on your own.

- Hopefully this post has inspired you. Take ideas you hear from other traders. Turn them into research. Then, turn them into trading strategies.

- If you were in the trading room last night, I mentioned these targets, and I was short for these targets. That was not far from the low of the day.

- It doesn’t mean they’ll always work, but it does give me confidence in my trading. Thanks for reading.

Leave a comment