-

Continue reading →: Indicator – Breakout Overlap

Continue reading →: Indicator – Breakout OverlapChart Link https://www.tradingview.com/script/azz12NIL-Zen-Breakout-Overlap-v1/ Summary How to use: Enjoy!

-

Continue reading →: Trading Skills #21: Spikes – H1/H2, L1/L2 and Failure

Continue reading →: Trading Skills #21: Spikes – H1/H2, L1/L2 and Failure– One of the key skills I need to day trade is the ability to distinguish between a trending environment and a trading range environment. – One way to do this is using Al’s inertia concept “In a trend, 80% of reversals fail. In a trading range, 80% of breakouts…

-

Continue reading →: Indicator – Spike Breaks

Continue reading →: Indicator – Spike BreaksIntro Please find a spike break indicator for research Indicator https://www.tradingview.com/script/EcZyPa3A-Zen-Spike-Break-v1/ Code For those that are interested the code is here. //@version=5 indicator(‘Zen_Spike_Break_v1’, overlay=true, max_lines_count = 500) bool plotspiketermination = input.string(“On”, “Show spike termination?”, options = [“On”, “Off”]) == “On” bool plot4H_or_4L = input.string(“On”, “Show 4 Highs or Lows?”, options…

-

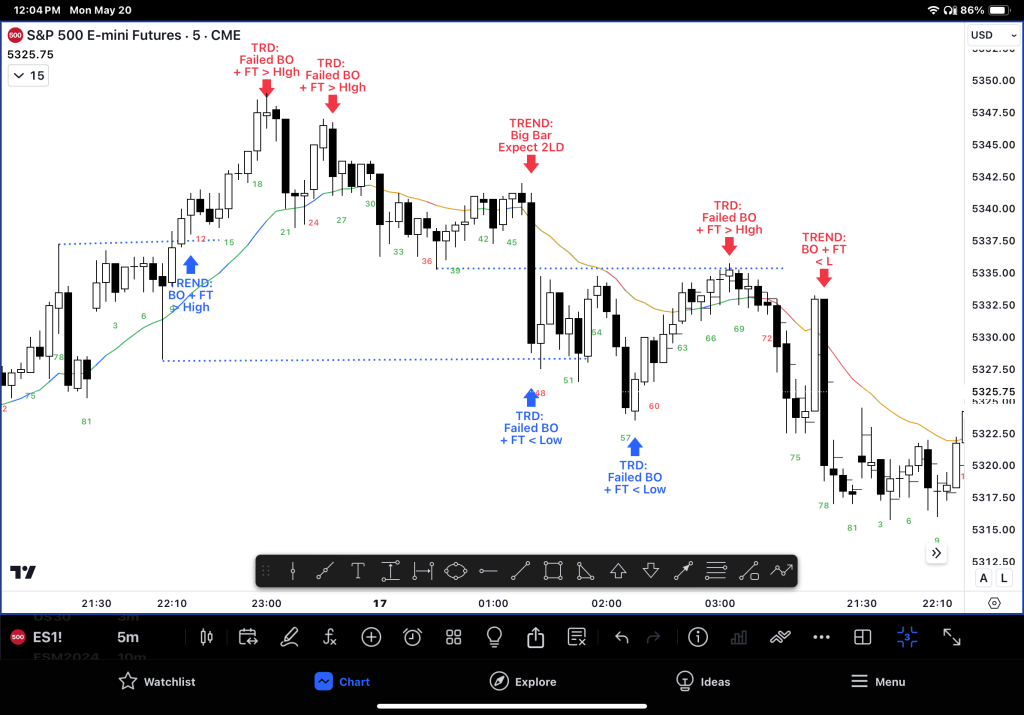

Continue reading →: Trader Skills #20: Trading Ranges: Failed BO + FT

Continue reading →: Trader Skills #20: Trading Ranges: Failed BO + FTExploring the impact of a failed BO + FT (Breakout and Followthrough) outside of key magnets (OHLC today / yesterday) and how we can use it to take TR (Trading Range) entries in a TRD (Trading Range Day) Summary from below research: – Failure to get BO+FT highly related sign…

-

Continue reading →: Trader Skills #19: Explorations in 2R

Continue reading →: Trader Skills #19: Explorations in 2R– The Risk of Ruin chart below clearly shows how difficult it is to blow an account getting 2:1 actual or initial risk. – If anything, most newer traders have high hit rates (scalping / closing before targets) but have largest loss > largest win and average loss > average…

-

Continue reading →: Trader Skills #16: Trading Ranges – RIP A once good trader lies here…

Continue reading →: Trader Skills #16: Trading Ranges – RIP A once good trader lies here…Ah you were my first love. Then we had a strong breakup. Now whenever we are together it is extreme! To be with you cost me a lot of money. But that investment was the best one I ever made. I have learned more from those days than any other.…

-

Continue reading →: Trader Skills #15: Breakout trading

Continue reading →: Trader Skills #15: Breakout tradingHere is an ongoing post where I am exploring different aspects of breakout trading. Firstly I look at a qualifying leg and how it impacts what comes next. Secondly I look at breakout gaps (low overlap with prior bar) as a micro-guide to the qualifying leg concept above. Lastly I…

-

Continue reading →: Trader Skills #14: Doubles (DT and DB)

Continue reading →: Trader Skills #14: Doubles (DT and DB)– This week was an interesting week for the classic double top and double bottom trades. – In fact in uncovered some flaws in my own price action reading that I believe will be valuable for me, so I’ll try and articulate them as best I can for others. –…

-

Continue reading →: Trader Skills #12: The Bear Channel

Continue reading →: Trader Skills #12: The Bear ChannelAh my old friend. You were there when I removed money from my account again and again. What makes you so persistent? Ways to trade a Bear Channel – Follow the breakout and catch a second leg – Wait for any 2nd reversal to fail – Reduce the timeframe to…

-

Continue reading →: Trader Skills #11: The Escape Hatch – 2nd Chance Exits

Continue reading →: Trader Skills #11: The Escape Hatch – 2nd Chance ExitsThe market is quite funny. The more observing I do, the more fair and balanced I see it. This is the total opposite of what happened for me as a beginner trader. I saw the other side making money, and me, well, giving it to them! But it seemed that…

-

Continue reading →: Trader Skills #10: Testing Everything

Continue reading →: Trader Skills #10: Testing EverythingI miss my Grandmother Leslie. She was a wonderful human being who tested, checked and rechecked everything to make sure it was impossible for her grandchildren to hurt themselves. Little rubber corners on tables, small gates to stop sleepwalking, testing locks and anything that was attached to anything else. Nowadays…

-

Continue reading →: Trading Skills #9: Experience

Continue reading →: Trading Skills #9: ExperienceQuote There is a quote I read the other day: “Good decisions come from experience, and experience comes from bad decisions.” Now in trading, bad decisions cost time and money.A And we all want to minimize it (not eliminate it.) But how to minimize bad decisions but maximize experience? How…

-

Continue reading →: Trader Skills #8: 1st Reversal Likely Minor

Continue reading →: Trader Skills #8: 1st Reversal Likely MinorIntro In a previous post I have covered the same principle from a different angle. My intention is that it will support the selection of higher probability (higher %) trade selection. See: Trader Skills #4: Two Attempts Concept – Market cycle -> Breakout -> Tight Channel. – Next market structure =…

-

Continue reading →: Trader Skills #7 : Channels

Continue reading →: Trader Skills #7 : ChannelsIntro Ah sweet channels. – They are the bane of a beginner trader I believe. – Yet now they are my favorite areas to trade. – For they look so obvious after the fact. – If you really connected every possible channel on the chart, you would be unable to…

-

Indicator: Session Time Bar Counting / Highlighting

Published by

on

Continue reading →: Indicator: Session Time Bar Counting / Highlighting

Continue reading →: Indicator: Session Time Bar Counting / HighlightingThis indicator helps highlight a RTH timeframe on a 24 hours instrument. Ie FTSE and DAX cash index but you want to only trade the higher volume times https://www.tradingview.com/script/GbFjgRwg-Session-Bar-Counting

-

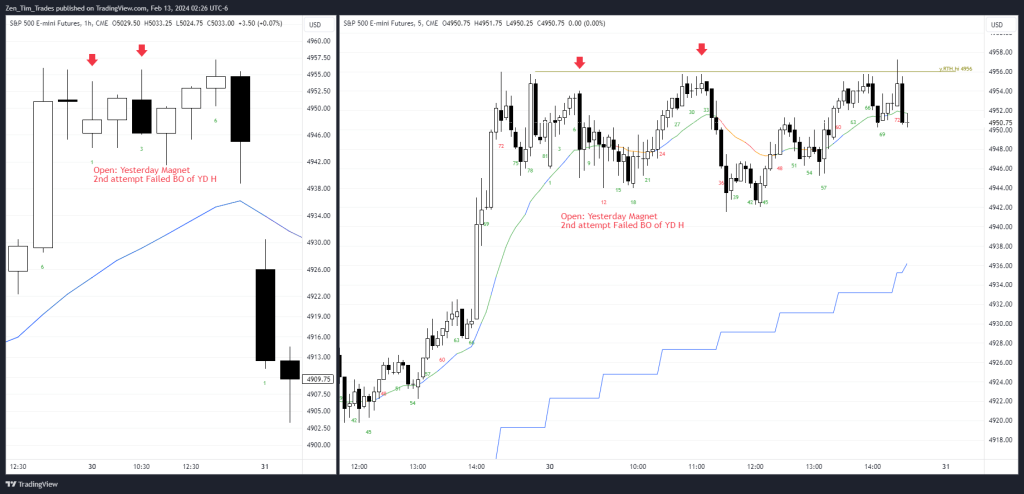

Continue reading →: Day Trader Skills #2: Open – Testing Yesterday’s OHLC Magnets

Continue reading →: Day Trader Skills #2: Open – Testing Yesterday’s OHLC MagnetsConcept A common pattern on the open is a reaction to the OHLC of yesterday’s price action. In particular, the High(H) and Low (L). This is not a surprise considering every bar on the chart is testing the H and L of the bars before it. The market will often…

-

Continue reading →: Day Trader Skills #1: The Opening Range

Continue reading →: Day Trader Skills #1: The Opening RangeIntro One skill that helps me trade is the ability to read the opening range. Definition The Opening Range is ambiguous. But for my purposes here I use the following: Principles that help me find trades: Example Charts Here are some charts showing the mark up I like to practice…

-

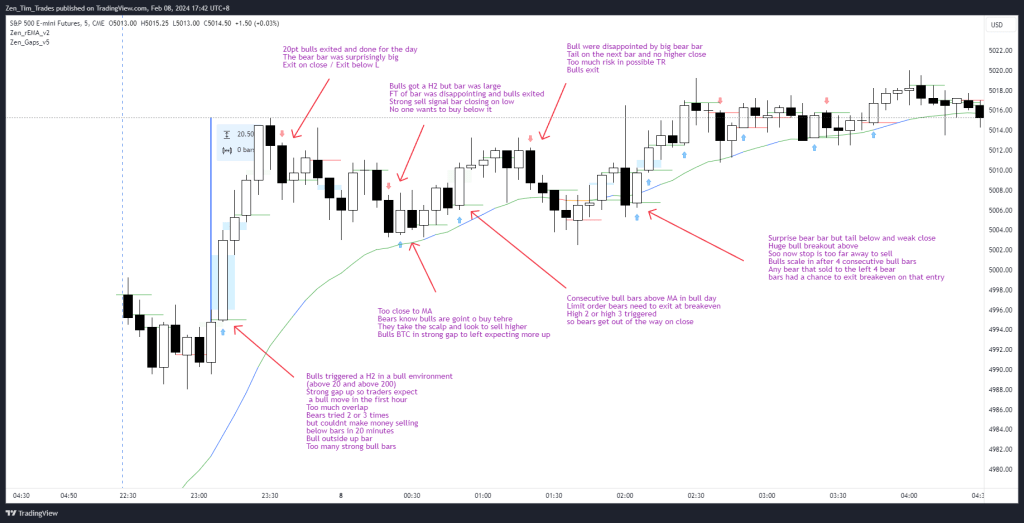

Continue reading →: Trader Skills #6: Micro Timeframe (LTF)

Continue reading →: Trader Skills #6: Micro Timeframe (LTF)Summary – Practice seeing the timeframe below your trading time to improve entries and exits. – A High 2 on the 5 min might be a wedge bottom breakout pullback on the 1 min chart. – Practice until you do not have to zoom in. Example:

-

Continue reading →: Trader Skills #4: Two Attempts

Continue reading →: Trader Skills #4: Two AttemptsIntro If at first you don’t succeed. Try again! In our PA training we learn to look for two attempts. We look for a 2nd reversal. Now sometimes this 2nd reversal attempt gets a test, we call a 3-push pattern / wedge but really I see it as a test…

-

Continue reading →: Trader Skills #5: The 80% Rule

Continue reading →: Trader Skills #5: The 80% RuleSummary – 80% of reversals fail in Trends – 80% of Breakouts fail in Trading Ranges – Having guidelines for determining what we are in on the trading timeframe helps increase probability and point count. The Second Entry – A common entry technique relates to the “2 attempts” principle. This…

-

Continue reading →: Trader Skills #3: Traps and Escape Hatch

Continue reading →: Trader Skills #3: Traps and Escape HatchIntro – What is a trap? – First, it doesn’t really exist. There is no external force trapping anyone. Paranoia will not make trading easier. – Because no one knows what the next bar is, it is always a surprise. – Good traders understand probability and have a range of…

-

Continue reading →: Indicator: Gaps

Continue reading →: Indicator: GapsHere is a gap indicator I put together. It shows gaps of many kinds: Link: https://www.tradingview.com/script/kydtsICb-Zen-Gaps/

-

Continue reading →: Indicator: Reversal and FT

Continue reading →: Indicator: Reversal and FTIndicator and link Link https://www.tradingview.com/script/smrTSvcf-Zen-Reversal-and-Followthrough-Rev-FT-Research Concepts One of the main principles of price action trading is that of 2 attempts. – This applies to breakouts – This also applies to reversal attempts. Here I will discuss reversal attempts. Putting it together Like any discipline, once we understand one concept on…

-

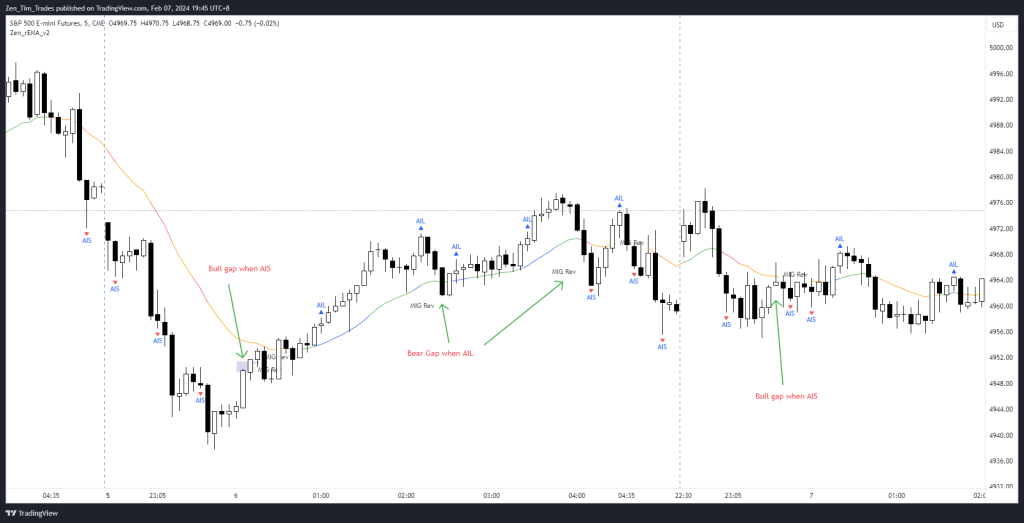

Continue reading →: Indicator: Microgap Reversals (MIG Reversal)

Continue reading →: Indicator: Microgap Reversals (MIG Reversal)MIG Reversal – Bull MIG Reversal – Bear See earlier post for the download for the indicator. Set indicator settings to:

-

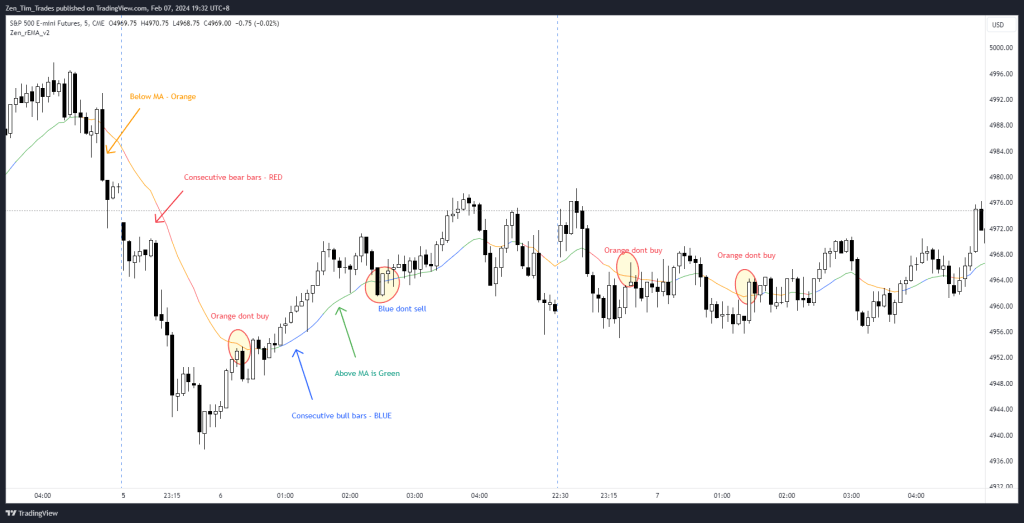

Continue reading →: Indicator: rEMA (Rainbow EMA)

Continue reading →: Indicator: rEMA (Rainbow EMA)Credit to Ali Moin-Afshari for his awesome material here. This indicator colours the moving average (MA) when there are consecutive bars. It helped me to stop making so many mistakes at the MA. Link is here. https://www.tradingview.com/script/pQlmaHqq-Zen-rEMA-v2

-

Continue reading →: What is Zen?

Continue reading →: What is Zen?Intro This question has fascinated me since I was child trying to read my Dad’s book about it. That’s 30+ years. My best answer right now is: Zen is a lifestyle meditation. Zen is also my nickname Given to me by my martial art brother Double Dragon, 15 years ago.…

Hi,

I’m Tim

Welcome to Zen Trading Tech.

I’m a Aussie day trader and I post trading tips, practice drills, and indicators that helped my trading get to a professional level.

Everything here is to help train the eyes and hands to trade better. If it helped me I’ll post it for others. Hope you enjoy!

Join the fun!

Stay updated with our latest tutorials and ideas by joining our newsletter.