Indicator and link

Link

https://www.tradingview.com/script/smrTSvcf-Zen-Reversal-and-Followthrough-Rev-FT-Research

Concepts

One of the main principles of price action trading is that of 2 attempts.

– This applies to breakouts

– This also applies to reversal attempts.

Here I will discuss reversal attempts.

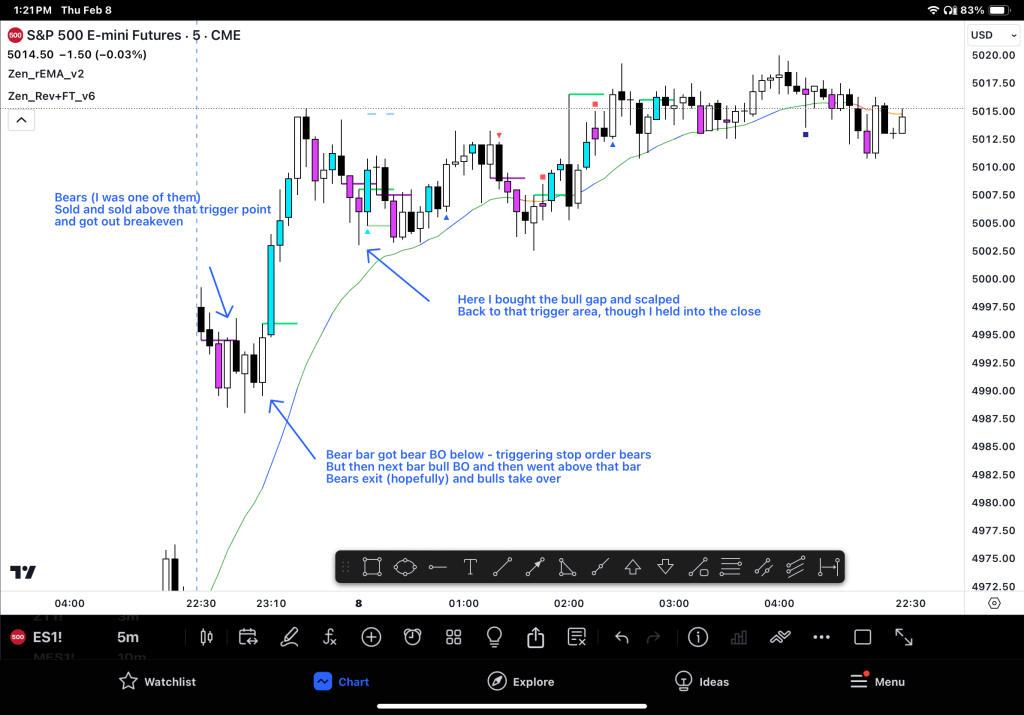

Putting it together

Like any discipline, once we understand one concept on its own, This connects to the principle of trade management for swing traders.

In general swing traders will let the market go against them one time, but not twice.

So being able to identify where that 2nd reversal attempt is can help me stay in sync with the market.

– When bulls are in control, the bears get 2 chances to reverse it.

– When bears are in control, the bulls get 2 chances to reverse it as well.

Once one side has had two chances and fails, the move keeps going and repeats.

Reversal Indicator

– I found in my unofficial research that the best kind of reversals are when a bull bar breakouts above a prior bull bar – or bear bar breakouts below a prior bear bar

– My best guess, from my own trading performance, is that if I am holding short and a bull bar appears, that is disappointing. If a STOP order bull can buy that reversal bar and make money above it… even if only a quick scalp, then my case for more down is weak,

– I will rarely hold a STOP or MKT order short position if there are two opposite breakouts against me, no matter how small.

– I will hold a LIMIT order short position because I’m betting on their breakouts failing. In this particular case, time is the factor. If the trade hasn’t worked in 3 bars it’s likely a dud and I’ll get back to flat!

This is a reversal indicator which has helped me develop this skill in my trading.

Just turn off settings you don’t want – ie Limit fade.

This code also checks if a breakout one way is followed by a pair of breakouts the other way. My coding skill is not great, so I did this manually through many hours of checking charts.

The advantage is I got so good at finding the examples to code, I don’t really need the indicator anymore! WIN!

– Just like people, sometimes a trade doesn’t do what we expect. But with clear guidelines you can trade safely.

– I like it when girls have beautiful long hair. I also like food at a cafe. But when that hair is sitting on my food in a cafe I don’t like it much. Reversals can be like this. Sometimes you get a good reversal in the wrong place!

Advanced trading ideas:

– Once you get the hang of the exits when you’re in – what about being flat and using it for targets? 🙂

– Here I demonstrated (unintentionally) both techniques. One to save position and get a small profit. Then after a bull move up I was looking to buy a pullback.

– I placed a limit order at the gap and my TARGET was the trigger.

– I was cheeky and had my entry a little lower than the best gap entry, but just above where the bears 1:1 was… because you gotta bet against them 🙂

Enjoy!

Leave a reply to mark Cancel reply