Summary

– Trends BO and FT

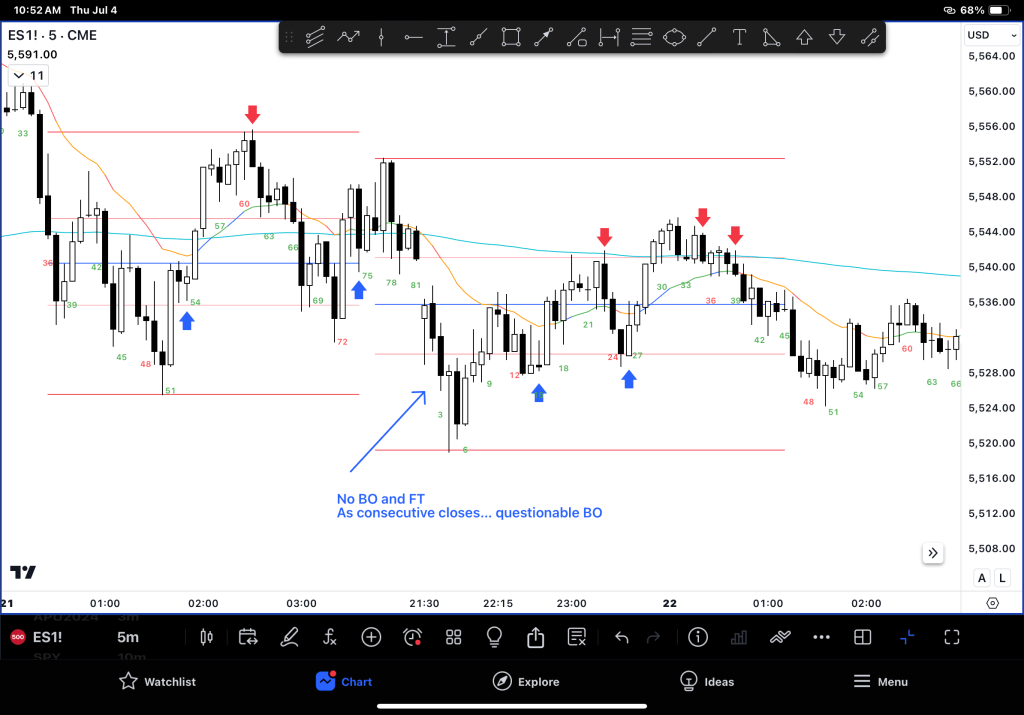

– Trading Ranges don’t – so they fail and reverse and FT

– So fading BO’s in the TR is the key skill to develop

Investigation

– In the chart below, you can see one side DOESN”T get the 2nd entry… that’s a sign for things to come.

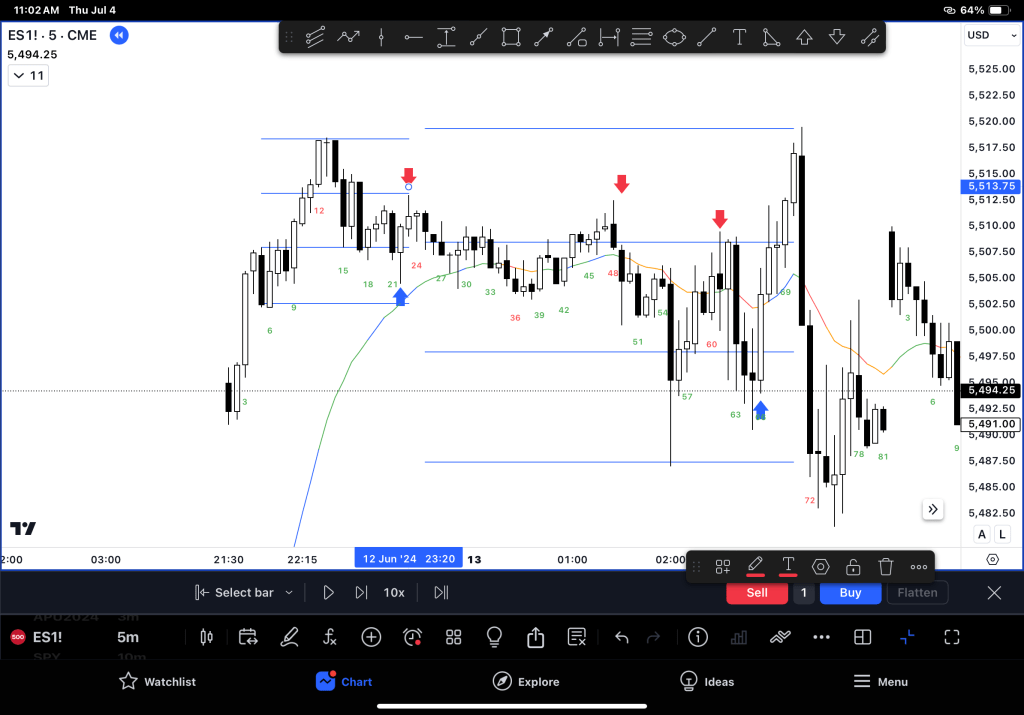

– So now we can see that the TR starts from the last leg – the top of the last SX and low of the last BX being magnets.

– On the chart above, once the reversal to B9 happens, let the L2 go and wait and see if it fails – if the L2 works then new LOD likely and there will be more Channel entries likely.

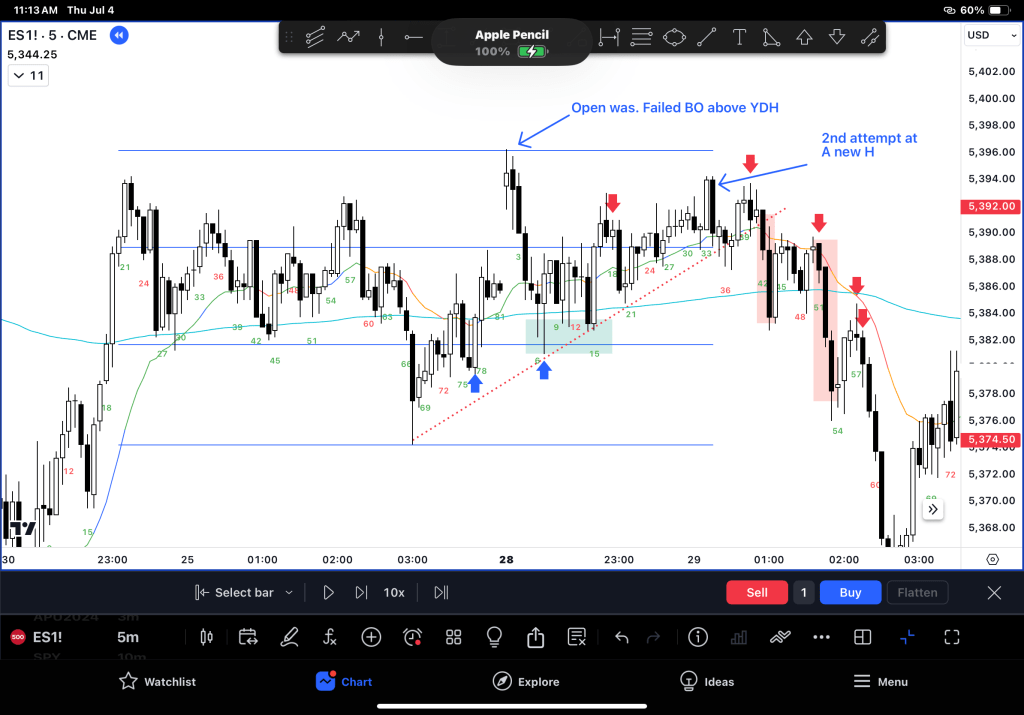

– So what about when the range breaks out finally?

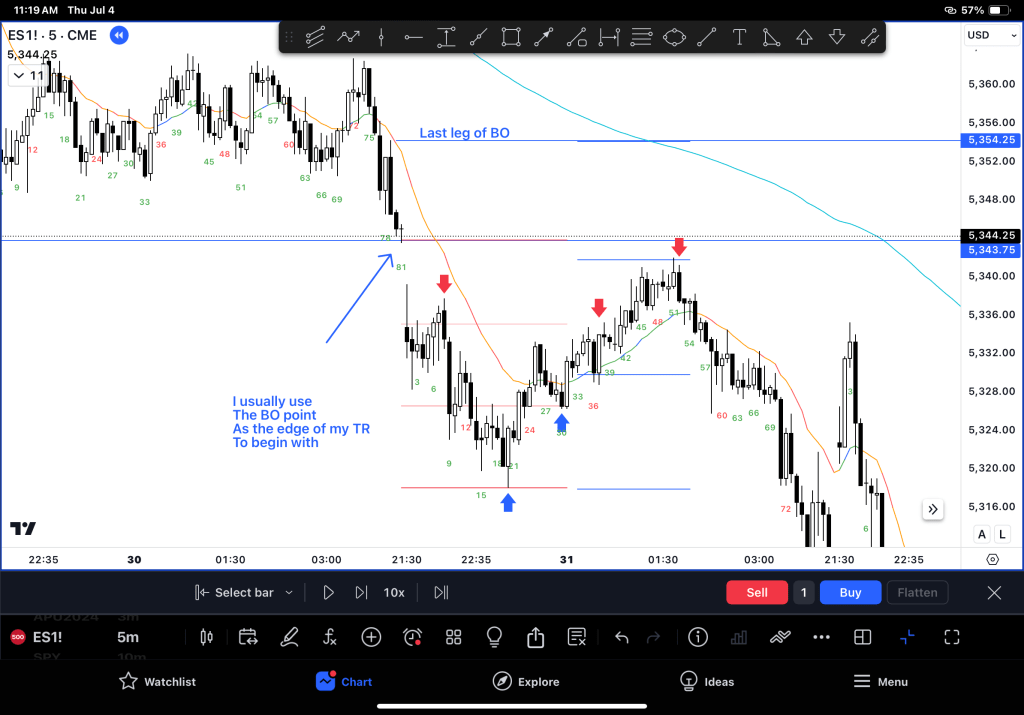

– So which range is the “range”?

– Well we can combine them like this chart

– In the transition from trend to trading range a flag fails. See below once way to analyze

– Once we went below B1 it became a larger trading range

– It’s a good technique because even if it fails, that area becomes a secondary trade like the below chart

– the market tries one way and then the other. But there are signs that the market is building momentum before it gets out of the TR.

– See below for a 2nd failed attempt at a BL BO led to multiple short trades

– So how to draw the right TR before you can see the whole pattern?

– I like to use the gap, the breakout point as my range.

– Here you can see sometimes it is the whole leg from back in the range

– TR are forgiving if you trade small and scale in

Conclusion

– Trading range trading is heavily dependent on seeing the range first and then taking a second reversal.

– But as the range shifts then it becomes less clear, and traders are more likely to EXIT on strong bars not stay in.

Enjoy!

Leave a comment