- Intro

- Video

- Market Behaviours

- Market Cycle

- Are legs the same size?

- Ways of Counting Legs

- Method: Spike Breaks

- Method: Volatility / Implied Pauses

- Method: Combination

- Restarting the count

- Method: Small Pullback Trends

- Practice

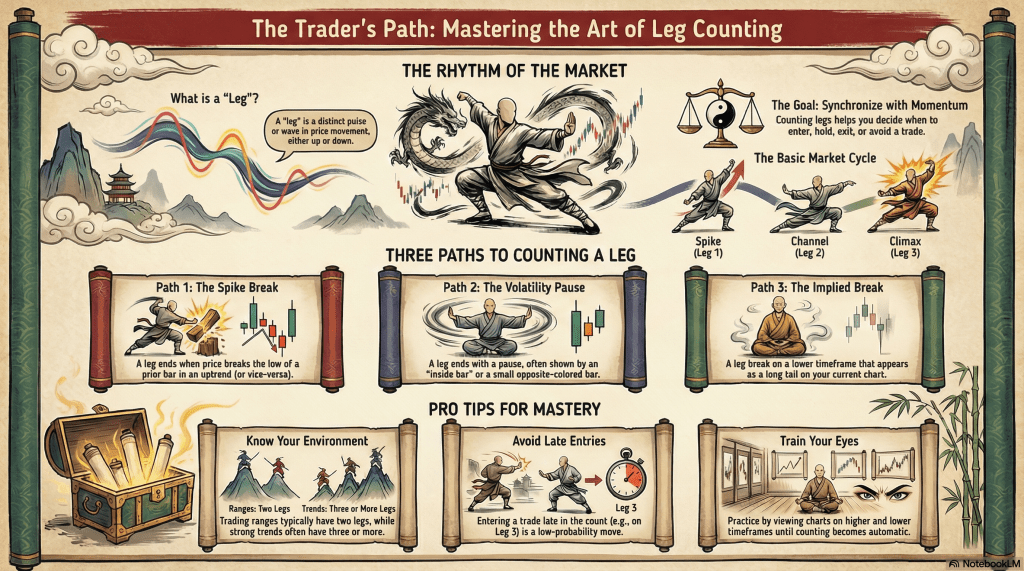

Intro

In price action trading we look at relationships.

As price moves in pulses / waves we look at their relationships to each other and what came before it. In the hope to profit from what comes after it.

Counting these helps improves our price action reading skill. This can help take higher % trades.

There are a few ways to count legs.

Note – I made an indicator for Tradingview here that helps you count spike breaks. It is not perfect but it will help you learn the concept until your eyes see it automatically. The code is there as well to see.

The function of this is to get into, stay into, stay out of, get out of a trade.

Not to win the counting award.

Video

Market Behaviours

- Price, like energy, moves in waves.

- I’m not in the psychic business of prediction.

- I’m in the business of profiting or loss-limiting from its momentum (or lack thereof!)

- Strong moves often have a second piece to them.

- Remember Al’s rule – 80% of reversals in trends fail. 80% of breakouts in trading ranges fail.

Market Cycle

- Market cycle is:

- Spike (leg 1),

- Pullback (start of the channel),

- Leg 2,

- Two-legged pullback (can be final flag),

- Leg 3,

- Sometimes more legs / pullbacks.

- Breakout mode.

Are legs the same size?

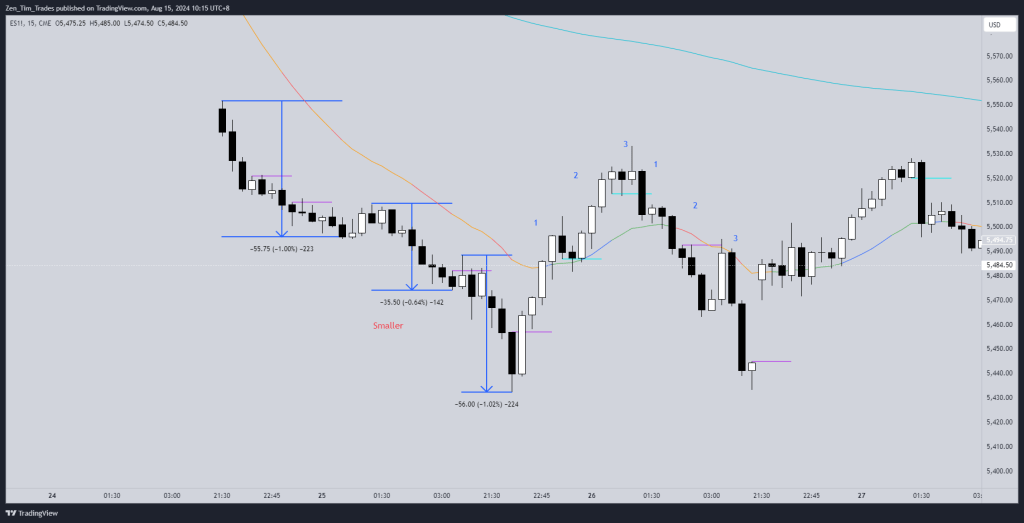

- It is more common to get 2 or 3 of the legs equal size.

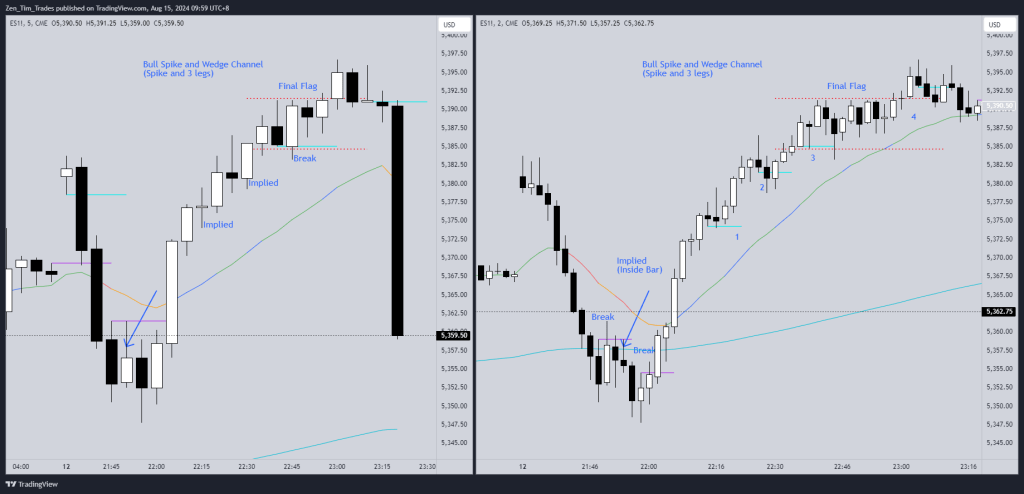

- Spike and wedge channel will have spike and then 3 more legs. practice identifying both.

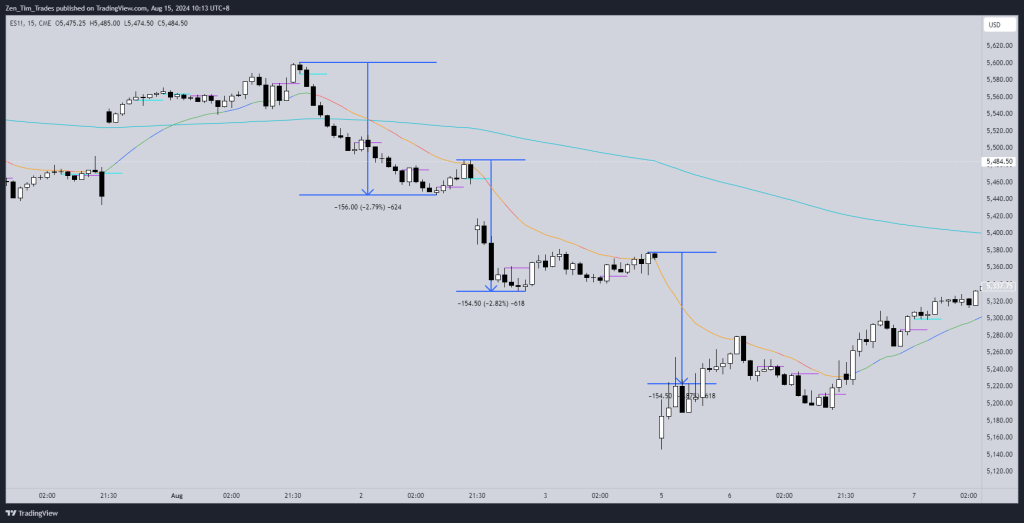

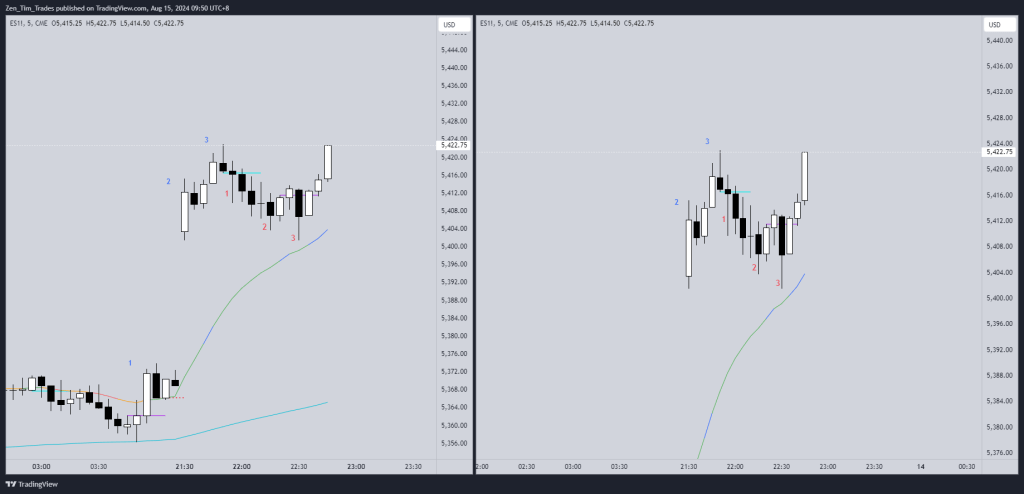

- See below how Leg 2 often gets cut in half to two parts:

- Here all 3 were same size and overshoot climax to end – which formed a tight trading range on the open.

- Basically look at one other timeframe to ensure you’re not micromanaging a good trade.

Ways of Counting Legs

There are 3 ways to count legs:

- Spike breaks

- Volatility pauses (one or more bars) / Implied (same bar)

- Combination

- For my indicator I don’t count a bar that is part of the opposite direction.

- For example in counting legs UP, I would not include the bar that formed the lowest low of the prior bear leg

- What if it breaks at the same price? I count as one.

- These are important to see, but the function is the same, how to get into or our of a trade.

Method: Spike Breaks

- Simple to see.

- Going up, we go below the low of a prior bar – end of a leg!

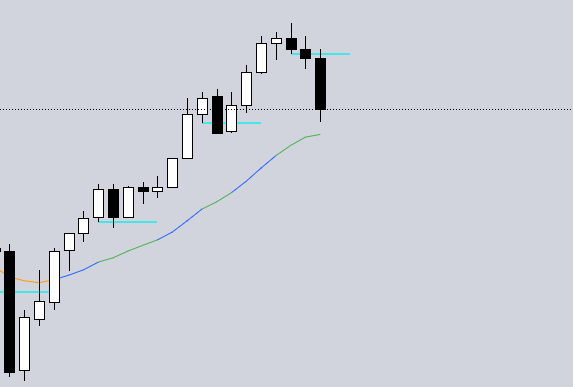

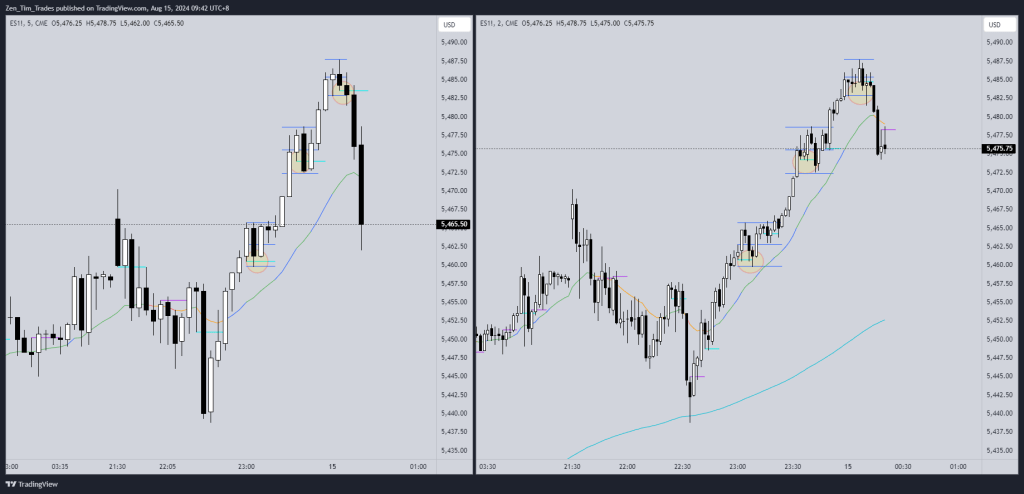

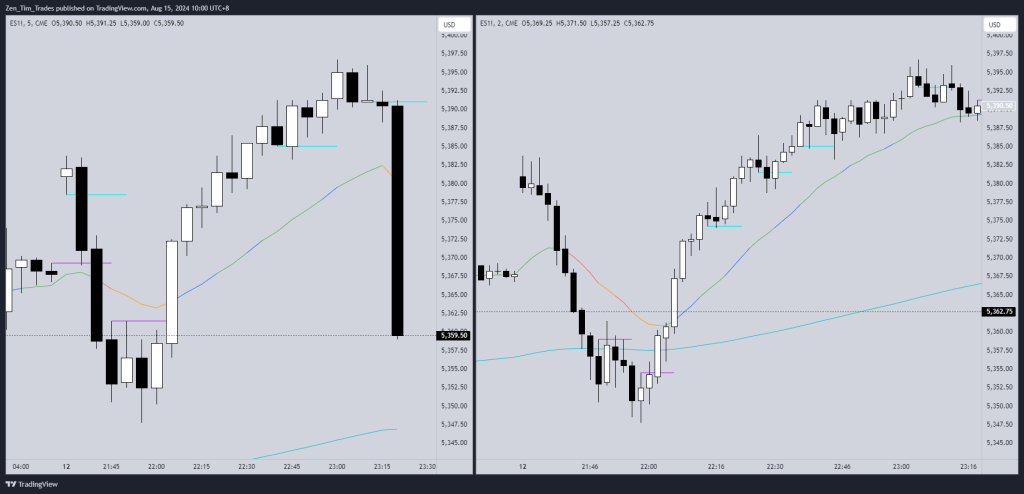

- To practice you can ZOOM into a lower timeframe

- Look at the 2mn version of the above side by side with the 5mn

- OK Tim but you didn’t know Leg 3 ended so suddenly until it did.

- Sure, but that is why Leg 3 is a time many traders stay flat or look for reasons to take profits.

- And we don’t trade a reversal until there has been a clear trendline break.

- You can also go up a timeframe to get a better feel

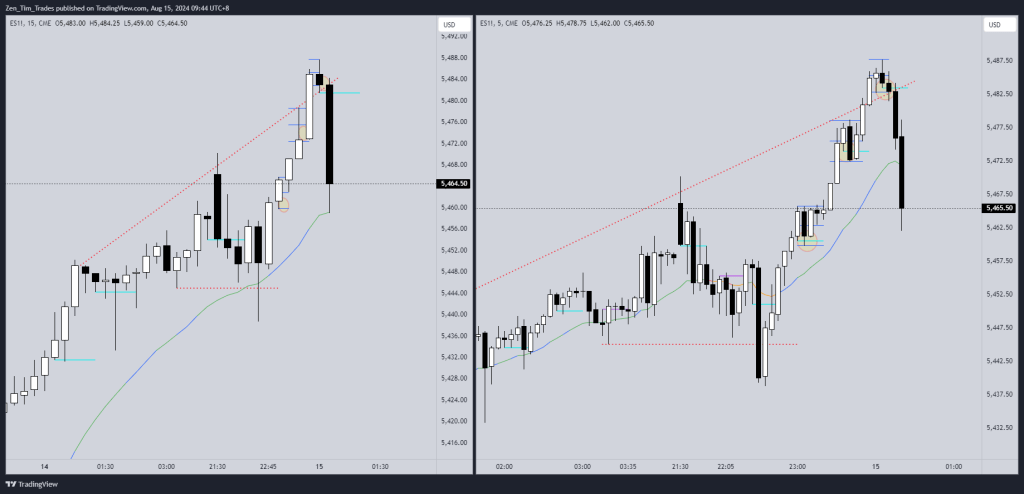

- Here is the 15mn and 5mn of the same structure:

- So a 15mn trader was looking at a bull breakout of a bull channel (low % trade.)

- They rode it until a bear bar appeared on the 15mn and bailed. And on the 5min so should you!

Method: Volatility / Implied Pauses

This method uses the above principle to look at the legs and see where the volatility expanded and contracted.

- Leg count continues from prior day!

- The pauses were end of the bull legs.

- Then the bear leg down had overlapping bars so implied is a better way to count.

- See how when price is overlapping is becomes more difficult.

- An Inside bar is usually the end of a leg – but it needs context.

- Most traders use them as signs to take profits, or targets, but are more advanced as entry points.

- Consecutive inside bars are counted as one.

Method: Combination

This takes practice – set a timer and do 20min of it a day until it becomes clear.

Clear means you can SEE the lower time frame count on the higher time frame.

Intermediate level would be seeing the 5mn chart and knowing whether the 15mn chart had pullbacks and what the 15m leg count is!

At this point you will feel much more relaxed when trading.

Now lets test you.

I have the lower time frame to help (cheating 🙂

Unmarked

Marked

Restarting the count

- Sometimes the leg itself is so strong it becomes a leg on a higher time frame – and so needs more legs!

- The 3 legs up were strong enough to get 2 more legs of its own (15mn)

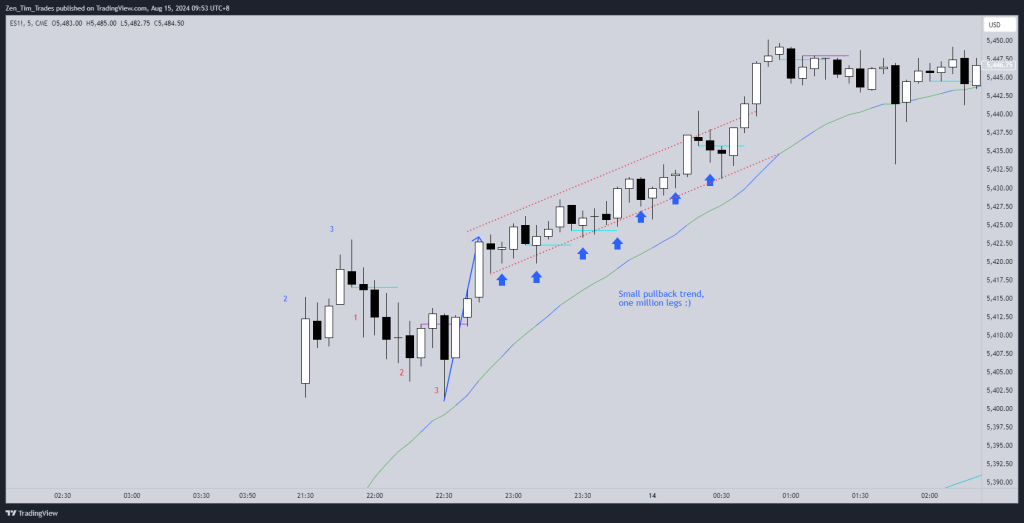

Method: Small Pullback Trends

- What is there are many legs like in a small pullback trend? Trade the spike and channel and ignore the count.

- What? Ignore it? Yes.

- The function is to read the PA, which is always in long, so the only high % trade is long or stay flat. It is a gap up, double bottom, bull spike, a breakout – don’t sell.

Practice

Now you have seen the clear and the grey examples, I would encourage you to find 20 – 50 -100 more charts and see if you can find other ways that help to count it.

I hope that helped encourage further study and practice.

Please let me know if that was useful!

Cheers

Happy trading.

Tim

Leave a reply to Lucky Cancel reply