Intro

- Trendline breaks are often are followed by a test of the H or L and then a reversal.

- Many traders will lose money on that failed breakout

- So this drill is to help reduce those losses

Video

- I made a video on this here:

- Intro

- Video

- Drill 1: Trendlines – Break- Test or not?

- Drill 2: Trendline Break, New High, Reversal

- Drill 3: Trendline Break on the Open

- Drill 4: Moving Average Break

- Conclusion

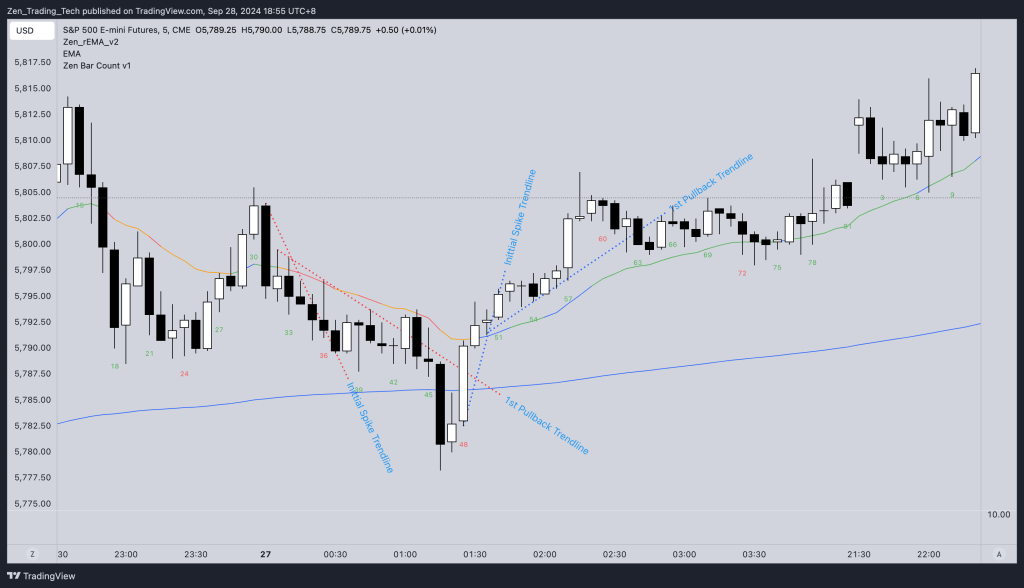

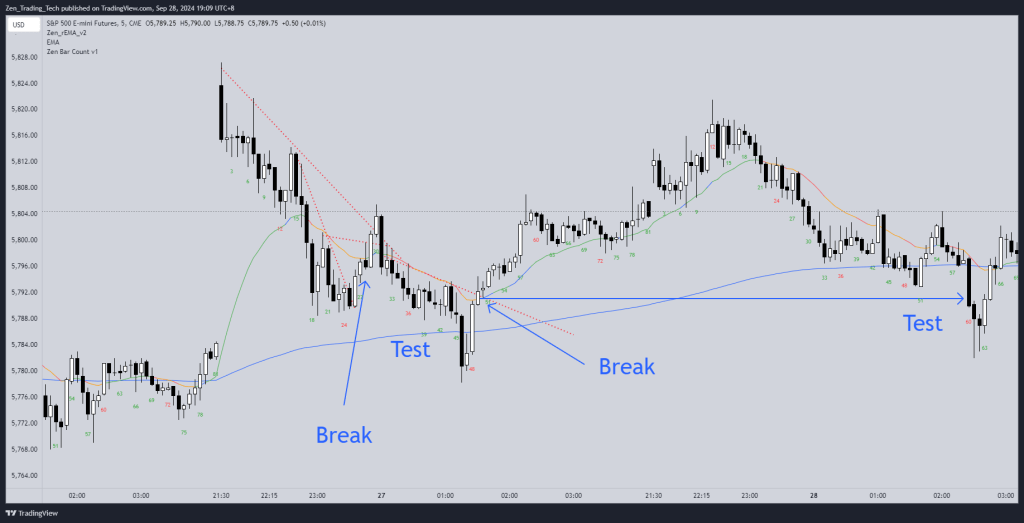

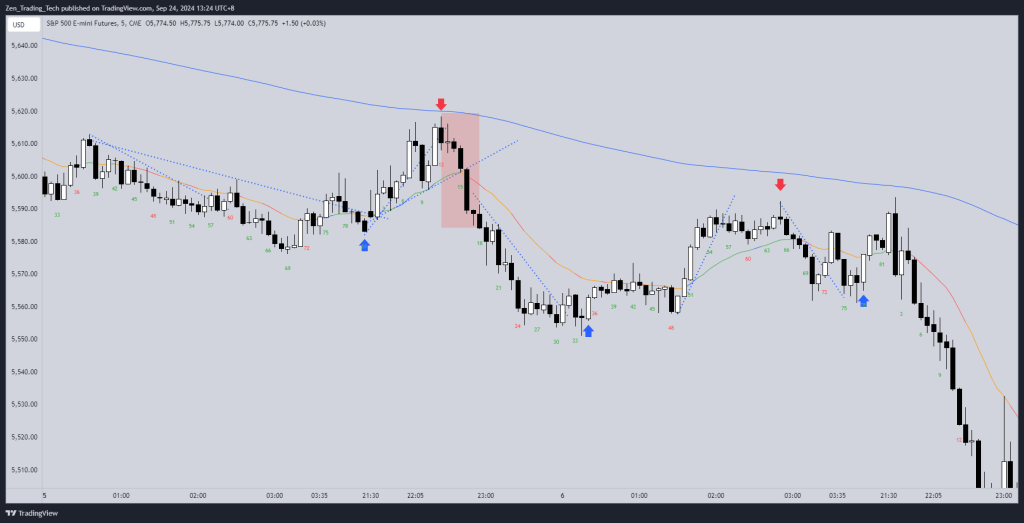

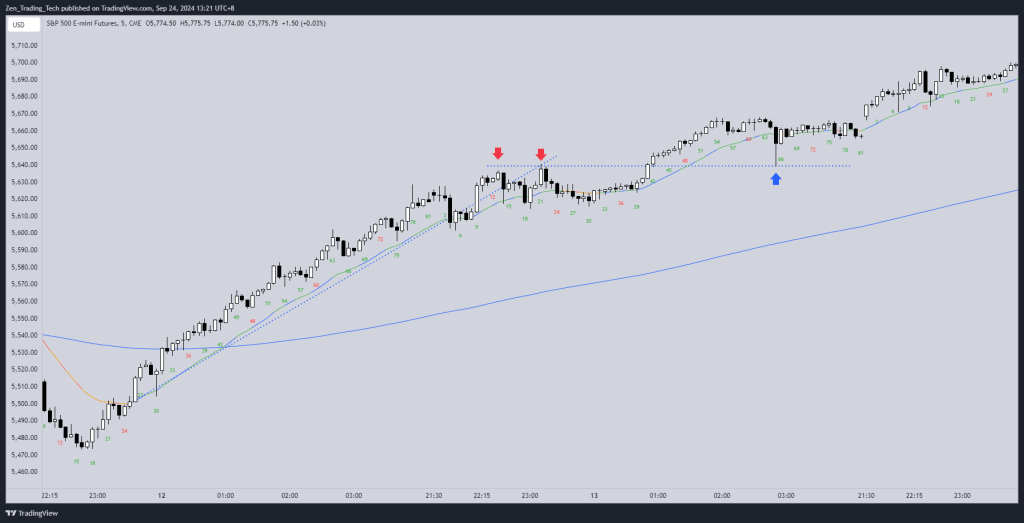

Drill 1: Trendlines – Break- Test or not?

Instructions

- Bear trendline is ABOVE

- Bull trendline is BELOW

- You can draw the whole move – but you often have to re-draw them.

- This is because the line from the initial spike will be different if you connect the trendline from the first pullback

- See examples below

- It works better if you take it from the 1st pullback

- Did we test it or not after?

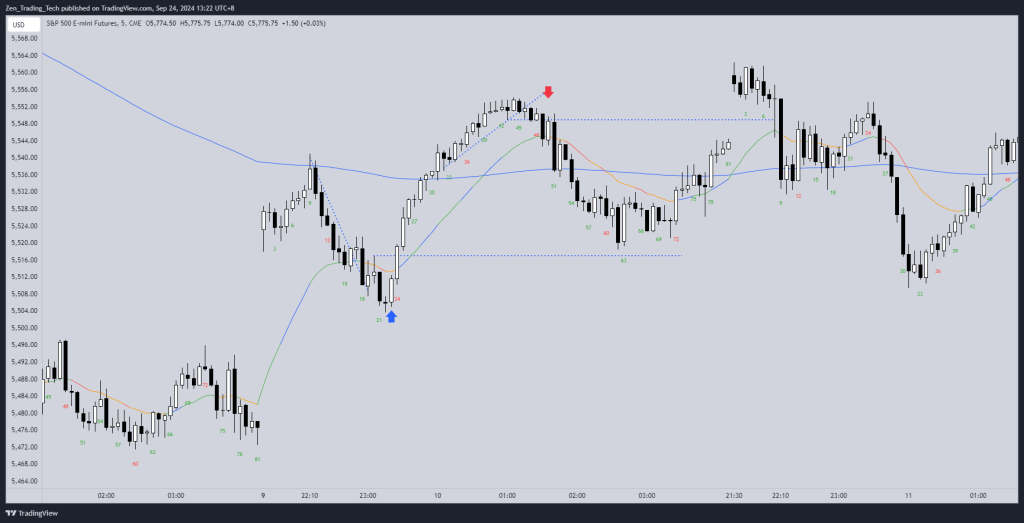

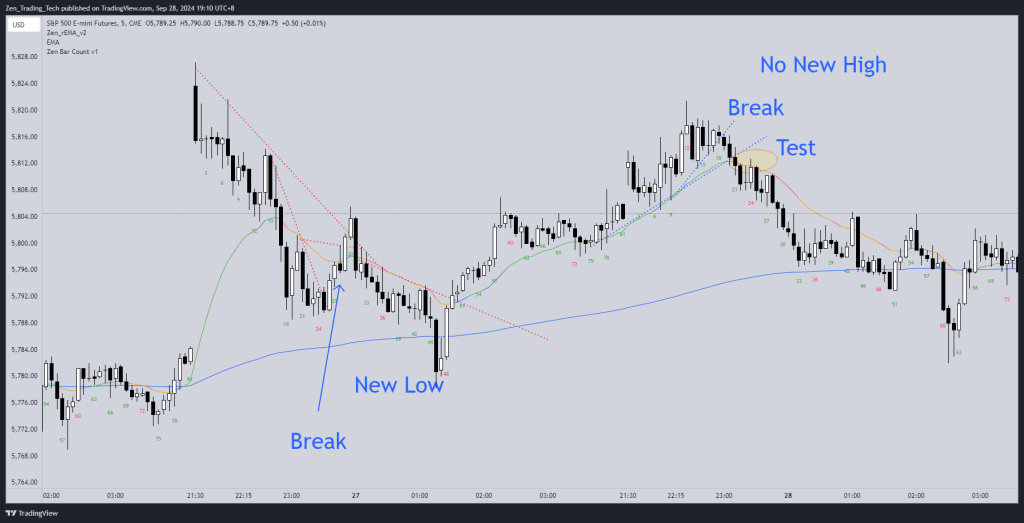

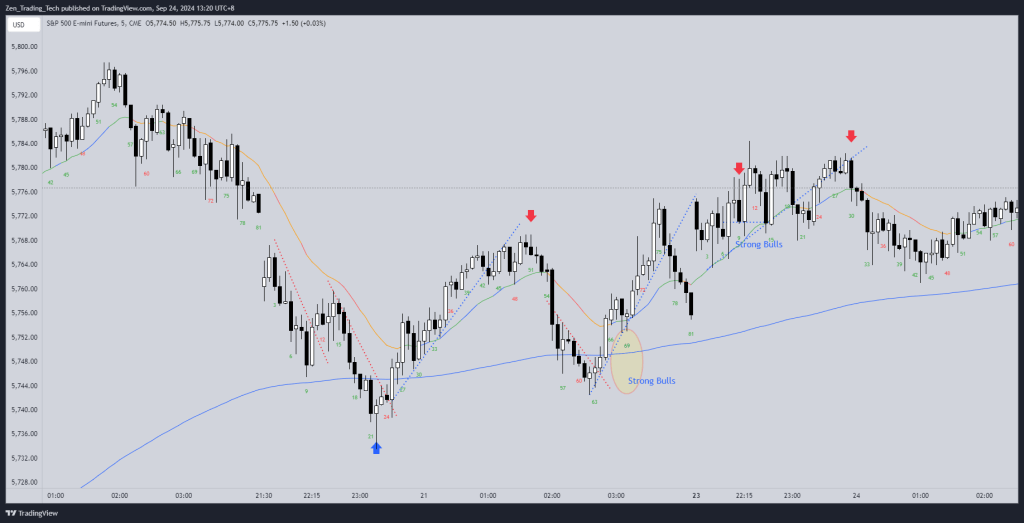

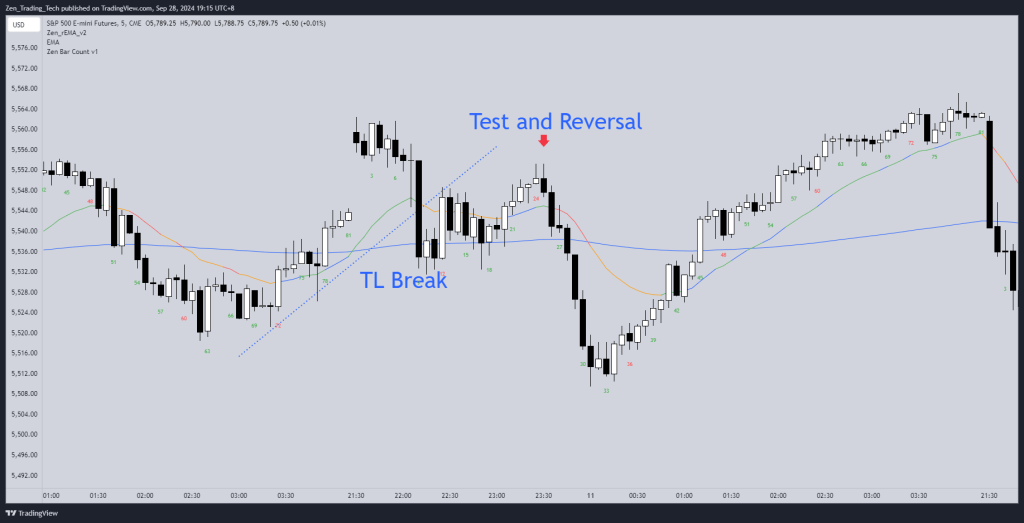

Drill 2: Trendline Break, New High, Reversal

Instructions

- This traps traders into a fake breakout

- These appear as higher-higher double tops and lower-low double bottoms

- It is very common on the open

- When channel is too tight:

- Avoid Trading Countertrend When No Trendline Break

- Stay In Swing When No Trendline Break

- Test does not have to get to new high or low – reversal strong

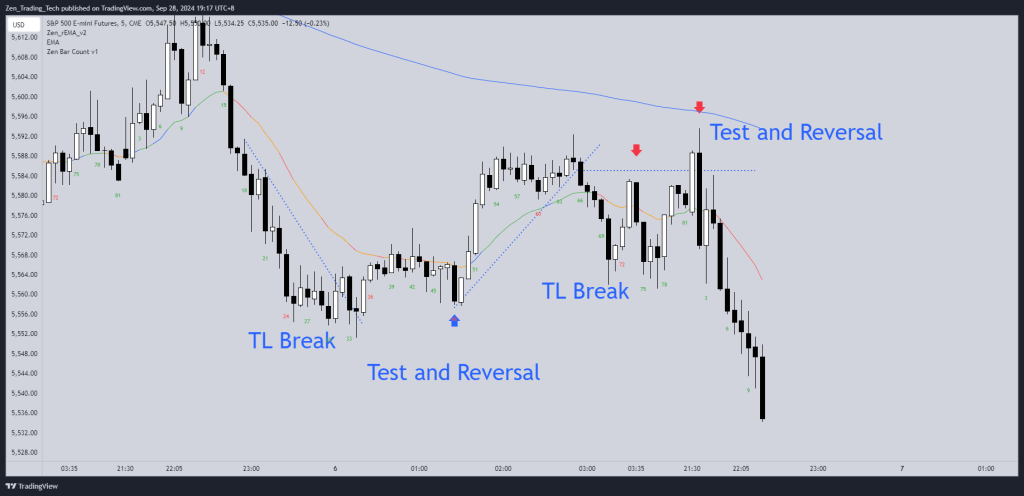

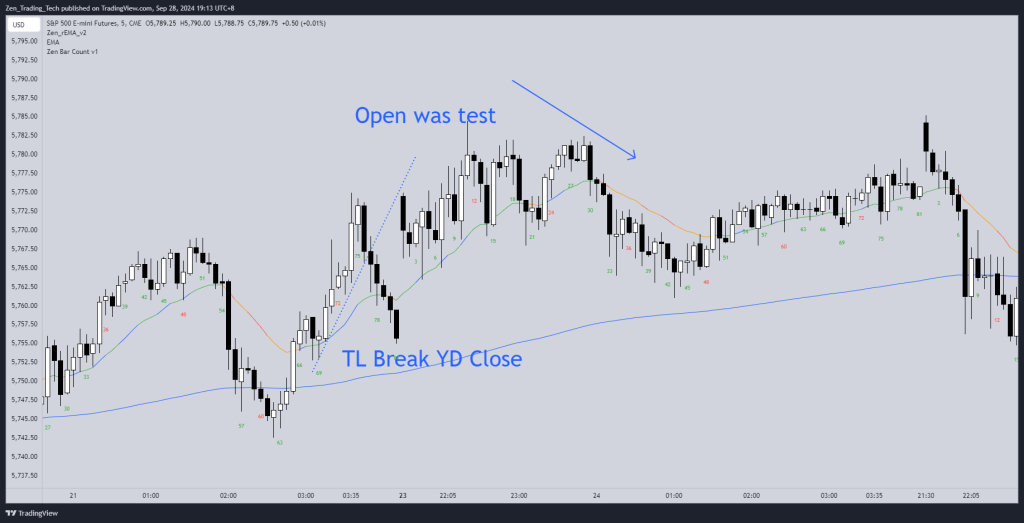

Drill 3: Trendline Break on the Open

Instructions

- Go and review 20 opens with gaps and see how common this pattern appears

- Sometimes the break was YD close, other times it is a new break on the open

- How could you use it in your trading?

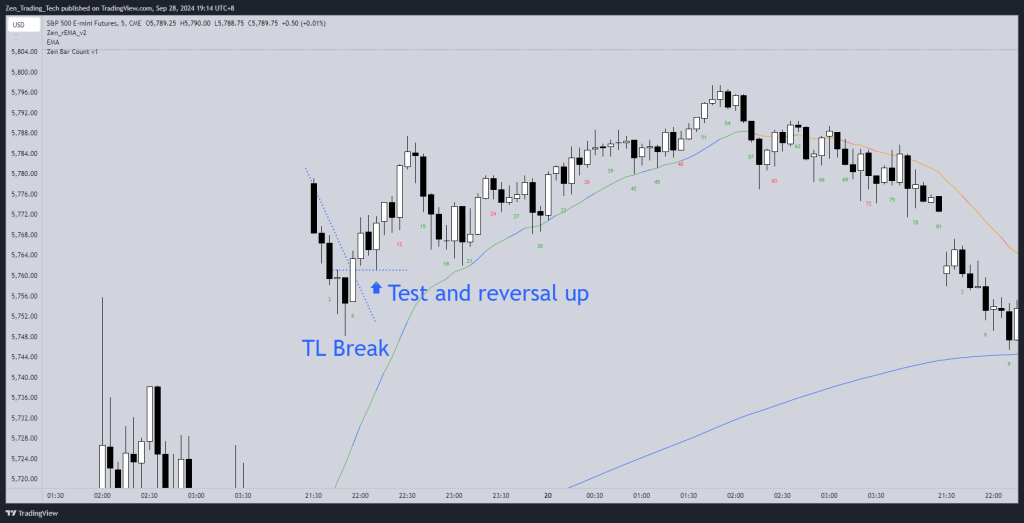

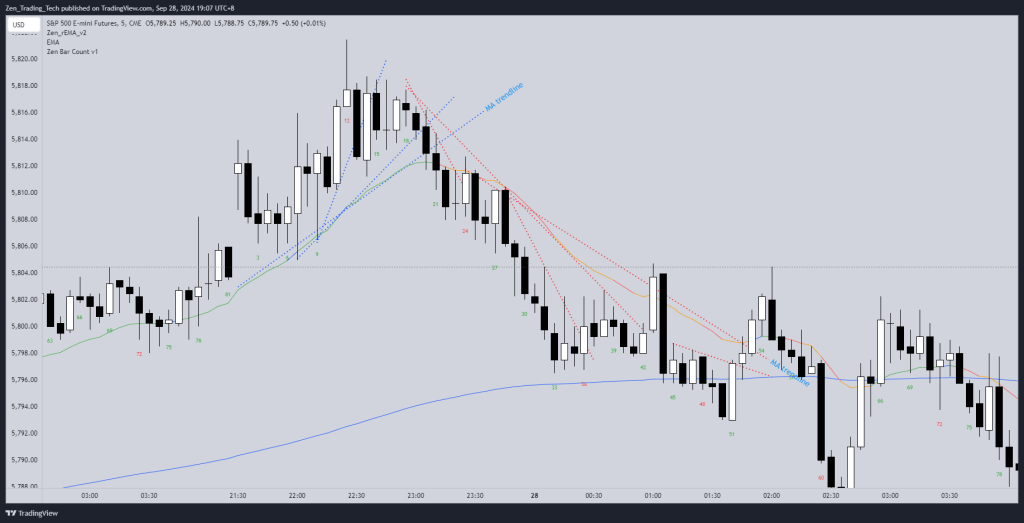

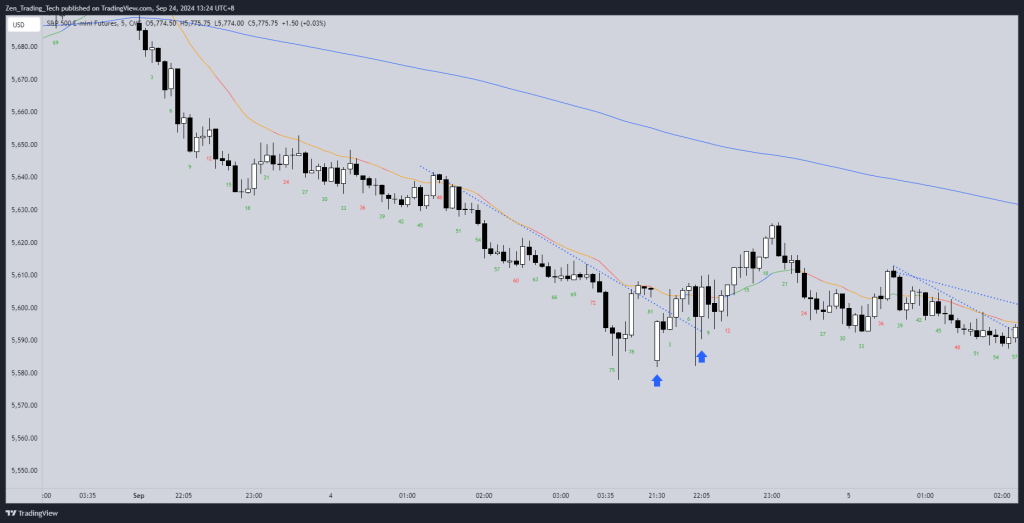

Drill 4: Moving Average Break

Instructions

- Here a break / cross of the moving average which doesn’t come back – often comes back later.

- Sometimes the next day on the open

Conclusion

- This is a really great drill to avoid losses taken at the end of a move and position yourself flat ready to trade the new direction

Leave a comment