- Intro

- Assumed Knowledge

- Video

- What is a High 2?

- Drill #1: Marking all the High 2

- Not all High 2’s are good to trade

- Drill #2: Strong H2 vs Weak H2

- Trendlines

- Drill #3: Did the High 2 break a trendline?

- High 2 is a second entry

- Drill #4: High 2 is a Second Entry

- High 2 is after the other side has failed twice to reverse

- Drill #5: High 2 after 2 attempts to reverse fail

- High 2 Fail -> Measured Move Down

- Drill #6: High 2 Fails -> MM Down

- Conclusion

Intro

- Talk about High 2 and how to trade

- Reverse it all for the BEAR case and a Low 1

Assumed Knowledge

- Spikes

- Consecutive bars – indicator

- Stop entries indicator and video

- Pullbacks / 2-Legged Pullbacks videos

- Check out Al Brooks book – Trading Ranges for more details on bar counting

- Also my video here on Bar Counting

- 2 Legged pullback after a spike

Video

What is a High 2?

- Go up and we pull back below the low of a prior bar. That is the end of a leg.

- When we go above the high of a prior bar now we call it a High 1.

- If we don’t come back down again keep counting High 1.

- If it goes below that bar and then reverses up we call it a High 2.

- You can continue for H3, H4, etc

- We will focus on High 2 because the market often moves in 2 legs.

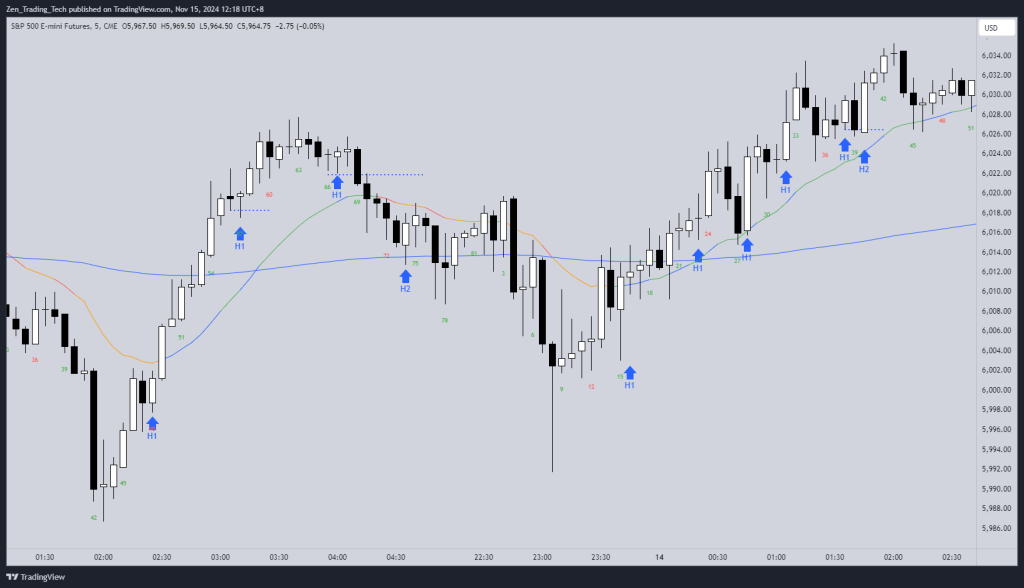

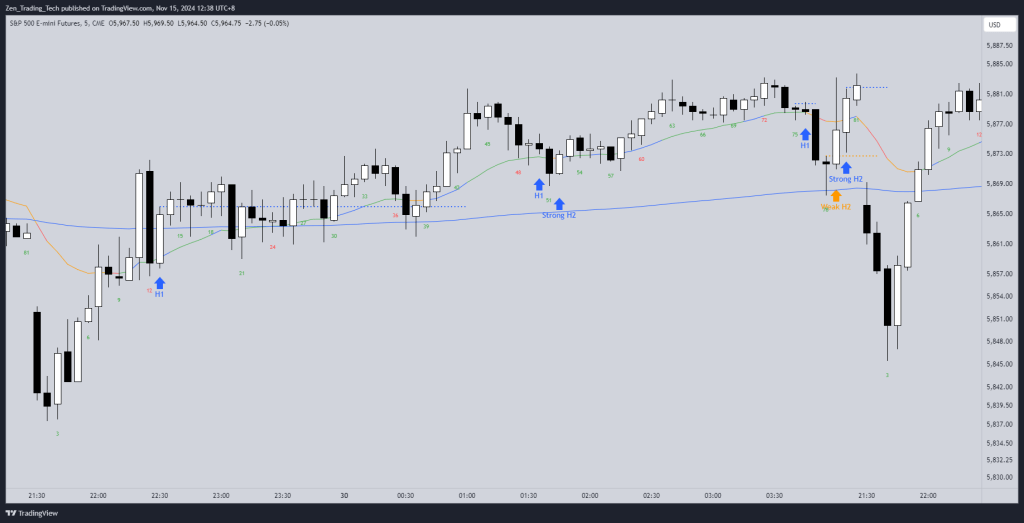

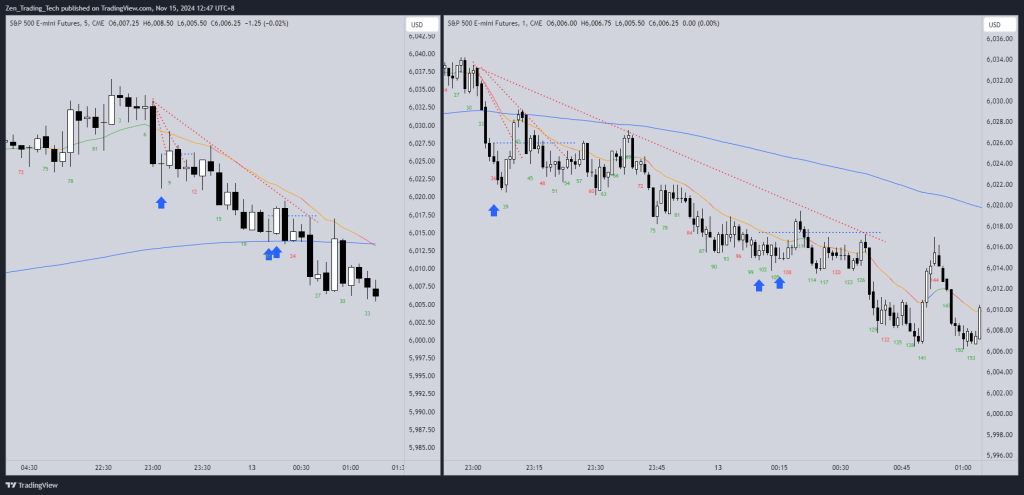

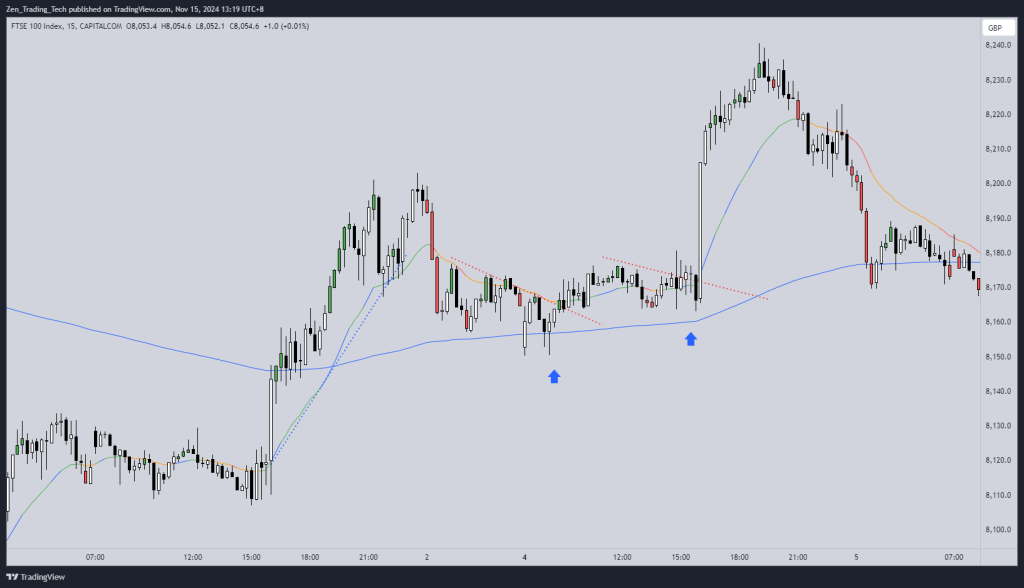

Drill #1: Marking all the High 2

- Look for a breakout / spike and then once a bar goes below the low of a prior bar, the next time we go above the high of a prior bar is a High 1. If we then resume down and repeat it – we call it a High 2

- Mark the bar that GOES ABOVE – that is the High 2 bar

Not all High 2’s are good to trade

- You will notice some High 2 are going above a bear bar – this is not as reliable as going above a bull bar

- All High 2’s form as the market is going down – after going up before!

- But it would be better if there were already BULLS in the market before we buy as well!

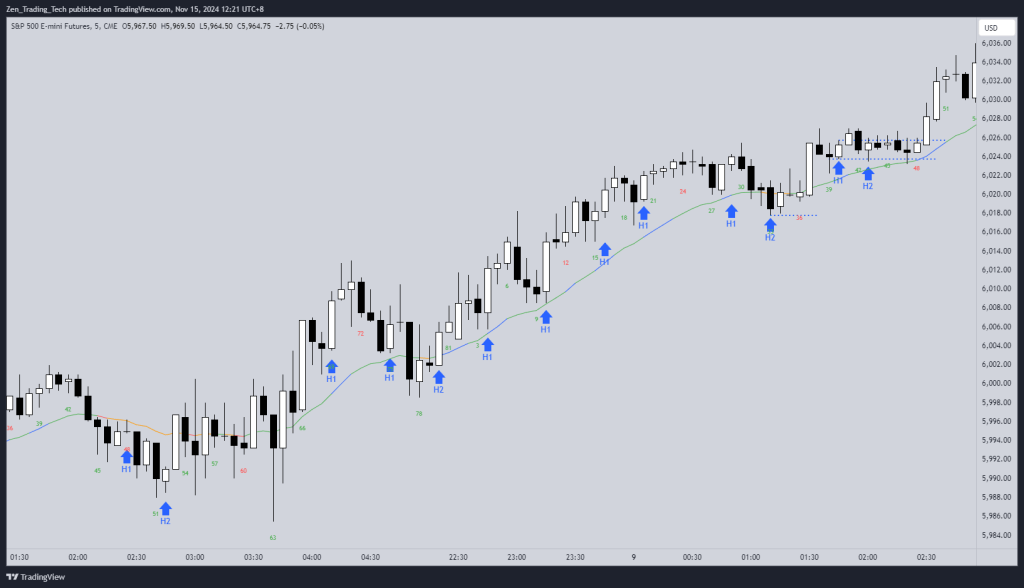

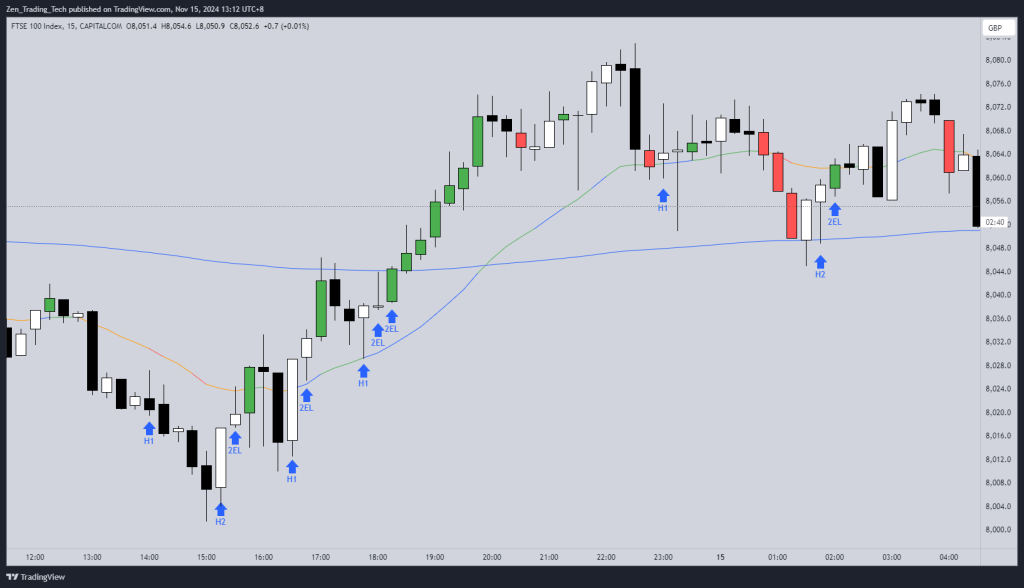

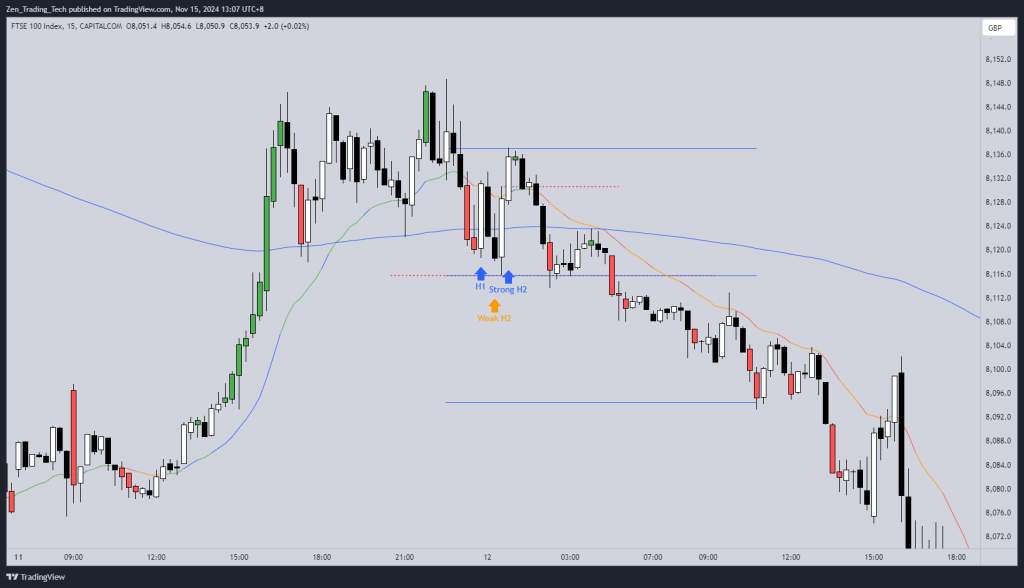

Drill #2: Strong H2 vs Weak H2

- Ignore market structure

- High 2 above a Bull Bar is higher probability

- Now look for High 2 but look a bar or so later to identify the first time it goes

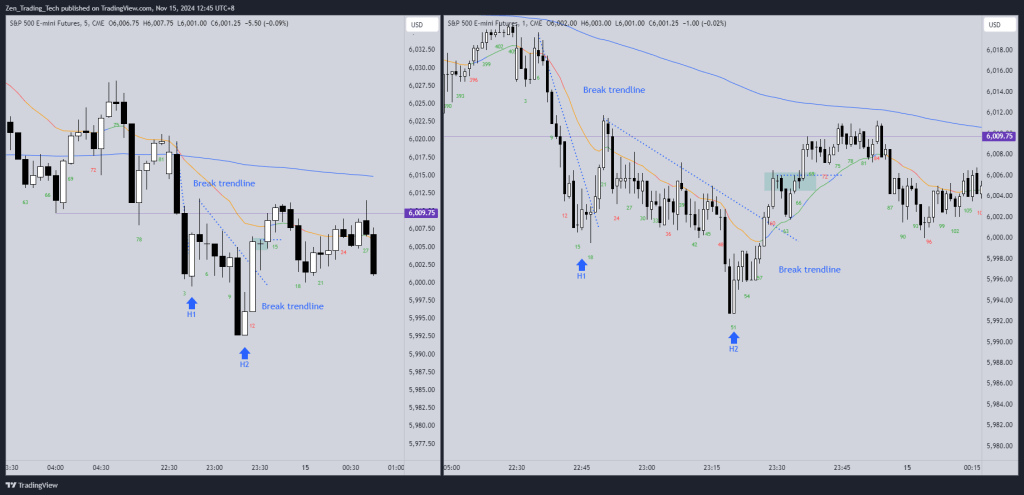

Trendlines

- You will have noticed above – without the concept of trendlines it can get ridiculous.

- High 1’s and High 2’s break very small trendlines.

- Connect Highs of bear moves for bear trendlines.

- This prevents us from buying very high in a bear spike, because the trendline was never broken.

- See here how it didn’t break any trend line

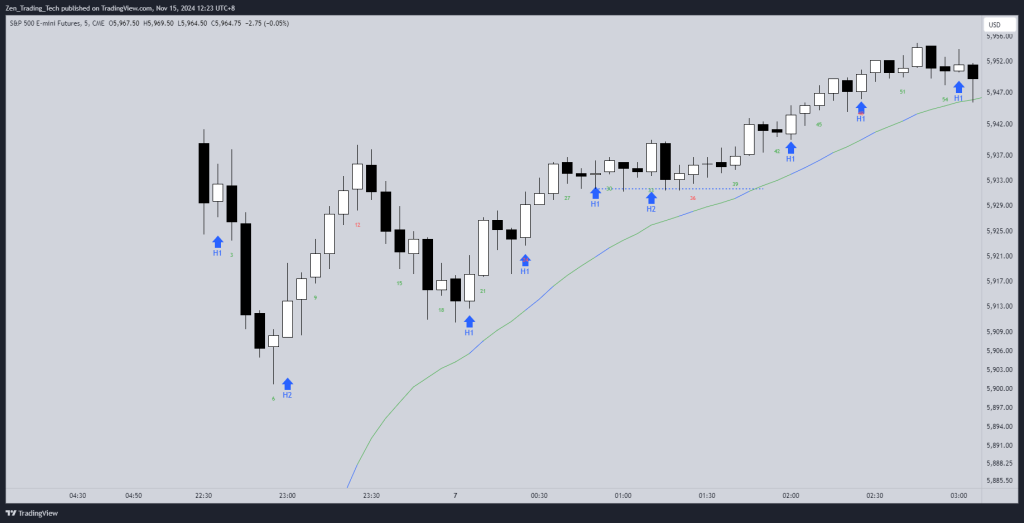

Drill #3: Did the High 2 break a trendline?

- Look at the structure and see if it broke anything significant

- Ask yourself how does this change your understanding of a High 2?

- How can you start to use the higher time frames to find good entries

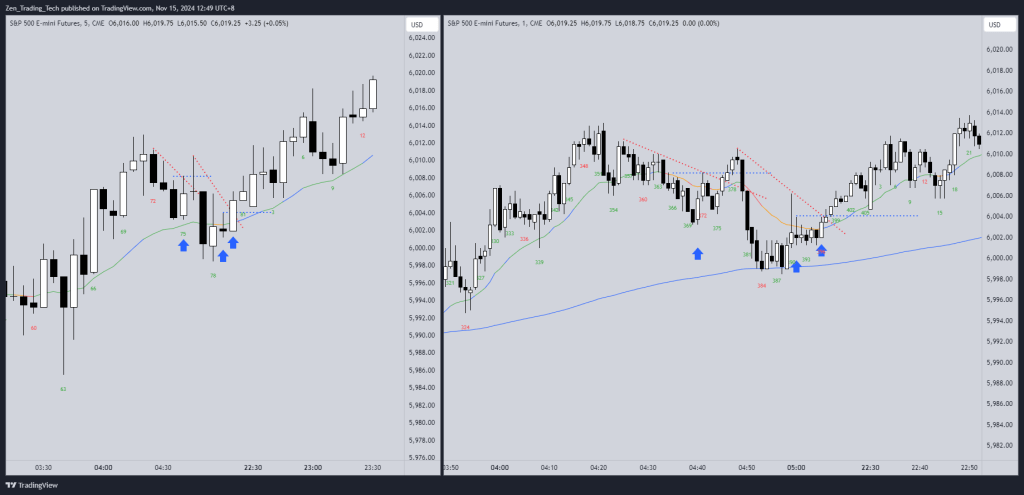

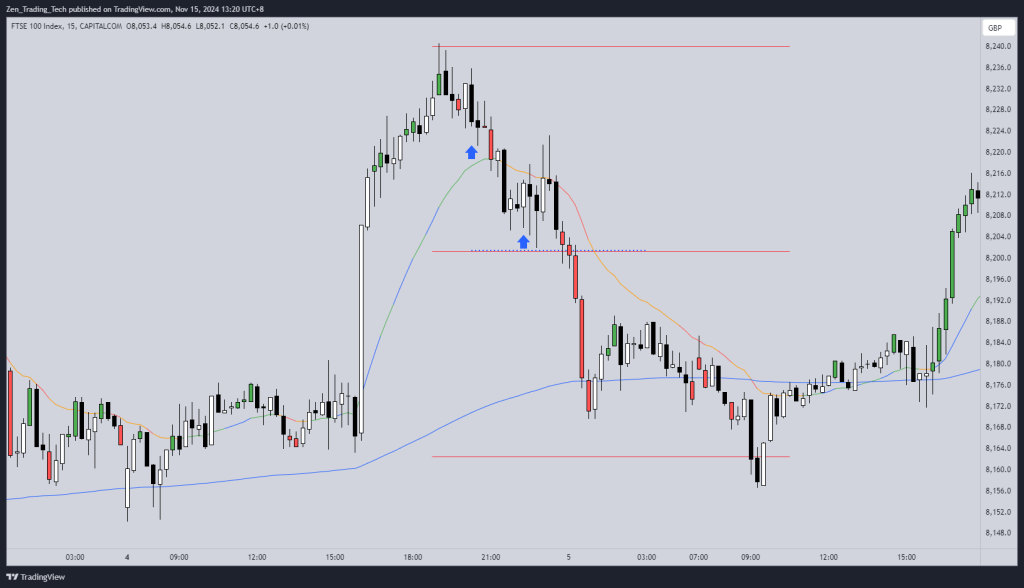

High 2 is a second entry

- So now in the drills you can see there are god signals and better signals

- As a trader becomes more familiar with the High 2 concept you start to use it as a way to practice patience.

- The High 2 is the second entry after the High 1. This sounds similar but can lead to greater agility in trading.

- So if you see a bad High 1, the next entry is a High 2.

- The second best entry after the High 1 triggers

- See the chart below

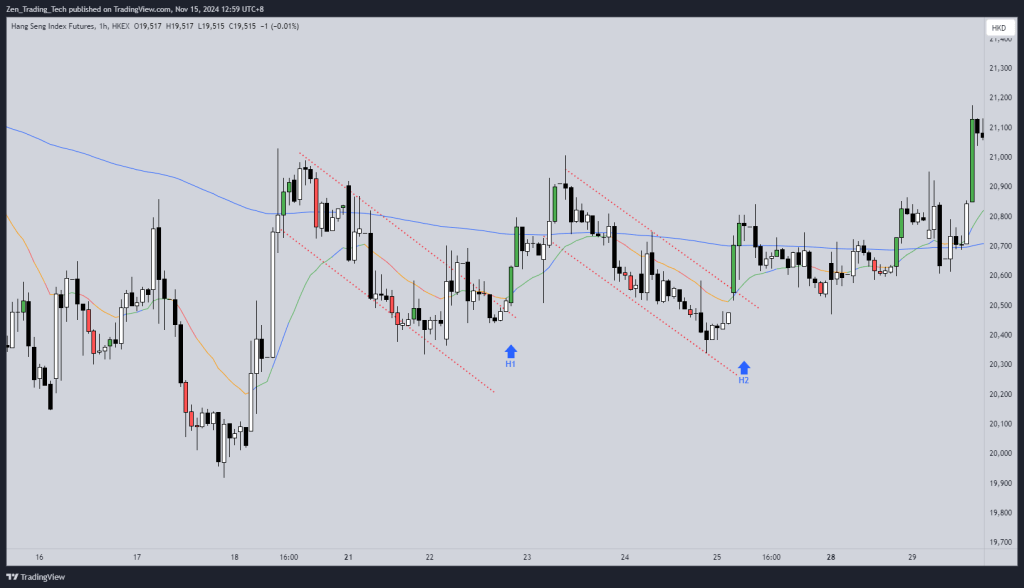

Drill #4: High 2 is a Second Entry

- Now your turn! Practice identifying the second best entry after the High 1 triggers

- You can also find H2 that are weak and take the next signal

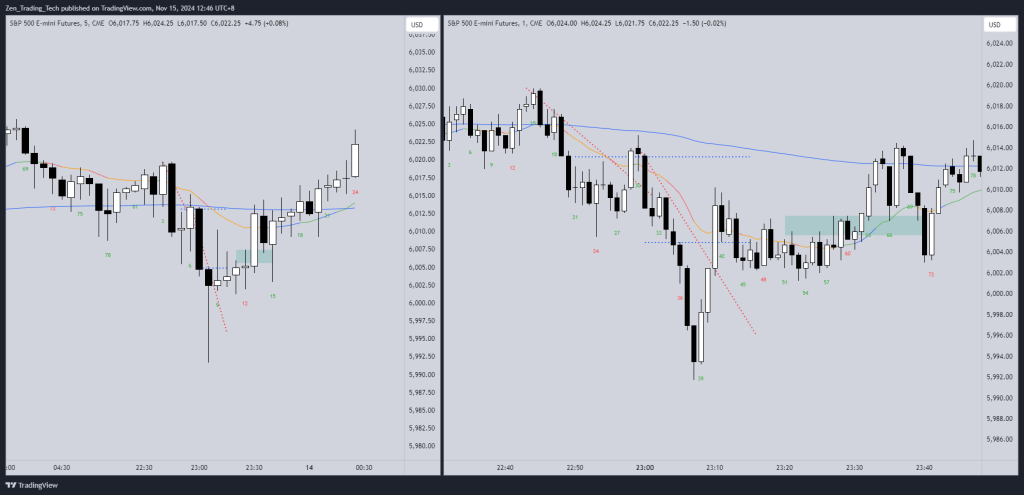

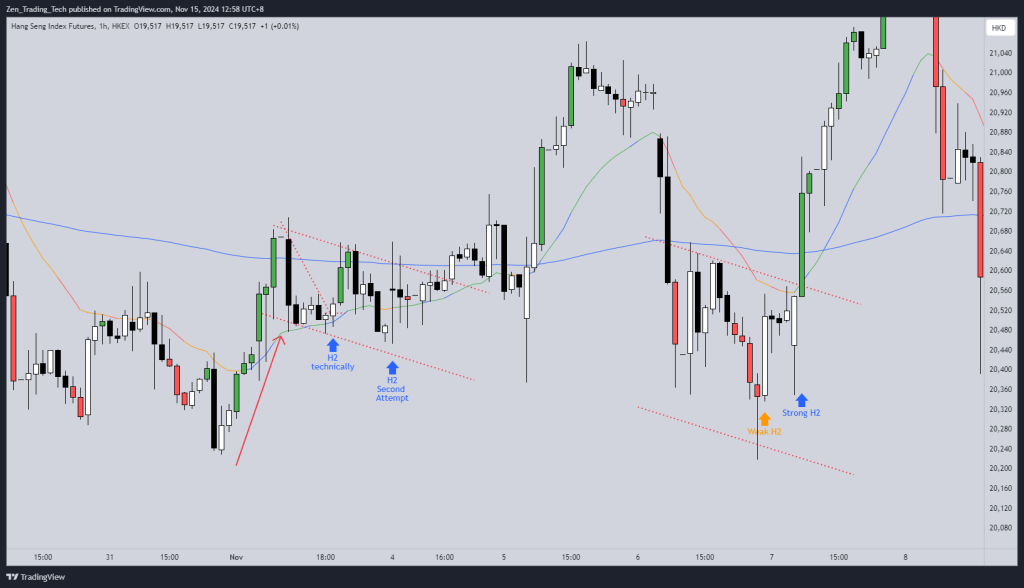

High 2 is after the other side has failed twice to reverse

- As a trader becomes more familiar with the High 2 concept you start to use it as a way to practice patience.

- The High 2 is the second entry after the High 1. This sounds similar but can lead to greater agility in trading.

- The exactness of the bars, gives way to a feeling of the price action.

- The High 2 has a relationship to the Higher time frame

Drill #5: High 2 after 2 attempts to reverse fail

- Now your turn to find High 2’s based on a feeling of the chart – including the higher time frame

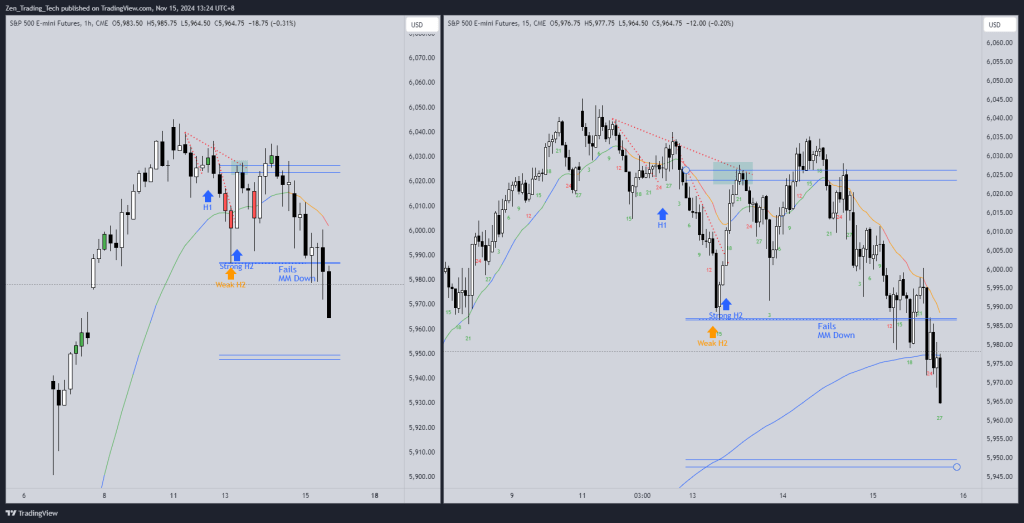

High 2 Fail -> Measured Move Down

- Once the second attempt fails it can often lead to a measured move down

- Sometimes the entry for the High 2 is just too high for traders to be convinced

- High 2 after 2 attempts to reverse fail.

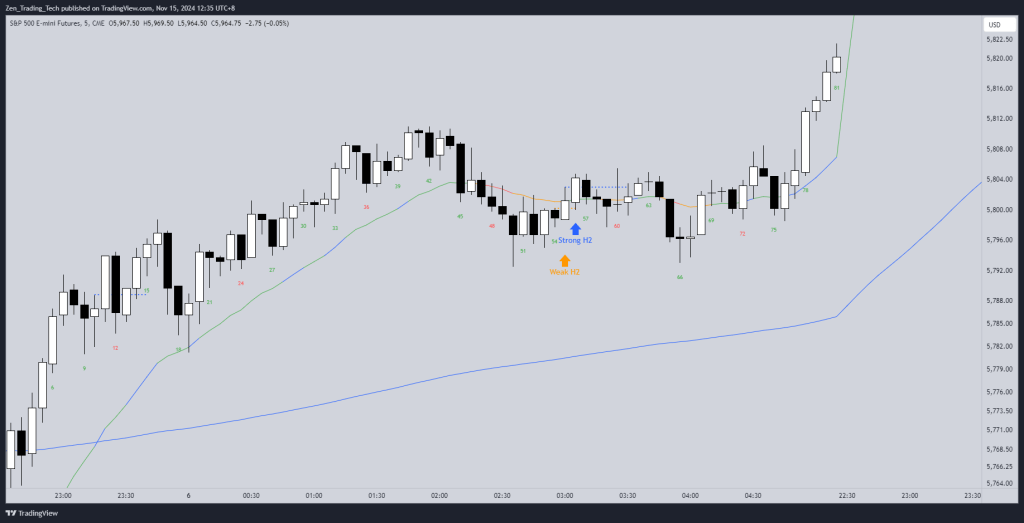

Drill #6: High 2 Fails -> MM Down

- Now find H2 that failed and created a MM down.

- Which worked and which did not?

Conclusion

- I hope you found that useful.

- Now you have several of the drills I do to trade High 2 entries

- Please let me know in the comments what you learned!

Leave a reply to ellie van hunsel Cancel reply