- Intro

- The 6 Trading Decisions

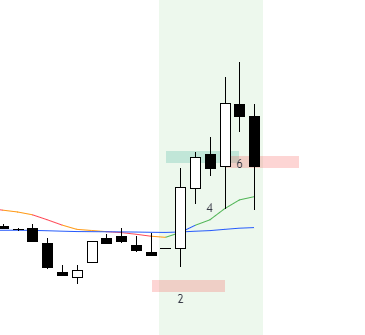

- Drill #1: Buy the Close, Sell The Close Game with TradingView Replay

- Simplify Your Trading: Trade Longer, Clearer, and Smarter

- Drill 2: Analyse Your Past Trades – What % of your Trades are Level 1,2,3?

- Drill 3: Analyse Your Past Trades – Continuation vs Reversals

- Common Mistakes I See from Traders

- Drill #4: High 1 and Low 1 Drills

- Drill #5: Trading a Channel

- Conclusion

Intro

- Trading can feel overwhelming when faced with countless decisions every moment, especially on a fast-moving 5-minute chart. But what if you could streamline your process and focus on just six core setups?

- This post introduces these six trading decisions, explains their progression in complexity, and offers drills to help traders simplify their approach, reduce stress, and improve clarity.

The 6 Trading Decisions

- 3 on the BUY side.

- 3 on the SELL side.

- BTC (Buy The Close)

Buy the close of the current bar. - STC (Sell The Close)

Sell the close of the current bar. - BA STP (Buy Above Stop)

Place a stop order to buy 1 tick above the high of the current bar. - SB STP (Sell Below Stop)

Place a stop order to sell 1 tick below the low of the current bar. - BB (Buy Below)

Buy at the low or 1 tick below the low of the current bar. - SA (Sell Above)

Sell at the high or 1 tick above the high of the current bar.

Drill #1: Buy the Close, Sell The Close Game with TradingView Replay

TradingView’s bar replay mode is a fantastic tool to practice the simplest setups: BTC and STC. Here’s how:

- Enable bar replay and pick a random historical segment.

- Trade only using BTC and STC setups.

- Track your results and adjust as needed.

The bar is going to confirm my decision – not tell me what to do – thats too late!

- Play a game BTC STC

- If its BULL bar, can only BUY or do nothing

- If its BEAR bar, can only SELL or do nothing

- If in a position, can only exit on RIGHT kind of bar

- If doji, not strong, leave

- ie

- BEAR bar to sell = exit a LONG

- BULL bar to buy = exit a SHORT

- ie

- Trade 1:

- Other trades

Trading Range Day – You cannot use this technique at all!

- Now try yourself!

- See how it works well in a trend and DOES NOT work well in a trading range.

- Now you know why. You have to adjust your trading strategy to account for environments where the BREAKOUTS fail.

Simplify Your Trading: Trade Longer, Clearer, and Smarter

While these six decisions cover almost all trading scenarios, managing all of them at once can lead to mental fatigue and mistakes.

Instead, start by simplifying your trading process. Reducing your decision set helps you trade longer with more focus and fewer errors. Here’s a simple framework to reduce complexity:

- Level 1: BA STP & SB STP (Breakout Trades)

Start with pure breakout trades. They’re straightforward and have clear triggers. - Level 2: BTC & STC (Betting on Breakouts)

Graduate to betting on breakouts by trading the bar close. This requires better price action reading skills. - Level 3: BB & SA (Fading Breakouts)

Master fading breakouts once you have a strong grasp of price action. These trades involve more stress due to complex management and scaling.

Drill 2: Analyse Your Past Trades – What % of your Trades are Level 1,2,3?

- Review your recent trades.

- Categorize them by type (BTC, STC, BA STP, SB STP, BB, SA).

- Calculate the percentage of each type to understand your tendencies.

Drill 3: Analyse Your Past Trades – Continuation vs Reversals

- Review your recent trades.

- Of all your trades which ones were CONTINUATION trades and which ones were REVERSALS?

- What was the % split by # and hit rate?

- When I first did this drill 65% of my trades were reversals which had a 20% hit rate. 35% of my trades were continuation which had an 80% hit rate.

Common Mistakes I See from Traders

From the charts traders send me, two patterns stand out:

- Losses are not errors!

- Late Level 1 Entries: Many traders take breakout trades (BA STP/SB STP) too late, often on a third or later leg, reducing profitability.

- Overuse of Level 3 Trades: A lot of traders fade breakouts (BB/SA) prematurely and end up scaling into losing positions.

- Neglecting Level 2 Trades: Few traders focus on Level 2 (BTC/STC), even though this level is critical for developing solid price action reading skills.

To enjoy trading and build consistency, aim to master Level 2 first. It proves you’re at least 60% proficient in price action reading. Once you’re comfortable, you can finesse entries using Levels 1, 2, or 3 depending on the situation.

Drill #4: High 1 and Low 1 Drills

High 1 and Low 1 setups are breakout entries on small pullbacks in trends.

- Identify a trending market.

- Use bar replay to practice entering High 1 or Low 1 setups – BTC/STC

- Focus on executing your plan consistently.

- BONUS: How many of these trades did you take last week?

Drill #5: Trading a Channel

- In channel markets, practice buying or selling small (Level 1 and 2) on early moves and adding size later when the price confirms (Level 3 trades).

- This helps you build confidence in managing complex setups.

- You need to have VARIOUS entry techniques for the DIFFERENT areas of the market cycle.

- Which all depend on your PA reading to execute.

- BONUS: How many of these trades did you take last week?

Conclusion

Simplifying your trading decisions can reduce stress, improve clarity, and help you trade longer and better. By focusing on Level 2 trades (BTC & STC) and gradually incorporating other levels, you can develop confidence in reading price action and finessing your entries.

Start practicing with the drills above, and let me know how they work for you.

Thanks for reading, and happy trading!

Leave a reply to Tim Fairweather Cancel reply