- Intro

- Link

- Video

- Explainer – Rainbow EMA

- Missing Wedge Entries

- Signal Triggers above / below prior opposite signal

- 3 Signals is one way to count a Wedge

- Strong trend then first opposite signal – prob minor reversal

- Remember where you took your loss – don’t re-enter the same way there

- Trading Ranges

- Conclusion

Intro

- In this article I will review a FREE TRADINGVIEW indicator I made and how you can use it in your trading

- Designed for traders who have done the Brooks Trading Course and understand how PA traders use the MA

- Designed for traders who understand what ALWAYS IN means in Al Brooks trading

Link

https://www.tradingview.com/script/pQlmaHqq-Zen-rEMA-v2/

Video

- I made a video on this here: [Coming Soon]

Explainer – Rainbow EMA

- Indicator that changes colour based on whether price is above or below

- Indicator that changes colour based on whether there are 2 consecutive good closes above / below the MA (Always In)

- Optional Always-In arrows to show who’s in control – based on minimum of two closes above/below MA. Goto settings, select SHOW ALWAYS IN

Changing Colours

Always in

Combining both

Missing Wedge Entries

- Always in is not an easy concept in trading ranges – always flipping back and forth.

- Traders believe the market WILL NOT breakout. So as soon as a signal appears, that is often the start of a reversal

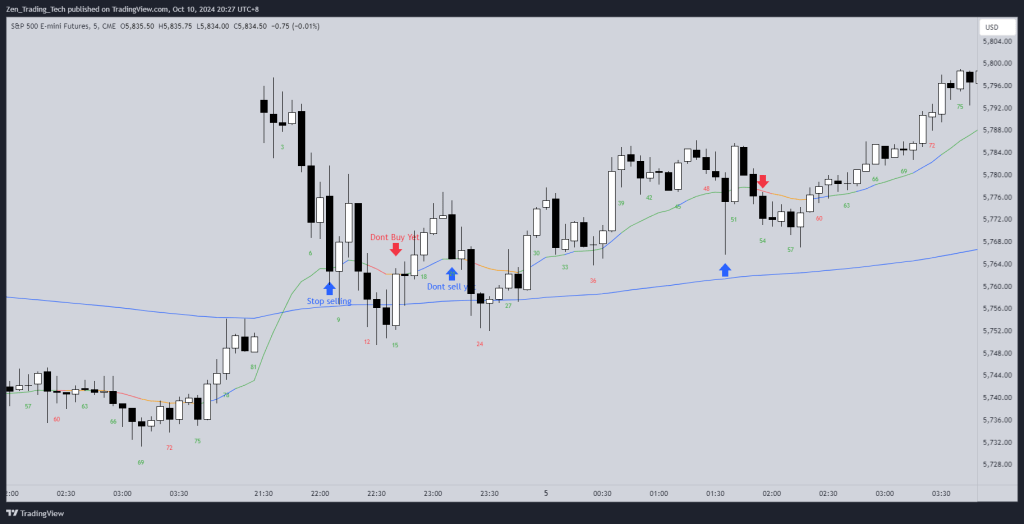

Signal Triggers above / below prior opposite signal

- Always in LONG signal fails and a new SHORT signal appears below it. Likely MM and 1 x Risk.

3 Signals is one way to count a Wedge

- You can use it for LEG COUNTING as well.

- Every-time consecutive bars appear, count a leg.

- Here we see consecutive wedge bottoms as the reversal.

Strong trend then first opposite signal – prob minor reversal

- Always in can be used to identify the first counter-trend signal, the trendline break.

- But don’t take it. Instead look for a test of the extreme.

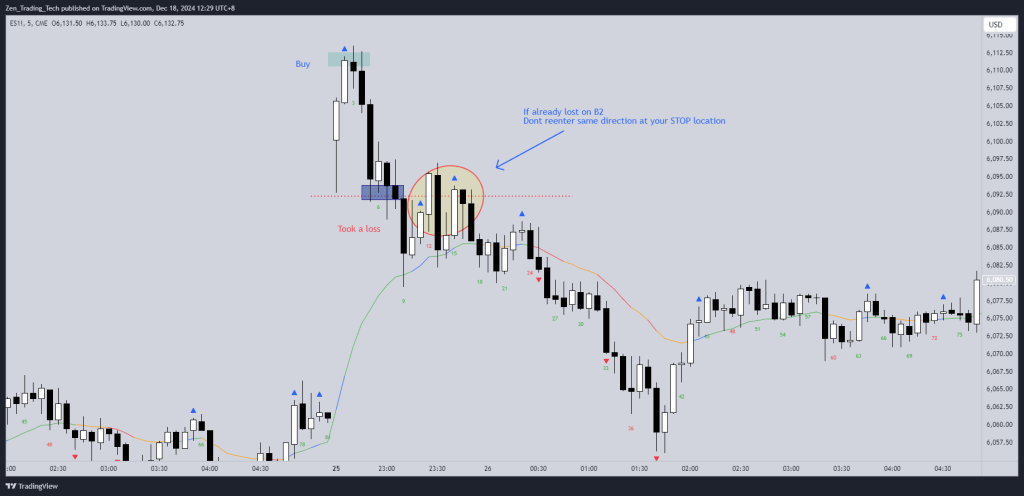

Remember where you took your loss – don’t re-enter the same way there

- Always in LONG here was a losing trade.

- So don’t REENTER at that LOSS area.

- Wait for another signal to develop.

Trading Ranges

- Stop following the signals

- The DBBLF (Double Bottom Bull Flag) at the first circle was a better LONG

- Watch video for detailed explanation

Conclusion

- I hope this indicator helps you use the MA and ALWAYS IN in your trading and your research to improve your price action skills.

Leave a reply to fxmalloc Cancel reply