Every trading day provides a roadmap for the next. The market isn’t random—it follows repeatable patterns, and the traders who study them are the ones best prepared to take advantage when they appear again.

By reviewing today’s price action, you build a playbook for tomorrow. The same setups happened again today—just like yesterday.

- Video

- Major Trend Reversal: Low of the Day and a Trendline Break Test

- Wedge Pullback Long on the Open

- Bull Breakout, Always in Long, First Pullback

- Gap Up, Second Entry Short Was the High of the Day

- Gap Up and 3rd Good Buy Signal (H3)

- The Market Repeats – Your Homework is Your Edge

Video

- Coming tomorrow

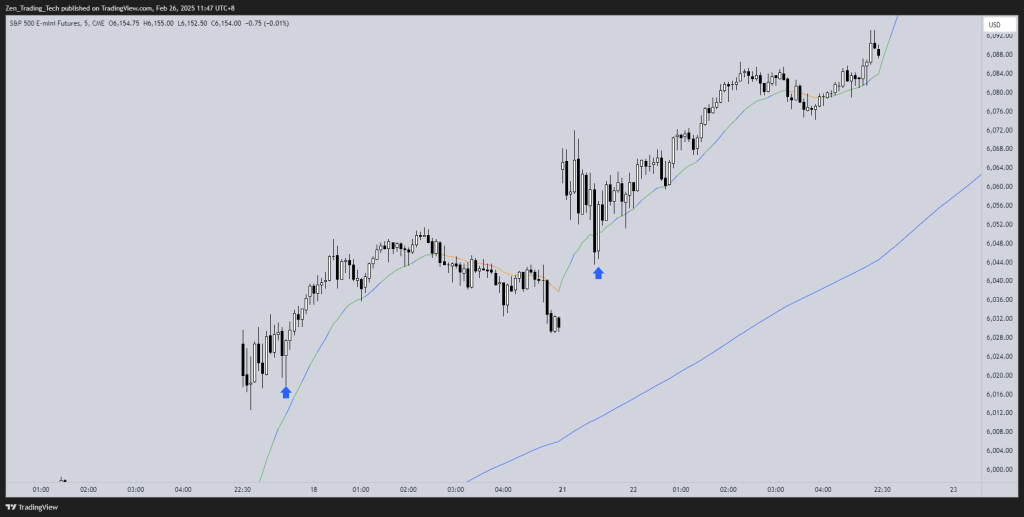

Major Trend Reversal: Low of the Day and a Trendline Break Test

- Strong bear spike on the open.

- Bulls broke a trendline and tested for the low of the day attempt.

- On the first day, the test formed a higher low; on the second day, it was a lower low.

- How would you participate? Would you stay short or flat until bulls showed strength?

- A possible swing long setup formed.

- The test of the double bottom had a three-push move, a common reversal structure.

- This is also a dueling lines pattern—where a three-push move tests support before reversing.

🔍 Check your charts: Have you seen this type of reversal before? If so, how could you improve your execution next time?

Wedge Pullback Long on the Open

- Both days opened with a three-push leg that wasn’t very strong, setting up multiple buy signals for a swing up.

- On the first day, the three legs were more horizontal—bulls never got stopped out.

- On the second day, the legs were more vertical, leading to stronger momentum.

🎯 How do you handle these pullbacks? Do you wait for confirmation, or are you comfortable entering on opposite weakness?

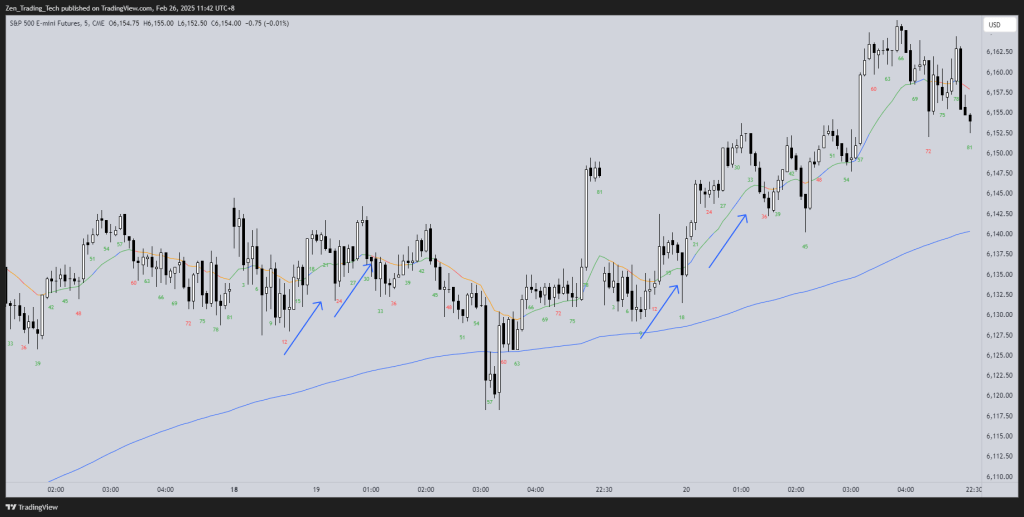

Bull Breakout, Always in Long, First Pullback

- Why are these two days similar when one had a big gap down and the other a small gap up?

- Because both days went always-in long on the open.

- On the first day, lots of bull bars and a two-legged pullback confirmed strength.

- A big bull bar setup the trade of the day.

- On the second day, the market gapped up above yesterday’s high, forming a bull breakout.

- The pullback created an H2 (second entry long)—a strong buy signal.

- The second buy signal occurred above both moving averages—buying the entry or the follow-through provided a solid swing trade.

📌 Next time you see a strong open, will you recognize the first pullback as a high-probability entry?

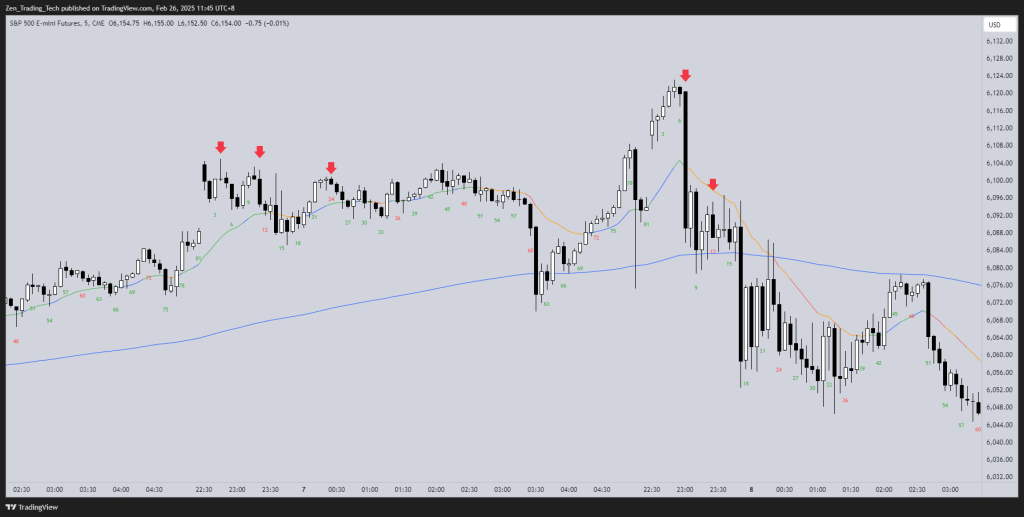

Gap Up, Second Entry Short Was the High of the Day

- The first day opened with a gap up and consecutive bear bars, signaling a possible swing down.

- Traders waiting for a second entry short saw it become the high of the day.

- On the second day, there was another gap up, but this time with weak bull bars, tails, and an inside bar with bad follow-through.

- A second entry short set up again.

- Why was the second day similar? Because the market never traded above the second entry short level.

- If you used correct stop placement, you wouldn’t have lost money.

📊 Look at your past trades—how often does a gap up lead to a second entry short? Is this something you could integrate into your strategy?

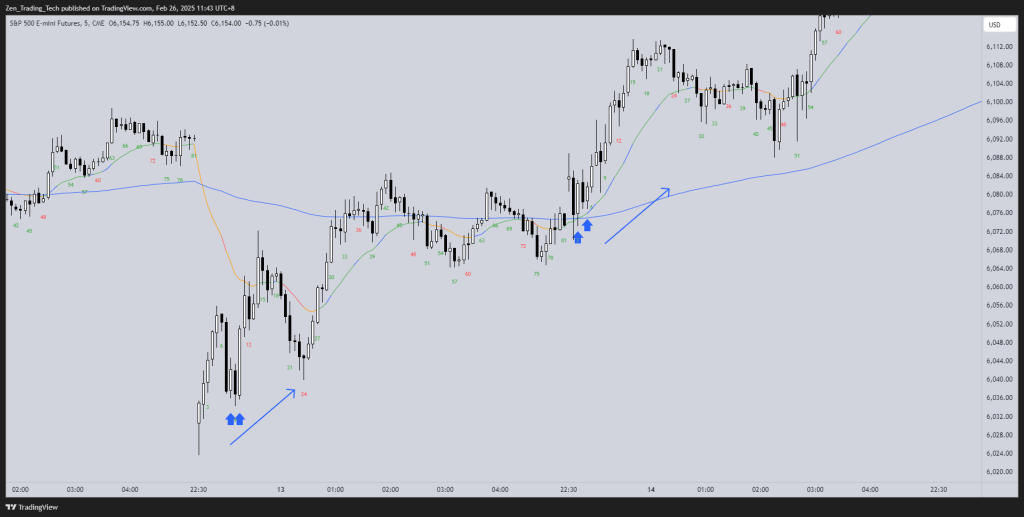

Gap Up and 3rd Good Buy Signal (H3)

- Both days gapped up and went sideways on the open, forming a similar pattern.

- Each session had three pushes down, but neither was able to create a strong bear trend.

- On the first day, the price action was more horizontal—taking the third buy signal (H3) was the trade of the day.

- On the second day, waiting for the third buy signal again led to another strong trade.

📌 Do you track how often the third push leads to a reversal? If not, consider adding this to your trading review process.

The Market Repeats – Your Homework is Your Edge

These setups aren’t unique events—they happen again and again.

The proof is in the charts—these patterns have already played out before, and they will appear again. The question is: Will you recognize them next time?

📊 Pull up your charts—do you see similar structures in past sessions? How can you refine your execution to take advantage of them next time?

Leave a reply to Tim Fairweather Cancel reply