Introduction

In this post, I’m going to talk about entering tight channels.

I’ll review a variety of different ways we can approach a tight channel, with the goal of helping you develop a method that suits you.

For a long time, I struggled to enter tight channels, often looking back the next day and wondering why I missed EVERY opportunity.

By practicing and experimenting with different techniques, you can find a method that works best for you.

What is a Tight Channel?

A channel refers to price action moving diagonally, either upward or downward.

The speed often aligns by moving parallel with a moving average.

This can include micro-channels, where the price steadily trends without breaking key levels like the high of a prior bar.

However, the type of tight channel that often proves difficult to enter typically has some overlap and strong counter-trend bars.

For example, during a strong bear day, you may see several buy signals that ultimately fail, making it hard to find a successful entry.

10 Entries

Here are 10 ways to enter in tight channels.

I hope you find some that suit you:

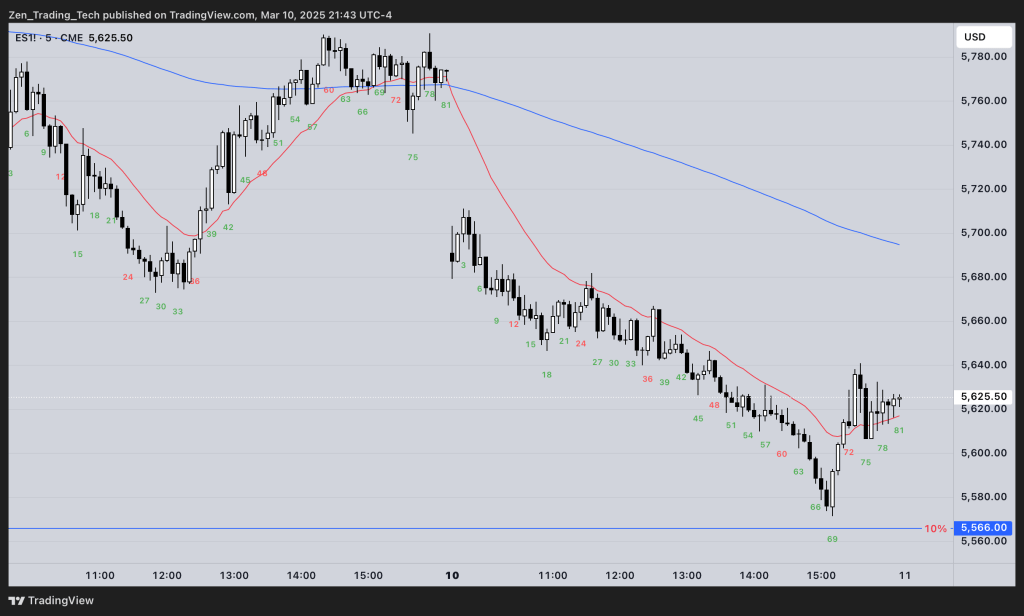

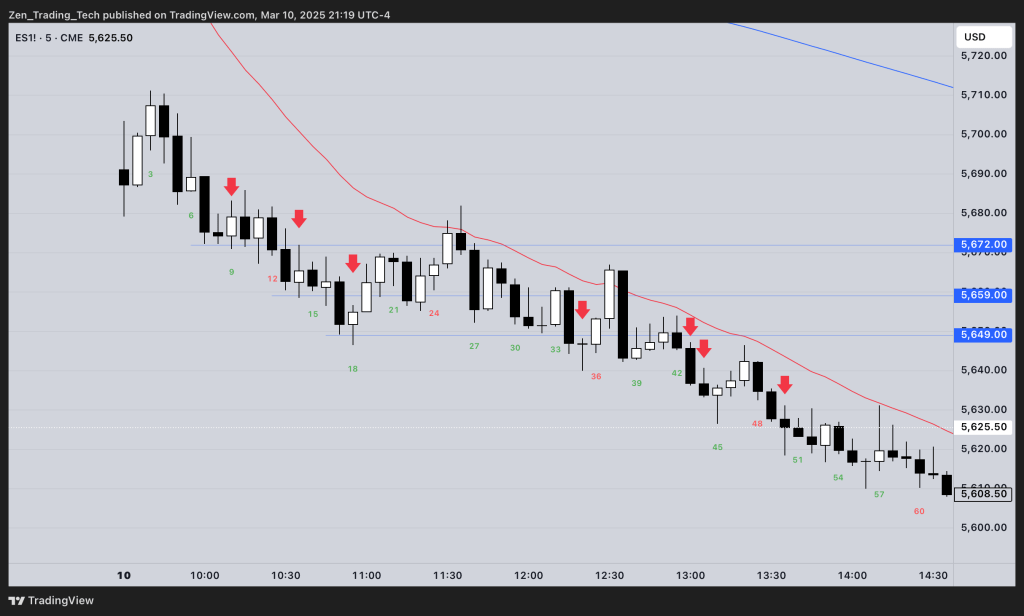

Fading Breakouts of Bear Trend Lines

- Connect at least 2 highs with a line and project it down

- Enter on the touch of that line

- Or wait for a sell signal bar at the line

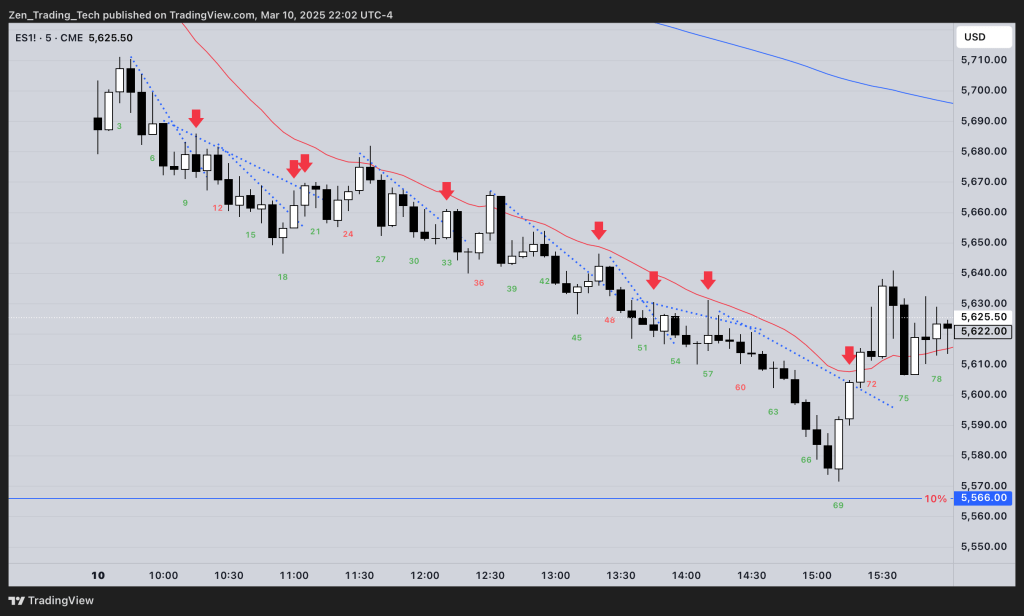

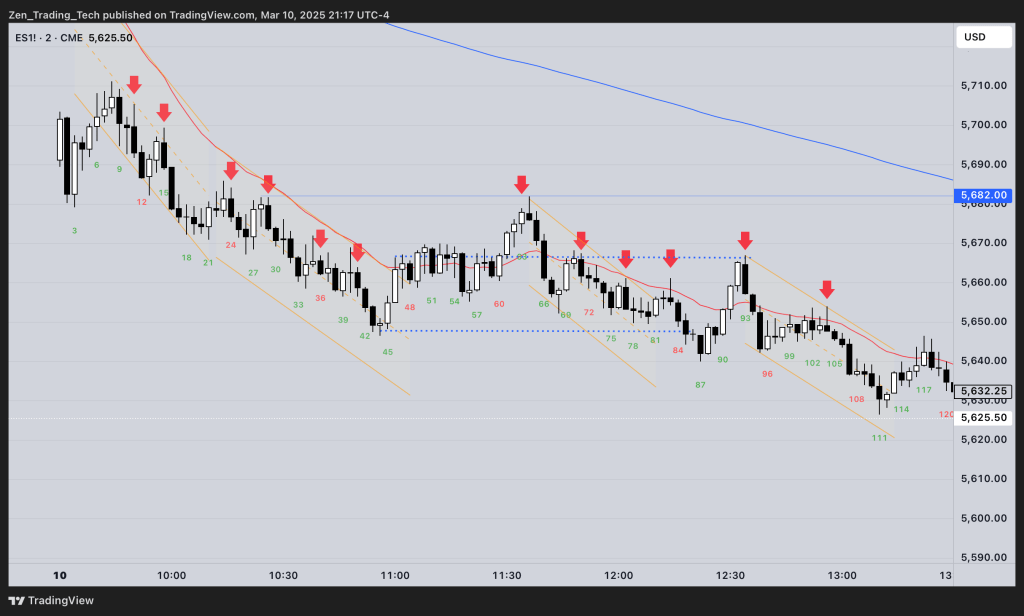

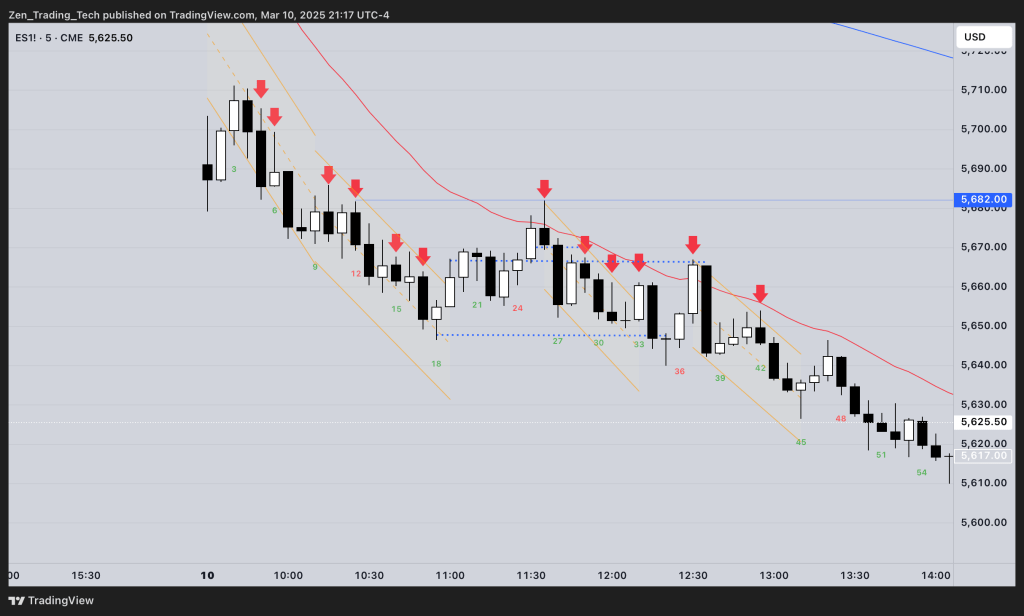

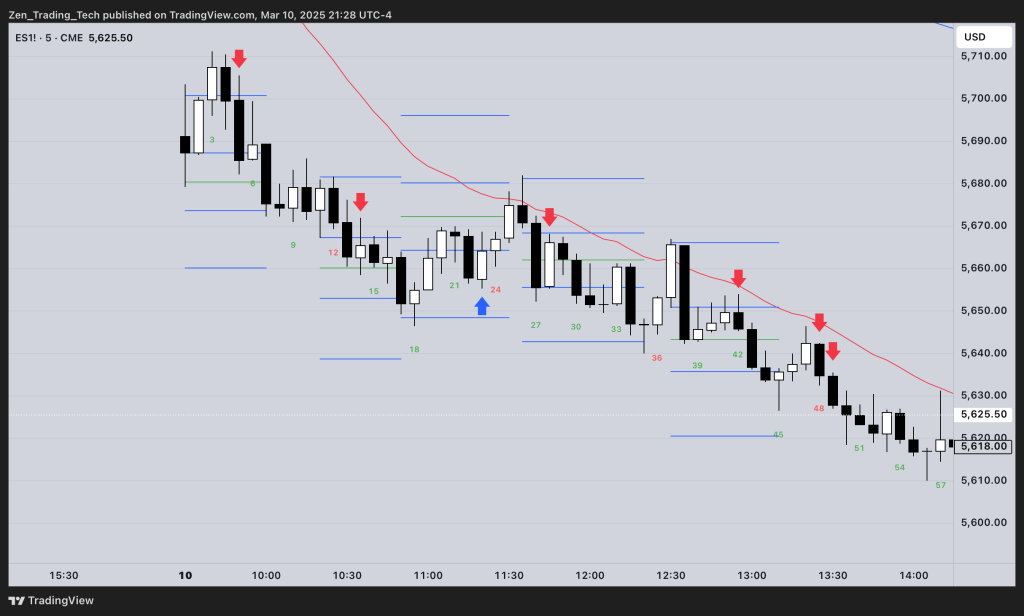

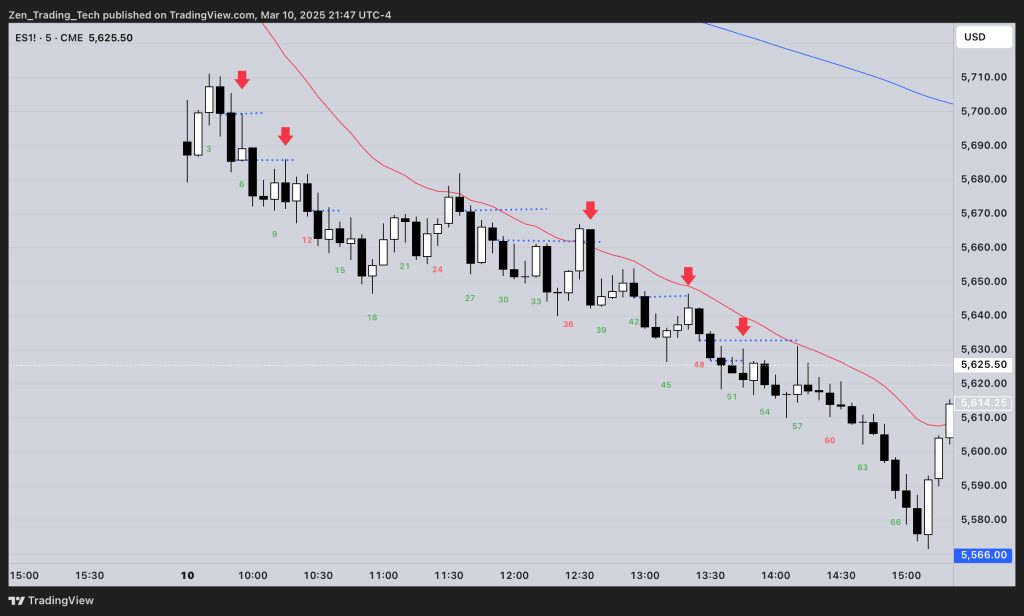

Down a Timeframe: Use 2 min Chart

- Here are the 2 min entries above

- Enter on 1 or 2 legged pullbacks, especially near the MA

- We can plot them on a 5min chart below:

Sell New Lows

- We are always in short

- 70% chance if we make a new low we will test it

- I call this the highest high 1 / lowest low 1

- Even selling a new low of the day small size and adding on a pullback at least a scalp size away

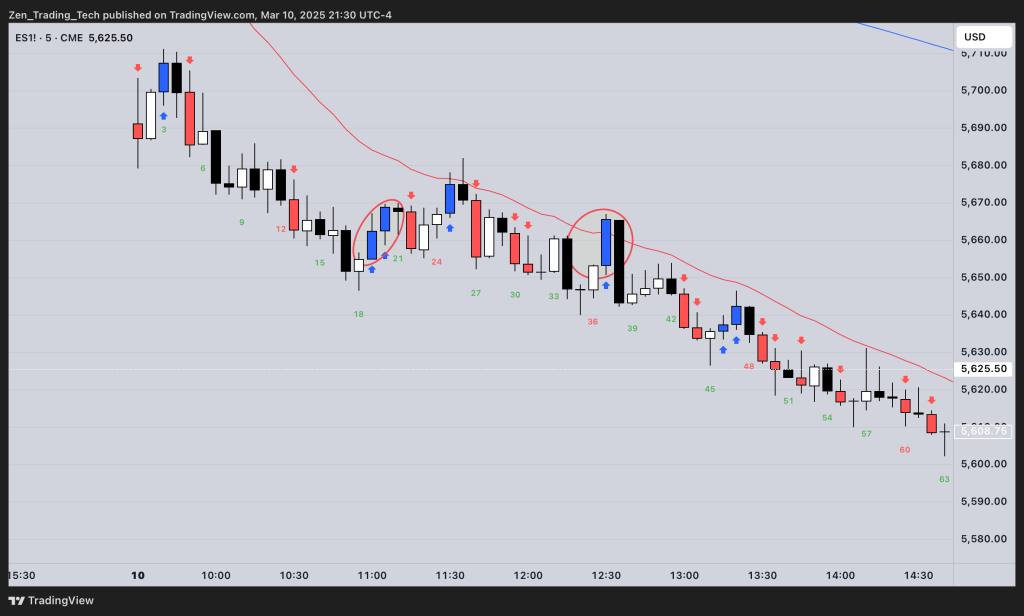

Fenster → I’ll Flip Ya

- The Fenster comes from one of my favourite movies “The Usual Suspects” and is based on Benicio Del Toro’s character: Fenster.

- The ‘Flip Ya’ means one side took a good signal bar and now they need to get out of it.

- I’m betting on them leaving that trade now. They probably won’t enter again for a bar or 3.

- I should get 1r or 2r of their signal bar. I don’t care if they scale in or not.

- The other way to look at it. Imagine you are a beginner, where do you constantly buy on these days and lose? Sell there!

Close > High : Close < Low

- Here the indicator is colouring when there is a CLOSE below the LOW of a prior bar. Or for a bull bar, a CLOSE above the HIGH of a prior bar.

- It is a breakout and follow-through indicator you can find here:

- All of these entries are reasonable BO and FT sells.

- I would not take the counter-trend ones and instead WAIT for them to fail.

- If they succeed then the channel has likely ended and go back to trading range styles of trading.

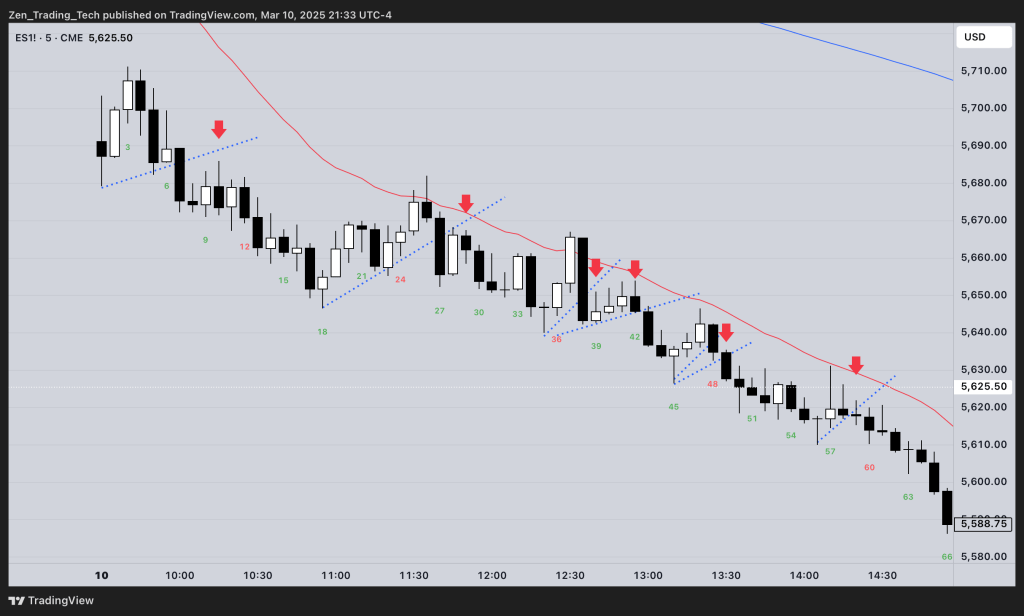

Breakout Pullback Bear Flag

- In a bear channel and tight bear channel, we expect pullbacks to fail and become flags. BOPB Flag entry.

- A good way to enter flags is a breakout and pullback entry.

- Using lines below the micro-bull trend line, you can see where the test back is.

- Using a limit order or selling the test bar, expecting more down.

Limit Order Test of a Breakout Gap

- There is a bear breakout and it creates a breakout gap.

- Entering on a limit order at that area is a good technique.

- If you get a bad entry bar you can bail on it and try again later.

- The best entry is a bar with a tail.

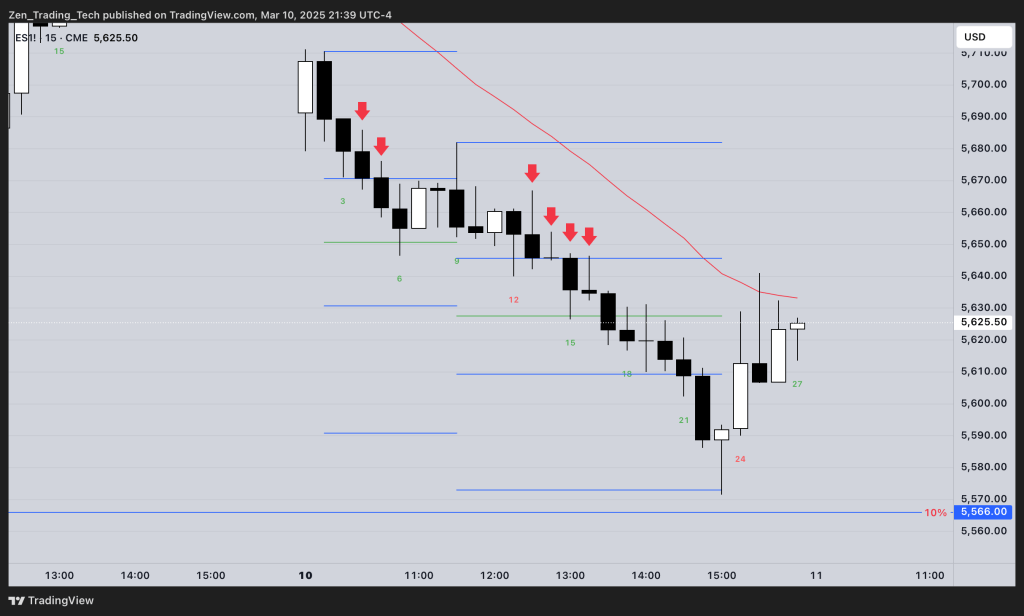

Up a Timeframe: 15m BO and FT (L1)

- Go up to the 15 min chart.

- Strong breakout and follow-through – sell the close with wide stop.

- Or wait for breakout and pullback and sell the low 1.

- Because the timeframe is larger, the trade needs more time and a smaller size to work.

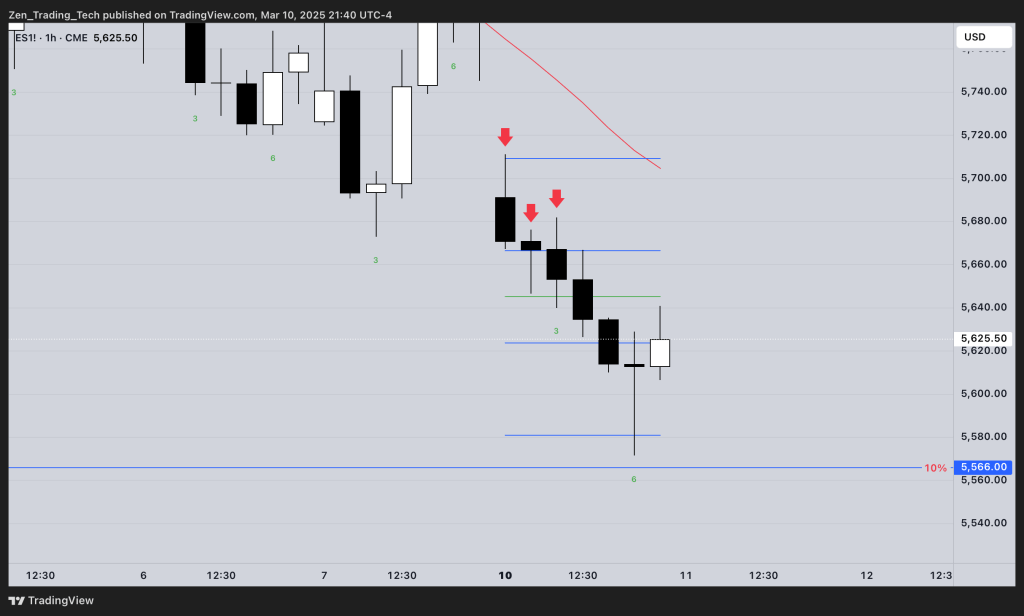

Up a Timeframe: 60m BO and FT (L1)

- Go up another timeframe: 60m chart

- Consecutive bear bars on the open -> expect another legs sideways to down.

- Here it was 2R of the first 60m sell signal bar to mark the end of the bear trend.

2nd Chance Entries

- So there was a good entry you didn’t take. I wish I could have taken it.

- But then the market comes back to test it again – the second chance!

- Here are good signal bars which we came back to test.

- Note you don’t get a second chance at all of them!

Summary

Each of these methods offers a unique way to approach a tight channel.

The key is to practice these techniques and identify which method aligns best with your trading style.

By consistently reviewing your trades and analysing your entries, you’ll improve your ability to capitalise on tight channel opportunities.

Take your time, practice these methods, and build confidence in your ability to enter the market during challenging price action.

I hope you enjoyed this post!

Leave a reply to Tim Fairweather Cancel reply