Most traders think their edge is in their strategy.

But the deeper I’ve gone into this game, the more I’ve realized:

My real edge is repetition. Pattern recognition. Conditioning. Preparation.

What are my repeated weak behaviours in trading and how I can improve on them to become better.

Let me explain how I got there — and how flashcards changed the way I trade.

I take time to open a flashcard and then review yesterday’s price action from the perspective of that card.

Sometimes I will set a timer – 1 minute per card or longer. Or just go through each card and find all the patterns and move on.

📈 Step 1: See the Math Behind Your Trades

Early on, I started tracking my trades more visually.

- Entry and exit marked.

- Initial risk (the stop loss I started with).

- Actual risk (what I really risked once I adjusted).

That simple exercise revealed something most traders miss:

Not all wins are good. Not all losses are bad.

When you understand the risk-reward maths behind every trade, you start making informed decisions.

🔁 Step 2: Continuation vs. Reversal – Know Your Game

The next thing I looked at was the type of trades I was taking.

Not all trades are equal — especially when it comes to hit rate.

Here’s what I found:

- If I focused on continuation trades, my win rate was solid. That gave me room to take less or more than 1R and often add.

- But when I took reversal trades, my hit rate was near 20%. That would’ve been fine if I was getting 5R reward. But I wasn’t. I was barely getting 2R.

The lesson?

If the maths doesn’t work, neither will your strategy.

Tracking this helped me strip out low-quality trades and refine my approach. Most of trading is of a breakout continuation style.

🧠 Step 3: Flashcards for Trader Conditioning

This brings us to the game-changer:

Daily flashcards.

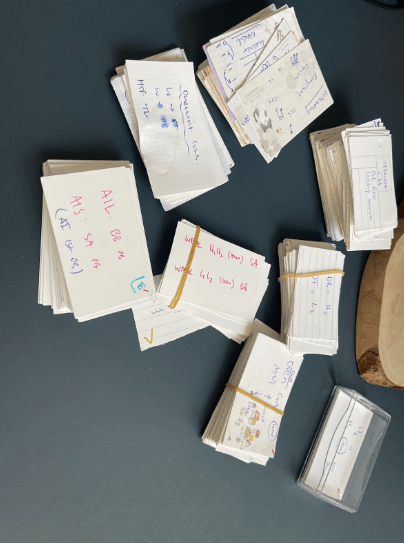

I’ve been doing this for years now.

The first time I built my deck, it had over 60 flashcards. It took me 5 hours to get through. I was so slow at finding patterns.

And I got so tired after only 5 minutes

But over time with practice it becomes faster and easier. Now hardly much stress at all.

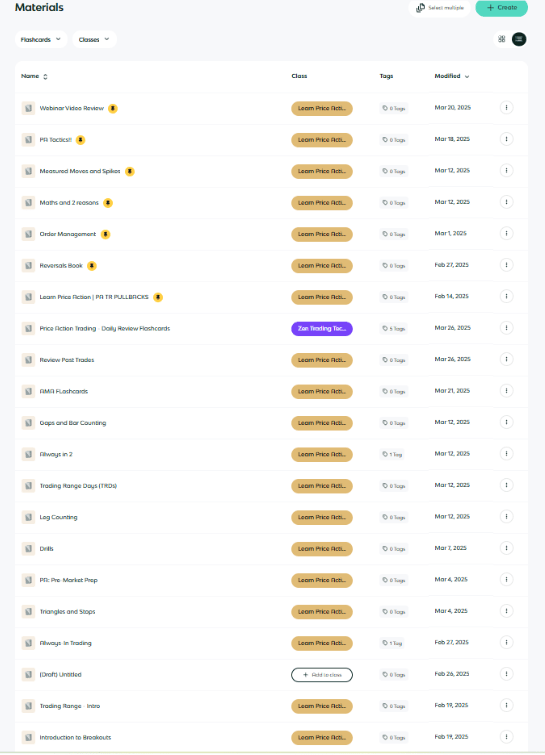

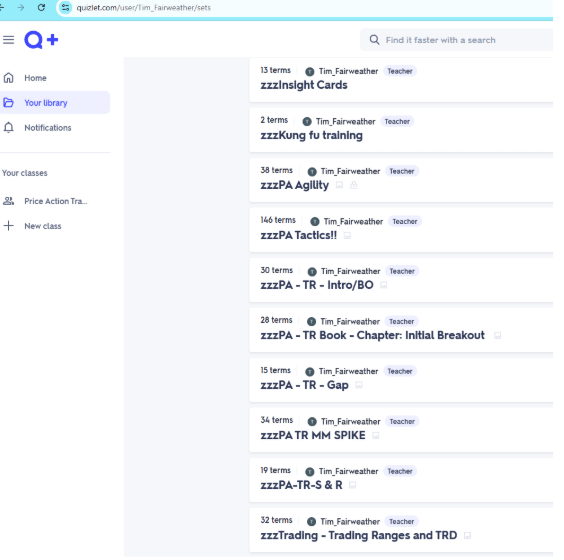

Now my daily drill listing has well over 100. Most of which I put into the deck below.

I can review my full list in under an hour and not too bad.

Why it works:

It’s not about memorization.

It’s about conditioning your brain to see recurring setups across different timeframes:

- Weekly

- Daily

- 60-min

- 15-min

- 5-min

- Open of the Day

- Day Structure (Trend Day vs Trading Range Day)

Every flashcard is built from a real trade — good or bad.

Some made me money. Others cost me.

But all of them taught me something I didn’t want to forget.

🛠 Try It For Yourself (Free Resource)

If you want to try it yourself, I’ve uploaded my flashcard deck here:

👉 ZTT Flashcard Deck on Knowt

Open a flashcard and then review yesterday’s price action from the perspective of that card.

Also – I’ll be uploading more over the coming weeks:

I’ve tried Anki, Quizlet — all of them. Knowt is the easiest and best for this use.

Once you’re in:

- Start reviewing the deck

- Let me know which cards are unclear — I’ll add extra notes or audio

- Use it daily to sharpen your edge before the market opens

🧩 Bonus: Make Your Own Deck

This is where the real power comes in:

- Screenshot your own trades (good or bad)

- Turn each trade into a flashcard — just one per card

- Add a quick note: What worked? What didn’t? What should I remember next time?

When I started reviewing my own mistakes before the session, performance changed.

I became more present. More prepared. Less likely to repeat the same errors.

🎯 Final Thoughts

Flashcards aren’t magic.

They’re just a tool — but a powerful one.

When used right, they become your pre-market conditioning.

Your mental warm-up.

A way to lock in the lessons you’d otherwise forget.

If you’re serious about leveling up your trading — not just intellectually, but habitually — start using flashcards.

And if you do?

Let me know how it goes. I’d love your feedback.

Leave a comment