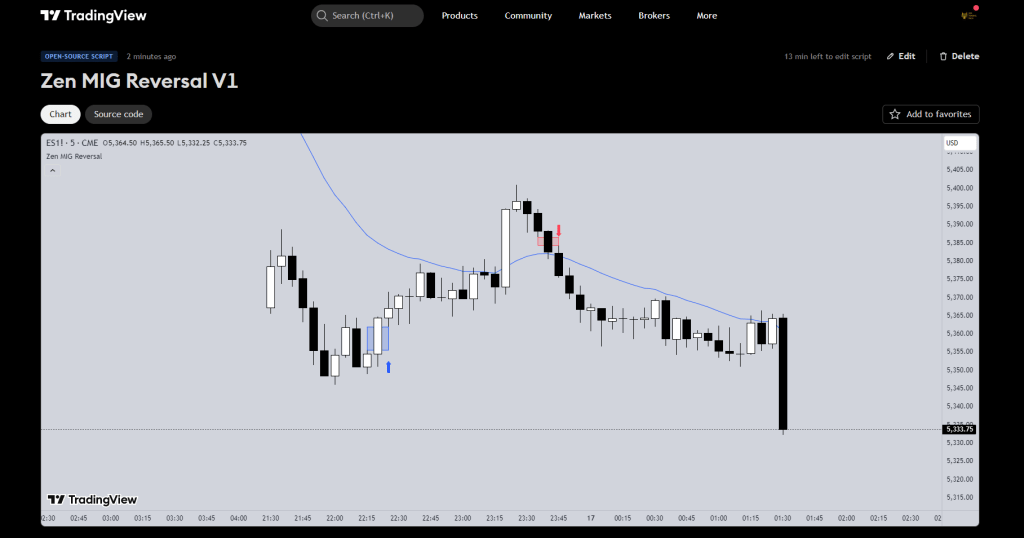

This indicator is built to highlight a specific kind of 3-bar structure — something I’ve seen repeat after momentum gaps or aggressive moves.

it is a micro-gap (gap between 3 same-colour bars) on the WRONG side of the moving average.

Bears getting 3 consecutive bear bars ABOVE the MA? MIG Reversal

Bulls getting 3 consecutive bear bars BELOW the MA? MIG Reversal

It doesn’t happen often, and that’s the point. It’s not designed to give you constant trades. It’s meant to mark rare spots that are worth studying.

The Setup

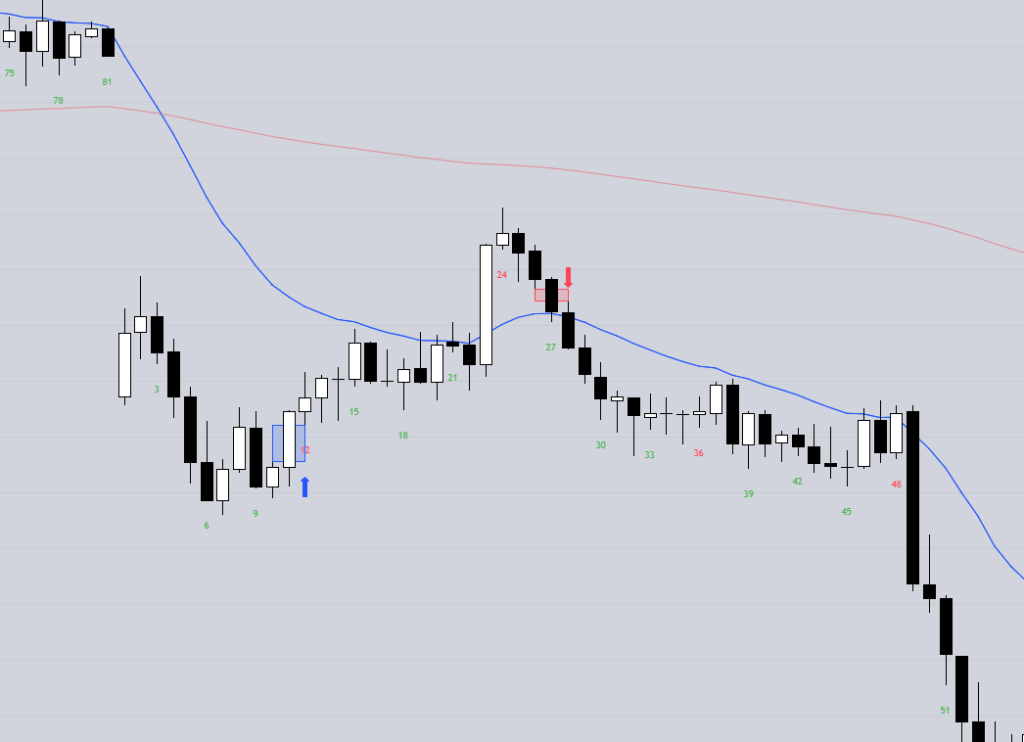

There are two patterns in the script: Bull Reversal and Bear Reversal.

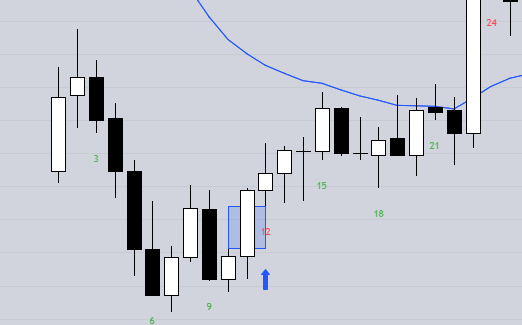

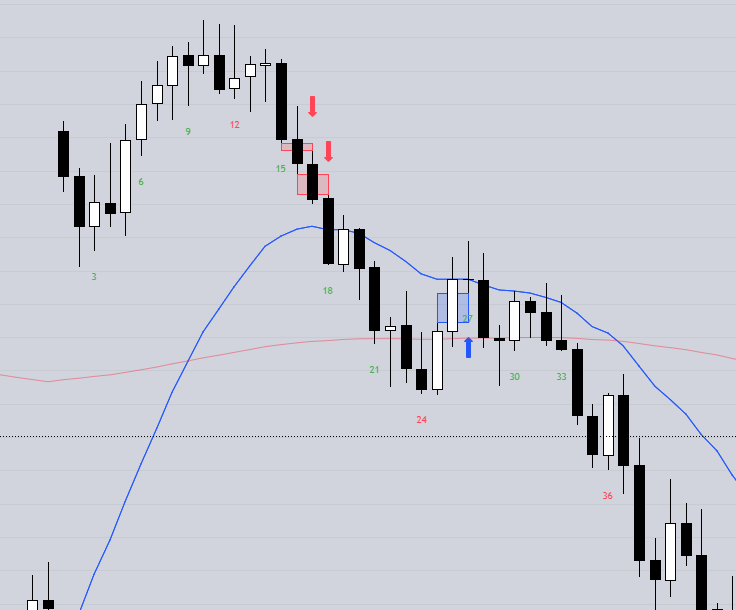

Bull MIG Reversal:

- 3 bull bars in a row

- The third bar’s low is above the high of the first bar – gap

- The low is also below the 20 EMA

This shows strong momentum that might be extended. A box is drawn from the high of the first bar to the low of the third. A small blue arrow appears just below the bar before the signal.

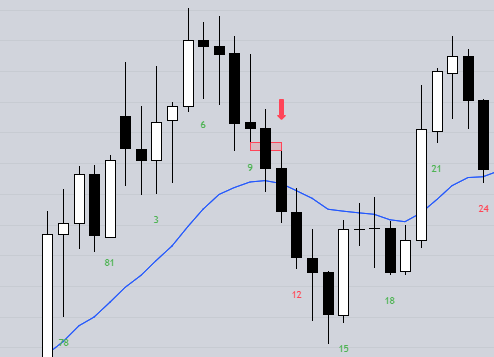

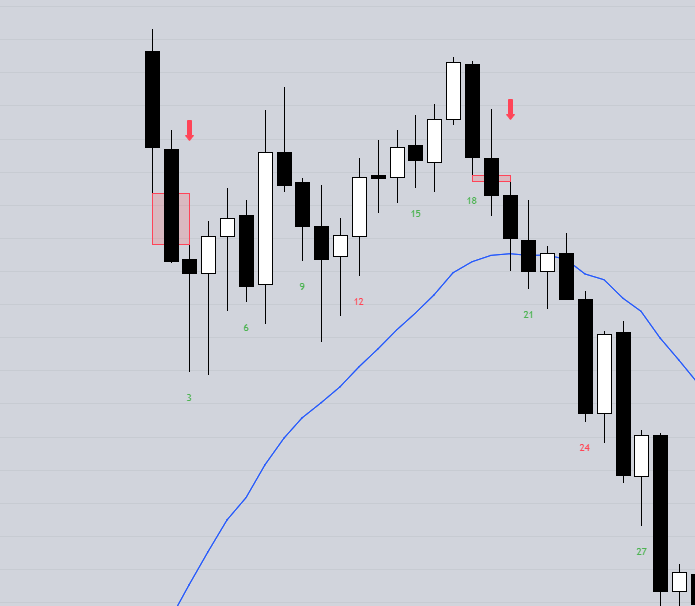

Bear MIG Reversal:

- 3 bear bars in a row

- The third bar’s high is below the low of the first bar – gap

- The high is also above the 20 EMA

This marks a potential exhaustion point after a selloff. A red box highlights the zone from the low of the first bar to the high of the third. A red arrow appears just above the bar before the signal.

Filtering out Countertrend signals

- Sometimes two legged pullbacks have one leg as a MIR Reversal – remember context and try to align yourself with the strongest move

Why Use It

It’s meant for discretionary traders who want to track clean patterns — not automate entries.

It has a very high hit rate – even more if you can exclude / filter out the counter-trend ones.

Custom Options

- Toggle arrows on/off

- Toggle the EMA line on/off

- Adjust smoothing

Final Thoughts

It’s a rare setup. That’s intentional. You’ll only see it a few times per month per symbol — but when it shows up, it’s usually worth a second look.

Link to the indicator:

Zen MIG Reversal V1 on TradingView

Note: This is not financial advice. Use at your own discretion. Backtest everything.

Leave a reply to Tim Fairweather Cancel reply