Here is a simple way to sharpen your entries:

Split the range into halves and review your trades.

Ask yourself:

- Are you consistently trading the wrong side of the range?

- Are you using a stop that actually makes sense based on structure?

- If you are closing early, do you have a habit to have a stop much wider than your target?

🛠️ Exercises to Practice

🔹 Exercise 1: Find a 1R Exit

- Use the 50% mark of the range.

Find a simple 1R (risk:reward = 1:1) target

Focus on small wins first — you’ll clean up a ton of mistakes just by making sure you’re taking trades that have a reasonable 1R built-in.

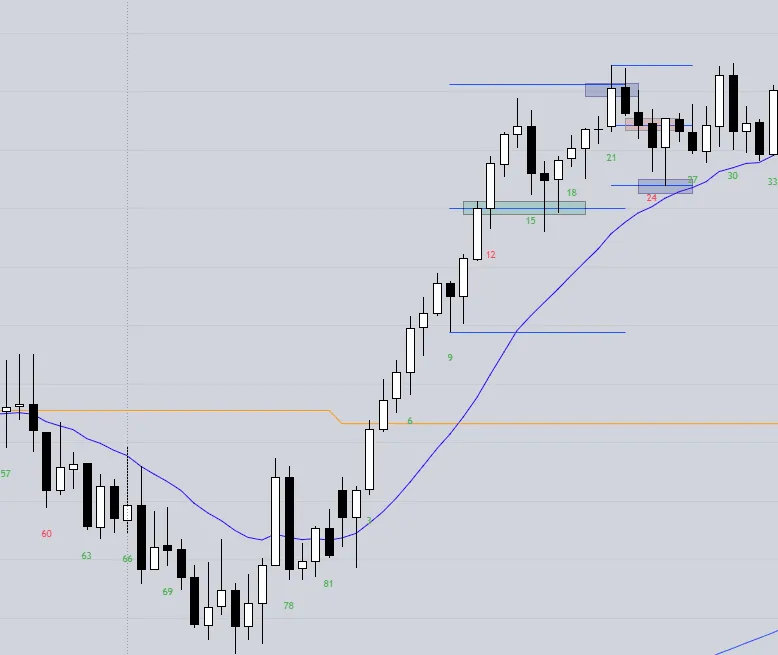

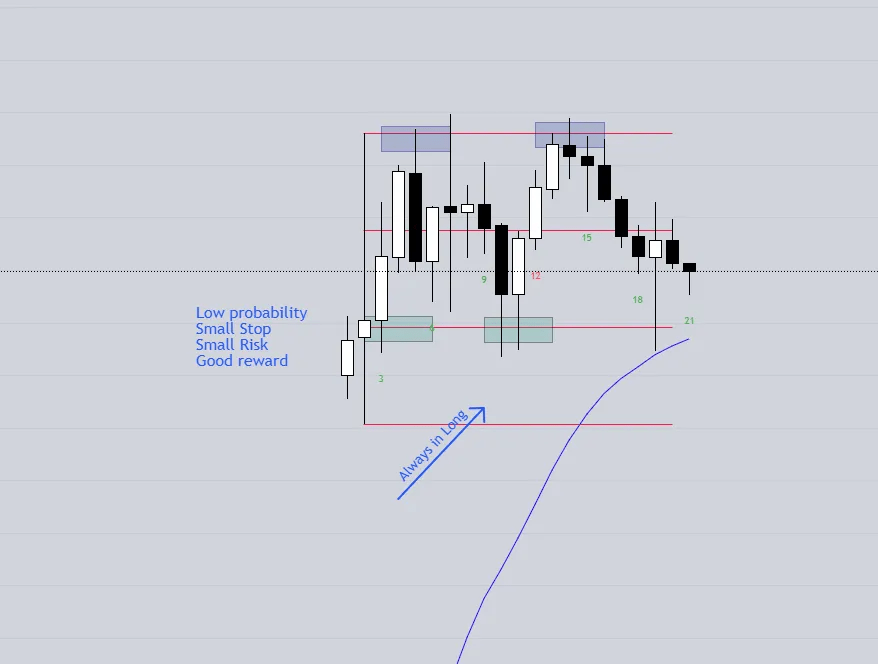

🔹 Exercise 2: Both Sides Can Exist Close Together

Sometimes, both bull and bear trades are valid.

But the Always-In direction shows which side has an easier path to profit.

Key: You still need to pick your battles — one side will often have a smoother path, even if both sides get setups.

🔹 Exercise 3: Mark Up Your Own Trades

Step 1:

Use the fib tool and mark the logical 50% zones.

Step 2:

Now replace the marks with your own real entries.

Did you buy too high? Sell too low? Rush?

Step 3:

Compare your trades to the logical structure.

Were you:

- Always chasing?

- Fading strength?

- Ignoring the range boundaries?

⚡ Final Tips:

- Focus on 1:1 targets for now — simple structure-based exits.

- Spot your good trades AND your dumb ones — don’t get emotional, just notice them.

- Rushing or forcing often shows up clearly when you see your own entries against the clean structure.

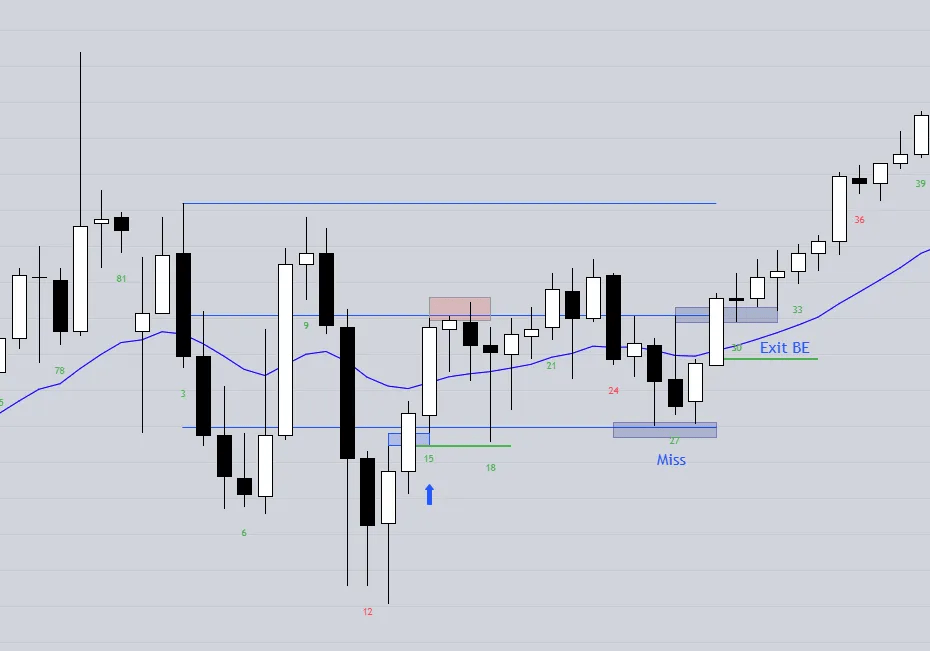

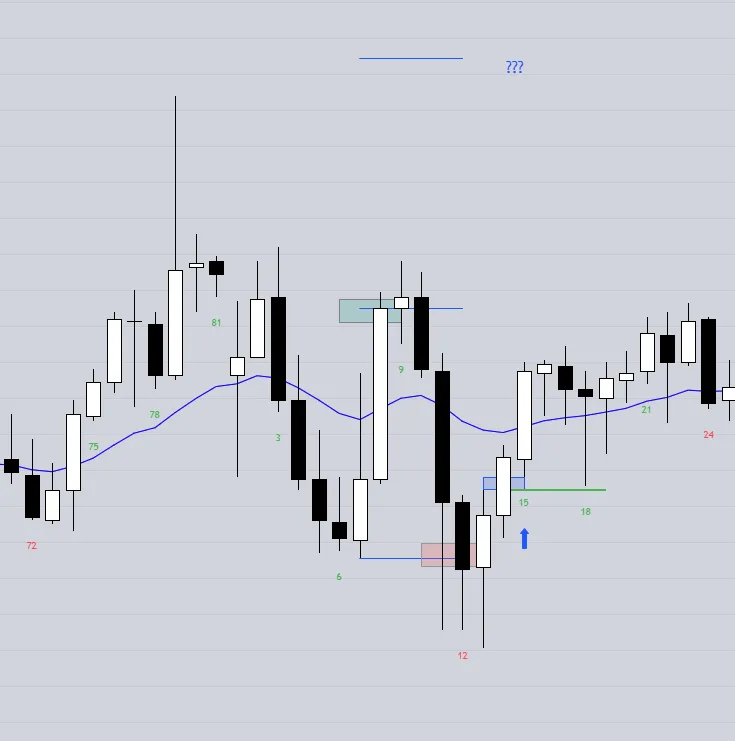

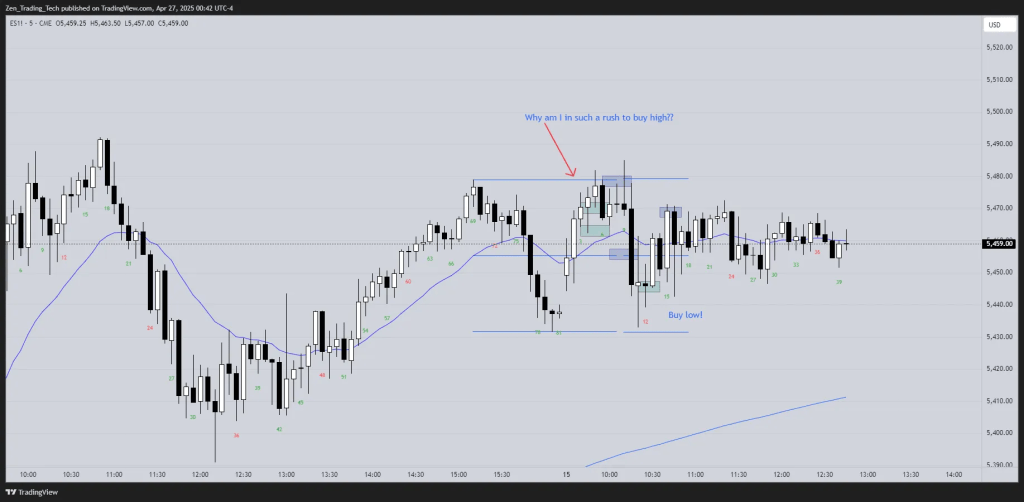

- You can take this drill and look at 1/3s if this is too easy. Some of mine from last week:

Here are some of my dumb ones:

- Why am I in a rush to buy high?

🔥 Why This Works

Most traders don’t realize they’re fighting the market structure until they see it on their own charts.

Awareness first. Correction second.

Get reps in. Review. Adjust.

Let’s go. 🚀

Leave a comment