- 🔍 Introduction

- 🧠 The Concept

- Example #1: Trending TR Day (TTRD)

- Example #2: TR Open and Bear Swing

- Example #3: TR Open and Bull Swing

- Example #4: Bull Trend From Open

- Example #5: Bull Swing Failed, Bear Swing

- Example #6: TR Open

🔍 Introduction

Many traders are working off the 5-minute chart.

But often, a quick check of the Higher Time Frame like a 15-minute chart can clarify whether your trade made sense in the broader structure. I think it helps me hold trades longer.

Bearing in mind the more charts we add to the mix, the more likely we will confuse ourselves. So at first I think its best to practice this on your own trade reviews after the session.

Ideally building towards the ability to stay in sync with both charts.

This exercise forces a second perspective.

🧠 The Concept

Once you’ve marked your trades on the 5-minute, pull up the 15-minute view of the same session.

Ask:

- Was this trade aligned with the 15-minute structure?

- Was the move clear, or did I force something that wasn’t there yet?

- Would the 15-minute view have helped me wait, enter better, or skip entirely?

This isn’t about overcomplicating things.

It’s about training your ability to zoom out briefly before committing.

Lets look at these trades below:

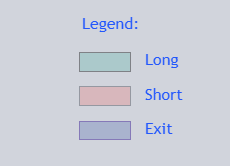

Example #1: Trending TR Day (TTRD)

This trader is trying to trade a breakout but keeps having to exit – sometimes fast, sometimes too slow.

Once we add the 15m chart we develop new ideas.

- Always in long on the 15m chart

- Stop placement was too close for an environment with deep pullbacks, but too FAR for 5 min trades

- Trader is buying HIGH and selling LOW – which is opposite of how scalpers are trading this. Trader should have switched once take two consecutive losses this way.

- Exits were too small compared to stop locations – panic closes probably to feel good about a win

- Neither Breakout B12, nor B18 confirmed with FT bar – should exit faster, avoid trade

- The blue arrows are mark reasonable 15m bull entries – but all 15m sells were low probability only – scalps back to MA

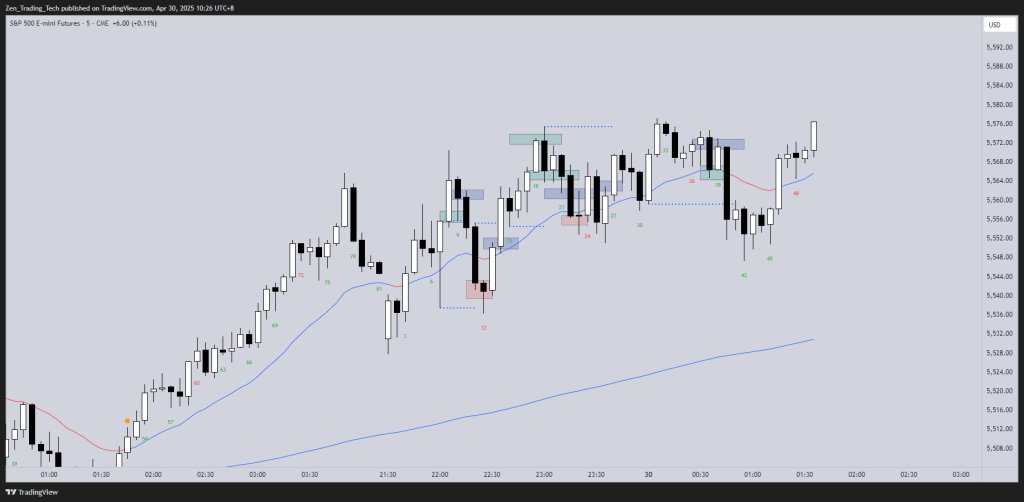

Example #2: TR Open and Bear Swing

- First two trades were reasonable based on 15m chart – trader was quick to realise breakout was down and added to a winner.

- Most days have this kind of behaviour – you try to position for a swing direction but if it fails you just keep waiting for the next setup

Example #3: TR Open and Bull Swing

- Scalp down made sense on 15m chart – back to MA – but the high buy wasn’t confirmed on the higher time frame.

- But the trader quickly switched to buying low and selling high and scalping.

- The trader was also able to switch to a swing buy after 5 reversals – which was consecutive good bull bars on the 15m chart.

Example #4: Bull Trend From Open

- Consecutive 15m bull bars, buy the close and looks like they held for 1 R+

- Microchannel on 15m chart buy scalp

- The trader aligned themselves with the 15m chart all day and did NOT take any CT scalps.

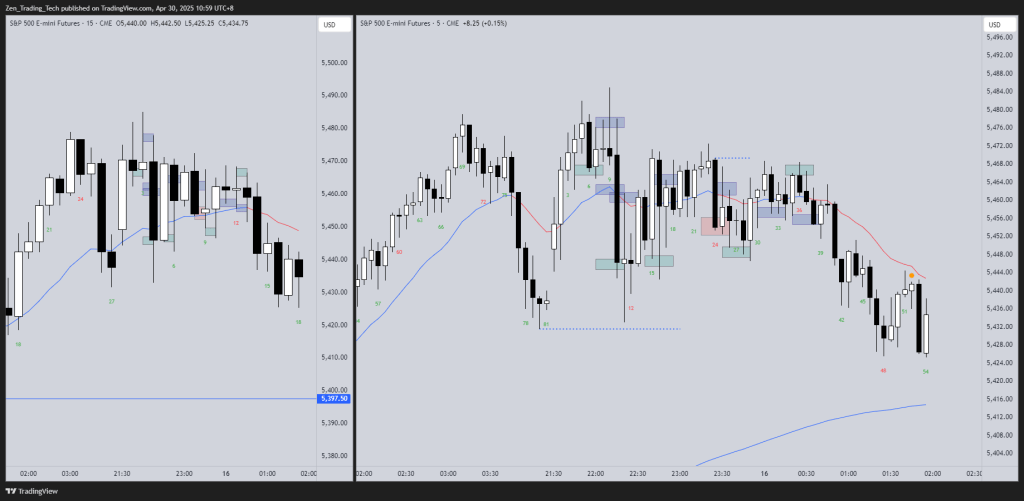

Example #5: Bull Swing Failed, Bear Swing

- Reasonable scalps on the 15m chart on the open, bears have no signal.

- The 15m bull high 1 triggers.

- Ok to take early short, because far from MA so good maths. Also ok to wait.

- Then once 3 good bear bars, trader shorted.

- The trader aligned themselves with the 15m chart all day and did NOT take any CT scalps.

Example #6: TR Open

- Trader was expecting a bull channel, once took a loss switch the BLSH scalping for most of session.

- Most good buys were fading 15m bear bars at the 15m MA – great!

- Apart from a couple of small mistakes, selling B24 close and buying B35 close, mostly in sync.

🛠️ Your Turn to Practice🛠️

- Mark your trades on the 5-minute chart as usual.

- Open the same time period on the 15-minute chart.

- Check if your trade made sense in the 15-minute structure.

- Add a short comment:

- Was the direction clear?

- Did the 15m support the trade?

🔁 Build the Habit

This drill teaches you to:

- Spot where your entries make sense across timeframes

- Avoid weak locations that looked fine on 5m but weren’t supported on the larger picture

- Sharpen timing, without switching timeframes all session

Do this for the next week and let me know what changed!

Tim

Leave a reply to David swartz Cancel reply