Intro

- Research consecutive bars (CSC) for spike trades, second legs and swings

- Free indicator for TradingView

- Free strategy for TradingView

- Some interesting summary results!

Indicator

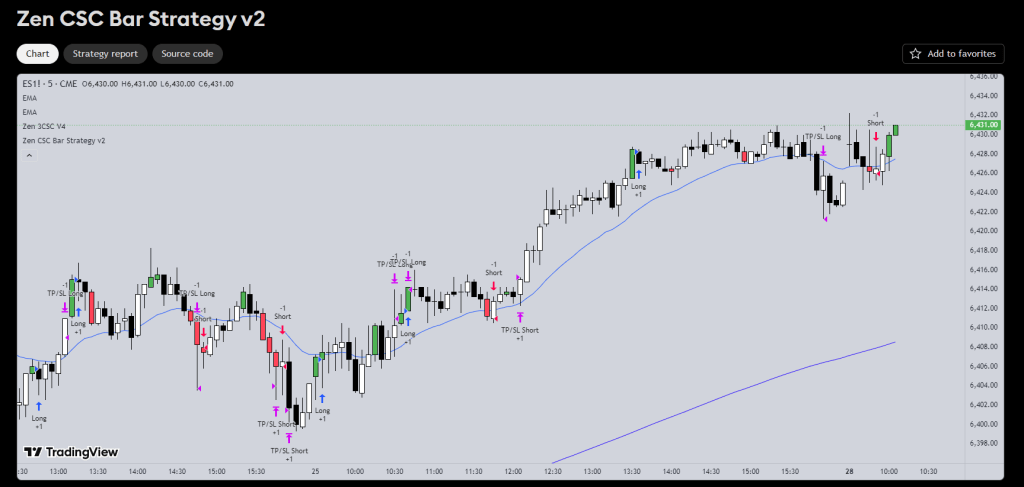

Strategy

Link here: https://www.tradingview.com/script/WEXwahbE-Zen-CSC-Bar-Strategy-v2/

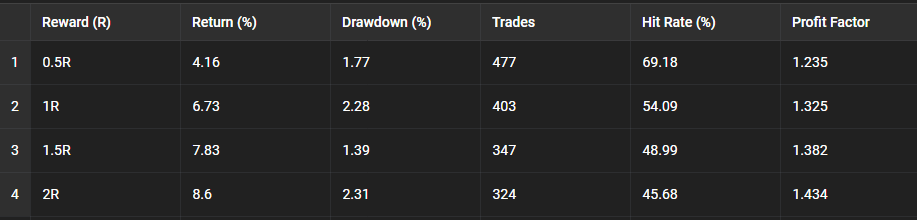

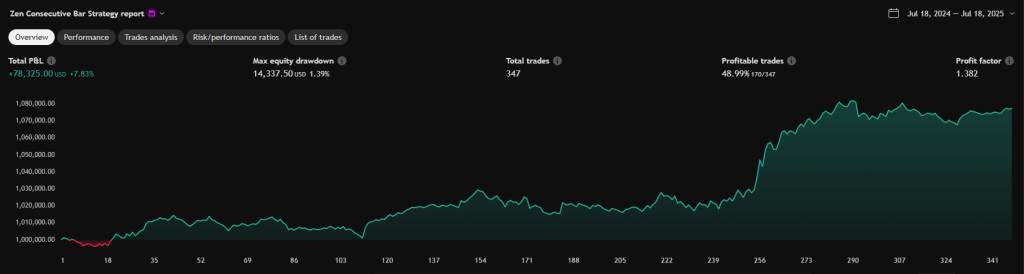

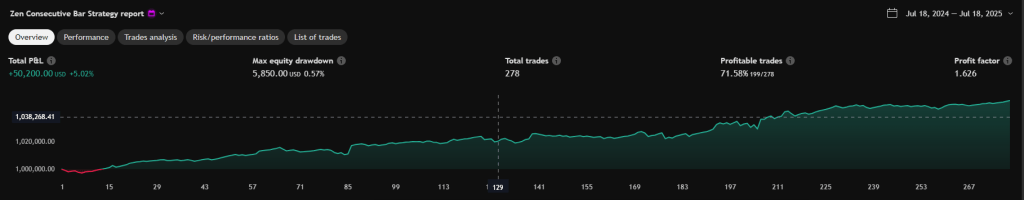

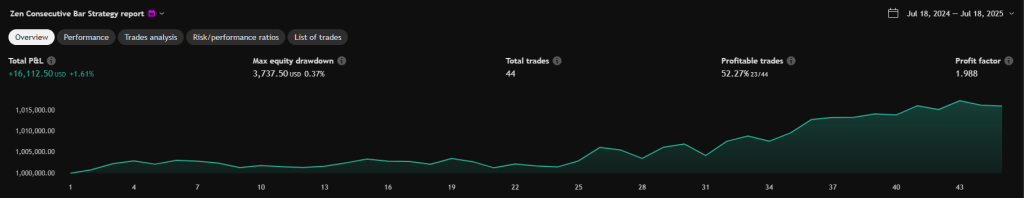

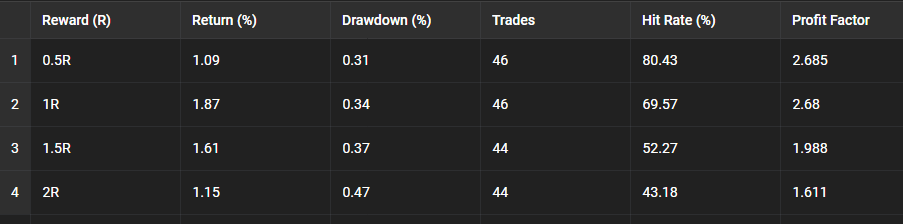

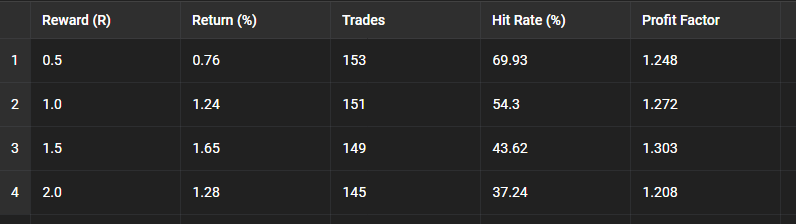

5 Consecutive bars, 5min RTH, ES

- For the 4 kinds of reward (0.5R, 1R, 1.5R, 2R)

- Only 1 trade allowed at a time – fill or kill

- Buy the close of 5th bull bar, sell the close 5th bear bar

- Close trades at close of the session

- Last 12 months

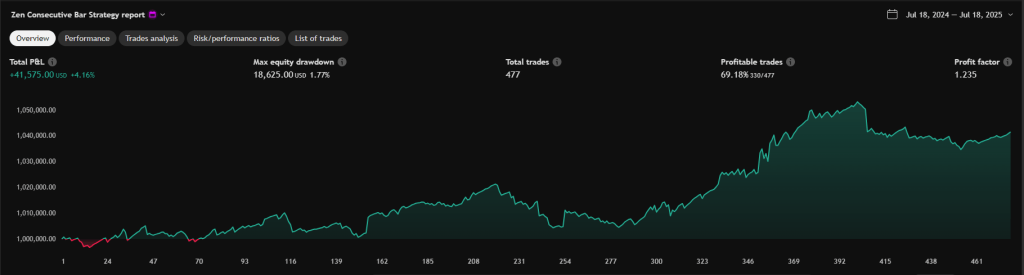

1/2R Reward

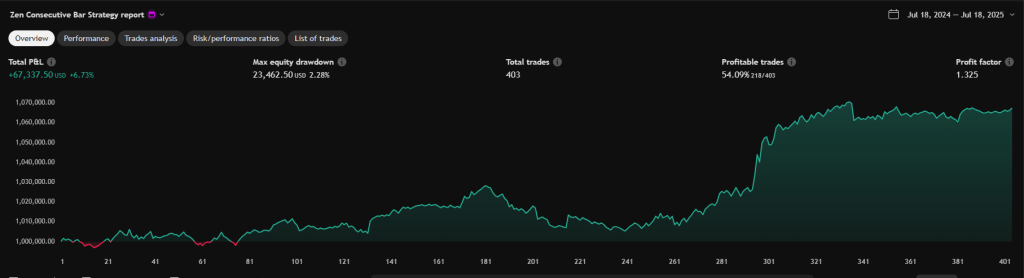

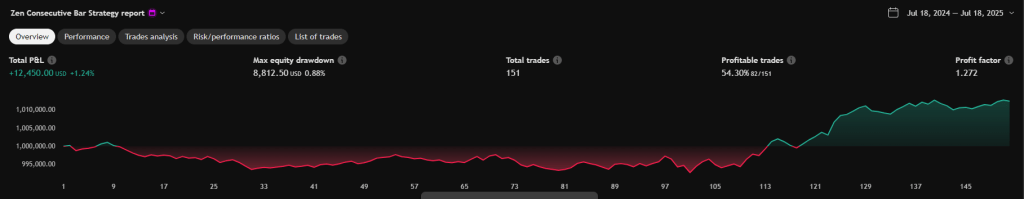

1R Reward

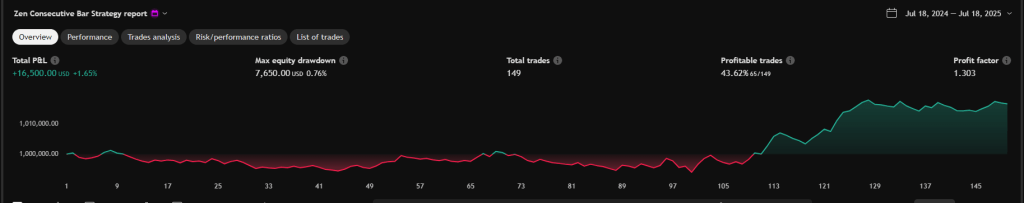

1.5R Reward

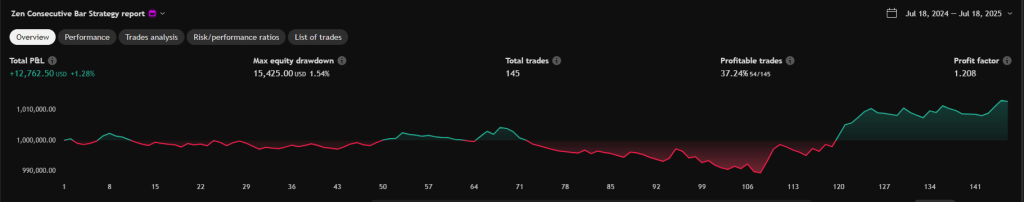

2R Reward

Notes

- Swing outperforms

- Idea could be to add filters

- Maybe MA filter so only triggers if BUY is ABOVE MA, etc

- Trail stop to breakeven at 1R or close 1/2 at 1R?

Idea: Timeframe as a filter – Try on 2min Chart

- Everything worse!

Idea: MA as a filter – BUY ABOVE MA, etc

- Made all of them worse except for the 1R – so interesting!

- What about the opposite – only SELL above MA and only BUY below MA – for reversal idea

Idea: ES mostly goes up, so just take longs?

0.5R

1R

1.5R

2R

Summary

- Doesn’t beat our original settings of trading both ways but still a reasonable strategy

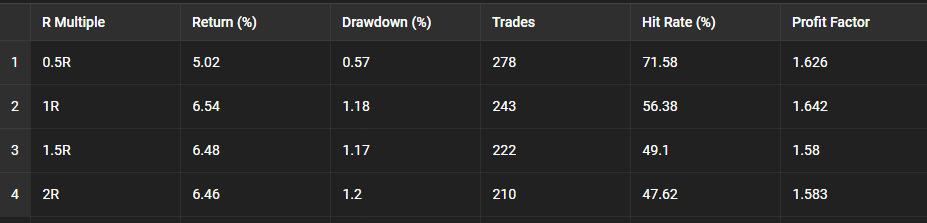

Idea: MA as a filter – REVERSALS – Sell if CSC Bears bars ABOVE MA, etc

- Signal frequency issue – but good results

1/2R

1R

1.5R

2R

Summary

- 2nd leg trading superior hit rate, 0.5-1R expectation

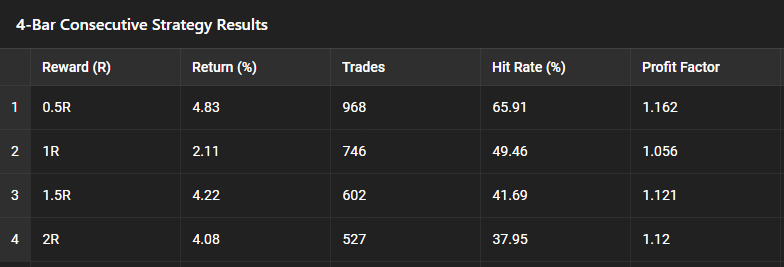

4 Consecutive bars, 5min RTH, ES

- Now what about 4 consecutive bars, long/short, above/below MA

1/2R

1R

1.5R

2R

Summary

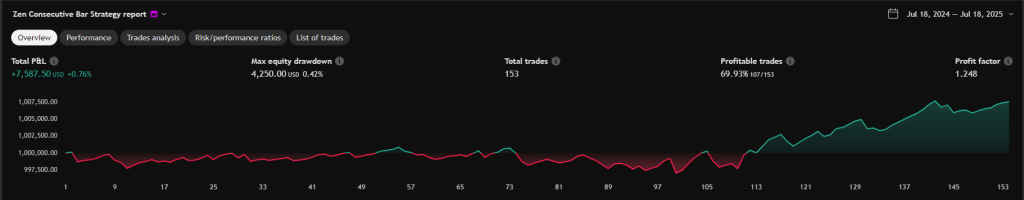

4 CSC Reversals

1/2R

1R

1.5R

2R

Summary – 4 CSC Reversals

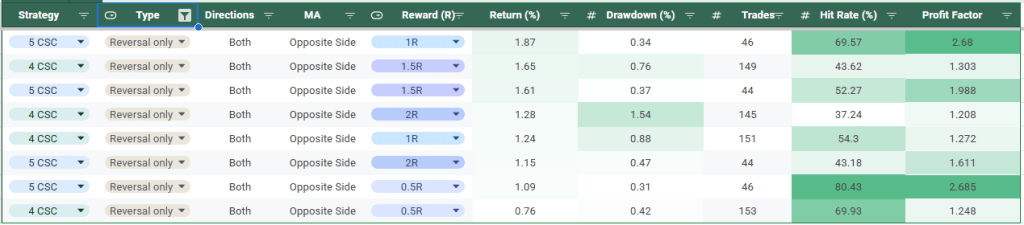

Summary – 4 CSC vs 5 CSC Reversals

- 4 CSC vs 5 CSC Reversals

- High probability % scalp 1/2 – 1R

- Best performance was 1 – 1.5R

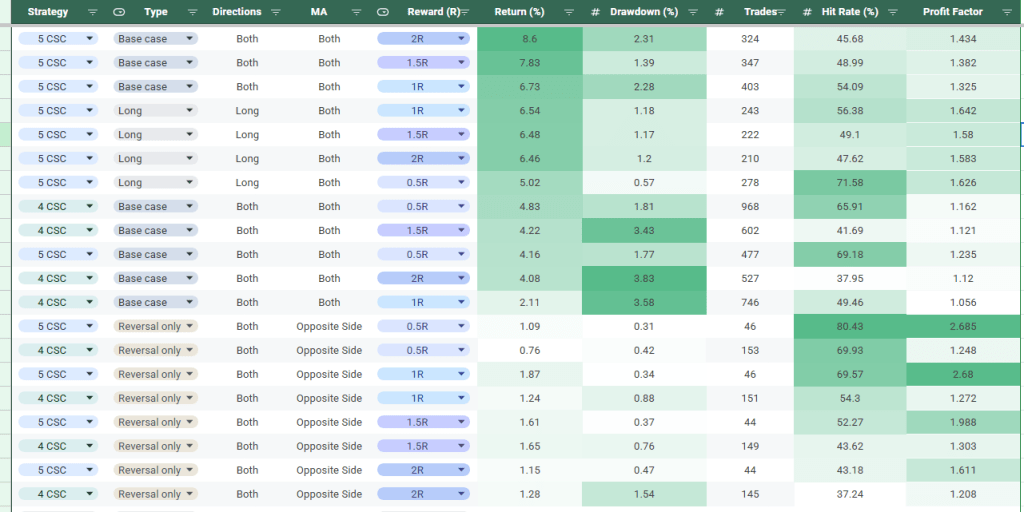

Summary of All Results in Post

- Best performer was 5 CSC swinging

- Highest hit rates

- 4-5 CSC Reversal

- 4 CSC vs 5 CSC Reversals

- High probability % scalp 1/2 – 1R

- Best performance was 1 – 1.5R

- Highest frequency trade – 4 CSC for a scalp

Conclusion

- I hope you enjoyed this post as a way to inspire and encourage you to research statements you hear when you are learning trading.

- With ChatGPT and your charting package it is practical to review and refine your strategies.

Thanks, Tim F

Leave a reply to mahdad Cancel reply