Thanks to everyone who joined the live stream this weekend: Orlando Workshop – Back to Basics + Price Action Coaching Introduction.

If you missed it, here’s the replay:

(Video loaded to where I start.)

During the session, I walked through a couple of documents that are worth revisiting.

Below are the links. Click through to Google Drive, then go to File → Make a copy to save them:

Chart Mark-up Video

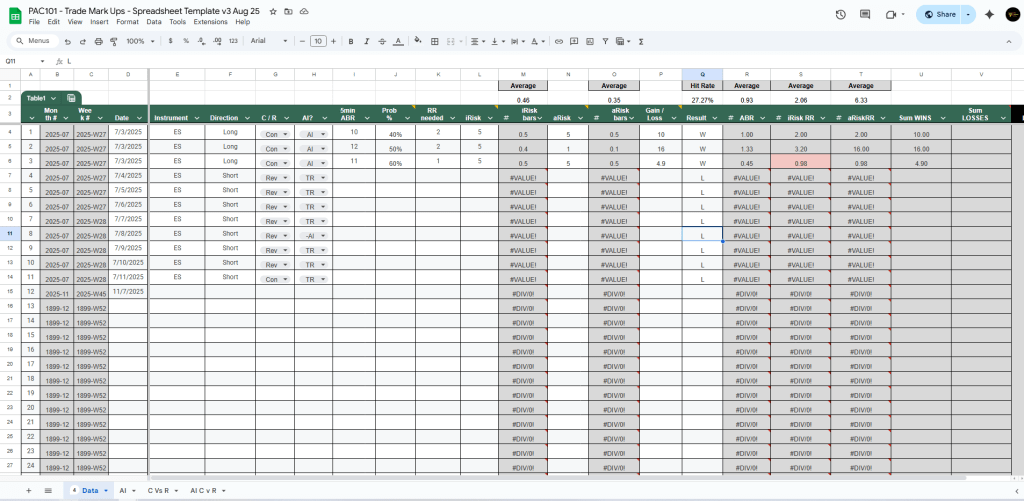

Trade Tracker

- Click File and Make a Copy

- Initial Risk = Stop distance in points

- Actual Risk = How far trade went against (You can call it MAE)

- ABR = Average Bar Range (You can use ATR) measure of average bar size on your execution timeframe

https://docs.google.com/spreadsheets/d/1LciAAGlpbPf-aNezOnH1hr-sn1xzG0A-6bm45Iur16g/edit?usp=sharing

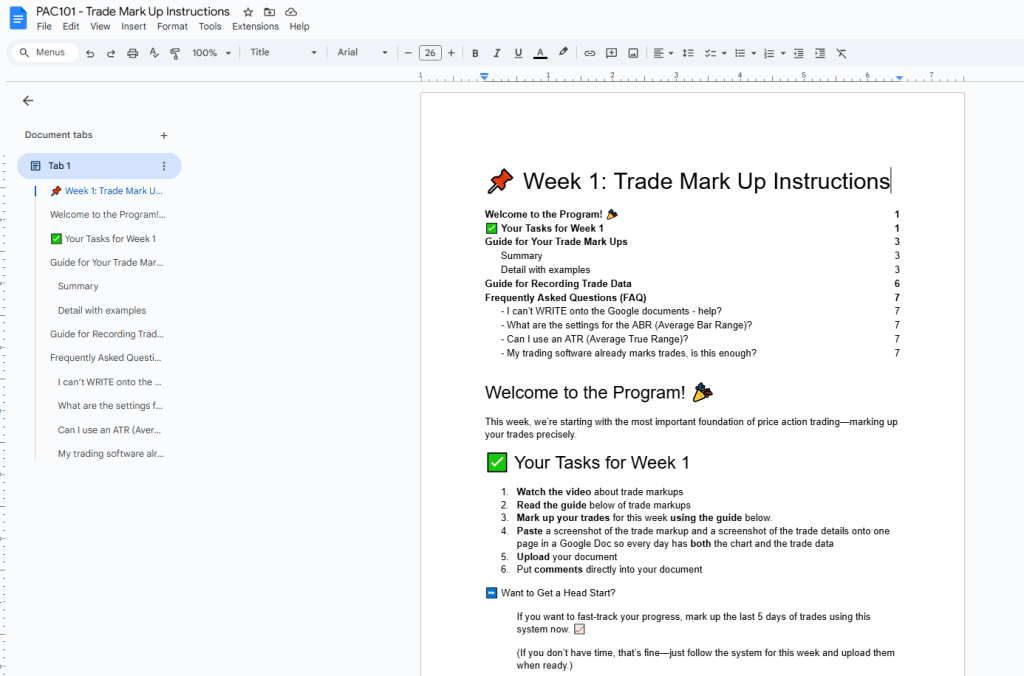

Explanations

https://docs.google.com/document/d/11Mn1H-qxjchYgaAsduzyPhPN373hDWjdNl2ycfwpgVo/edit?usp=sharing

Word Document

You can use any word document – I like Google Docs because it has handy tab feature. Paste screenshots into it. So you will be able to observe your process over time and also run stats on your spreadsheet.

Suggestions

- Start with marking up trades with current options.

- Slowly add more options over time.

– Tim F

Zen Trading Tech

Leave a reply to lovingbravely048bd29c78 Cancel reply