Every trader makes mistakes.

The difference between an edge which survives the market and one that doesn’t is not the absence of errors, but being aware of where they show up.

All of the below have haunted me from time to time. Being aware of them already improves my edge.

Trading is a game of probabilities. Even with mistakes, an edge can be built, refined, and sustained.

This post looks at seven common mistakes and shows how to adjust them so that your process becomes more robust — not perfect, but profitable.

Big thanks to the trader for sending these in!

1. Trading the Biggest Bar on the Chart

Oversized bars look tempting but carry big risk. Losses from them can outweigh many smaller wins.

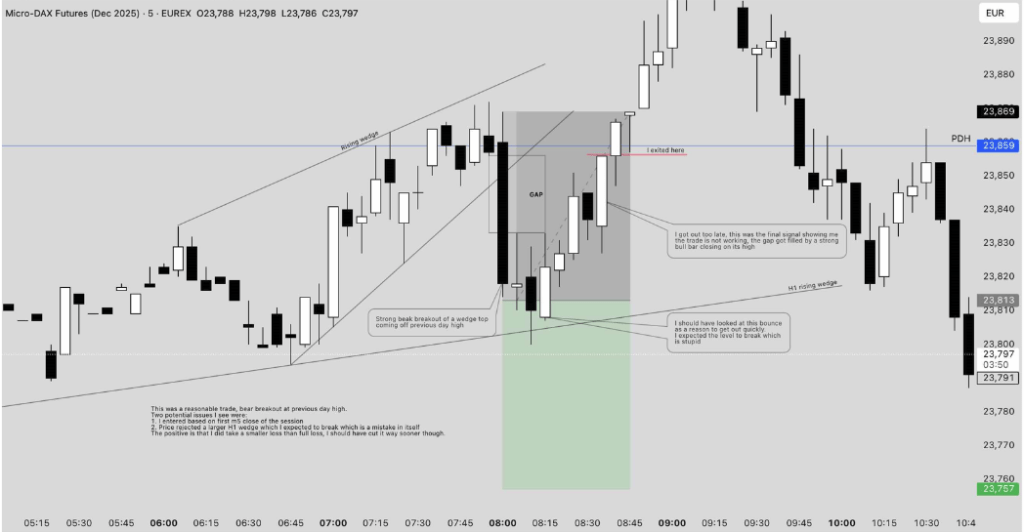

Here the trader was hoping for continuation only for it to turn into a climax reversal. So you can turn the lack of momentum one way, into a possible swing up.

Adjustment: Track how often you trade the largest bar on the chart. Reducing — or eliminating — those entries lowers variance and steadies your curve.

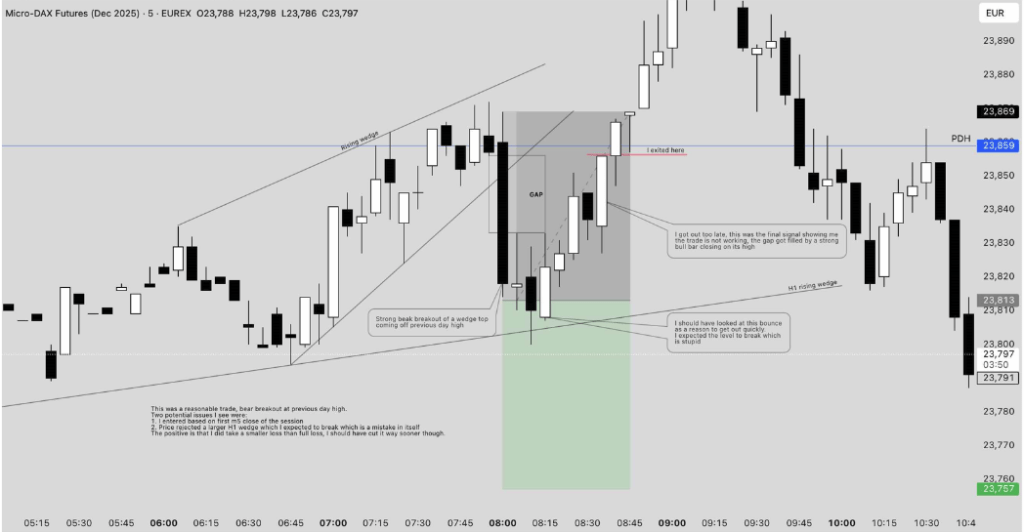

2. Entering Too Early at the Open

The first three bars are volatile and often lead to reversals. Skipping them entirely is VERY-realistic for many traders.

Adjustment: Reduce size or ignore setups in bars one to three (or even 6). Have a plant o enter if it turn into a strong trend (ie pullback entry options.)

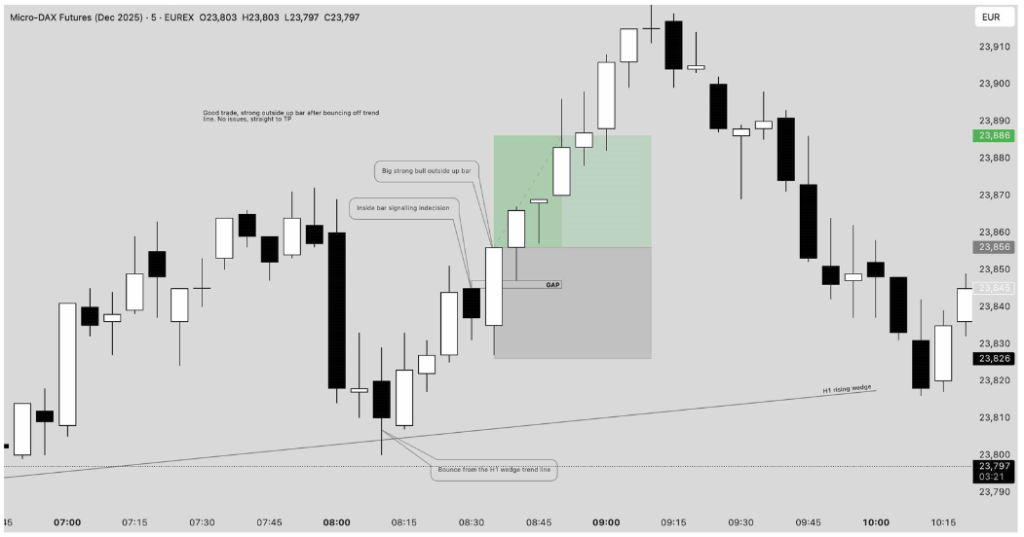

3. Market Cycle – Does my Order Type Match the Phase?

Failing to distinguish between trend, trading range. Failure to use spike, pullback, channel, leg count and climax phases leads to orders that don’t match the trade idea.

Stop entry 1 tick above the high? Aggressive bull breakout

Stop entry 1 tick below a bull bar low? Channel entry / trading range entry

See if you can match order types and locations to the market cycle.

Adjustment: Match the trade to the market cycle. Is it a strong breakout? No? Then a channel entry is the most aggressive available to you. Is it a trading range? Then buying on a stop one tick above a big bull bar is probably not the right trade.

4. Momentum Trades: Need Momentum

High-momentum setups should move quickly. If they stall, the probability drops.

Adjustment: Give momentum trades an additional bit of trade management – maybe a strict time limit. Exiting early when they fail doesn’t remove losses, but it reduces them — preserving capital for the next setup. A failed momentum trade is often a great reversal swing – one the trader in the chart took.

5. Wait for Urgency to Trade Breakouts

How easy is it for traders to enter at the same price?

How come I got in a trade, but traders can get the same price for 20 minutes?

Adjustment: Overlapping your entry price vs never came back to entry price. Use this as a guideline for managing trades.

6. Exiting on Weakness Instead of Strength

Many traders cut winners before an opposite signal appears.

I learn again and again that markets move way more than I think they can.

Adjustment: Instead of exiting on strength, scale out partial size. Wait for clear signs of opposite interest before closing out and see what happens to your trades.

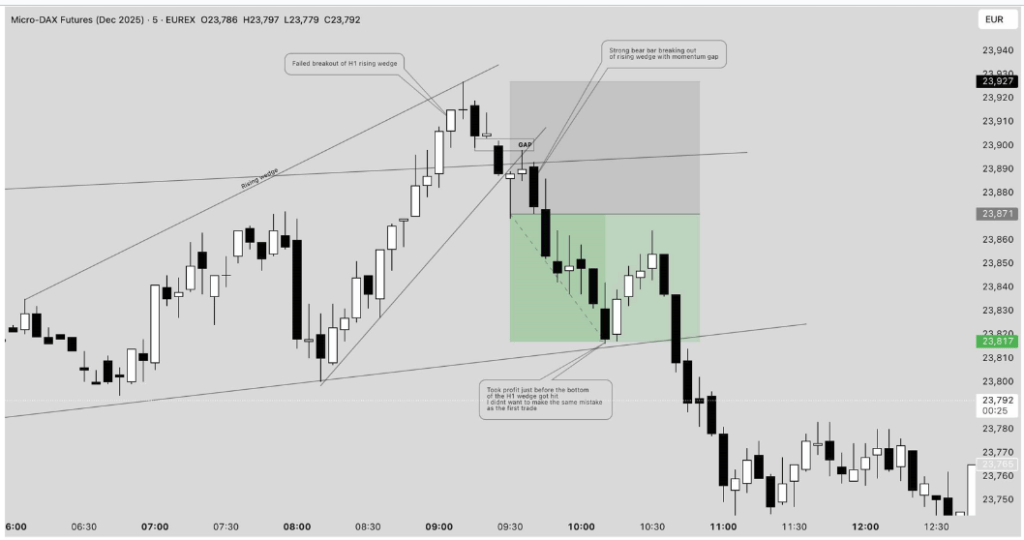

7. Continuation vs Reversal Trades

Continuation means you expect the market to continue what it is doing.

Reversal means the market will stop doing what its doing and do something else.

Continuation trades aim for smaller, higher-probability rewards.

Reversals require larger targets.

Adjustment: Label each trade type before entry. If you mislabel, your risk-to-reward won’t be ideal, but consistent application improves expectancy over time.

Final Thoughts

Trading is not about perfection. It’s about stacking probabilities so that the edge remains positive even while mistakes occur.

Traders will misread context, exit too early, or chase the wrong bar — and can still be profitable over time if they look at where the weakest area is and refine it.

The aim is not to remove mistakes, but to reduce their size, frequency, and impact.

Leave a comment