- CME Data – ES

- CME Settlement (Official Close)

- RTH Close (Session Close, Bar 81)

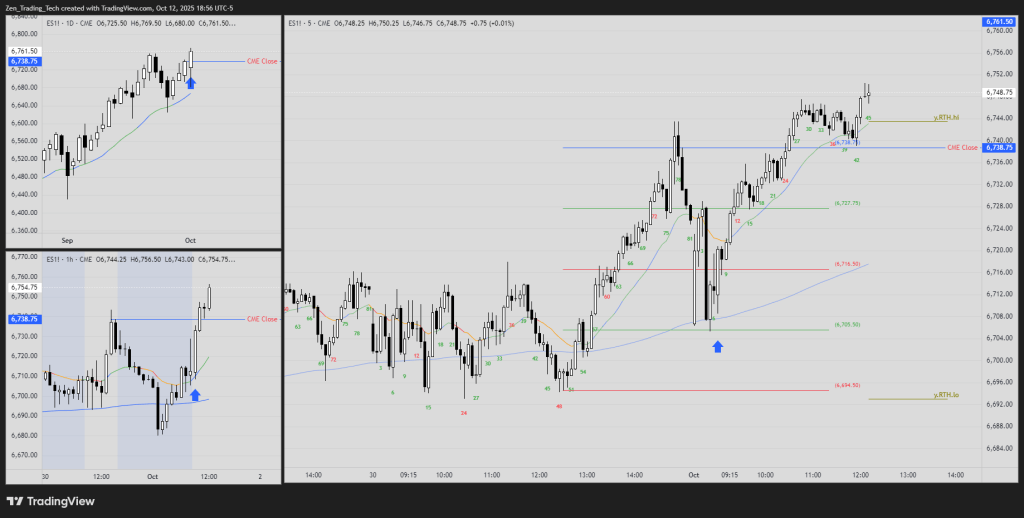

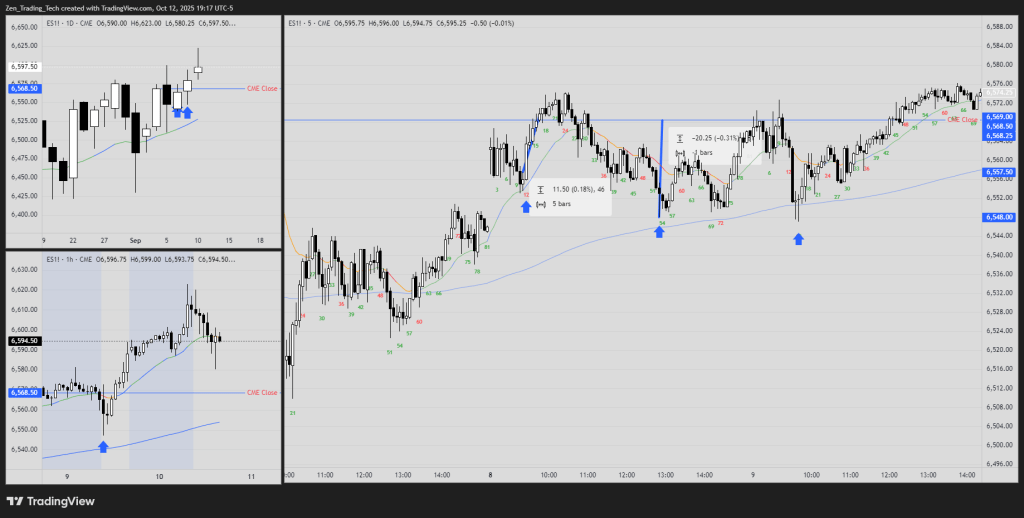

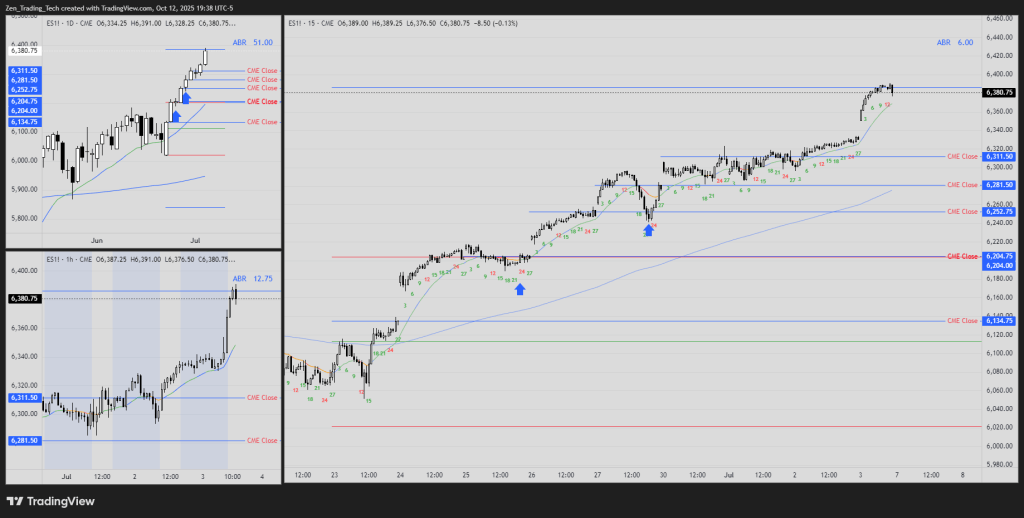

- Successful Test of CME close can be scalp distance away

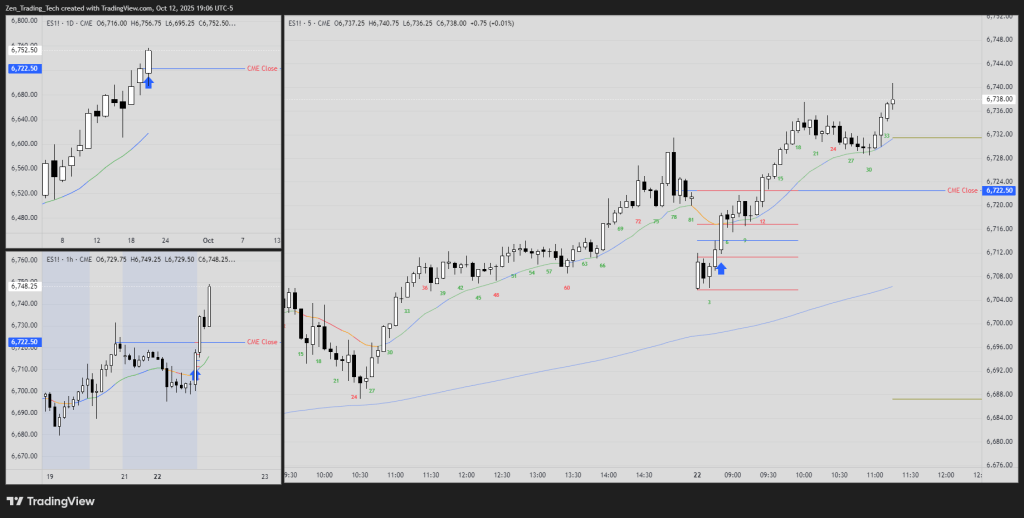

- Using CME Close for MM Up/Down

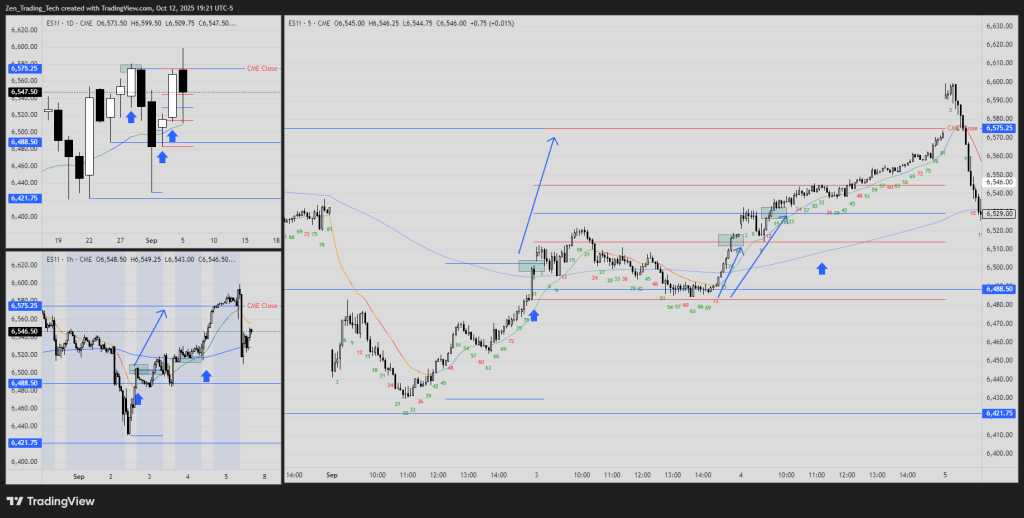

- CME Close test target for swing

- CME Close test target for scalps

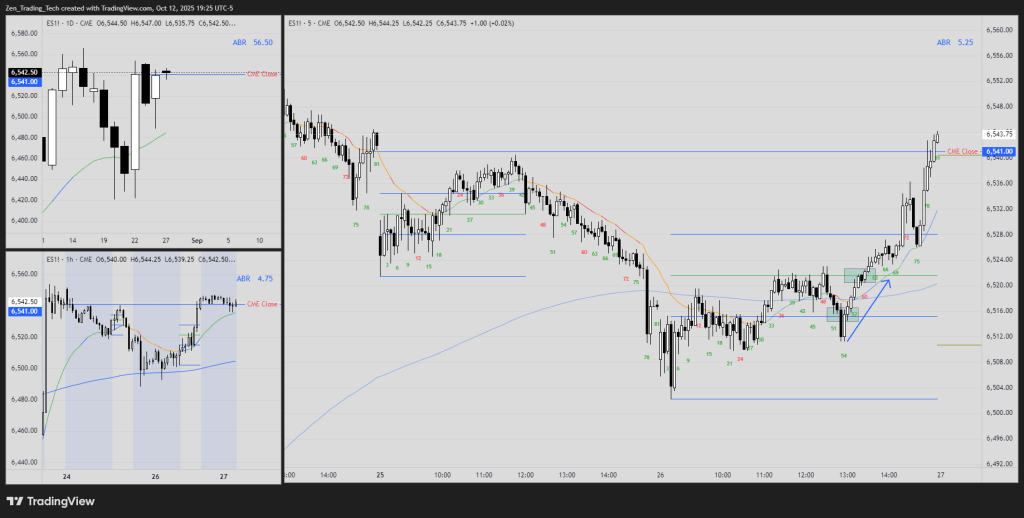

- CME Close prior day exit

- CME Close buy price for swing entry

- CME Close buy limit order but no fill? Strong Breakout MM

- Conclusion

Thanks to my friend and trader Tim Stout for the great chat we had in Orlando regarding ES – Bar 78 vs Bar 81. (CME vs RTH Close.) It was never a focus of my research before, having worked on Bar 81 only. So a big thank you for that mate!

CME Data – ES

- If you are looking to check your data you can find it here:

CME Settlement (Official Close)

- Calculated from the volume-weighted average price (VWAP) of all trades between 14:59:30 and 15:00:00 Central Time (CT) on the CME Globex platform.

- If no trades occur during that 30-second window, CME uses the midpoint of the best bid and ask at that time.

- This value is the official daily settlement price used for margining, clearing, and performance marking.

RTH Close (Session Close, Bar 81)

- Refers to the final trade of the Regular Trading Hours (RTH) session, typically 15:00 CT / 16:00 ET, marking the end of the U.S. cash equity session.

- Represents the last traded price of the RTH chart (often bar 81 in a 5-minute RTH sequence).

- Commonly used by discretionary traders for price action analysis, daily structure, and “day session” references.

- It is not used for settlement or margin purposes and may differ slightly from the CME settlement.

Key Distinctions

| Aspect | CME Settlement | RTH Close |

|---|---|---|

| Basis | VWAP (14:59:30–15:00:00 CT) | Last trade at session end |

| Function | Official mark for margin & clearing | Visual/trading reference |

| Alignment | Globex system time | U.S. cash equity close |

| Stability | Smoothed over 30 seconds | Can vary on last tick volatility |

| Use Case | Reporting, clearing, gap calculations | Price action analysis, session studies |

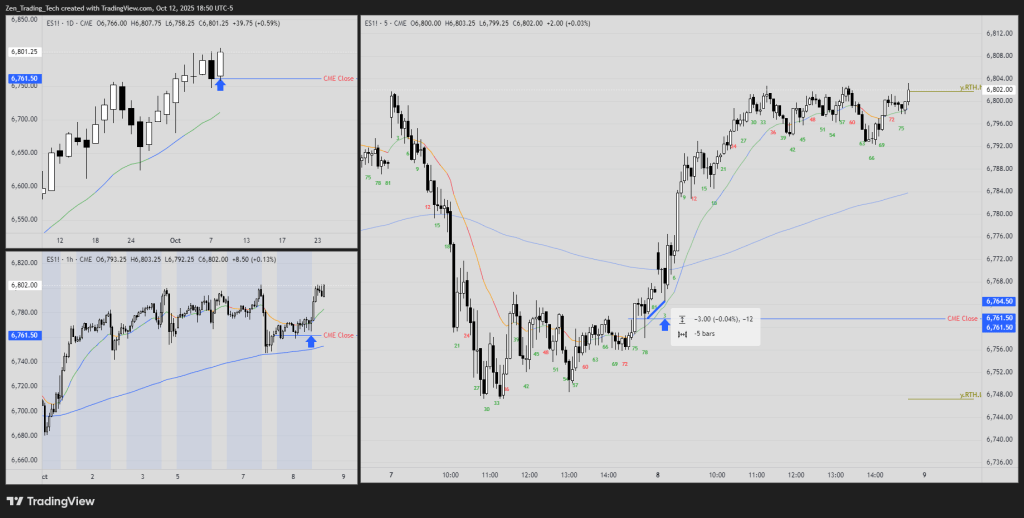

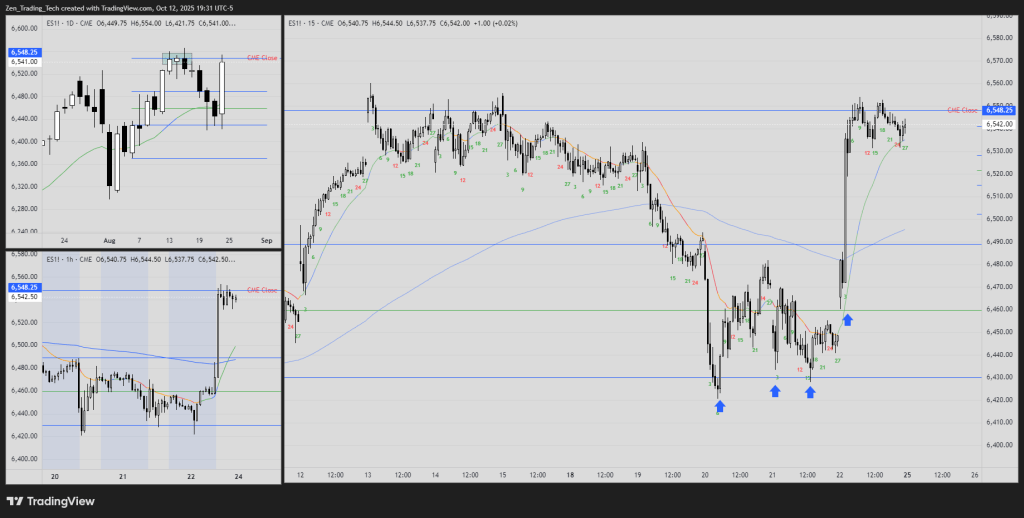

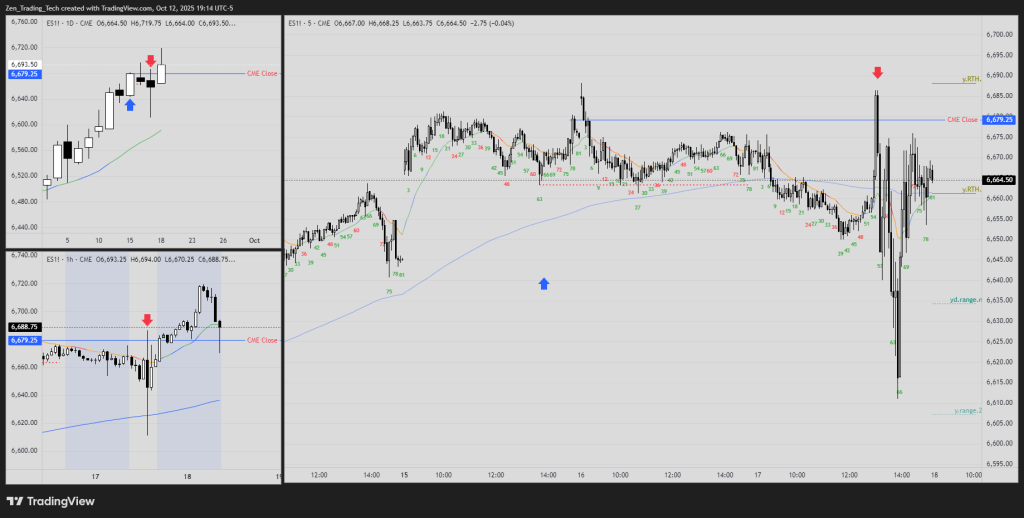

Successful Test of CME close can be scalp distance away

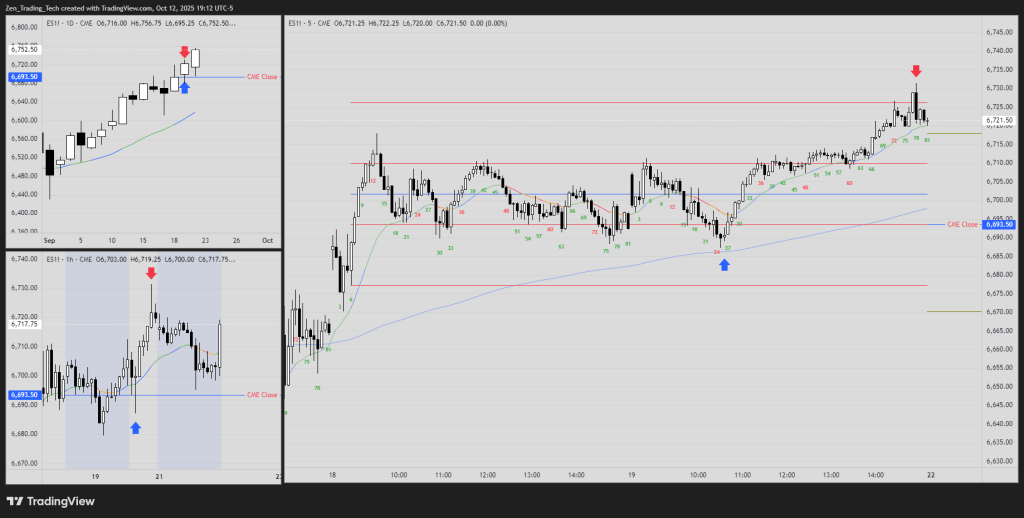

Using CME Close for MM Up/Down

- Failed breakout above /below can be a useful reference for swing targets on the open.

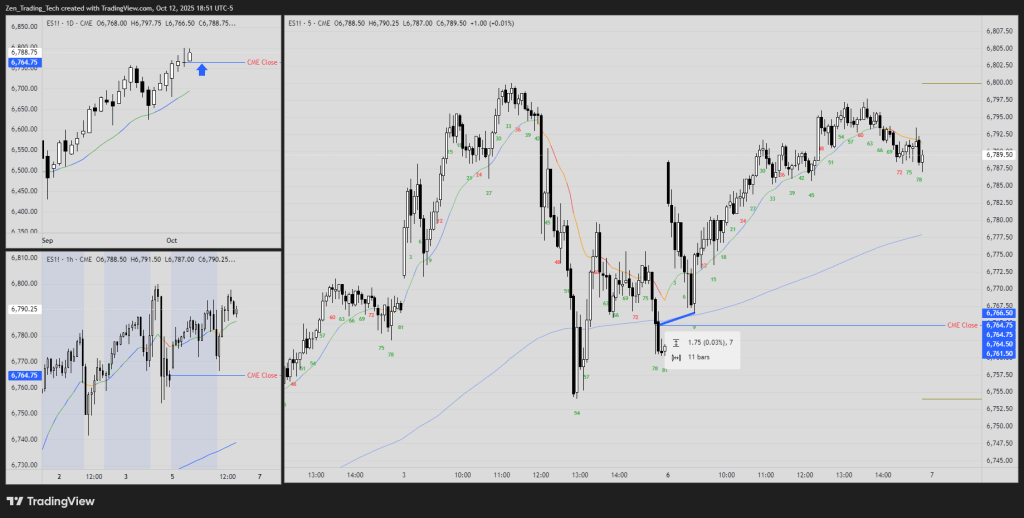

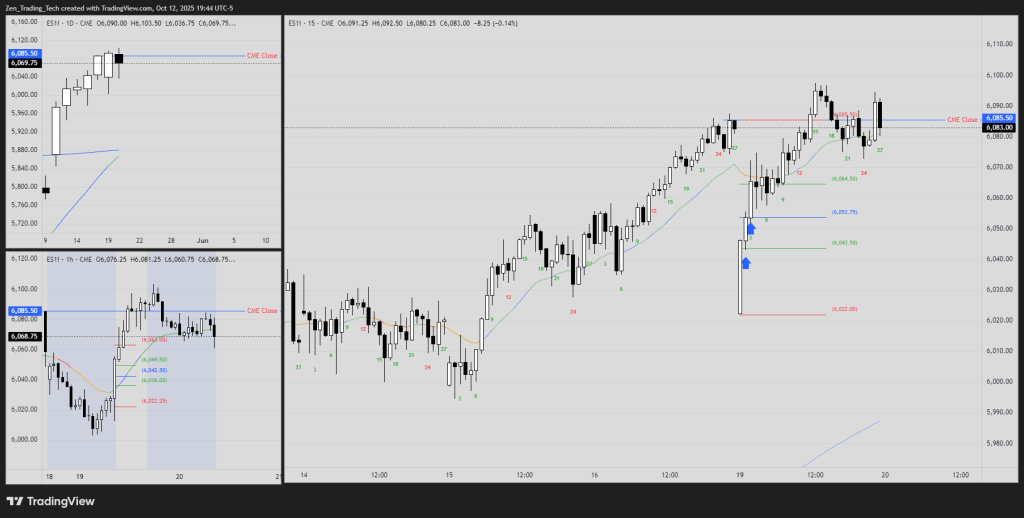

CME Close test target for swing

- Daily chart, good bull bar, but we open below it? Swing towards it the next day – look how precise!

- Strong selloff from a good buy signal on the DAILY chart

- So potential multi-day swing target – here using 60 mi chart ETH and RTH

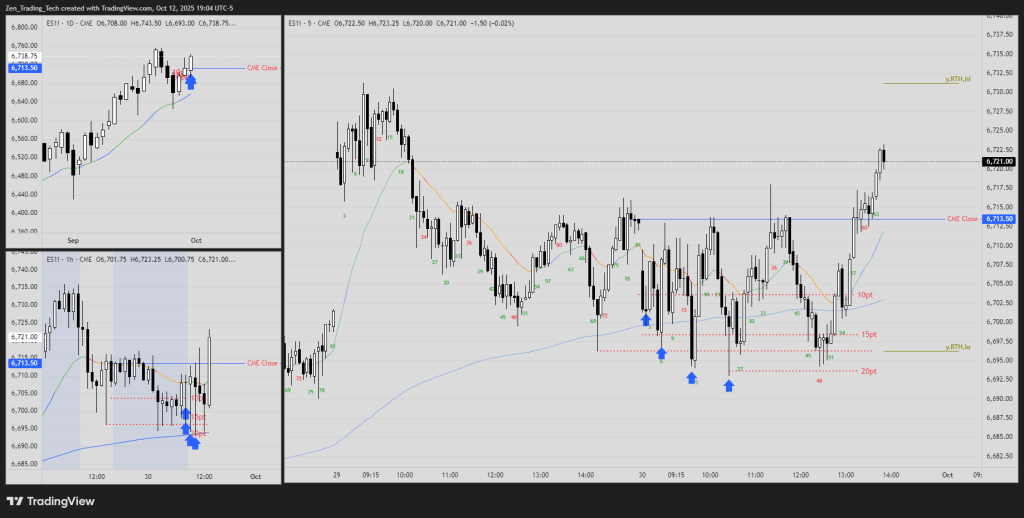

CME Close test target for scalps

- Traders buying 10pt – 15pt – 20pt away back to it and exiting at it

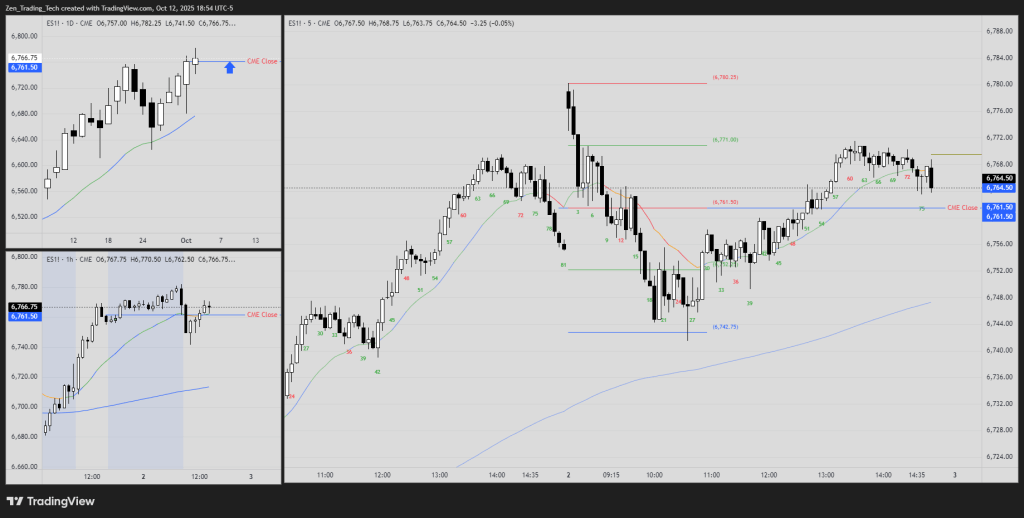

CME Close prior day exit

- Bull bar buy signal, but then reversal bar triggers, exit at that price

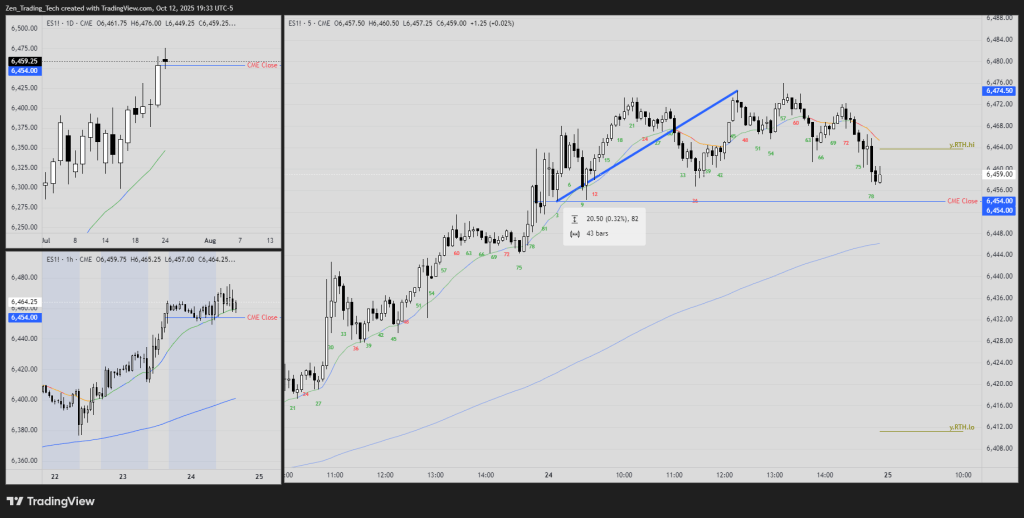

CME Close buy price for swing entry

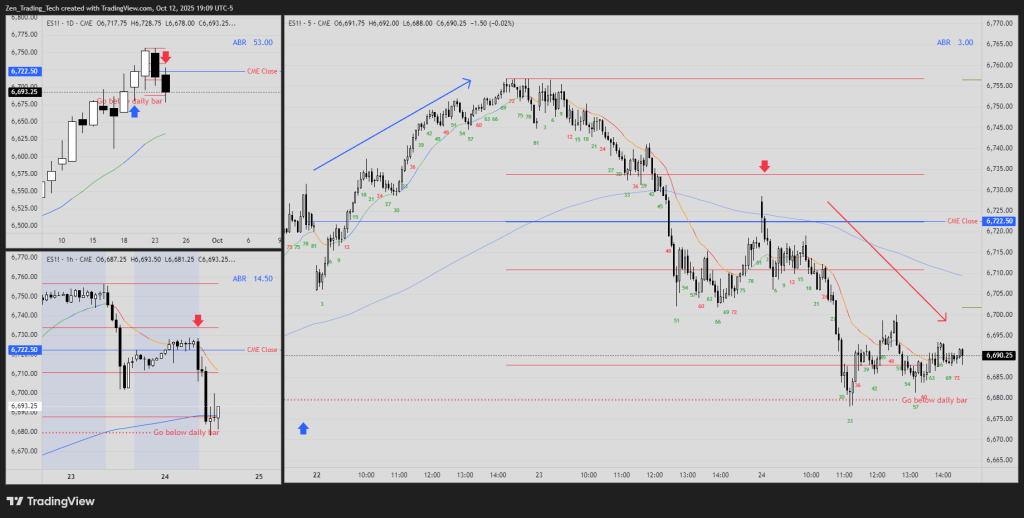

CME Close buy limit order but no fill? Strong Breakout MM

Conclusion

- I hope the exploration above will inspire you to research the appropriate magnets in your trading.

- If you day trade ES I would consider adding this to your arsenal!

Thanks,

Tim F

Leave a reply to gleaming85caea15ba Cancel reply