- What is a Measured Move?

- Indicator

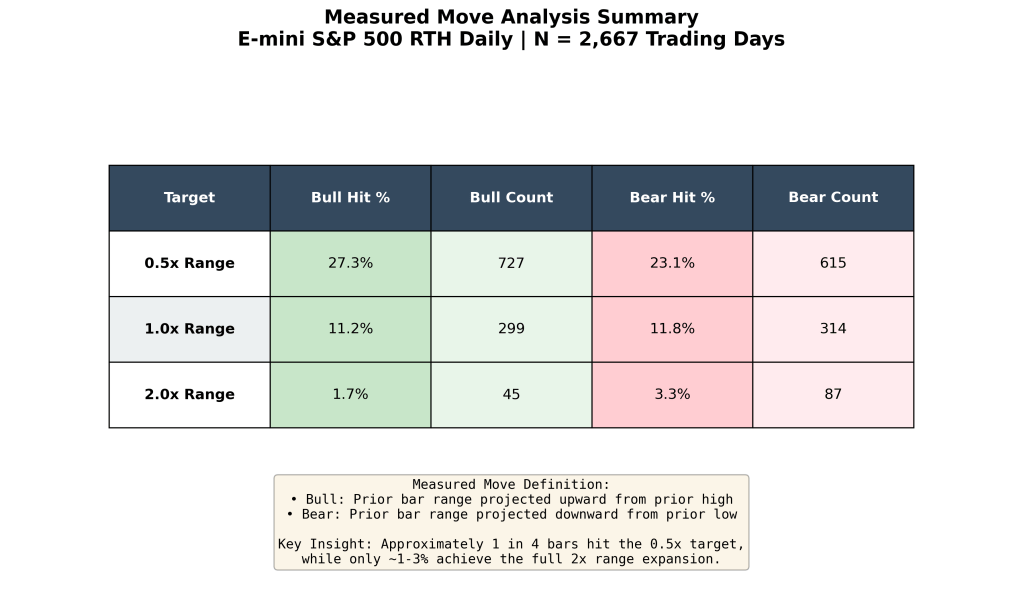

- ES Daily Chart and Measured Moves

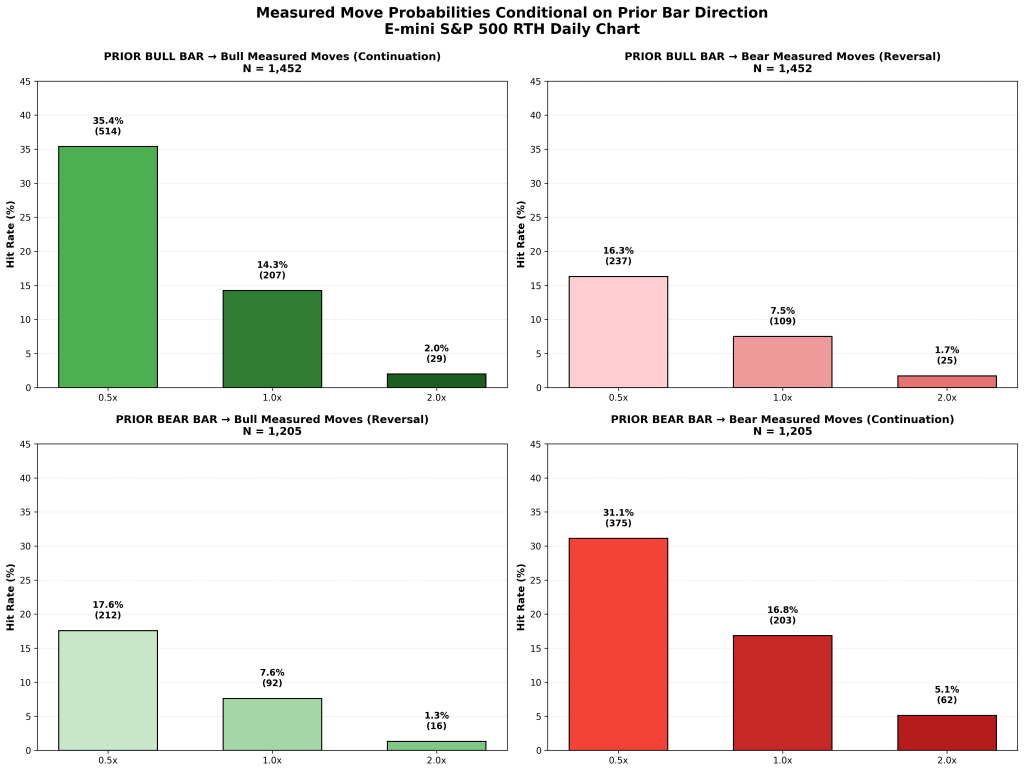

- What if Yesterday was a Bull bar vs Bear Bar?

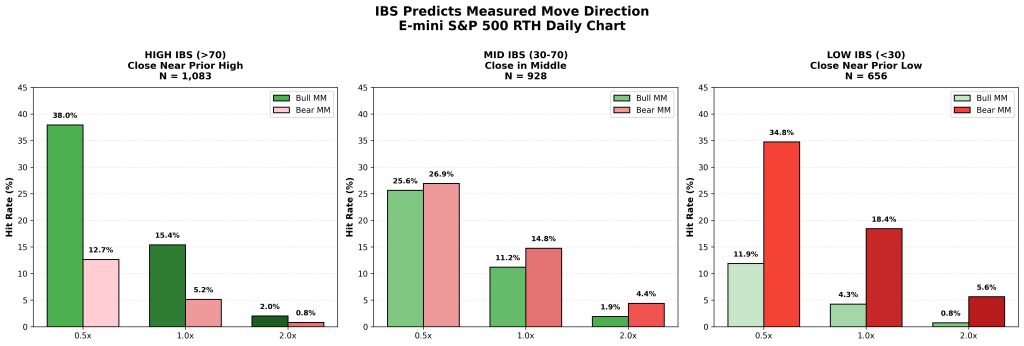

- What about Internal Bar Strength (IBS)?

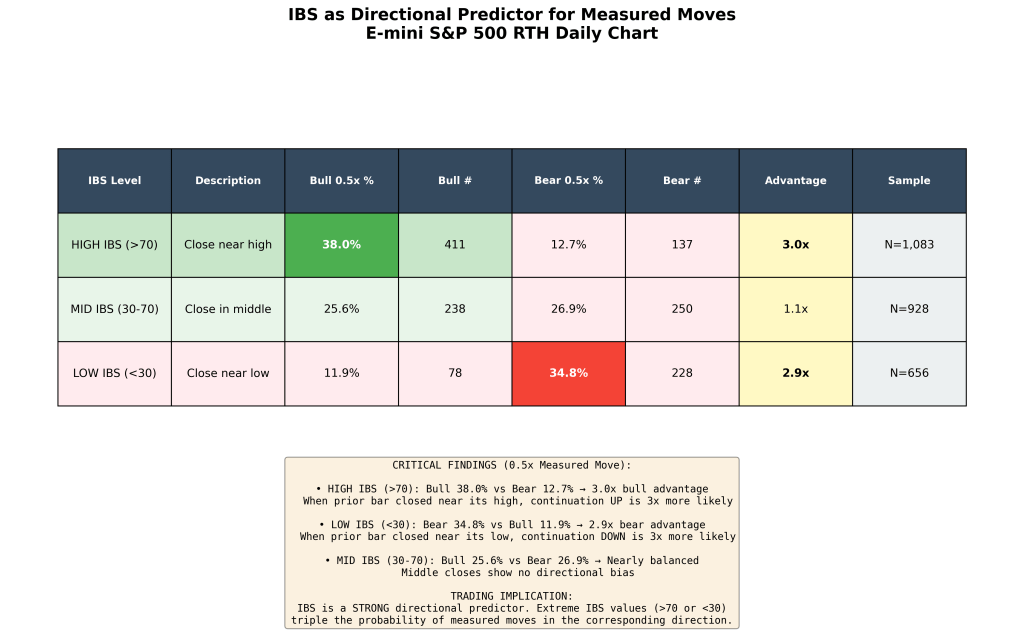

- Putting it all together

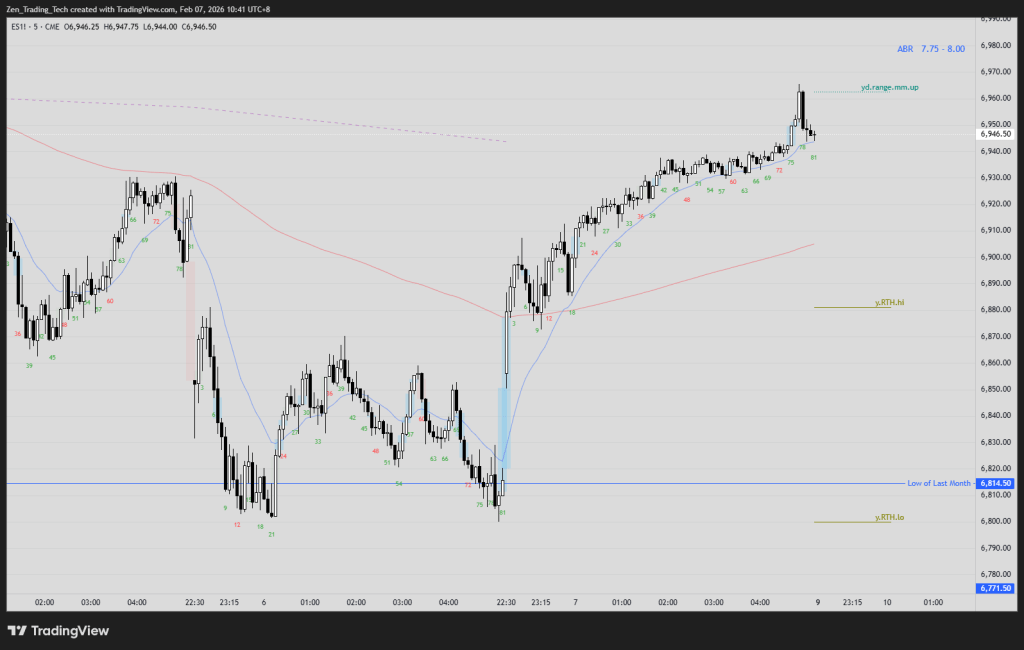

Yesterday was a bull trend from the open which ended at a measured move of the day before.

Which got me thinking about some old research I needed to update.

What really are the chance we get a measured move of yesterday’s range?

In this post I will explore it further to hopefully inspire you to research your own trading strategies.

What is a Measured Move?

- There are many kinds of measured moves

- The one I’m referrring to here is about the prior bars high – low and projecting it up and down.

- On the daily chart, the prior bar is yesterday.

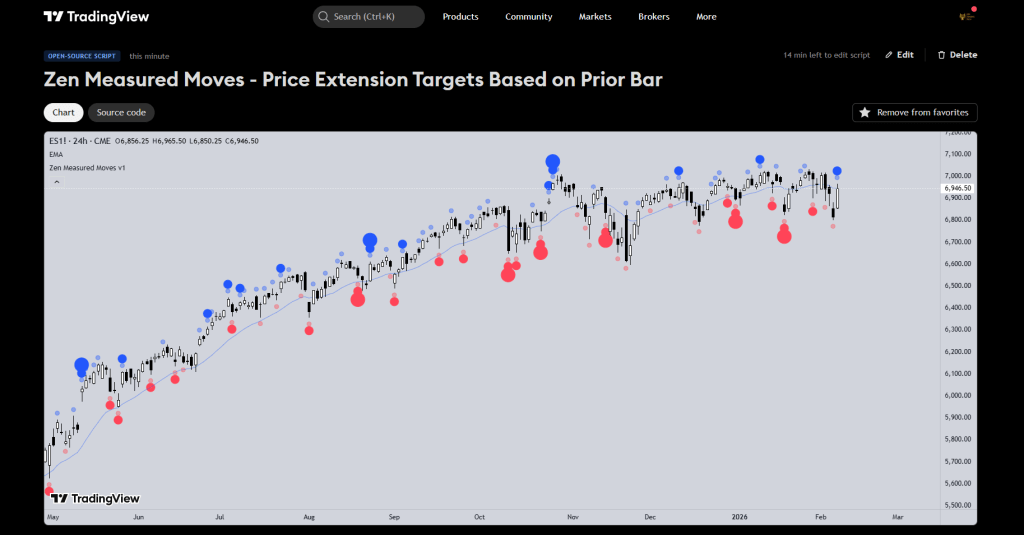

Indicator

- I wrote a free indicator for TRADINGVIEW with open source code you can use.

Simply:

- 50% of YD rannge small light dot

- 1 x YD range medium full dot

- 2 x YD range is big full dot

- You can use this to pull data into excel for your research

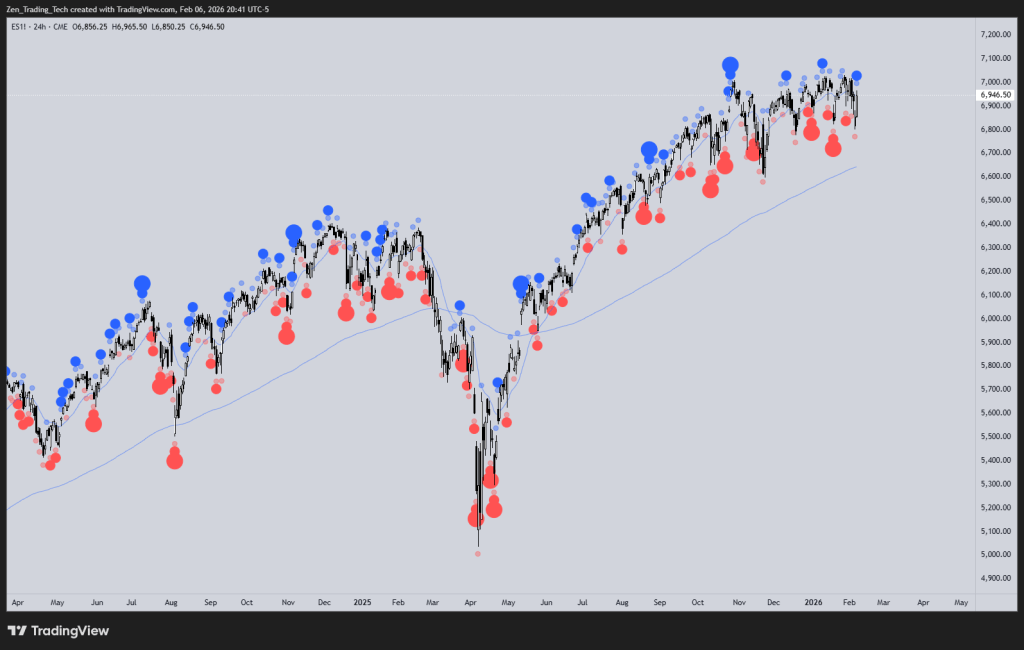

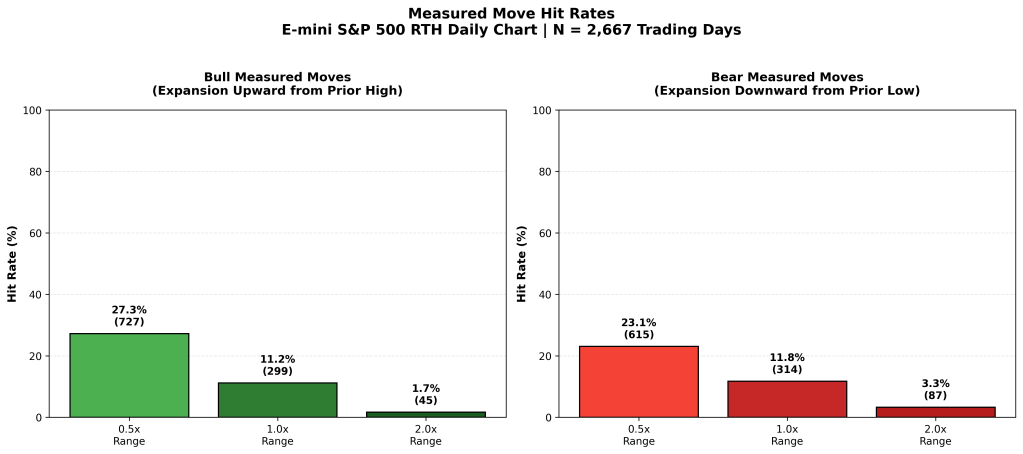

ES Daily Chart and Measured Moves

- What is the chance of a measured move of yesterday? Pretty low…

What if Yesterday was a Bull bar vs Bear Bar?

- A little bit of a boost but not really

What about Internal Bar Strength (IBS)?

- Does the close matter more relative to the high/low of the bar?

- Yes ok we found a better predictor but its marginal at best.

Putting it all together

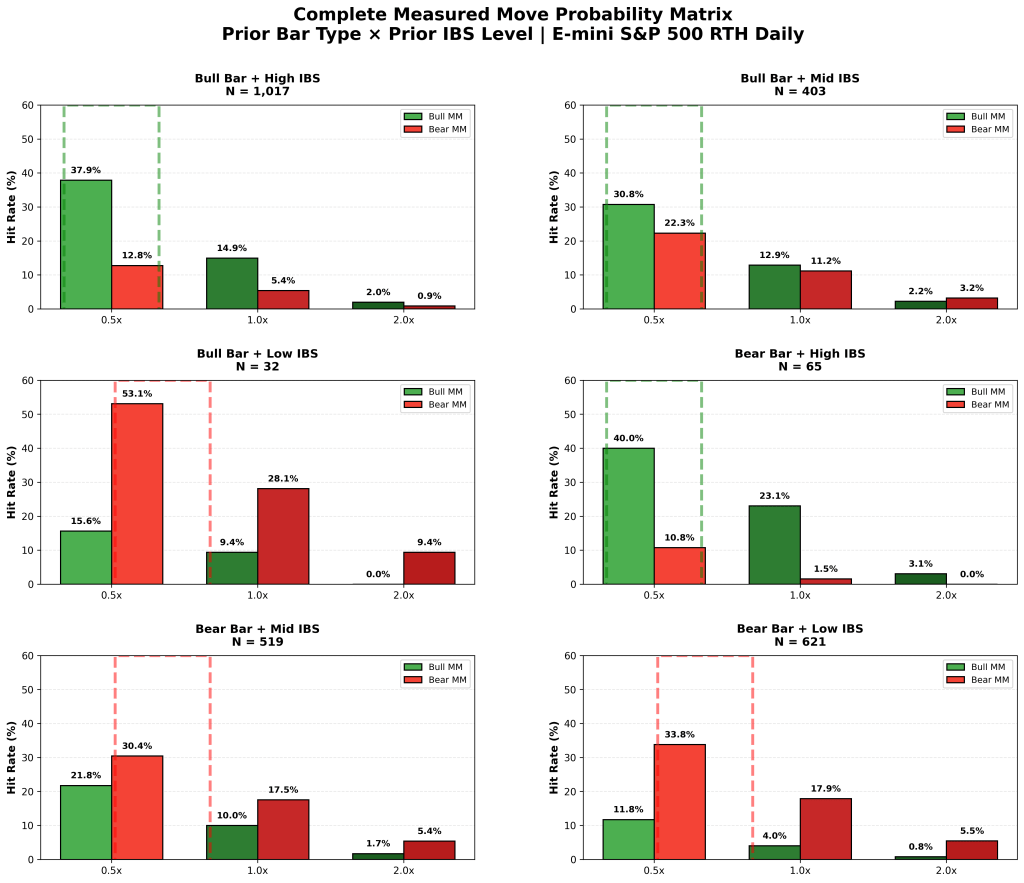

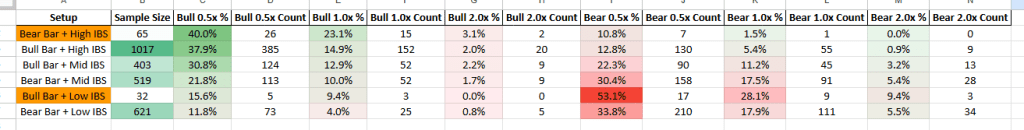

- When we split it again with bull and bear bars and IBS it is now more useful for finding swing targets (40% hit rate)

- Stats below.

- It wasn’t what I thought

- Actually the best predictor was a REVERSAL bar. A bear bar yesterday with HIGH IBS. or a BULL bar yesterday with a LOW IBS

- But still 50% measured move of yesterday seems common enough to use as a target

- But that research can be for another day!

Leave a reply to barryde Cancel reply